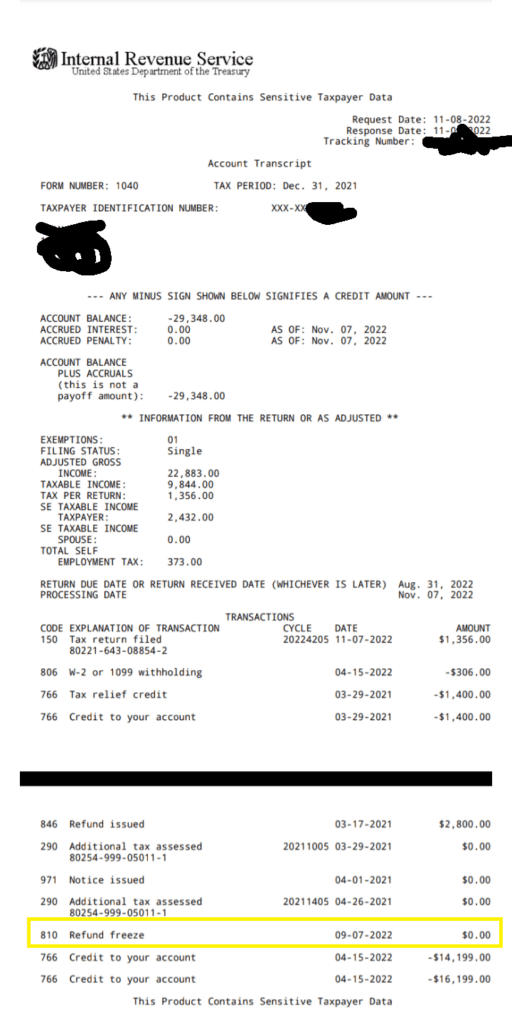

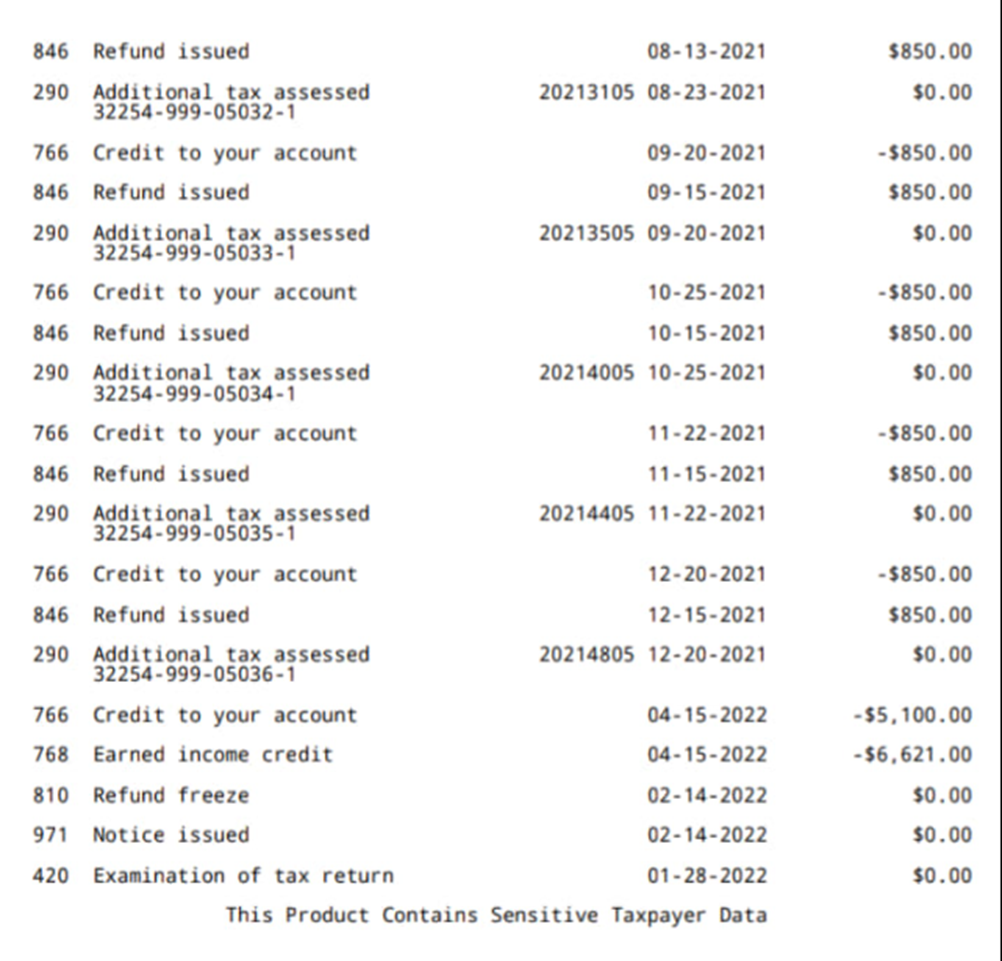

Tax Return Code 810 What does Code 810 mean on my transcript Unfortunately TC 810 means the IRS has found an issue with the tax filers return and has frozen any additional refund payments Your IRS account is on hold and

1 Best answer JohnW15 Intuit Alumni Yes the freeze should be removed assuming that the verification you went through proves you re the person named on the IRS Code 810 means a freeze has been placed on your refund or a freeze on your earned income credit The refunds are frozen due to some reasons such as

Tax Return Code 810

Tax Return Code 810

https://images.pexels.com/photos/6863517/pexels-photo-6863517.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

IRS Tax Transcript Code 810 Refund Freeze And What It Means When

https://savingtoinvest.com/wp-content/uploads/2022/11/image-2-512x1024.png

Code 846 Refund Issued On Your IRS Tax Transcript What It Means For

https://savingtoinvest.com/wp-content/uploads/2022/03/image-5.png?is-pending-load=1

Code 810 means your refund is halted and inaccessible until the hold releases The 810 freeze overrides refund codes like 846 to prevent release of funds We will start by explaining what an 810 refund freeze is and the common reasons why it might occur including mistakes on your tax return unpaid debts and fraud prevention measures

Added verbiage and timeframes for Transaction Code 810 Responsibility Code 4 Changes made for policy changes in RIVO IPU 22U1022 issued 10 14 2022 14 IRM Code 810 on your tax transcript refers to an adjustment made to your tax return It s like that unexpected plot twist in a movie you didn t see it coming but now

Download Tax Return Code 810

More picture related to Tax Return Code 810

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

Meaning Of Codes On WMR IRS2GO Or IRS Transcript For Your Tax Return

https://savingtoinvest.com/wp-content/uploads/2022/02/image.png

Withholding Tax Return

https://zatca.gov.sa/ar/eServices/PublishingImages/incom tax submission.png

62 rowsSection 10 Examination Issues 21 5 10 Examination Issues Manual Transmittal September 06 2023 Purpose 1 This transmits revised IRM Otherwise use a Hold Code 2 and release the refund using RN 810 811 or issue a manual refund if required See IRM 21 4 6 5 10 6 Issuing the Injured Spouse Refund Satisfy

As a tax return is processed there are transaction codes added to it to indicate changes These transaction codes are three digits long They are used to identify a transaction 9 HUGE Tax Write Offs for Individuals EVERYONE can use these Unravel the mysteries of Code 810 IRS in this informative video Dive deep into the complexities of Tax Code

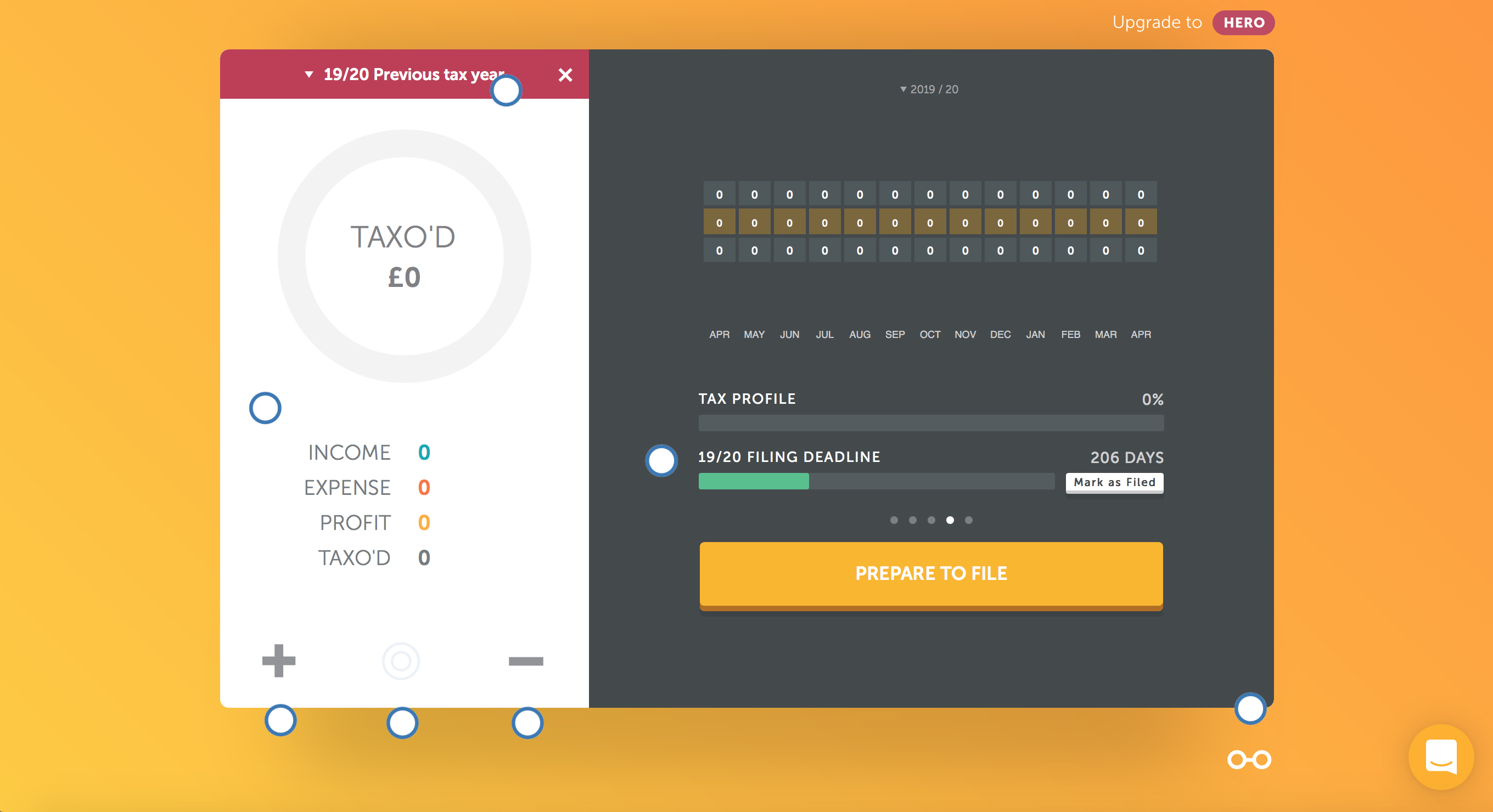

TAXO D TechRadar

https://cdn.mos.cms.futurecdn.net/rRmQrrrw7zMv897QeEENzb.jpg

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

https://savingtoinvest.com/irs-tax-transcr…

What does Code 810 mean on my transcript Unfortunately TC 810 means the IRS has found an issue with the tax filers return and has frozen any additional refund payments Your IRS account is on hold and

https://ttlc.intuit.com/community/retirement/...

1 Best answer JohnW15 Intuit Alumni Yes the freeze should be removed assuming that the verification you went through proves you re the person named on the

IRS Tax Transcript Code 810 Refund Freeze And What It Means When

TAXO D TechRadar

What Is Code 570 And 971 On My IRS Tax Transcript And Will It Delay Or

How To Use Aadhaar Card For Electronic Tax Return Verification

Tax Return Employment Self Employment Dividend Rental Property

How To Read Tax Account Transcripts Like A Tax Pro

How To Read Tax Account Transcripts Like A Tax Pro

Tax Return And Tax Investigators Stock Photo Alamy

NFocus Tax Service LLC Clearwater FL

810 System80 Inc

Tax Return Code 810 - Added verbiage and timeframes for Transaction Code 810 Responsibility Code 4 Changes made for policy changes in RIVO IPU 22U1022 issued 10 14 2022 14 IRM