Tax Refund Self Employed Web If your annual earnings from self employment in Germany are more than the tax free allowance as of 2022 9 984 you ll need to pay income tax Einkommensteuer no matter whether you re a freelancer or run a company Like with any income tax the amount you ll need to pay depends on the size of your income But unlike employees

Web 31 Okt 2019 nbsp 0183 32 Self employed and freelancers do not have to pay tax on the income they earn but only on their profits In a tax return all costs incurred within a calendar year can be deducted from the tax These expenses reduce Web 7 Dez 2023 nbsp 0183 32 For sole proprietorships and partnerships a tax free threshold of 24 500 applies to their revenue In the case of trade tax the rate of levy differs depending on the municipality The figure of 3 5 is a fixed factor which is also added as a multiplier The trade tax is calculated as follows Trade income 3 5 rate of levy

Tax Refund Self Employed

Tax Refund Self Employed

https://i.ytimg.com/vi/z3bYyMV1fXs/maxresdefault.jpg

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

https://i.ytimg.com/vi/B9P96APDSVw/maxresdefault.jpg

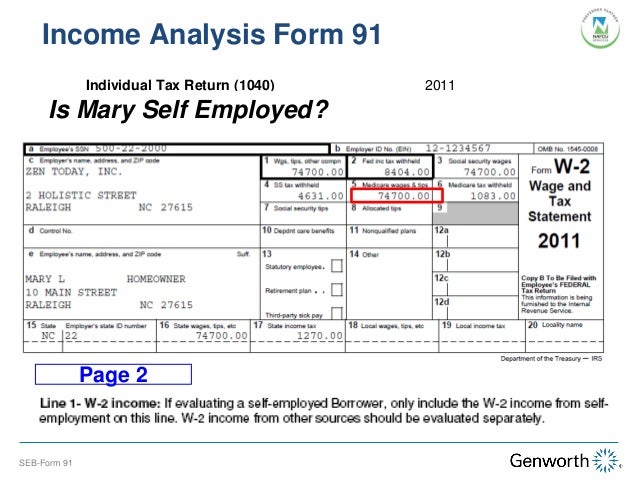

Income Tax Forms Income Tax Forms For Self Employed

http://image.slidesharecdn.com/finalpresentationgenworth1-130405081725-phpapp01/95/selfemployed-borrower-case-study-part-i-completing-the-form-91-with-personal-tax-returns-webinar-slides-15-638.jpg?cb=1365150312

Web 27 Apr 2023 nbsp 0183 32 The lowest tax rate is currently 14 and increases linearly with higher income The top tax rate is 42 which is due when you have an income of at least 57 918EUR or higher Starting from 274 613EUR the maximum rate for taxable income of 45 applies If your income is even further above this limit you will always have to pay Web Refunds appeals and penalties Check how to claim a tax refund Disagree with a tax decision Estimate your penalty for late Self Assessment tax returns and payments

Web 14 Dez 2023 nbsp 0183 32 Self employed income tax allowances in Germany In Germany self employed workers are subject to the same 10 374 allowance as other workers but they also get a 2 800 allowance for health insurance Another way self employed workers can reduce their tax bill is to offset work related outgoings against their overall tax bill Web You have to file an income tax return if your net earnings from self employment were 400 or more If your net earnings from self employment were less than 400 you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040 SR instructions PDF Back to top

Download Tax Refund Self Employed

More picture related to Tax Refund Self Employed

How To Calculate Your Taxes self employed YouTube

https://i.ytimg.com/vi/6aMS8mXloOo/maxresdefault.jpg

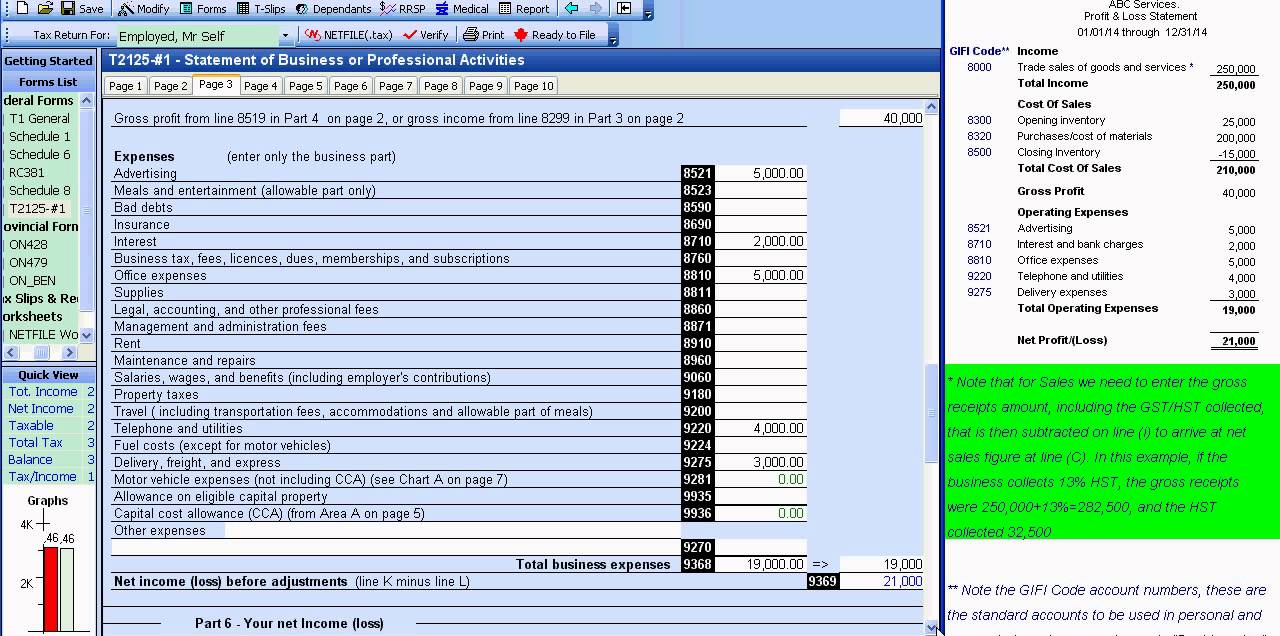

How To Do Self Employed Tax Return In Canada YouTube

https://i.ytimg.com/vi/3ZTnHecMdvY/maxresdefault.jpg

When Tax Refund Start 2024 Nita Lynnette

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

Web 27 Apr 2023 nbsp 0183 32 For 2020 the Freibetrag tax free threshold for income tax was 9 408 for single self employed persons In the 2021 tax year this threshold rises to 9 744 If your entire income amounts to less than these amounts in the relevant tax year you are not obliged to pay income tax unless you re married in which case your partner s Web 18 Nov 2023 nbsp 0183 32 Germany has a tax free threshold which basically means that every Euro earned under that threshold is not subject to income tax The tax free threshold in 2024 is at 11 604 Euros There are further tax free thresholds that you can use to your benefit for example in regards to trade tax as well as for investment income Parents are also able

Web Self Assessment is a system HM Revenue and Customs HMRC uses to collect Income Tax Tax is usually deducted automatically from wages and pensions People and businesses with other income Web 6 Dez 2023 nbsp 0183 32 Are self employed people eligible for tax refunds Self employed people can claim tax refunds if they ve paid too much tax For example if you make a mistake on your tax return you may be entitled to some money back However HMRC deals with tax refunds for Self Assessment taxpayers differently How to get a tax refund as a self

State And Local Income Tax Refund Worksheet 2019

https://www.syracuse.com/resizer/WB1TXWFmZrJ0rI51xwbfqLh9OJ8=/700x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/TJOMXPBO55ACPICAGFFHXJJ5ZI.JPG

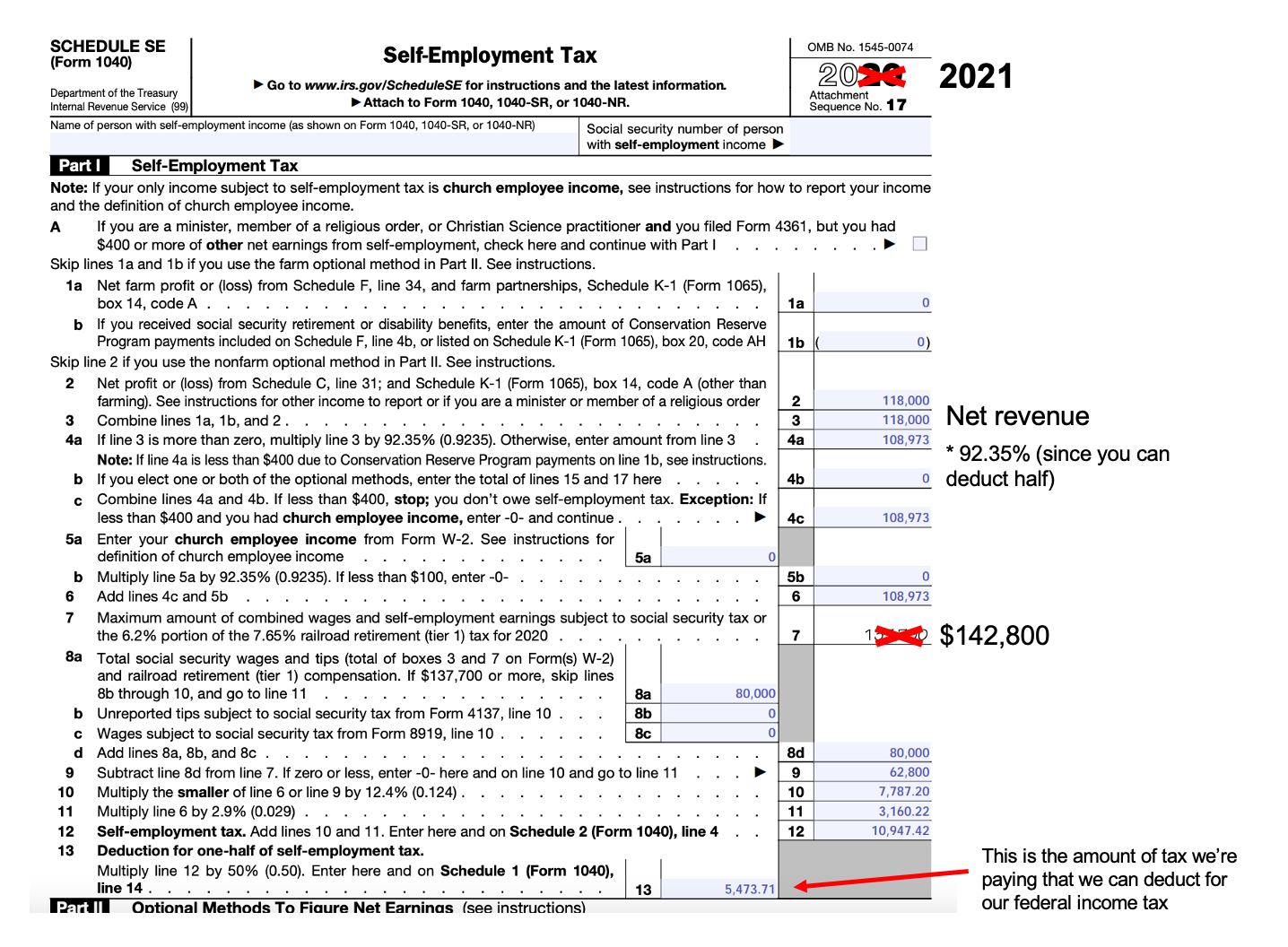

Self Employed Tax Refund Calculator JaceDillan

https://images.squarespace-cdn.com/content/v1/5e94adbc25a0ae61d843b475/1631660328281-6URFQ1JKAFLIJEBCHYDD/Schedule_SE_Example_2021

https://n26.com/en-eu/blog/self-employed-in-germany

Web If your annual earnings from self employment in Germany are more than the tax free allowance as of 2022 9 984 you ll need to pay income tax Einkommensteuer no matter whether you re a freelancer or run a company Like with any income tax the amount you ll need to pay depends on the size of your income But unlike employees

https://germantaxes.de/tax-tips/deduct-taxes-as-self-employed-freelancer

Web 31 Okt 2019 nbsp 0183 32 Self employed and freelancers do not have to pay tax on the income they earn but only on their profits In a tax return all costs incurred within a calendar year can be deducted from the tax These expenses reduce

Self employed Tax Credit Refund setc 1099 Expert

State And Local Income Tax Refund Worksheet 2019

USA 1040 Self Employed Form Template Income Tax Return Templates Self

Estimate Self Employment Tax EMPLOYMENTWUS

Lesson 2 Self Employment Income Taxes YouTube

An Annotated Guide To The 1040 The New York Times

An Annotated Guide To The 1040 The New York Times

Self Employment Tax Forms FACS Coding Quest

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax

Amazon Flex Take Out Taxes Augustine Register

Tax Refund Self Employed - Web 4 Okt 2023 nbsp 0183 32 Access tax forms including Form Schedule C Form 941 publications eLearning resources and more for small businesses with assets under 10 million