Tax Refund Formula Formula General Formula for computing annual income tax refunds Tax Due Prepaid Tax Payments Tax Payable or Refund Sample Cases A Compensation Income for employees The employee has a basic salary of Php 30 000 monthly or Php 360 000 annually

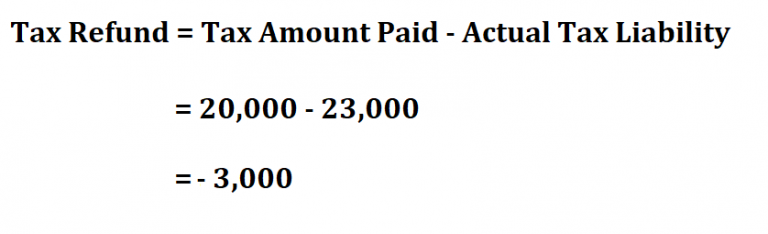

Formula to calculate tax refund To calculate your tax return you first need to know your tax liability Then find the difference of the amount you paid for tax and your actual tax liability Example If for instance your company paid 20 000 as tax calculate your tax refund if your actual tax liability was 23 000 For most people tax is collected by an employer at a rate that estimates your tax for the year Your actual earnings and the deductions that you re allowed to claim might cause you to pay too much tax which leads the Internal Revenue Service to issue you a

Tax Refund Formula

Tax Refund Formula

https://www.learntocalculate.com/wp-content/uploads/2021/02/tax-refund-2-768x234.png

Maths A Tax Lesson 4 Calculate Medicare Levy Tax Refund YouTube

https://i.ytimg.com/vi/intJY97SidI/maxresdefault.jpg

Individual Income Tax Formula Sections Flashcards Quizlet

https://o.quizlet.com/zLJZAgnC8lE2jEsv2mxuLA.png

Subtract line 24 from line 33 If the amount on line 33 is larger than the amount on line 24 that s what you overpaid In theory you should get this amount back as a refund Enter this overpayment on line 34 If the total tax owed line 24 is more than the tax you paid line 33 you ll owe taxes 1 Refunds under GST are of the below kinds Export of goods under LUT Letter of undertaking Export of goods on payment of IGST under the claim of rebate Inverted duty refund Other claims Sec 54 3 of CGST Act 2017 states a Zero rated supplies made without payment of tax

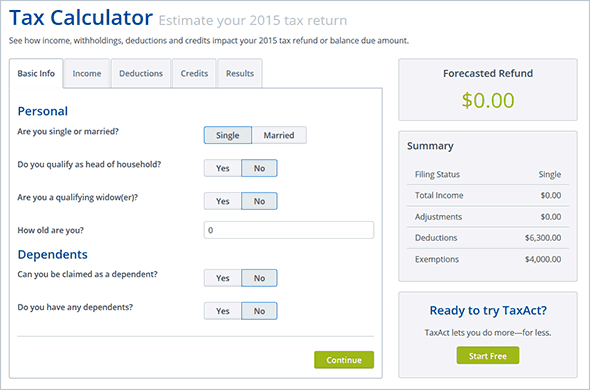

Start TurboTax for free The tax calculator estimates that I owe money How do I lower the amount The simplest way to lower the amount you owe is to adjust your tax withholdings on your W 4 Our W 4 Calculator can help you determine how to update your W 4 to get your desired tax outcome Commissioner for Revenue Individuals Refunds Refunds Last Updated 06 04 2022 There are cases where the CFR needs to issue a refund to the taxpayer whether an individual a company a partnership or an organisation due to overpaid tax or a tax credit deduction resulting in a refund

Download Tax Refund Formula

More picture related to Tax Refund Formula

Income Tax Calculator Online Calculate Income Tax For FY 2019 20

https://www.trickyfinance.com/wp-content/uploads/2018/10/income-tax-calculate-min.jpg

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

https://i.ytimg.com/vi/B9P96APDSVw/maxresdefault.jpg

Tax Refund Table Philippines Brokeasshome

https://desk.zoho.com/DocsDisplay?zgId=659143319&mode=inline&blockId=7yto42bc7b440aaa941ecacd7603afdbe8111

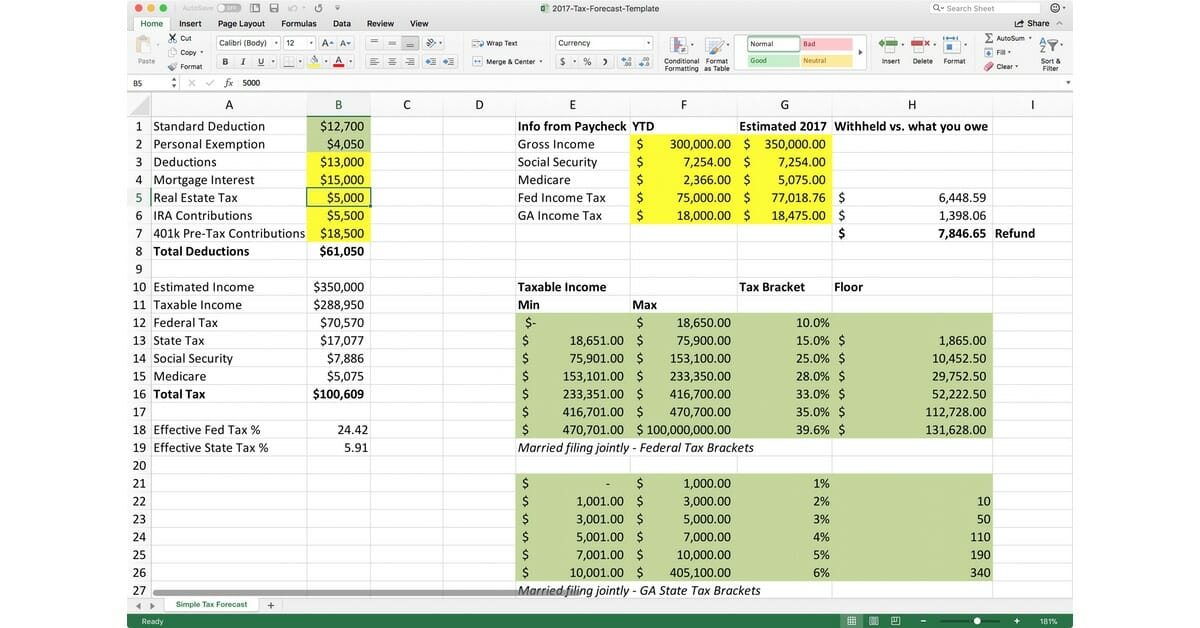

Maximum amount of refund formula and terms Maximum refund amount Turnover of inverted rated supply of goods and services X Net input tax credit Adjusted total turnover Tax payable on such inverted rated supply of goods and services Illustration Supply of Fabric Bags Output Value Rs 1 400 GST on the above Generally your refund is calculated by how much money is withheld for federal income tax minus your total federal income tax for the year There are other factors too like deductions

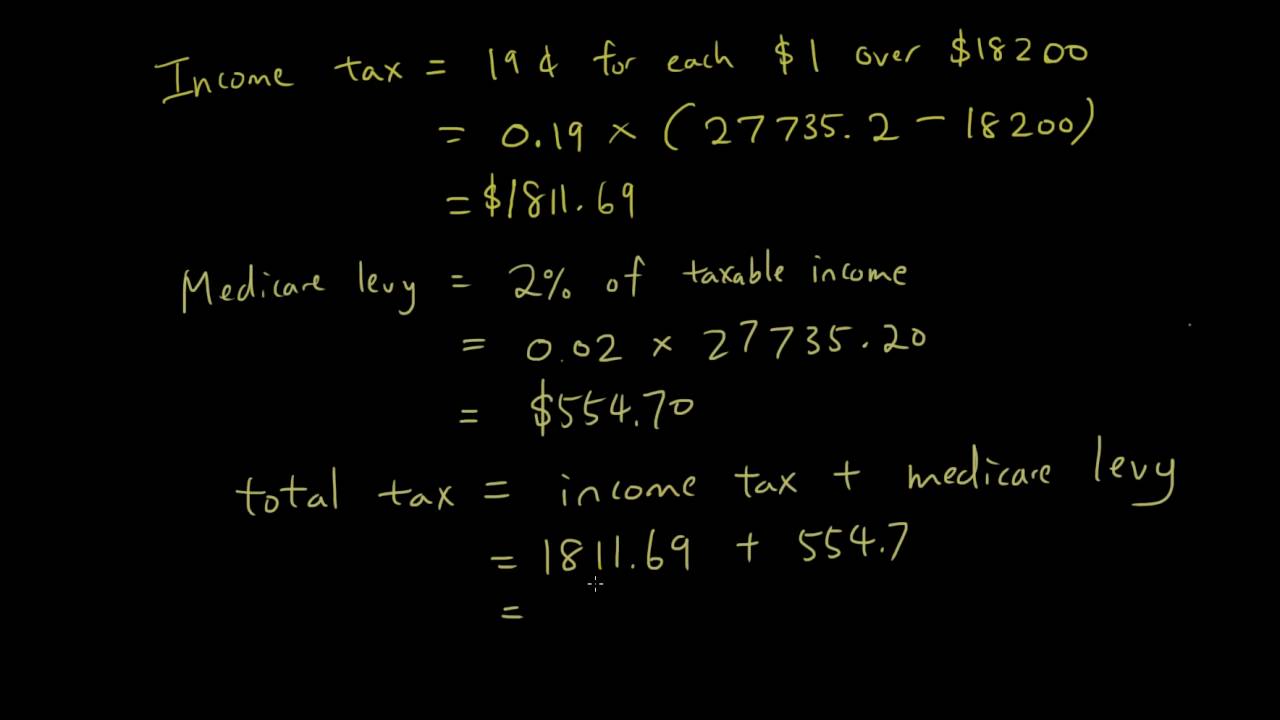

The idea is really quite simple After calculating your taxable income you use the information in the tax tables to determine your total income tax for the year This amount is then compared to the amount that you actually paid throughout the year in the form of withholdings from your paychecks Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2024

Refund Formula For Export Without Payment Of Tax YouTube

https://i.ytimg.com/vi/6ujQTauExdA/maxresdefault.jpg

Mathematics For Work And Everyday Life

https://lah.elearningontario.ca/CMS/public/exported_courses/MEL3E/exported/MEL3EU01/MEL3EU01/MEL3EU01A03/_images/incomeTax.jpg

https://filipiknow.net/tax-refund-philippines

Formula General Formula for computing annual income tax refunds Tax Due Prepaid Tax Payments Tax Payable or Refund Sample Cases A Compensation Income for employees The employee has a basic salary of Php 30 000 monthly or Php 360 000 annually

https://www.learntocalculate.com/calculate-tax-refund

Formula to calculate tax refund To calculate your tax return you first need to know your tax liability Then find the difference of the amount you paid for tax and your actual tax liability Example If for instance your company paid 20 000 as tax calculate your tax refund if your actual tax liability was 23 000

How To Estimate Your Tax Refund Or Balance Due TaxAct Blog

Refund Formula For Export Without Payment Of Tax YouTube

Looking Good Deferred Tax Calculation Format In Excel Llp Balance Sheet

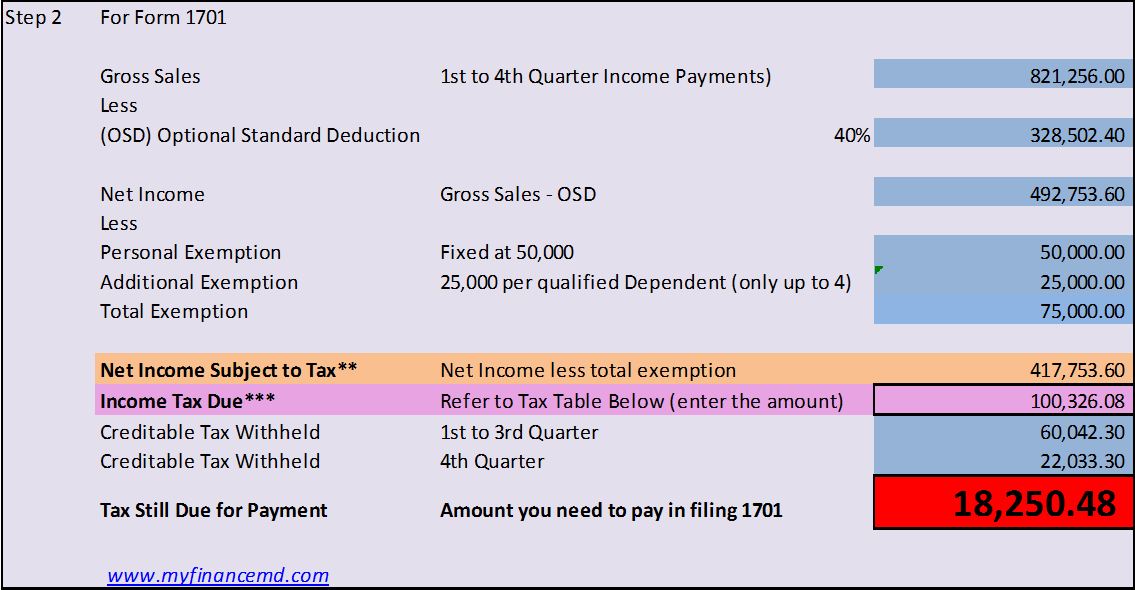

How To Compute Income Tax Refund In The Philippines A Definitive Guide

How To Claim Tax Refund In Philippines For Income Tax YouTube

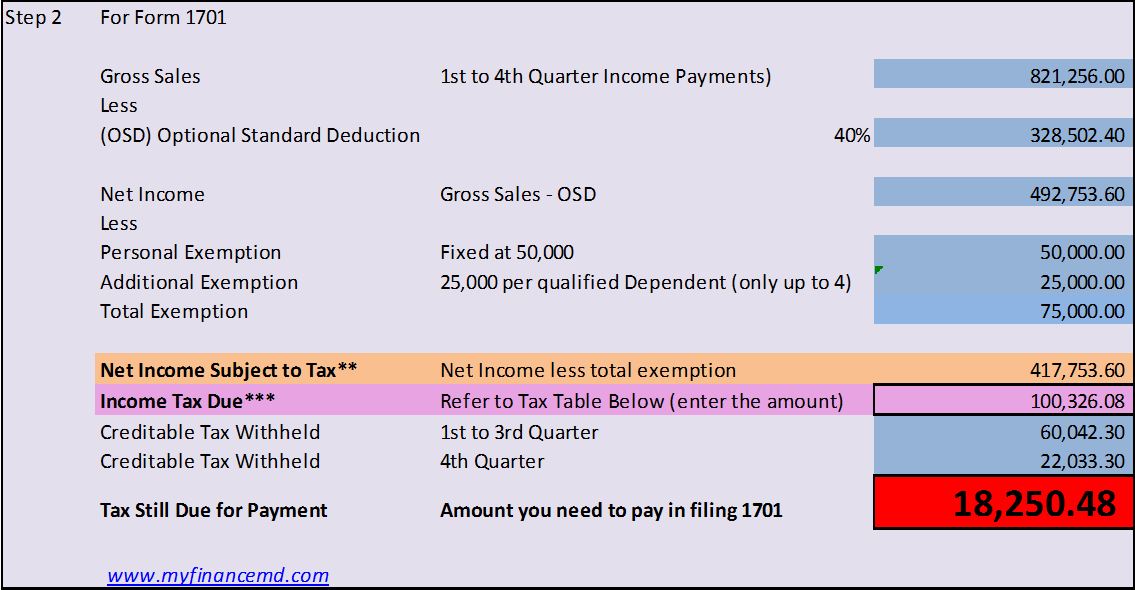

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

Where s My Refund How To Track Your Tax Refund 2022 Money

Federal Tax Refund Status Where Is My Federal Tax Refund

Manage Your Tax Refund With Direct Deposit

Tax Refund Formula - Start TurboTax for free The tax calculator estimates that I owe money How do I lower the amount The simplest way to lower the amount you owe is to adjust your tax withholdings on your W 4 Our W 4 Calculator can help you determine how to update your W 4 to get your desired tax outcome