Tax Refund For Rent Paid You must always report rental income on your tax return How to pay If you are receiving rental income for the first time or if the amount has changed see the

You can claim the tax credit for rent payments you made in 2022 or 2023 by making an income tax return You can also claim the tax credit for payments made in A portion of your rent is used to pay property taxes You may qualify for a Renter s Property Tax Refund depending on your income and rent paid Who Qualifies Claim the

Tax Refund For Rent Paid

Tax Refund For Rent Paid

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2017/10/Section-80GG-Income-Tax-Deduction-for-Rent.jpg

IRS Check My Refund Check All The Necessary Details Here Eduvast

https://www.eduvast.com/wp-content/uploads/2023/08/Untitled-design_20230822_002740_0000.jpg

Published on April 28 2022 Written by Eric Reed If you re wondering whether you can deduct your rent on your taxes the short answer is yes You can deduct rent if you live in a state that allows it However only 22 The Rent Tax Credit reduces the amount of Income Tax that you are due to pay for a tax year To benefit from the Rent Tax Credit you must have an Income Tax

1 REQUEST PREPAYMENTS We recommend that you ask the Tax Administration to set up prepayments for you as soon as you start renting out a house If you pay rent on your primary residence you might be able to claim a state tax credit There is no federal renter s tax credit Most of these credits depend on the

Download Tax Refund For Rent Paid

More picture related to Tax Refund For Rent Paid

How Does Income Tax Refund For Individual Taxpayers Arise

https://media-exp1.licdn.com/dms/image/D4D12AQF1bBB8xHkBAA/article-cover_image-shrink_600_2000/0/1669647733177?e=2147483647&v=beta&t=JyTfhvDAPiNSSlGlTT0WcpIa2Yc8wcVQB9KypOuXBL0

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

https://i.ytimg.com/vi/B9P96APDSVw/maxresdefault.jpg

ABLE Accounts And Tax Time Savings National Disability Institute

https://www.nationaldisabilityinstitute.org/wp-content/uploads/2021/04/qrg-cover-taxes-and-able.png

If all members of your household are under 65 the credit can be as much as 75 If at least one member of your household is 65 or older the credit can be as much as 375 If your When do I owe taxes on rental income In general you must report all income on the return for the year you actually receive it even though it may be

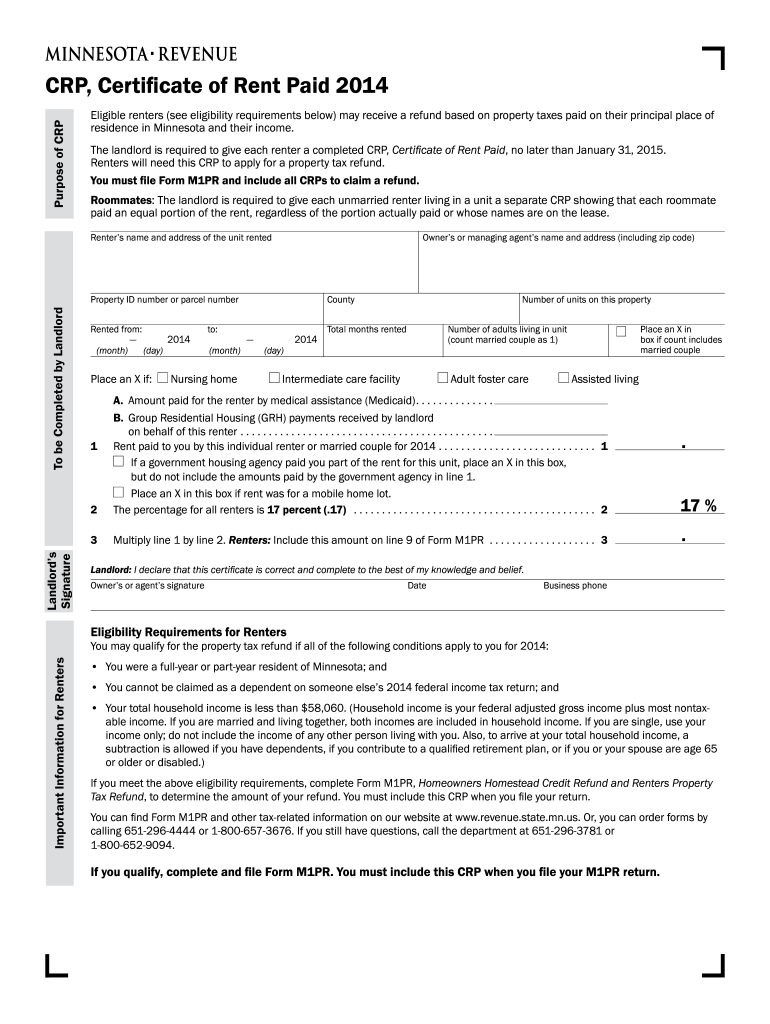

For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023

Check IRS Where s My Refund IRS Refund Status 2023

https://nufo.org/wp-content/uploads/2022/04/Where-Is-My-Tax-Refund-1-768x627.png

What To Do With Your Tax Refund CBS News

https://cbsnews1.cbsistatic.com/hub/i/2012/04/18/1c5a8c9b-a738-11e2-a3f0-029118418759/tax_refund_000016916535.jpg

https://www.vero.fi/en/individuals/property/rental_income

You must always report rental income on your tax return How to pay If you are receiving rental income for the first time or if the amount has changed see the

https://www.citizensinformation.ie/.../rent-tax-credit

You can claim the tax credit for rent payments you made in 2022 or 2023 by making an income tax return You can also claim the tax credit for payments made in

Your Tax Refund Starts At Jewel

Check IRS Where s My Refund IRS Refund Status 2023

Step To Check Income Tax Refund Status Reasons For Delay Chandan

Fillable Form M1pr Homestead Credit Refund For Homeowners And

How To Spend Your Tax Refund

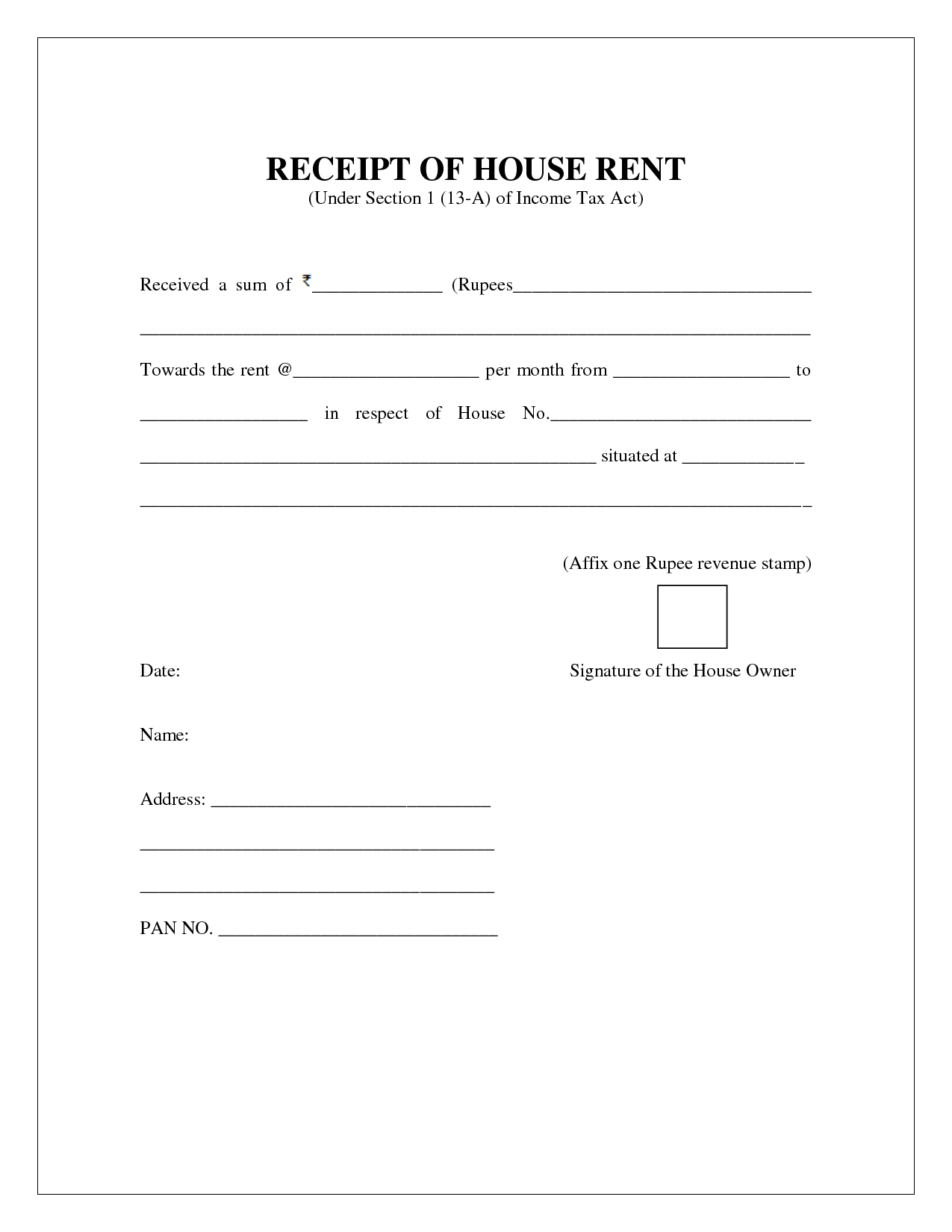

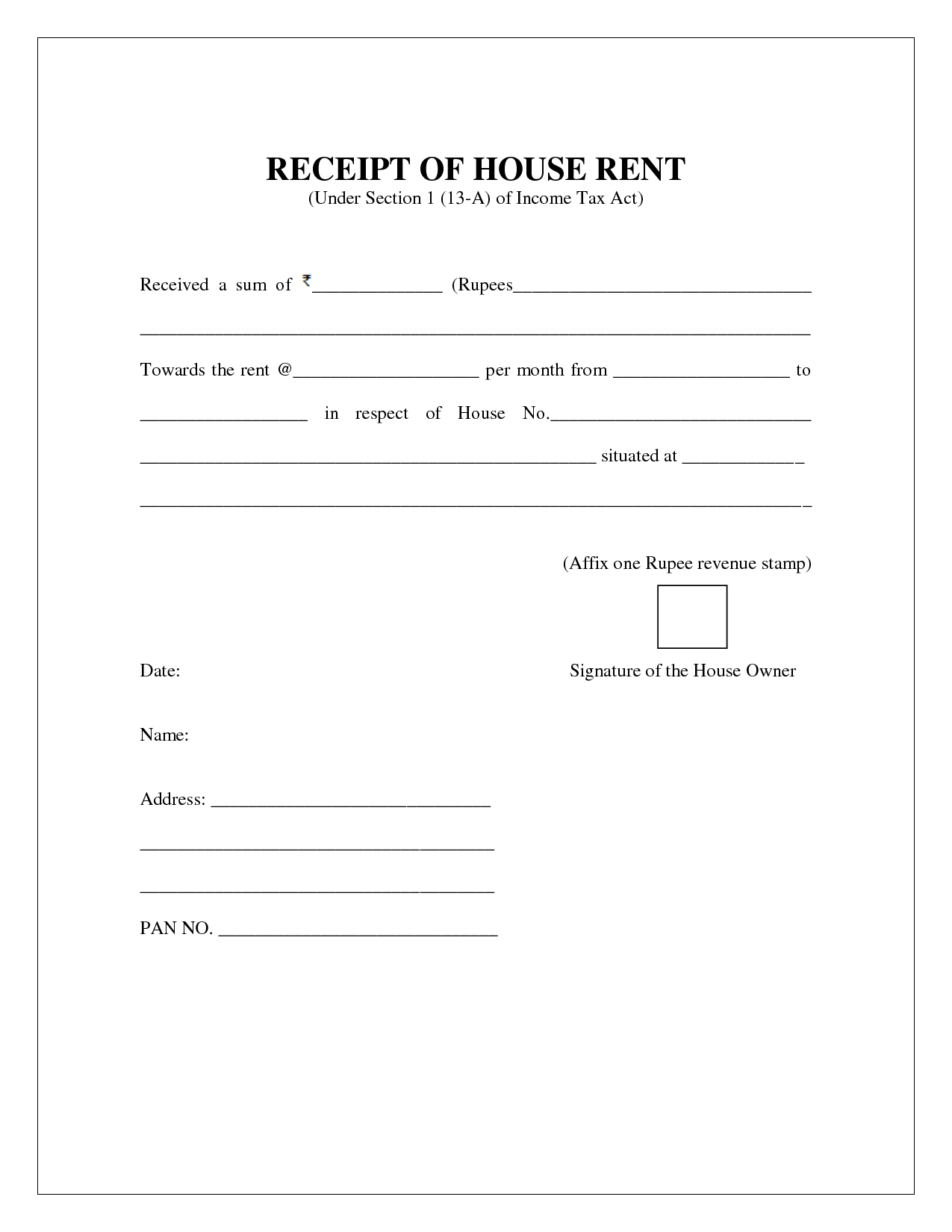

House Rent Slip Pdf Invoice Template

House Rent Slip Pdf Invoice Template

Renter s Property Tax Refund Minnesota Department Of Revenue Fill Out

Average Tax Refund In Every U S State Vivid Maps

Minnesota Property Tax Refund 2019 2024 Form Fill Out And Sign

Tax Refund For Rent Paid - If you pay rent on your primary residence you might be able to claim a state tax credit There is no federal renter s tax credit Most of these credits depend on the