Tax Relief On Hybrid Cars Uk 2023 Gov Uk Petrol powered and hybrid powered cars for the tax year 2022 to 2023 These rates will remain frozen until the 2024 to 2025 tax year Petrol powered and hybrid powered cars for the

The changes in the appropriate percentage for company cars for the tax year 2025 to 2026 through to the tax year 2027 to 2028 were announced at Autumn Statement 2022 Detailed proposal AMAPs electric and hybrid cars are treated in the same way as petrol and diesel cars Mileage Allowance Relief MAR electric and hybrid cars are treated in the same way as

Tax Relief On Hybrid Cars Uk 2023 Gov Uk

Tax Relief On Hybrid Cars Uk 2023 Gov Uk

https://assets.ey.com/content/dam/ey-sites/ey-com/en_be/topics/tax/tax-alerts/ey-tax-alert-mobiliy-hybrid-vehicles-banner.jpg

UK To Ban Most Hybrid Cars Including Prius From 2040

https://fm.cnbc.com/applications/cnbc.com/resources/img/editorial/2018/05/04/105185570-GettyImages-486222298.1910x1000.jpg

Top 10 Best Hybrid SUVs 2022 Autocar

https://www.autocar.co.uk/sites/autocar.co.uk/files/styles/gallery_slide/public/images/car-reviews/first-drives/legacy/1-toyota-rav4-phev-2021-uk-first-drive-review-hero-front_0.jpg?itok=1Uh32mFw

A driver paying 20 income tax would be liable for 20 of the taxable value each year typically split into 12 monthly instalments and collected from their monthly wages With a low taxable value Due to the ultra low emission nature of electric and plug in hybrid vehicles the UK Government provides tax relief to incentivise their uptake

The first year rate is based on the amount of CO2 carbon dioxide your car produces After that a standard rate applies Petrol and diesel car owners will pay from April 2023 190 a year it s 180 for alternative fuel cars such as hybrids Capital Allowances on electric cars in 2023 24 The specific capital allowances for electric cars in the 2023 24 tax year depend on the prevailing regulations and legislation at that time From April 2021 electric vehicles are eligible for 100 first year capital allowances

Download Tax Relief On Hybrid Cars Uk 2023 Gov Uk

More picture related to Tax Relief On Hybrid Cars Uk 2023 Gov Uk

Hybrid Cars Everything You Need To Know About This

https://elondumptrump.com/wp-content/uploads/2020/09/Toyota-Prius-Plug-in_trans_NvBQzQNjv4Bq57tiKJlMh5mLqnXzcyUnxmizpiPDYtaMFsRuYvitBpI-scaled.jpg

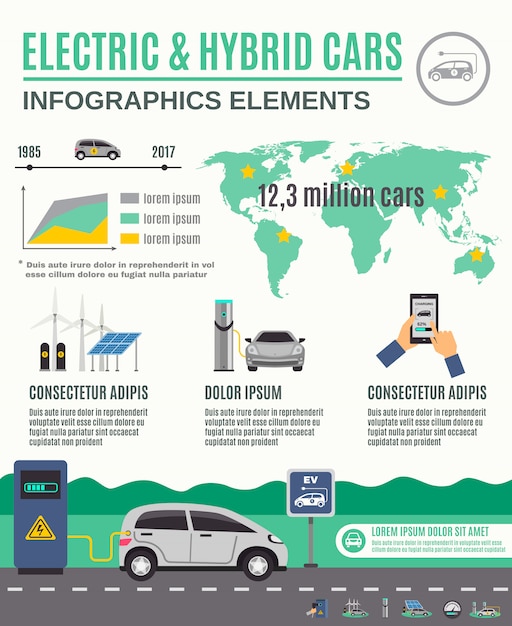

Free Vector Electric And Hybrid Cars Infographic Poster

https://image.freepik.com/free-vector/electric-hybrid-cars-infographic-poster_1284-9282.jpg

The 5 Best Plug in Hybrid SUV s To Keep Your Company Car Tax Down

https://www.pikeandbambridge.co.uk/uploads/images/cms/blog_large/1627985484BMWX545eMSportforweb.jpg

For 2019 20 low emission cars up to 50g km are taxed at 16 of list price or 20 for diesels However there have been significant reductions in this charge from April 2020 with electric only cars falling to 0 in 2020 21 as well as reductions for electric hybrids depending on their electric only range To ensure all drivers begin to pay a fairer tax contribution this meaure will bring electric vehicles which do not currently pay VED and AFVs and hybrids which pay a discounted rate into

Zero emission cars vans and motorcycles will have to pay Vehicle Excise Duty road tax from 2025 The government announced in November 2022 that electric cars will have to pay road tax from 2025 just five years before the UK bans the sale of new petrol and diesel engine cars in 2030 With 31 of 40 000 being 12 400 a 40 tax bracket employee would pay 4 960 a year or 413 33 a month in tax You would therefore be looking at an annual saving of over 4 500 if you went for the electric option What about tax on hybrid company cars Company car BiK rates are also determined by how far a car can travel in battery

Hybrid Cars With Rebates 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/8-popular-car-models-with-10-000-ves-tax-rebates-in-singapore-scaled.jpg

Nashenec

https://www.nashenec.co.uk/wp-content/uploads/2016/07/Tax-Your-Vehicle.jpg

https://www.gov.uk/guidance/company-car-benefit...

Petrol powered and hybrid powered cars for the tax year 2022 to 2023 These rates will remain frozen until the 2024 to 2025 tax year Petrol powered and hybrid powered cars for the

https://www.gov.uk/government/publications/income...

The changes in the appropriate percentage for company cars for the tax year 2025 to 2026 through to the tax year 2027 to 2028 were announced at Autumn Statement 2022 Detailed proposal

How Does A Hybrid Car Really Work This Infographic Explains It

Hybrid Cars With Rebates 2023 Carrebate

Personal Tax Relief 2022 L Co Accountants

A Guide To Electric Vs Hybrid Cars EVmotorcity

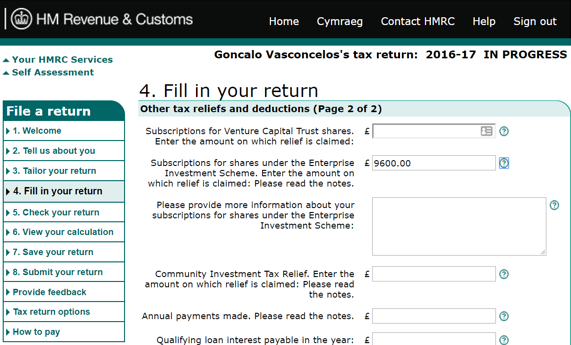

How To Claim EIS Income Tax Relief During HMRC Self assessment

10 Best Used Plug In Hybrid Vehicles Under 20 000 Kelley Blue Book

10 Best Used Plug In Hybrid Vehicles Under 20 000 Kelley Blue Book

How To Compare Hybrid Vehicles Advantages Types And Comparisons

The Best Hybrid Cars For Less Than 300 Per Month What Car

Car Road Tax Your Guide To Vehicle Excise Duty VED Parkers

Tax Relief On Hybrid Cars Uk 2023 Gov Uk - EV tariff Save with our exclusive GoElectric tariffs for electric car owners Electric cars Find out about car leasing charging points and EV tariffs Home charging points Get a fast and reliable 7kW smart home charger from Pod Point Electric car leasing Find your ideal electric car lease from our wide range of options available