Tax Return Due Date With Extension You must file your extension request no later than the regular due date of your return Taxpayers in certain disaster areas do not need to submit an extension electronically or

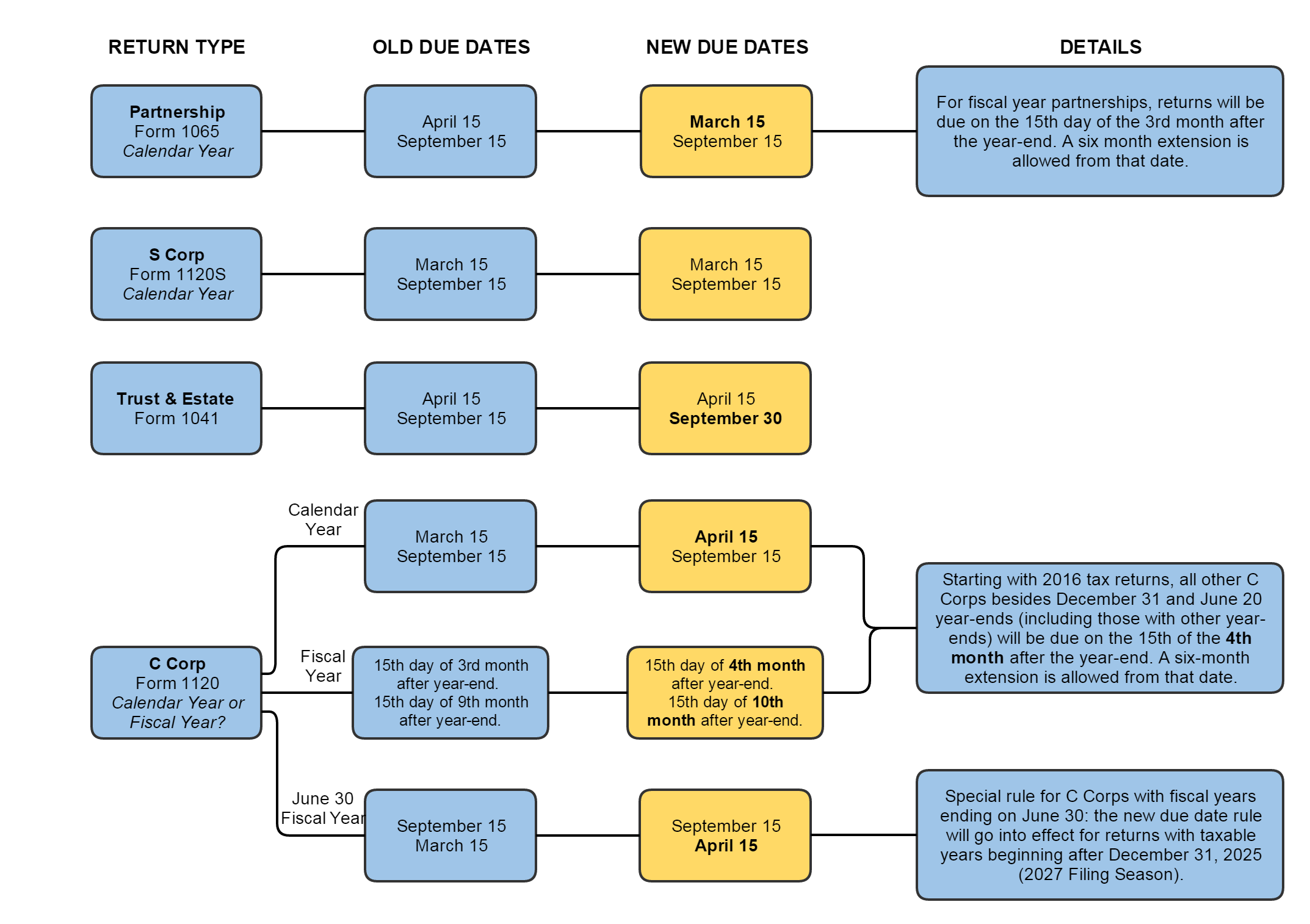

C and F Corporate returns with fiscal tax year ends other than June 30 are due the 15th day of the 4th month after the end of its tax year Form 7004 extensions for C and F Corporate The Income Tax Department has started receiving requests from individual taxpayers and tax professionals for extending the ITR due date for AY 2024 25 beyond July 31

Tax Return Due Date With Extension

Tax Return Due Date With Extension

https://faveplus.com/wp-content/uploads/2022/02/tax-returns.jpg

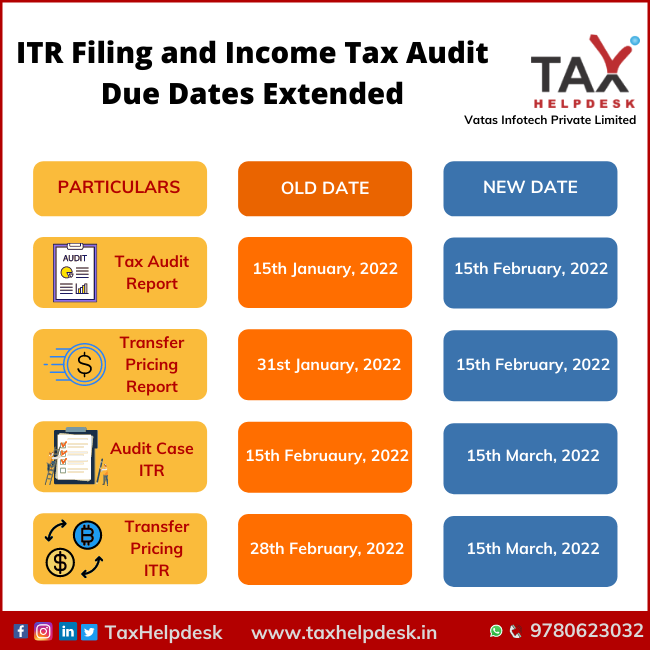

ITR Filing Income Tax Audit Due Dates Extended FY 2020 21 TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/01/ITR-Filing-and-Income-Tax-Audit-Due-Dates-Extended.png

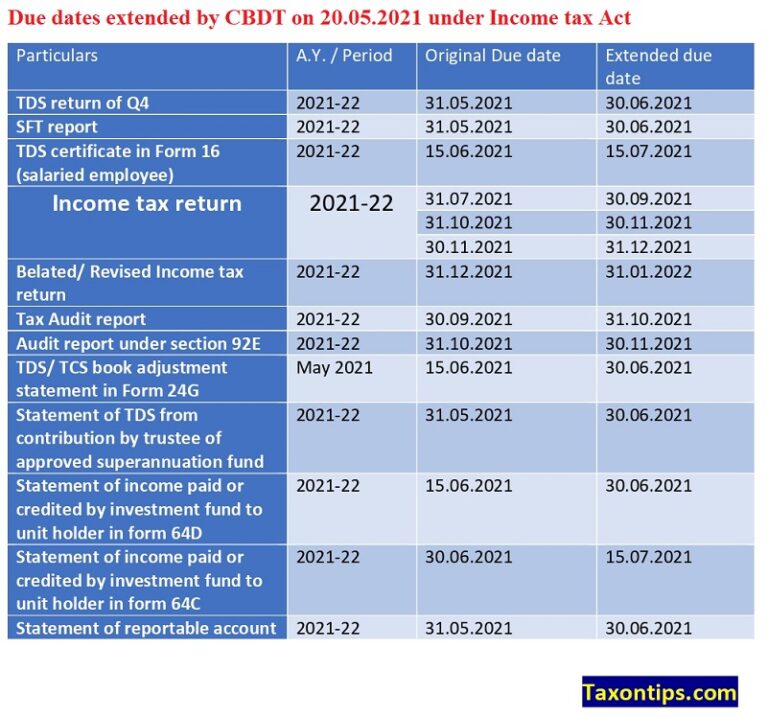

Breaking News Due Date For Income Tax Return Tax Audit TDS Return

https://www.taxontips.com/wp-content/uploads/2021/05/due-dates-extended-under-Income-tax-act-768x717.jpg

The new federal tax filing deadline is automatic so you don t need to file for an extension unless you need more time to file after May 17 2021 If you file for an extension Usually the due date to file an income tax return is 31st July for individuals and non audit cases and 31st October for audit cases of the relevant assessment year You can

To avoid possible penalties you should estimate and pay your federal taxes by the due date You can request an extension Online using IRS Free File program When you pay your estimated If you re unable to complete your federal tax return by the tax deadline you can file an extension with the IRS to avoid potential failure to file penalties Filing an extension will

Download Tax Return Due Date With Extension

More picture related to Tax Return Due Date With Extension

Income Tax Compliances Due Date Extension B Arun Balaji Associates

https://arunbalaji.co.in/wp-content/uploads/elementor/thumbs/income-tax1-p98ype9gbuedegtxepydjmhu2st7e9p309he5tygeg.jpg

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

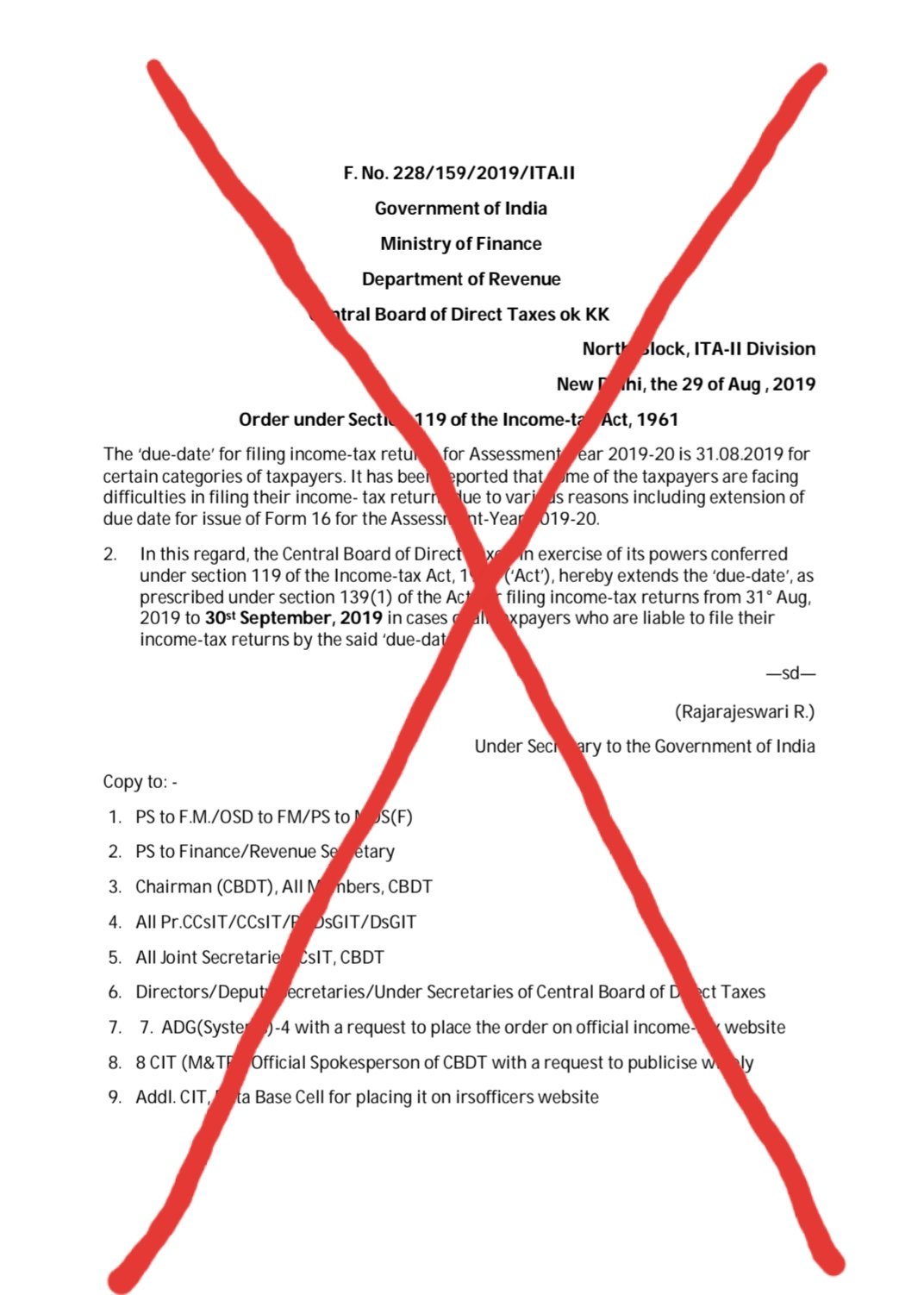

Income Tax Due Date Extension AY2019 20 IndiaFilings

https://pbs.twimg.com/media/EDNHYQxU0AA7Y4l.jpg:large

Instead of filing Form 4868 you can apply for an automatic extension by making an electronic payment by the due date of your return You can pay online or by phone See Extensions of Time to File Tax day might be circled in red on your calendar but circumstances may keep you from filing on time Fortunately you can request extra time to file

What is the tax due date for filing taxes with extensions Oct 15 If you filed Form 4868 extending the due date of your return this is the last day to file your tax return and pay any A tax extension is a request for an additional six months to file a tax return with the IRS In 2024 an extension moved the filing deadline from April 15 to Oct 15

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

https://pbs.twimg.com/media/Ftfrk2DagAECRKs.jpg

The 2021 Tax Filing Deadline Has Been Extended Access Wealth

https://access-wealth.com/wp-content/uploads/2021/03/tax-extension-2.jpeg

https://www.irs.gov/forms-pubs/extension-of-time-to-file-your-tax-return

You must file your extension request no later than the regular due date of your return Taxpayers in certain disaster areas do not need to submit an extension electronically or

https://www.thomsonreuters.com/en-us/help/ultratax...

C and F Corporate returns with fiscal tax year ends other than June 30 are due the 15th day of the 4th month after the end of its tax year Form 7004 extensions for C and F Corporate

Plastic Taxes Cheap Offer Save 63 Jlcatj gob mx

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Income Tax Returns Filing Due Dates Extended Ebizfiling

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

New Tax Return Due Dates Meadows Urquhart Acree And Cook LLP

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Concequencies Of Not Filing Income Tax Return By Due Date

Tax Return Due Dates And Filing For Extensions QATAX

File Your Income Tax Return By 31st July Ebizfiling

Tax Return Due Date With Extension - In Short With the July 31 deadline for filing income tax returns rapidly approaching taxpayers across the country are in a rush to complete their filings The Income Tax