Tax Return Credit 2023 You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified

A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your Earned income credit The earned income tax credit could be worth between 600 and 7 430 for the 2023 tax year depending on your filing status and the number of

Tax Return Credit 2023

Tax Return Credit 2023

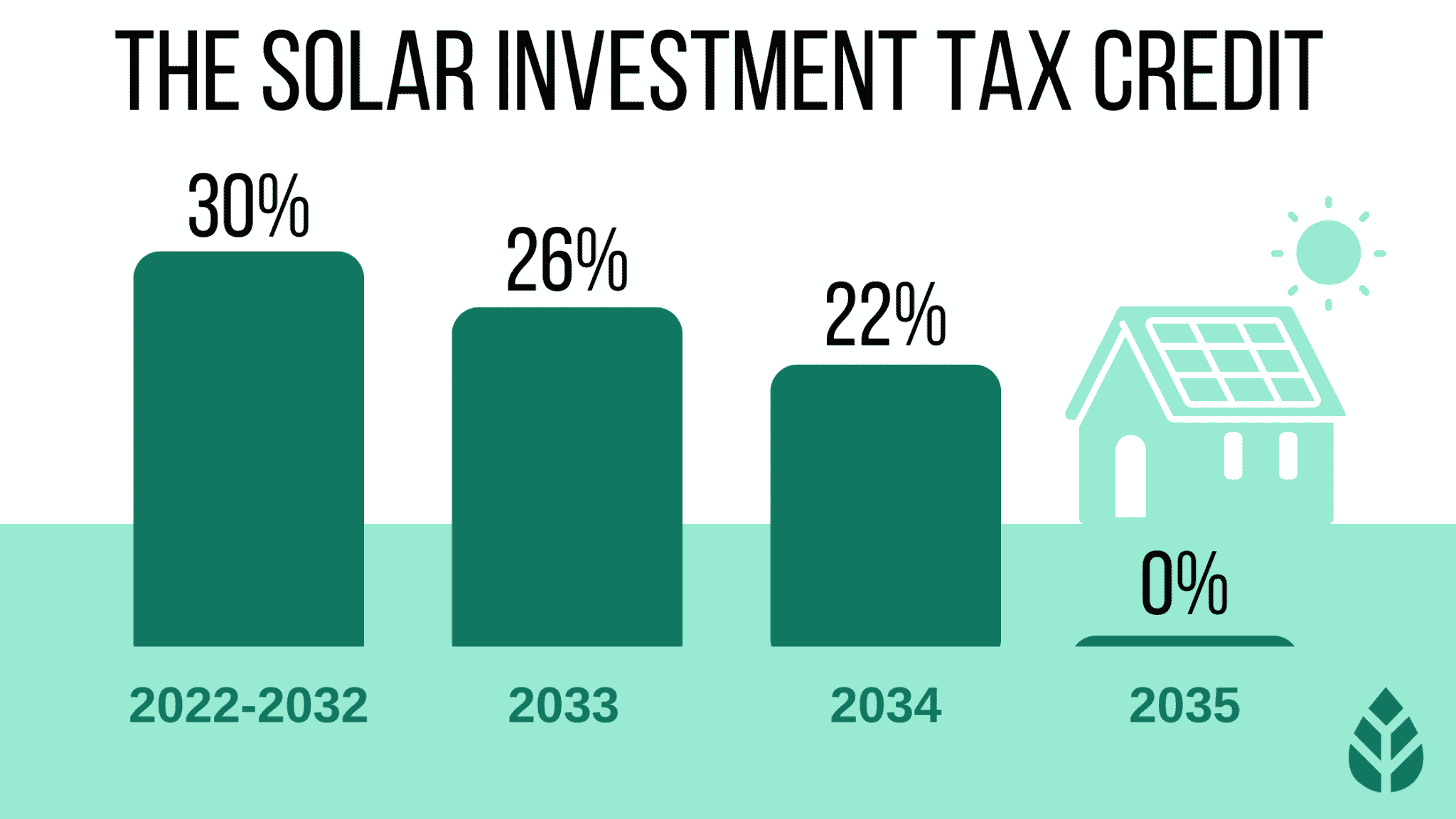

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

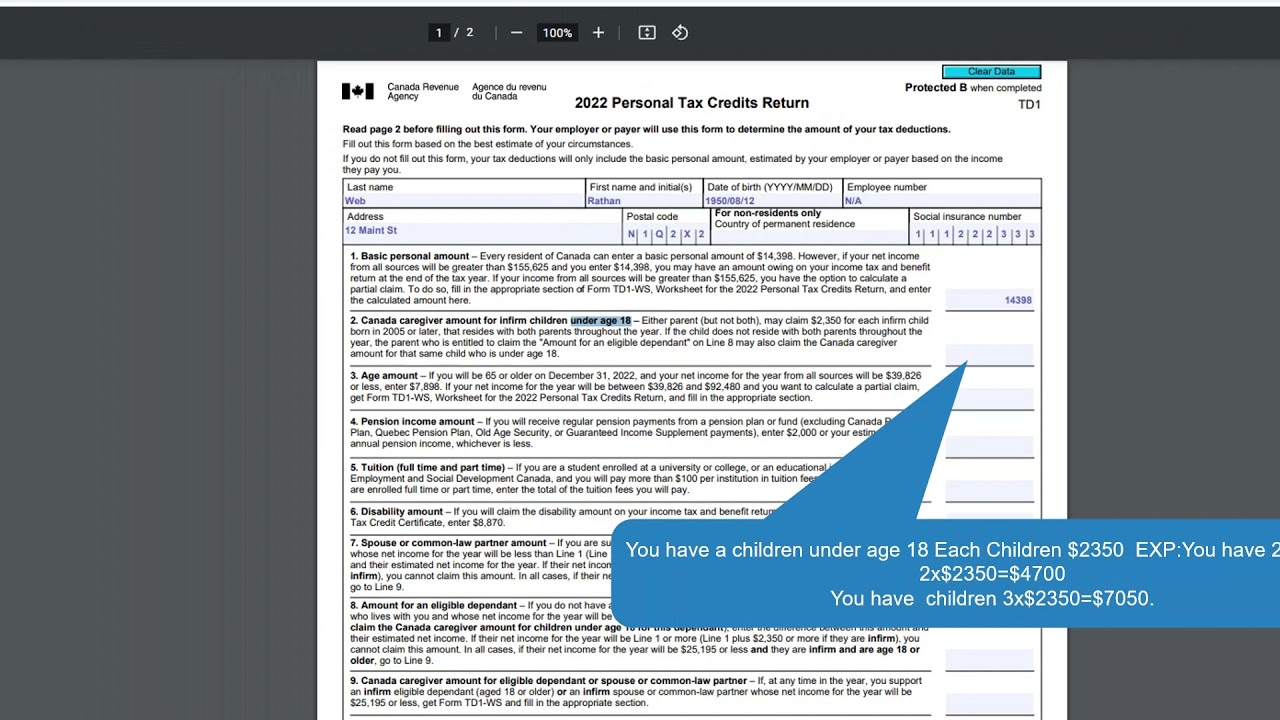

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg

Trump Tax Return Committee Releases Detailed Report Herald ng

https://int.nyt.com/data/documenttools/e5cb7acb35c3e3d9/1/output-1.png

For the 2023 tax year you can claim up to 2 000 per tax return The lifetime learning credit is typically used by students who don t qualify for the AOTC As its name implies you can use it Most people who are eligible for the earned income tax credit and the child tax credit claim those credits Together these credits lifted 6 4 million people out of poverty in 2023 more than any

The most noteworthy increases are about 7 for standard deduction amounts income tax brackets and the Earned Income Tax Credit EITC for tax year 2023 Understand how these increases impact your clients The income tax return calculator estimates your refund or taxes owed based on income deductions and credits By inputting relevant data it uses tax brackets and rules to provide an

Download Tax Return Credit 2023

More picture related to Tax Return Credit 2023

2023 Irs Tax Brackets Chart Printable Forms Free Online

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

https://studycafe.in/wp-content/uploads/2022/07/ITR.jpg

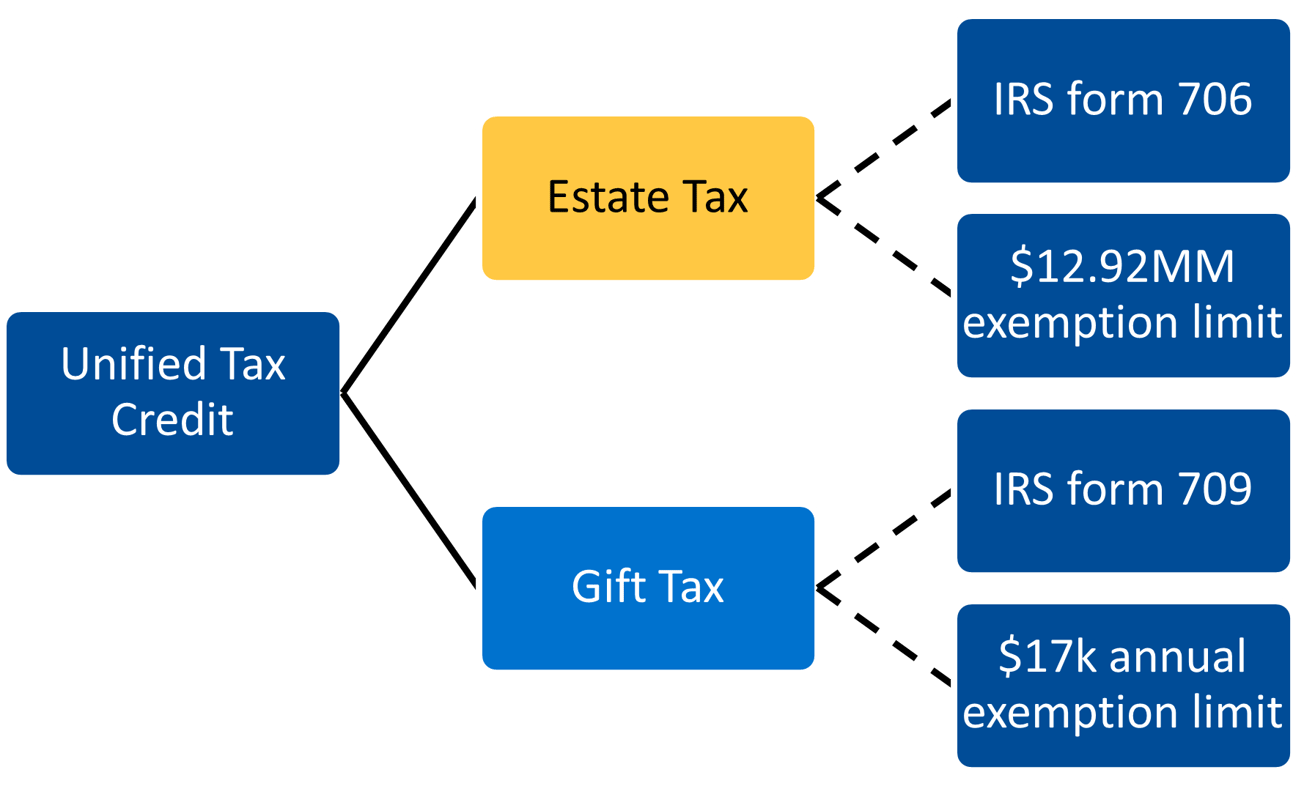

2023 Guide To The Unified Tax Credit

https://www.oakstreetfunding.com/hs-fs/hubfs/unified tax credit 2023.png?width=1315&height=788&name=unified tax credit 2023.png

This guide includes an overview of the most common tax credits available for the 2023 tax year that you may be able to apply when you file taxes in 2024 Claiming credits could wipe out your tax bill and even result in a refund Often confused with a tax deduction a tax credit directly reduces your tax liability Credits provide a

Use SmartAsset s Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount This calculator is updated with rates Federal tax credits can be a big help to low to moderate income taxpayers looking to reduce their taxes or maximize their tax refund Here are the 5 biggest tax credits you might

File Credit cards jpg Wikimedia Commons

http://upload.wikimedia.org/wikipedia/commons/4/4f/Credit-cards.jpg

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

https://www.irs.gov › credits

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified

https://www.irs.gov › ... › refundable-tax-credits

A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your

Child Tax Credit 2022 Age Limit Latest News Update

File Credit cards jpg Wikimedia Commons

I Amended My Tax Return Now What

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Is Itr Form Available For Ay 2023 24 Printable Forms Free Online

Make The Most Of Your 2021 Tax Return Cascade Community Credit Union

Vol 2 No 1 2021 Tax And Business Journal Jurnal Pajak Dan Bisnis

Tax Return Credit 2023 - For the 2023 tax year you can claim up to 2 000 per tax return The lifetime learning credit is typically used by students who don t qualify for the AOTC As its name implies you can use it