Tax Relief On Donations To Sports Clubs You may be able to claim tax relief on donations made to your sports body if you are an approved sports body and you have an approved project with the Department of

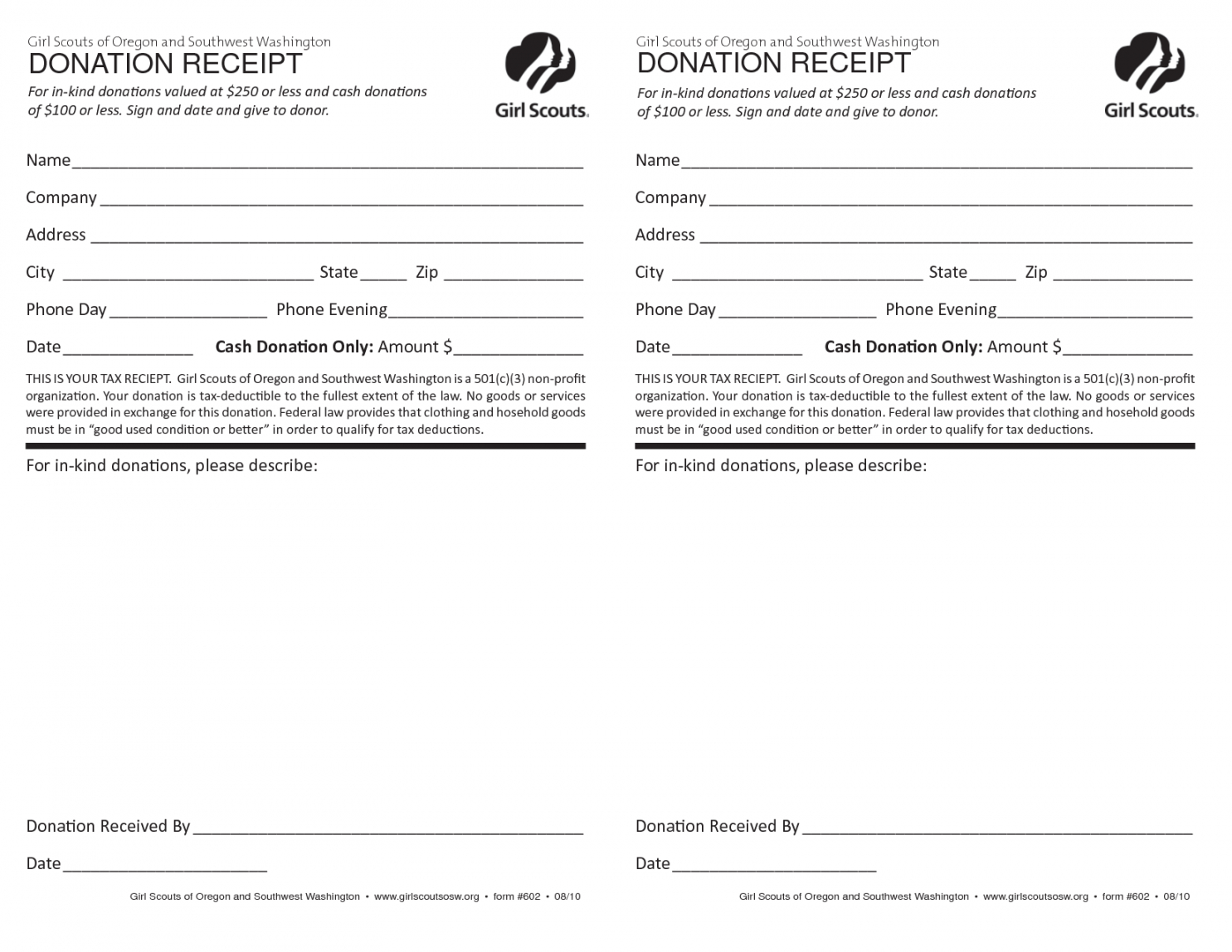

Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief The tax goes to you or the charity and how this works Who can apply for tax relief on donations to sports bodies The tax relief is available to approved sporting bodies who have an approved capital project with the Department of Transport Tourism and Sport To apply for tax

Tax Relief On Donations To Sports Clubs

Tax Relief On Donations To Sports Clubs

https://i.ytimg.com/vi/RDj1NUO1J6U/maxresdefault.jpg

Donating Land Property Or Shares To A Charity Thompson Taraz Rand

https://www.thompsontarazrand.co.uk/wp-content/uploads/2020/10/6d3d81dc-5c4e-4d01-805a-4ce9474f2f7d-1.jpg

Tax Relief On Donations To Charity Part 1 YouTube

https://i.ytimg.com/vi/4xFqSodsok4/maxresdefault.jpg

If your sports club registers with HM Revenue and Customs HMRC as a Community Amateur Sports Club you can benefit from some tax reliefs including claiming back tax on Gift Aid To make a Gift Aid donation you must have paid UK Income Tax and or Capital Gains Tax at least equal to the tax that all the charities and community amateur sports clubs

To qualify for tax relief your donations must be made to UK charities registered with the Charity Commission or to Community Amateur Sports Clubs CASCs Some overseas Individuals can make tax free donations to charitable organisations and to community amateur sports clubs CASCs The tax portion may go to the charity itself or to the donor The way tax

Download Tax Relief On Donations To Sports Clubs

More picture related to Tax Relief On Donations To Sports Clubs

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

ICAEW questions Pension Tax Relief Proposals M J Bushell

https://www.mjbushell.co.uk/wp-content/uploads/2020/10/Pension-2.jpg

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

As a business owner you are able to offset any cash donation that you give to a charity or a Community Amateur Sports Club CASC against your corporation tax This From April 2024 all non UK charities and CASCs will no longer be eligible to claim UK charitable tax reliefs This measure will ensure that UK taxpayer money only supports UK

Clubs which have adopted charitable status registered with the Charity Commission or community amateur sports club status known as CASC registered with Many sports clubs gain tax benefits by registering as a charity or CASC with HM Revenue Customs HMRC Once registered you can claim tax relief on income gains and

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Cloud 9 Accounting Team

https://cloud9accountingteam.co.uk/wp-content/uploads/2023/02/pexels-karolina-grabowska-5900037.jpg

https://www.revenue.ie › en › companies-and-charities › ...

You may be able to claim tax relief on donations made to your sports body if you are an approved sports body and you have an approved project with the Department of

https://www.gov.uk › guidance › help-with-charitable...

Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief The tax goes to you or the charity and how this works

How To Ensure You Get Tax Relief On Charitable Donations

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

Printable Printable Church Donation Receipt Template For Religious

Is A pensions Tax Raid Coming Weston Murray Moore

How To Get Tax Relief For Charitable Donations

Tax Relief On Home Help Comfort Keepers

Tax Relief On Home Help Comfort Keepers

FMCG Companies Seek Tax Relief On Dealer Discounts To Lift Sales

How To Claim Higher Rate Tax Relief On Pension Contributions

Do You Get Tax Relief On A Salary Sacrifice Pension Husky Finance

Tax Relief On Donations To Sports Clubs - Individuals can make tax free donations to charitable organisations and to community amateur sports clubs CASCs The tax portion may go to the charity itself or to the donor The way tax