Tax Return Eligibility In general tax returns have three major sections where you can report your income and determine deductions and tax credits for which you are eligible Income The

You must send a tax return if in the last tax year 6 April to 5 April any of the following applied you were self employed as a sole trader and earned more than 1 000 before taking Generally you need to file if Your income is over the filing requirement You have over 400 in net earnings from self employment side jobs or other independent work You

Tax Return Eligibility

Tax Return Eligibility

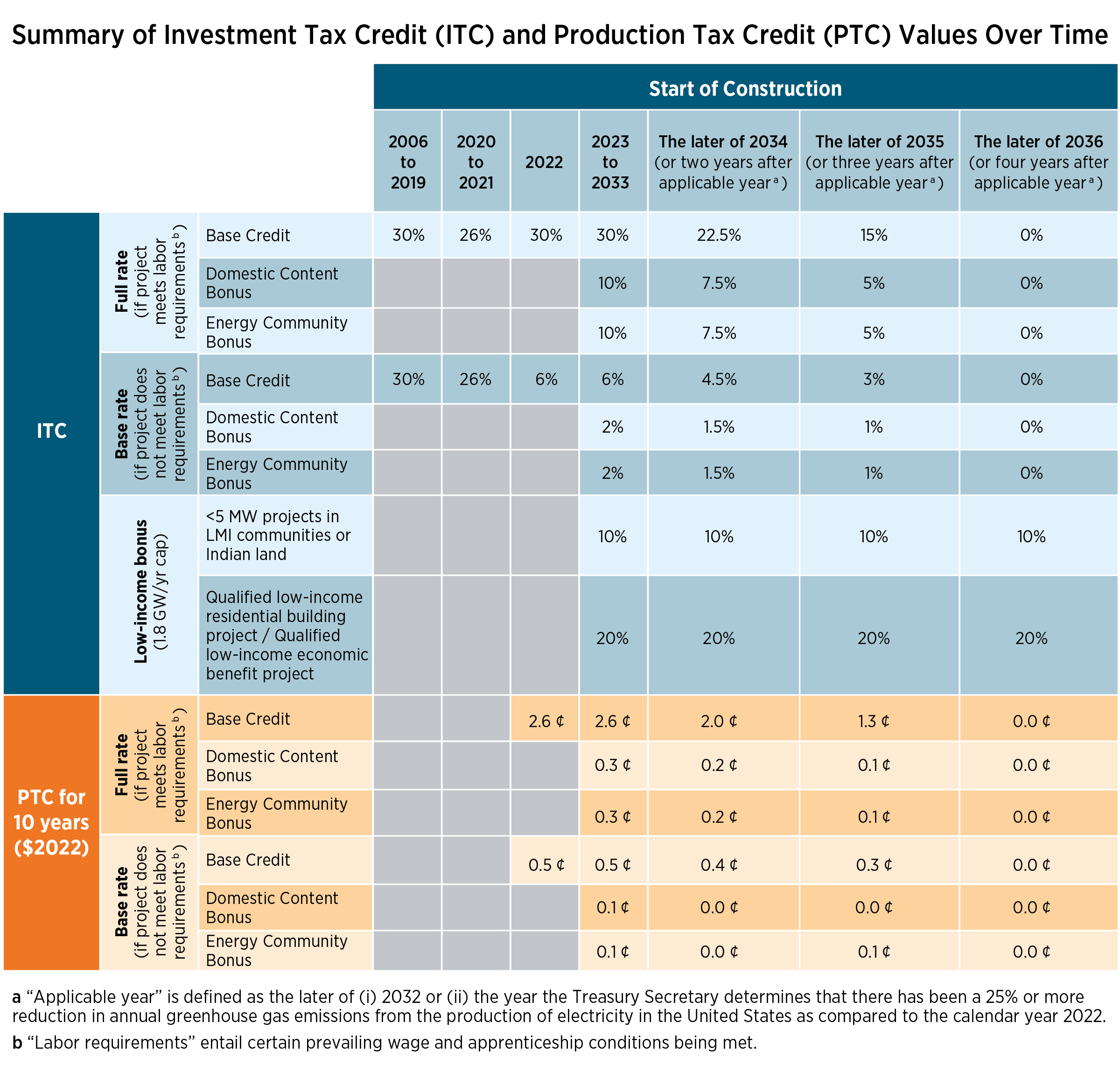

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

Eligibility Requirements Connect Canada Internships

http://connectcanadainternships.ca/wp-content/uploads/2019/03/Eligibility-Requirements-1000x600.png

Taxes Word Search WordMint

https://images.wordmint.com/p/Income_tax_return_crossword_1234865.png

A dependent is a qualifying child or relative who relies on you for financial support To claim a dependent for tax credits or deductions the dependent must meet specific NETFILE eligibility Certified tax software After you file NETFILE The NETFILE and ReFILE services are open for electronic filing from February 19 2024 at 6 00 a m

Individuals Hindu Undivided Families HUFs and others in India must file an income tax return based on certain criteria Use the TaxBuddy s ITR eligibility checker to determine your If you didn t get the full first and second Economic Impact Payments you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return to claim it

Download Tax Return Eligibility

More picture related to Tax Return Eligibility

Freelance Accounting Personal Tax Services

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100057362743633

8 Points To Check Eligibility For Income Tax Return Filing

https://blog.saginfotech.com/wp-content/uploads/2022/05/eligibility-income-tax-return-filing.jpg

Fixing Tax Returns The Qualified Amended Return

https://irstaxtrouble.com/wp-content/uploads/sites/5/2022/09/qualified-amended-returns-1568x1176.jpg

2024 01 23 Who should file a tax return including tax obligations for Canadian residents newcomers non residents and deemed residents those who live outside of Canada Verify ITR Filing Eligibility for FY 2023 24 AY 2024 25 Use Tax2win Income Tax Eligibility Calculator to Determine Your ITR Requirements

[desc-10] [desc-11]

Tax Return Deadline Extension

https://i0.wp.com/www.bachesamuels.com/wp-content/uploads/2022/01/Tax-return-red-1.png?fit=6912%2C3456&ssl=1

Rectification Of Income Tax Return 2023 Process

https://instafiling.com/wp-content/uploads/2022/12/rectification-of-income-tax-return-1080x675.jpg

https://www.investopedia.com/terms/t/taxreturn.asp

In general tax returns have three major sections where you can report your income and determine deductions and tax credits for which you are eligible Income The

https://www.gov.uk/self-assessment-tax-returns/who...

You must send a tax return if in the last tax year 6 April to 5 April any of the following applied you were self employed as a sole trader and earned more than 1 000 before taking

WHAT HAPPENS IF YOU DON T FILE AN INCOME TAX RETURN The Global Hues

Tax Return Deadline Extension

Tax Return Employment Self Employment Dividend Rental Property

IRS Commissioner Says Tax Return Backlog Will Clear By End Of 2022

Irs Tax Return 2023 Form Printable Forms Free Online

Who Is Eligible For The ERC Credit Leia Aqui Who Is Not Eligible For ERC

Who Is Eligible For The ERC Credit Leia Aqui Who Is Not Eligible For ERC

Withholding Tax Return

2022 Education Tax Credits Are You Eligible

When Should I File My UK Self Assessment Tax Return For 2022 23 Gold

Tax Return Eligibility - NETFILE eligibility Certified tax software After you file NETFILE The NETFILE and ReFILE services are open for electronic filing from February 19 2024 at 6 00 a m