Tax Return Due Date 2023 California Sacramento The California Franchise Tax Board today confirmed that most Californians have until November 16 2023 to file and pay their tax year 2022 taxes to avoid penalties

2023 S Corporation Income Tax returns due and tax due for calendar year filers 2023 Partnership and LLC Income Tax returns due and tax due for calendar year filers The tax deadline in California is Nov 16 2023 if you lived in a federally declared disaster area included in at least one of three different declarations This deadline applies to filing and paying your taxes

Tax Return Due Date 2023 California

Tax Return Due Date 2023 California

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

No Extension For Income Tax Return Due Date 2023

https://sirwiznews.com/wp-content/uploads/2023/07/sirpraradox_Income_Tax_Return_Filing_in_India_7bd82339-1ec8-43c4-b577-a0da9bd01f50.png

2023 Tax Due Dates Decimal

https://uploads-ssl.webflow.com/5e41d080471798e913648c3e/63b5e591f30ddf62c7b5d0c9_tax due date.jpg

This extension applies to the 2023 tax returns normally due on Tax Day April 15 2024 As a result individuals and businesses in the affected areas now have until June 17 2024 to file On Jan 11 2023 the IRS announced that California storm victims now have until May 15 2023 to file various federal individual and business tax returns and make tax payments The IRS is

Individuals whose tax returns and payments are due on April 18 2023 Quarterly estimated tax payments due January 17 2023 April 18 2023 June 15 2023 and September 15 2023 Business entities whose tax returns are Quarterly payroll and excise tax returns normally due on May 1 July 31 and Oct 31 Calendar year 2022 returns filed by tax exempt organizations normally due on May 15 Other returns payments and time sensitive

Download Tax Return Due Date 2023 California

More picture related to Tax Return Due Date 2023 California

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

File Your Income Tax Return Now Last Date Is 31st July 2023

https://www.nbaoffice.com/wp-content/uploads/2023/06/Green-and-White-Tax-Day-Social-Media-Graphic.png

Income Tax Return Due Date Last Date 2021 ITR Filing Online Payment

https://static.india.com/wp-content/uploads/2021/12/Income-Tax-Return-ITR-Filing-News.jpg

With the relief those who would have had an October 16 2023 extended tax filing deadline now have until February 15 2024 to file However tax year 2022 return tax payments originally due on April 18 2023 are not eligible for the extension Franchise Tax Board FTB has extended the filing and payment deadlines to October 16 2023 for California individuals and businesses impacted by 2022 23 winter storms Visit FTB s website for more detailed information

April 5 2023 The delay to mid October applies to every 2022 related action that would have faced an April 17 deadline including making tax favored contributions to an IRA or a health savings The IRS further postponed tax deadlines for most California taxpayers to Nov 16 2023 In the wake of last winter s natural disasters the normal spring due dates had previously been

Tax Statutory Compliance Calendar For The Month Of March 2023

https://ebizfiling.com/wp-content/uploads/2023/03/March__4_.png

Itr Filing Last Date Fy 2022 23 Ay 2023 24 Income Tax Return Due

https://www.mompreneurcircle.com/wp-content/uploads/2023/07/itr-filign-Income-Tax-Return-Due-Date.jpg

https://www.ftb.ca.gov/about-ftb/newsroom/news...

Sacramento The California Franchise Tax Board today confirmed that most Californians have until November 16 2023 to file and pay their tax year 2022 taxes to avoid penalties

http://www.taxes.ca.gov/Income_Tax/Important_Dates

2023 S Corporation Income Tax returns due and tax due for calendar year filers 2023 Partnership and LLC Income Tax returns due and tax due for calendar year filers

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

Tax Statutory Compliance Calendar For The Month Of March 2023

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates

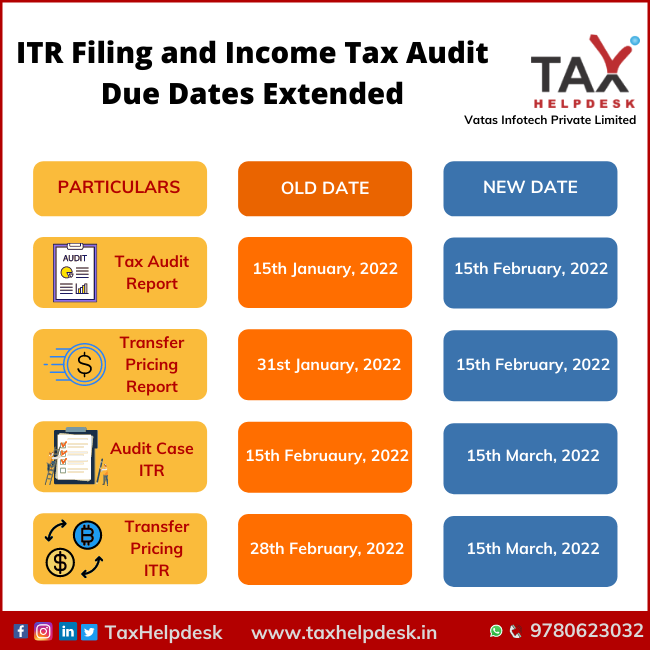

ITR Filing Income Tax Audit Due Dates Extended FY 2020 21 TaxHelpdesk

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

Plastic Taxes Cheap Offer Save 63 Jlcatj gob mx

Coronavirus Last Date To File IT Returns Extended Ummid

Company Tax Return Due Date 2023 Australia Pay Period Calendars 2023

Tax Return Due Date 2023 California - On Jan 11 2023 the IRS announced that California storm victims now have until May 15 2023 to file various federal individual and business tax returns and make tax payments The IRS is