Tax Relief For Pensioners Pensions under the Greek foreign pensioners scheme will be taxed as follows Annual flat rate of 7 on pensions and withdrawals from non Greek private pension schemes Annual flat rate of 7 on foreign income dividends interest capital gains

You pay tax on your pension if your total annual income adds up to more than your Personal Allowance For 2024 2025 this means you pay tax on your pension if your income is over 12 570 As a general rule of thumb you can withdraw up to 25 of your pension pot tax free Unlike basic rate tax relief you will need to actively claim higher rate tax relief on your pension contributions You can do this in two ways through your self assessment or by contacting HMRC directly

Tax Relief For Pensioners

Tax Relief For Pensioners

https://forrestbrown.co.uk/wp-content/uploads/2021/09/Stocksy_txp24f5e82ftaB300_Medium_3370983.jpg

Here s The Real Story On Tax Relief RateMuse

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

Exempt Pension From Income Tax To Provide Relief To Senior Citizens

https://english.cdn.zeenews.com/sites/default/files/styles/zm_700x400/public/2021/08/29/965608-untitled-design-2021-08-29t151042.188.jpg

In some cases you need to claim tax relief on pension contributions yourself You ll need to make a claim if If you re paying in an amount greater than 10 000 you ll need to contact HMRC to What is pension tax relief What is higher rate tax relief What is the UK threshold for higher rate tax in 2024 How do I claim higher rate tax relief Can I claim higher rate tax relief for previous years Is there a cap on pension tax relief Tax treatment depends on your individual circumstances and may be subject to future change

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the relief at source method is always used Find out how the government tops up your pension savings in the form of pension tax relief and how to make sure you re getting the full amount you re entitled to What is pension tax relief How much pension tax relief can I get in 2024 25 Is there a limit on the amount of pension tax relief I can get How do I claim pension tax relief

Download Tax Relief For Pensioners

More picture related to Tax Relief For Pensioners

Personal Tax Relief 2022 Latest CN Advisory

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

.png)

Pensioners Should Get Tax Relief For Private Medical Care Sir Edward

https://www.edwardleigh.org.uk/sites/www.edwardleigh.org.uk/files/news-gallery/Screenshot (81).png

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

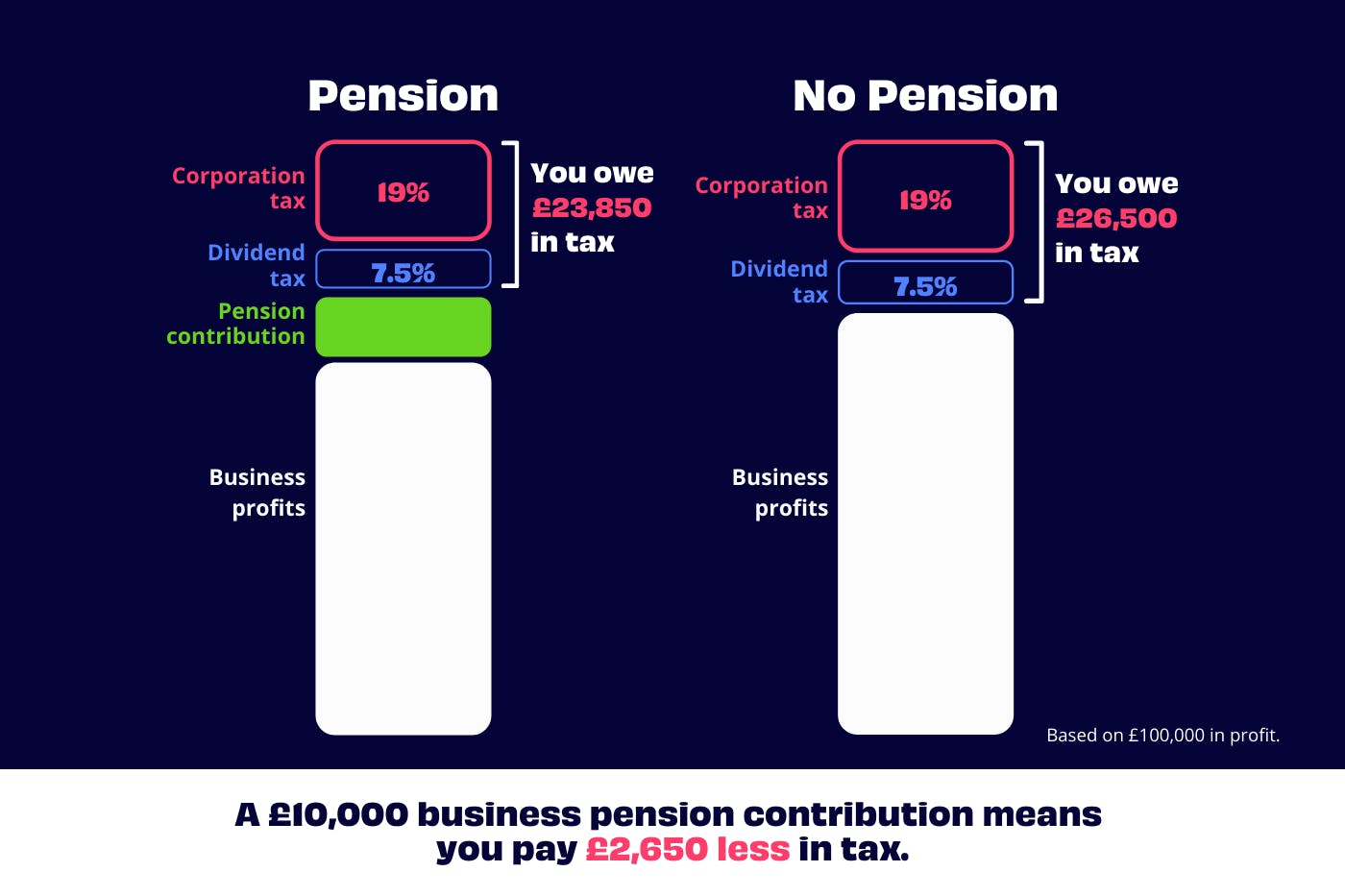

Higher rate taxpayers can claim an extra 20 tax relief on earnings they pay 40 tax on totalling up to 40 in pension tax relief This means 10 000 of pension contributions could cost as little as 6 000 The Government has announced that from the 2024 2025 tax year you ll be able to claim the tax relief you don t get automatically through payroll if you re in an occupational pension and earn below 12 570 If you re unsure how you get tax relief for your workplace pension ask your employer

[desc-10] [desc-11]

Tax Lien Removal Tax Relief Boxelder Consulting

https://boxelderconsulting.com/wp-content/uploads/2020/12/Tax-Relief-Formatted-Hero-Big-Tree-Amongst-Trees.png

Save It For Another Day Pension Tax Relief And Options For Reform

https://www.resolutionfoundation.org/app/uploads/2016/03/Pages-from-Pension-tax-relief-2.jpg

https://www.relocateandsave.com › tax-residency-in-greece

Pensions under the Greek foreign pensioners scheme will be taxed as follows Annual flat rate of 7 on pensions and withdrawals from non Greek private pension schemes Annual flat rate of 7 on foreign income dividends interest capital gains

https://www.ageuk.org.uk › ... › income-tax › income-tax

You pay tax on your pension if your total annual income adds up to more than your Personal Allowance For 2024 2025 this means you pay tax on your pension if your income is over 12 570 As a general rule of thumb you can withdraw up to 25 of your pension pot tax free

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

Tax Lien Removal Tax Relief Boxelder Consulting

List Of Personal Tax Relief And Incentives In Malaysia 2023

Claim Tax Relief Of Employing A Carer Home Care Matters

Tax Relief In 2020 21 For Working From Home Beech Business Services

Pensioners Urged To Claim State Pension Or Risk Payment Delays

Pensioners Urged To Claim State Pension Or Risk Payment Delays

List Of Personal Tax Relief And Incentives In Malaysia 2023

Self Employed Pension Tax Relief Explained Penfold Pension

Pension Tax Relief In The United Kingdom UK Pension Help

Tax Relief For Pensioners - [desc-13]