Tax Refund Definition Most individual taxpayers use one of the IRS s 1040 form in addition to forms that report or calculate taxes owed or paid on special types of income In general a tax return involves calculating gross income capital gains losses deductions interest payments distributions and

Refund can refer to the amount that the Internal Revenue Service will pay to a taxpayer based an overpayment of estimated tax or employer withholding Tuesday June 18 2024 Our Top Picks Best Money Making Tips TRALs are very controversial because the fees and interest are often very high Often borrowers don t realize or don t understand that paying even 100 for a 2 000 loan equates to a usurious annual interest rate that under other circumstances would be totally unacceptable A tax refund anticipation loan TRAL is a short term loan from a

Tax Refund Definition

Tax Refund Definition

https://marketbusinessnews.com/wp-content/uploads/2017/12/Tax-return-definition-and-illustration.jpg

Tax Refund Definition What Is A Tax Refund TaxEDU

https://files.taxfoundation.org/20200625160533/linkedin-In-Stream_Wide___Treasury_check_stimulus_relief_money_50-e1593116021793.jpeg

Tax Refund Definition What Is A Tax Refund Capital

https://img.capital.com/imgs/glossary/600xx/124-Yield-Stock-.jpg

The joint return test is a measure that prevents taxpayers from claiming undue exemptions There are two circumstances under which a married individual may be claimed as a dependent and still file a joint return The first is if both spouses file a tax return solely to receive a due refund and are not otherwise required to file a return How Does Loss Carryback Work For example if a company has a net operating loss in the current year of 2 000 000 it can carry that backward to the previous year to offset its net operating income of 2 000 000 The company would then have a zero tax liability 2 000 000 less 2 000 000 At this point the company could apply for a refund

The first 8 025 is taxed at 10 802 50 The next 24 525 is taxed at 15 3 678 75 The next 49 100 is taxed at 25 12 275 The next and final 18 350 is taxed at 28 5 138 Total tax owed 21 894 25 The highest federal tax bracket changes often but it is usually around 35 of any income over about 375 000 note that this The total amount of tax you owe could be calculated as follows 10 of 9 875 12 of 29 774 22 of 2 315 28 6 858 28 In this example you would owe 6 858 28 in federal income taxes for 2019 before deductions Since you fell into the 22 tax bracket you would have a marginal tax rate of 22 However because you actually owed

Download Tax Refund Definition

More picture related to Tax Refund Definition

Tax Refund Tax Refund Definition

http://image.slidesharecdn.com/taxreliefdefinitionfreehelpfulhint-100408232233-phpapp01/95/slide-1-728.jpg?1270786973

Pin On Funny Definition Posters

https://i.pinimg.com/originals/92/f4/ed/92f4ede46d7fa270dd5d28e3c9ab53be.jpg

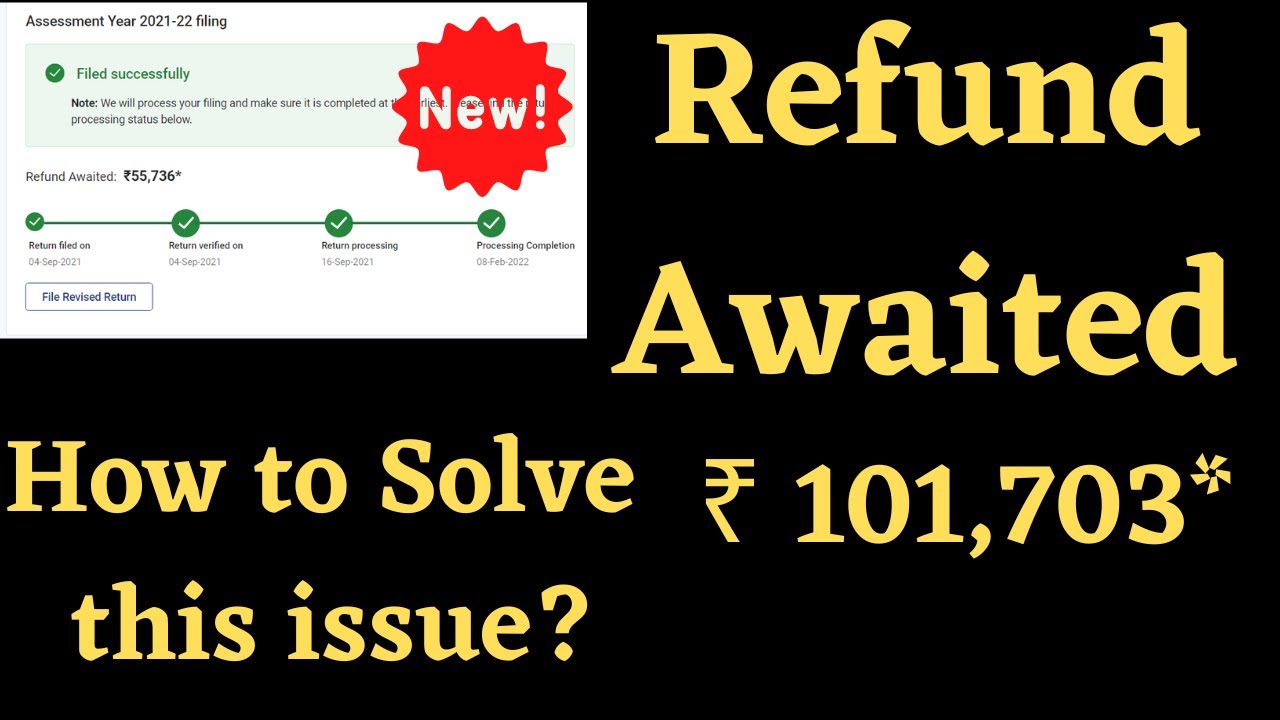

Income Tax Refund Awaited Meaning Solve The Issue Of Refund Awaited

https://i.ytimg.com/vi/JQ3lL7IFrw8/maxresdefault.jpg

Specifically according the IRS Form 1045 is for individuals estates or trusts that want to apply for a quick tax refund resulting from The IRS defines what counts as an eligible loss For individuals this includes loss of property arising from fire storm shipwreck other casualty or theft For small businesses losses due to federally Depending on where you live and where the show tapes you not only have to pay 40 in federal taxes but you also must pay 5 to the state in which you won the money and 5 to the state in which you live Your winnings net of tax would equal 1 000 000 400 000 50 000 50 000 500 000

[desc-10] [desc-11]

Smart Ways To Use Your Tax Refund DRB Capital

https://www.drbcapital.com/wp-content/uploads/2018/01/tax-refund.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

https://investinganswers.com › dictionary › tax-return

Most individual taxpayers use one of the IRS s 1040 form in addition to forms that report or calculate taxes owed or paid on special types of income In general a tax return involves calculating gross income capital gains losses deductions interest payments distributions and

https://investinganswers.com › dictionary › refund

Refund can refer to the amount that the Internal Revenue Service will pay to a taxpayer based an overpayment of estimated tax or employer withholding Tuesday June 18 2024 Our Top Picks Best Money Making Tips

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

Smart Ways To Use Your Tax Refund DRB Capital

Make Wise Use Of That Tax Refund Washington Jewish Week

Where s My Refund Up As Well As All IRS Systems Refund Schedule 2022

Progressive Income Tax Center For Illinois Politics

What To Do With Your Tax Refund CBS News

What To Do With Your Tax Refund CBS News

Four Ways To Double The Power Of Your Tax Refund Centerpoint Advisory

Refund Ngh a L G nh Ngh a V D Trong Ti ng Anh

Expats Guide Tax Refund In The Philippines Expat ph

Tax Refund Definition - The first 8 025 is taxed at 10 802 50 The next 24 525 is taxed at 15 3 678 75 The next 49 100 is taxed at 25 12 275 The next and final 18 350 is taxed at 28 5 138 Total tax owed 21 894 25 The highest federal tax bracket changes often but it is usually around 35 of any income over about 375 000 note that this