Tax Relief On Foreign College Fees This in depth guide concerns the taxation of people working for universities of applied sciences and universities in international situations

If you are a foreign student or trainee your income will not usually be taxed in Finland if it is sourced outside Finland On the other hand if you work for and are paid by a Finnish You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees

Tax Relief On Foreign College Fees

Tax Relief On Foreign College Fees

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

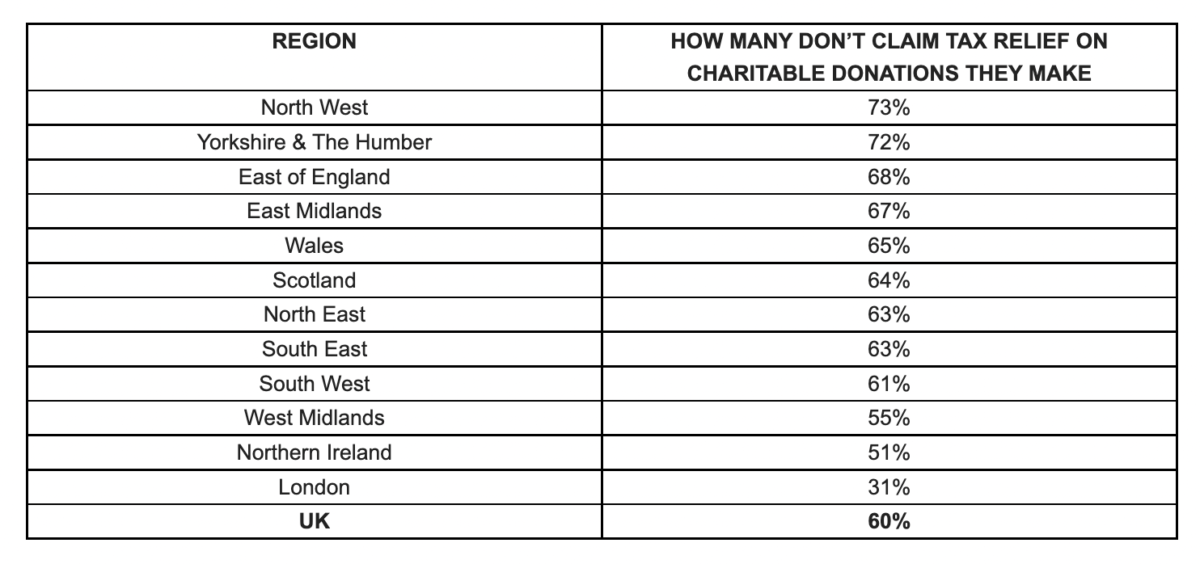

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

You can claim tax relief on fees paid for undergraduate postgraduate IT and foreign language courses using Revenue s myAccount service If you re self In this article we will explore the tax benefits offered on children s tuition fee the eligibility criteria and how to claim them The tax benefits offered on children s

Tax relief on tuition fees If you are not eligible for a maintenance grant you or your parent may claim tax relief on third level fees as follows Undergraduate courses Tax relief is Tax relief is available in respect of tuition fees paid in private third level institutions in institutions abroad and by repeat students and part time students The Student

Download Tax Relief On Foreign College Fees

More picture related to Tax Relief On Foreign College Fees

Tax Relief Matters Abacus Advice

https://www.aaltd.co.uk/blog/wp-content/uploads/2023/07/taxre.jpg

How To Maximise Tax Relief When Completing A Refurbishment

https://www.edwardsofgwynedd.com/wp-content/uploads/2023/12/Copy-of-Copy-of-Add-a-heading-1.png

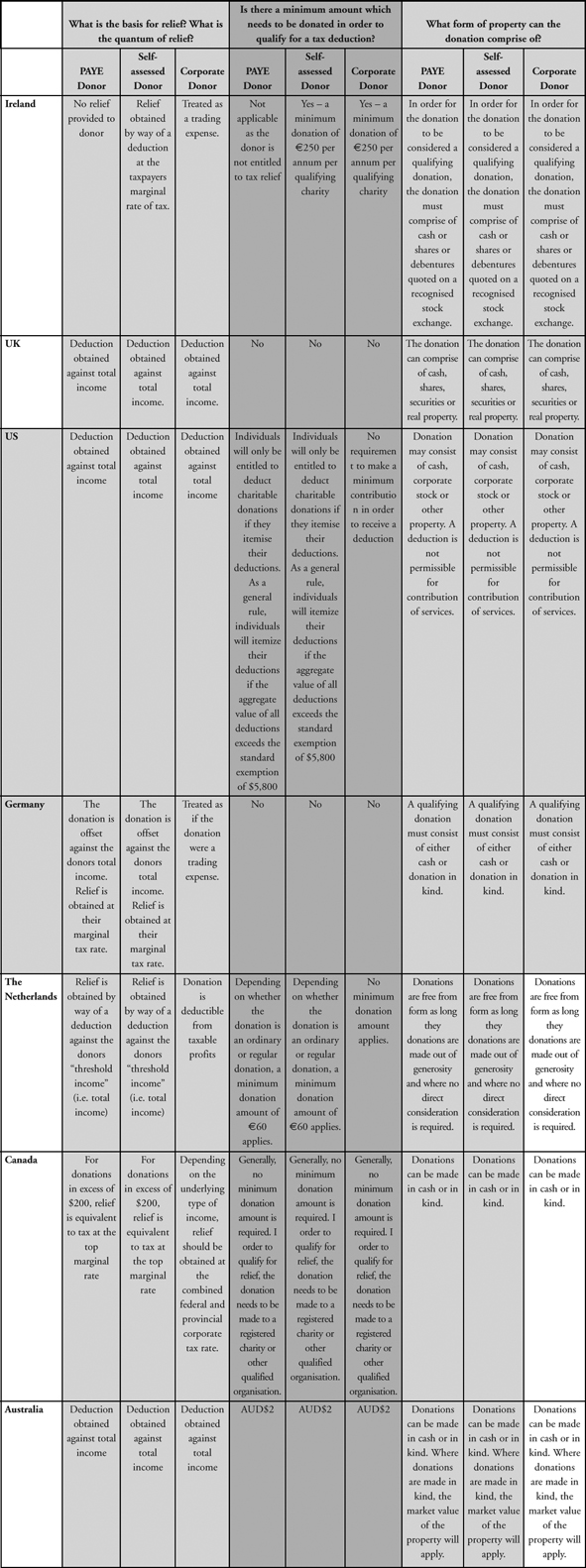

Tax Relief On Donations And Sponsorship Payments

https://media-exp1.licdn.com/dms/image/C4D12AQE4t2OG3AWSrw/article-cover_image-shrink_600_2000/0/1617873492793?e=2147483647&v=beta&t=ucD-O6YWn3nR-T52DbniDFjW0vmMjOM607U5ePQcsyA

Courses provided by colleges or institutions in other EU Member States or in the UK that provide distance education in Ireland are approved for the purposes of tax The relief is claimed by completing the tuition fees section on your Form 11 annual tax return at the end of the year If you receive any grant scholarship or

According to Section 80E students taking education loans to study in foreign universities can also avail of tax deductions under section 80E The interest paid on the loan amount If you are a deemed resident of Canada claiming eligible tuition fees a qualified foreign educational institution is a university college or other educational

New Tax Relief On Repatriation Of Intangible Property Ruchelman P L L C

http://static1.squarespace.com/static/52a5de52e4b03685242fc87b/54c6725ce4b00caefdcdb864/6475d5dc81a79f16111eac8f/1685518964808/intang.jpg?format=1500w

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

https://www.vero.fi/en/detailed-guidance/guidance/...

This in depth guide concerns the taxation of people working for universities of applied sciences and universities in international situations

https://www.vero.fi/en/individuals/tax-cards-and...

If you are a foreign student or trainee your income will not usually be taxed in Finland if it is sourced outside Finland On the other hand if you work for and are paid by a Finnish

What Is Tax Relief Can You Claim It Taxoo

New Tax Relief On Repatriation Of Intangible Property Ruchelman P L L C

Tax Relief On Income From Foreign Retirement Benefit EZTax

How To Claim Higher Rate Tax Relief On Pension Contributions

Will I Lose Pension Tax Relief When I Turn 75 I Still Run A Business

Will I Lose Pension Tax Relief When I Turn 75 I Still Run A Business

Tax Relief On Charitable Donations

7 Ways To Reduce Your PAYE Tax UK Bill ValueSpeaks

Conditions Related Tax Relief On HRA The Economic Times

Tax Relief On Foreign College Fees - You can claim tax relief on fees paid for undergraduate postgraduate IT and foreign language courses using Revenue s myAccount service If you re self