Tax Relief On Tuition Fees Uk Verkko Overview What s exempt What to report and pay Technical guidance Overview As an employer providing training expenses for your employees you have certain tax National Insurance and reporting

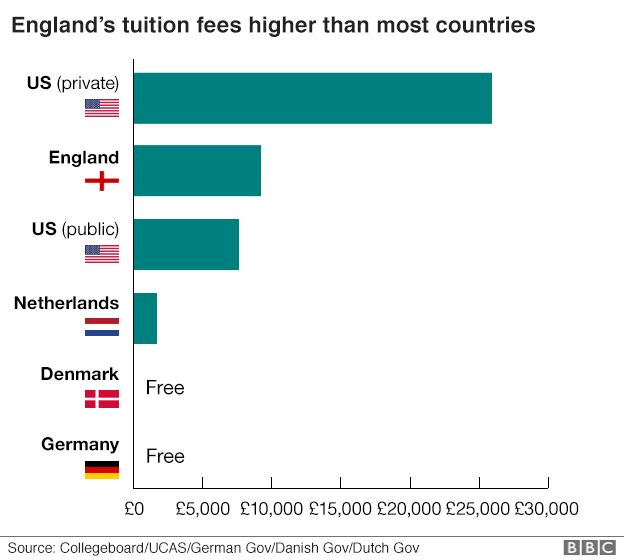

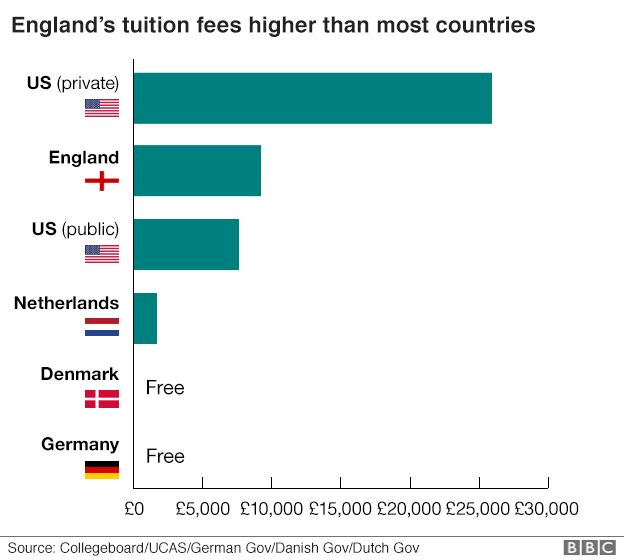

Verkko Expenses and benefits school fees for an employee s child As an employer paying your employees children s school fees you have certain tax National Insurance and reporting obligations Verkko 30 kes 228 k 2023 nbsp 0183 32 Higher education providers in England allocate their students home or overseas international status for the purpose of charging tuition fees Undergraduate home fees are currently capped by the Government at 163 9 250

Tax Relief On Tuition Fees Uk

Tax Relief On Tuition Fees Uk

https://www.alerttax.in/wp-content/uploads/2017/02/Tax-Benefits-on-Tuition-Fees-School-Fees-Education-Allowances.png

What Is Pension Tax Relief Moneybox Save And Invest

https://www.moneyboxapp.com/wp-content/uploads/2020/01/Copy-of-How-do-_pensions-work_-02-1024x516.png

The U S Leads The World In Tuition Fees Infographic

https://blogs-images.forbes.com/niallmccarthy/files/2017/09/20170912_Tuition_Fees.jpg

Verkko 24 helmik 2022 nbsp 0183 32 Today the government has also announced the tuition fee cap will be frozen at 163 9 250 for a further two years up to and including academic year 2024 to 25 further reducing the real cost to Verkko 23 elok 2022 nbsp 0183 32 Most university courses last for 3 years meaning that you would be able to extract a total of 163 39 710 163 13 570 13 070 x2 during your child s course However the cost for you to withdraw this amount normally would be almost 163 55 594 saving you over 163 16 000 in tax

Verkko Tuition Fee Loan Your university or college sets your tuition fee and the loan is paid directly to them You have to pay it back If you re a full time student you can get up to 163 9 250 Verkko 14 lokak 2020 nbsp 0183 32 Generally the cost of education is a private expense and tax relief is not available however there is a limited opportunity in some circumstances where children are employed in the family business This is found tucked away in s776 ITTOIA 2005 which provides a tax exemption for scholarship income

Download Tax Relief On Tuition Fees Uk

More picture related to Tax Relief On Tuition Fees Uk

Can I Get Tax Relief For Third level Fees Refund Your Tax

https://refundyourtax.ie/wp-content/uploads/2019/01/1-students.jpg

University Students In England Are Now Paying The Highest Tuition Fees

http://i.huffpost.com/gen/3708426/images/o-TUITION-FEES-PROTEST-LONDON-facebook.jpg

Student Loan Repayment Calculator UK 2019

http://i.imgur.com/1cpAF6B.png

Verkko 5 tammik 2024 nbsp 0183 32 January 4 2024 Roula Khalaf Editor of the FT selects her favourite stories in this weekly newsletter Labour explored a move to impose sales tax retroactively on private school fees to stop Verkko 11 jouluk 2023 nbsp 0183 32 Are private school fees tax deductible You can t use school fees to offset your tax bill But there are other ways to pay and save for private school more tax efficiently One popular route is going through the grandparents who may be happy to help out or use their grandchild s inheritance in this way

Verkko 15 marrask 2022 nbsp 0183 32 Unlike the provision of childcare or the award of scholarships there is no general exemption in place for the payment of school fees Introduction The payment of school fees on behalf of an employee is treated as though the employer has settled a pecuniary liability of the employee Verkko 14 tammik 2021 nbsp 0183 32 You may not be able to get tax relief on school fees in the UK but how can you reduce the costs of paying for private school fees Here are our top 8 tips 1 Set up a family business This is best done when the business is established It involves Grandma and Granddad setting up a family business and then naming the

Graduate Over Qualification In Britain Reaches Saturation Point

http://i.huffpost.com/gen/1693489/original.jpg

Tuition Fees Stock Photo Image Of Part Subject Time 22624224

https://thumbs.dreamstime.com/z/tuition-fees-22624224.jpg

https://www.gov.uk/expenses-and-benefits-training-payments

Verkko Overview What s exempt What to report and pay Technical guidance Overview As an employer providing training expenses for your employees you have certain tax National Insurance and reporting

https://www.gov.uk/expenses-benefits-school-fees-for-employees-child

Verkko Expenses and benefits school fees for an employee s child As an employer paying your employees children s school fees you have certain tax National Insurance and reporting obligations

UK Tuition Fees 2023 Guide Study In UK

Graduate Over Qualification In Britain Reaches Saturation Point

Tuition Fees Roberts Nathan Business Advisors Accountants

Income Tax Relief On Tuition Fees Likely Latest News India

.jpg)

Benefits Of Saving Through Your Pension Phoenix Wealth

Tuition Fees Theresa May Challenges Over priced Universities

Tuition Fees Theresa May Challenges Over priced Universities

Russell Group On Tuition Fees Students Should Pay But System Needs

Editable 5 Tuition Receipt Templates Pdf Free Premium Templates

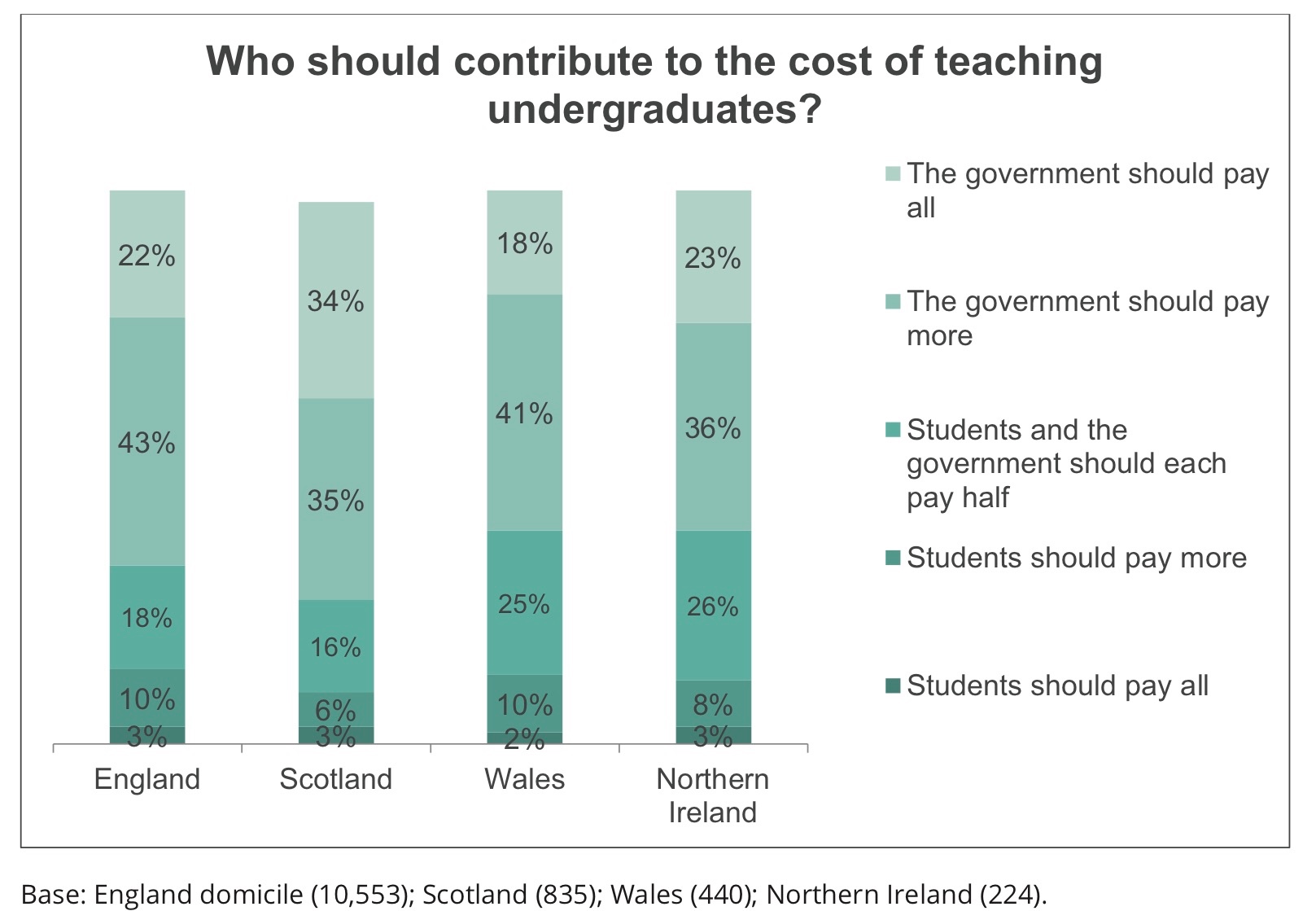

What Do Students Really Think About Tuition Fees HEPI

Tax Relief On Tuition Fees Uk - Verkko 12 tammik 2023 nbsp 0183 32 Most private schools have charitable status which means in England and Wales they qualify for at least 80 relief on business rates This discount was removed in Scotland in April