Tax Relief Leased Cars Verkko 11 helmik 2013 nbsp 0183 32 This means that if the car has emissions under 110g km you can get tax relief on all of the payments However if the car s emissions are above 110g km

Verkko 26 toukok 2022 nbsp 0183 32 You lease an electric car for 163 6 000 over the 2022 23 financial year You deduct the cost against profits As corporation tax is 19 then your tax savings Verkko 7 maalisk 2022 nbsp 0183 32 Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when you re choosing a vehicle to

Tax Relief Leased Cars

Tax Relief Leased Cars

https://www.jrwca.com/wp-content/uploads/2022/05/company-car.jpeg

How To Turn Your Lease Into Cash 3 Ways To Sell Your Leased Car On

https://blog.carnex.ca/wp-content/uploads/2022/03/How-To-Turn-Your-Lease-Into-Cash-3-ways-Sell-Your-Leased-Car-On-High-Value.jpg

12 Most Leased Cars For Under 50 000 Edmunds

https://media.ed.edmunds-media.com/kia/k900/2016/fe/2016_kia_k900_f34_fe_122161_1600.jpg

Verkko 10 toukok 2022 nbsp 0183 32 Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when you re choosing a vehicle to Verkko 6 toukok 2022 nbsp 0183 32 Benefits of business leasing for the self employed VAT Offsetting If your business is VAT registered then you can offset up to 100 of the VAT reducing the cost to lease a car or van overall

Verkko Lease rental restriction For businesses that hire or lease their cars tax relief is limited for higher emitting vehicles From April 2021 based on CO 2 emissions For Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 A 7 500 tax credit for electric vehicles will see substantial changes in 2024 It will be easier to get because it will be available as an instant rebate at

Download Tax Relief Leased Cars

More picture related to Tax Relief Leased Cars

Can You Ship A Leased Or Financed Car

https://www.caravanautotransport.com/wp-content/uploads/2021/07/ship-leased-financed-car.jpg

Here s The Real Story On Tax Relief RateMuse

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

R D Tax Relief In 2022 What You Need To Know

https://forrestbrown.co.uk/wp-content/uploads/2021/09/Stocksy_txp24f5e82ftaB300_Medium_3370983.jpg

Verkko Well if they do consider used ones That s because if you buy a used electric vehicle in 2024 from model year 2022 or earlier there s a tax credit for you too It s worth 30 Verkko 30 toukok 2023 nbsp 0183 32 Tax benefits on the car lease facility provided by the employer can be claimed depending on the ownership of the car and expenses incurred Read more here

Verkko April 26 2019 You know by now that you can get tax deductions for the personal use of a business car But what about if you re leasing a car Let s see how the HMRC treats Verkko Leased commercial vehicles Business tax relief on Leased vehicles As the lease rental restriction rules outlined above relate only to cars no restriction is applied on

What Are Deferred Tax Assets Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2023/07/23-optima-deferred-tax-assets.jpg

Tax Relief Special Installment Plans And Deadline Extensions Crowe

https://www.crowe.com/mv/-/media/crowe/firms/asia-pacific/mv/crowehorwathmv/covid-19-tax-relief---02-01.jpg?rev=16c3c54fa0f047eb884e55dec9cad9d9

https://www.taxassist.co.uk/.../what-tax-relief-is-available-on-a-leased-car

Verkko 11 helmik 2013 nbsp 0183 32 This means that if the car has emissions under 110g km you can get tax relief on all of the payments However if the car s emissions are above 110g km

https://www.thp.co.uk/leasing-electric-cars

Verkko 26 toukok 2022 nbsp 0183 32 You lease an electric car for 163 6 000 over the 2022 23 financial year You deduct the cost against profits As corporation tax is 19 then your tax savings

Prepare And File Form 2290 E File Tax 2290

What Are Deferred Tax Assets Optima Tax Relief

What Is The SEIS Tax Relief Scheme Exporaise

What Tax Relief Is Available On A Leased Car

The IRS Expands Tax Relief Again Fennemore

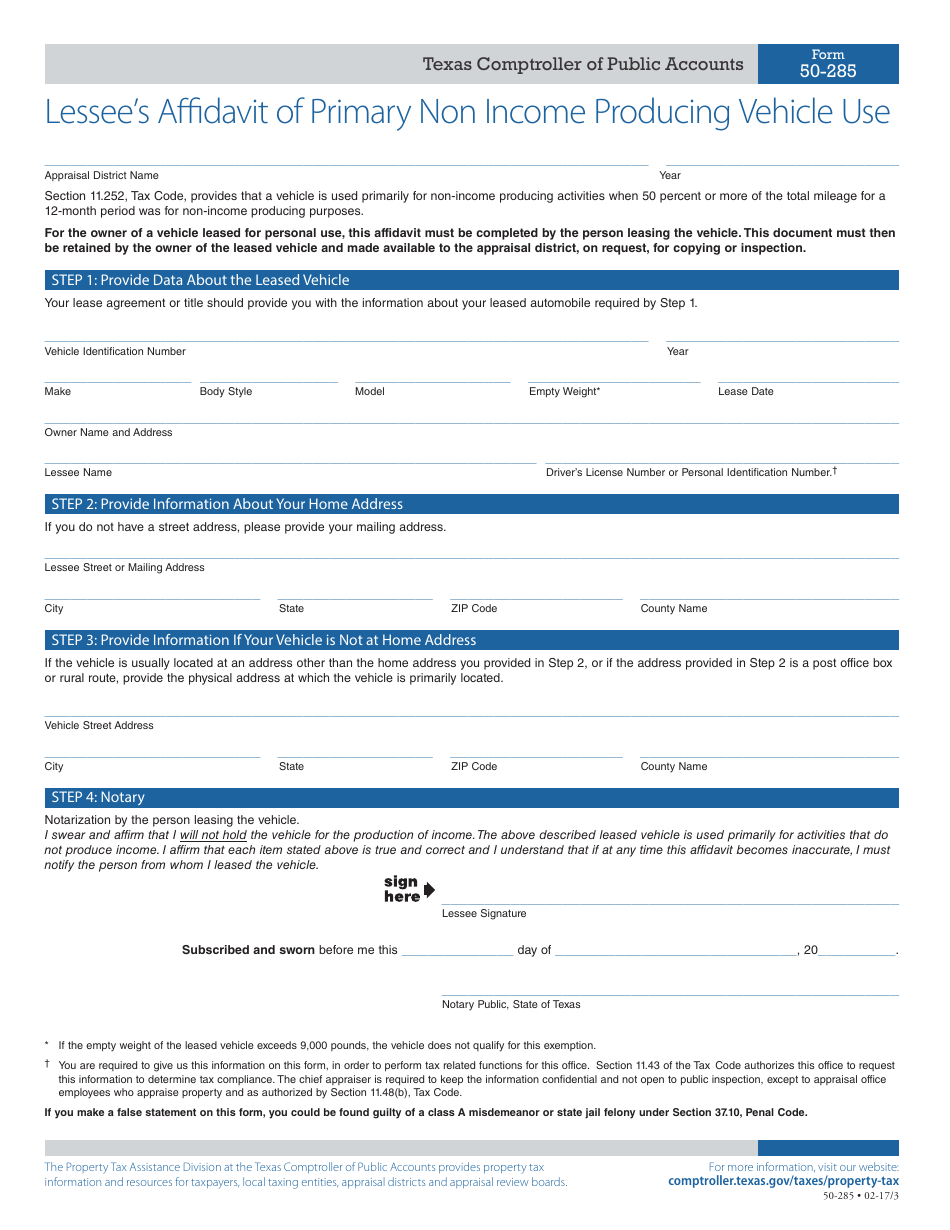

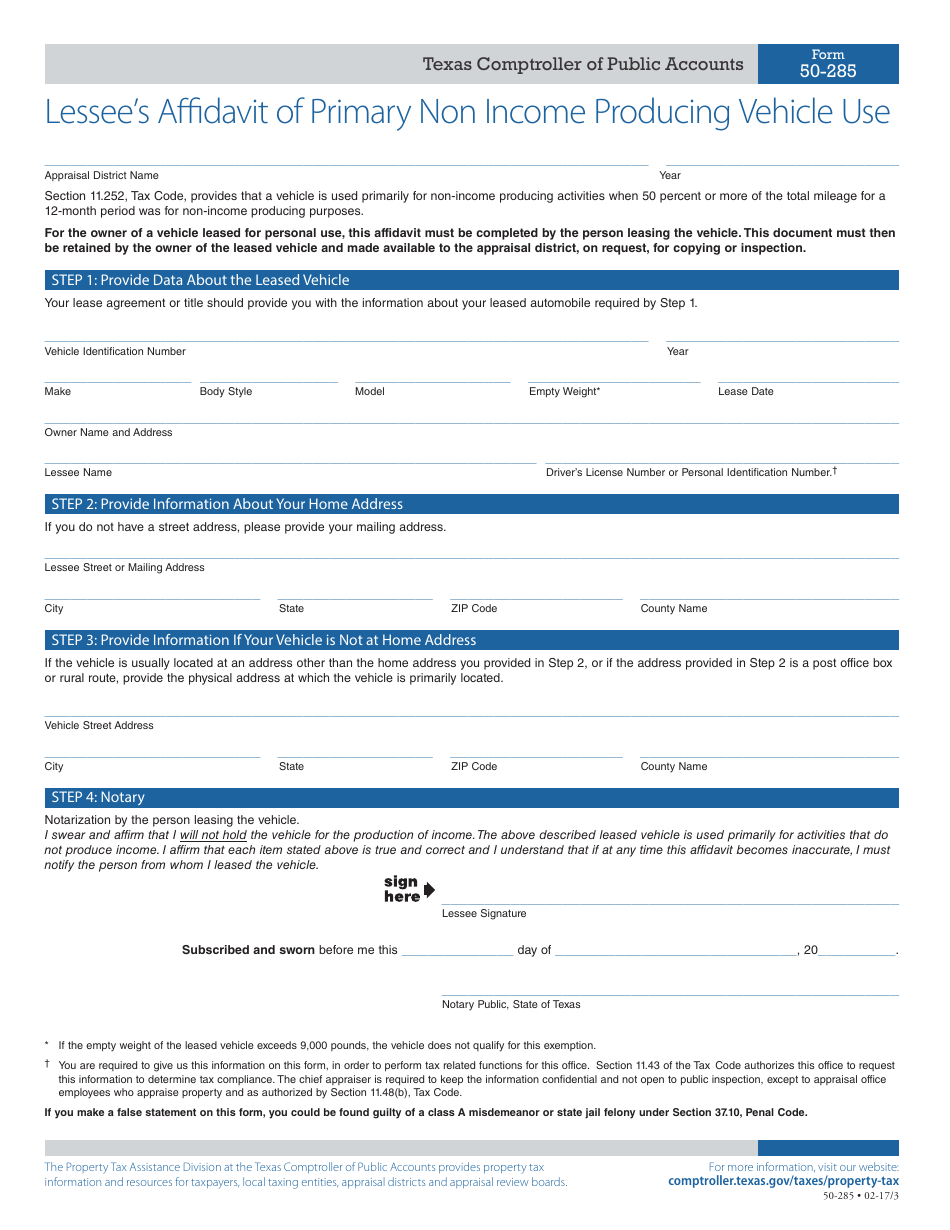

Property Tax On Leased Car In Texas Liked It A Lot Record Image Bank

Property Tax On Leased Car In Texas Liked It A Lot Record Image Bank

The Property Tax Credit Provides Relief But You Must Apply For It

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

What You Need To Know About Leased Car Insurance Corkhill Insurance

Tax Relief Leased Cars - Verkko 10 toukok 2022 nbsp 0183 32 Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when you re choosing a vehicle to