Tax Return Gov Website IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software It s safe easy and no cost to you

Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year Check your refund status make a payment find free tax preparation assistance sign up for helpful tax tips and more Your online account Access your

Tax Return Gov Website

Tax Return Gov Website

https://int.nyt.com/data/documenttools/e5cb7acb35c3e3d9/1/output-1.png

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

Five Grown up Ways To Spend Your Tax Return

https://apexadvice.com.au/wp-content/uploads/sites/137/2023/09/202309-5-ways-to-spend-tax-return-copy.jpeg

Enter the SSN or ITIN shown on your tax return Select the tax year for which you are seeking refund status Select the filing status shown on your tax return Enter the exact Sign in or set up a personal or business tax account Self Assessment Corporation Tax PAYE for employers VAT and other services

IRS Free File Guided Tax Software Do your taxes online for free with an IRS Free File trusted partner If your adjusted gross income AGI was 79 000 or less review each Taxpayers must file a federal income tax return even if they are not required to file and claim the credit to receive it Some states have a similar credit For additional

Download Tax Return Gov Website

More picture related to Tax Return Gov Website

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Do It Yourself Online Tax Return Prepare Taxes On The Internet And E

https://www.thebalance.com/thmb/n0qY5_o0VzoZ5tk64K_PBHbmHrs=/1333x1000/smart/filters:no_upscale()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif

Tax Return Free Creative Commons Handwriting Image

http://www.picpedia.org/handwriting/images/tax-return.jpg

Latest Updates On IRS Where s My Refund Check Status 2022 EEFRI

https://eefri.org/wp-content/uploads/2022/11/IRS-wheres-My-Refund-2048x1015.png

Steps to file your federal tax return You will need the forms and receipts that show the money you earned and the tax deductible expenses you paid These Call USAGov Chat with USAGov Top Find out how to track your federal or state tax refund online or by phone through the IRS or your state Know when to expect

Home Taxes Get help filing taxes Contact the IRS for questions about your tax return Visit the IRS contact page to find tools and resources that cover a variety of Generally you may claim Head of Household filing status on your tax return only if you are unmarried and pay more than 50 of the costs of keeping up a home for yourself and

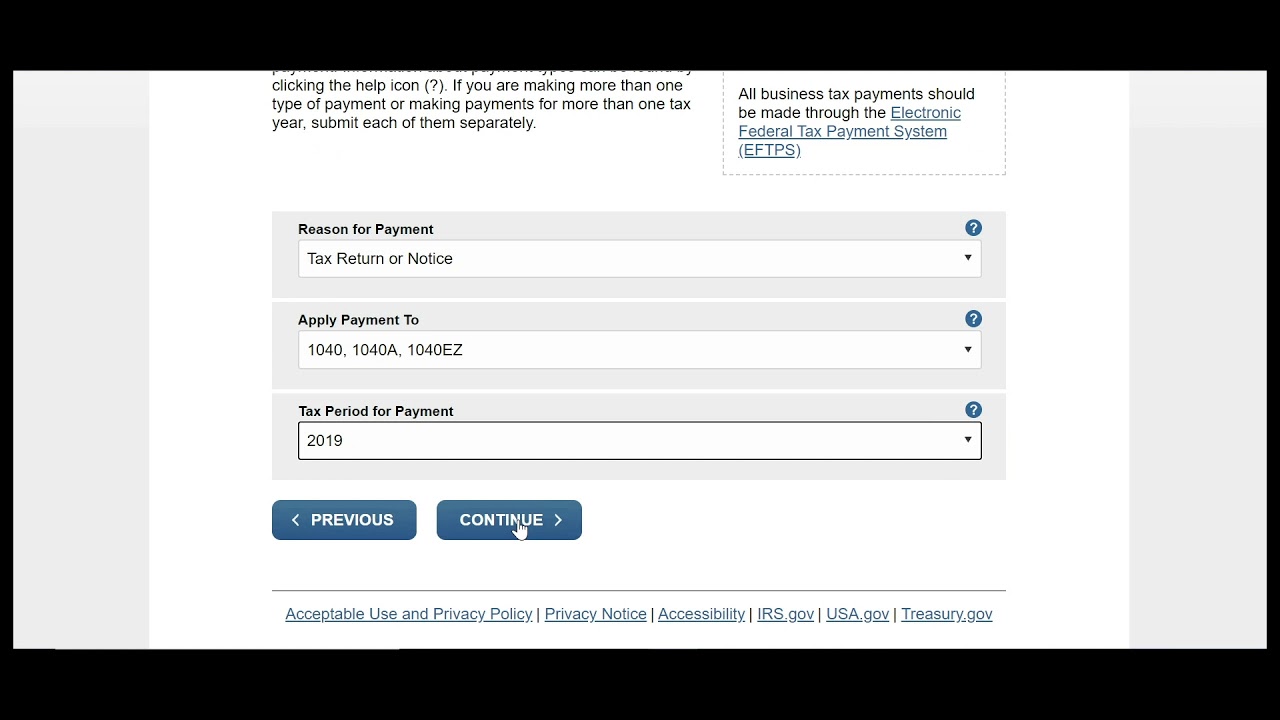

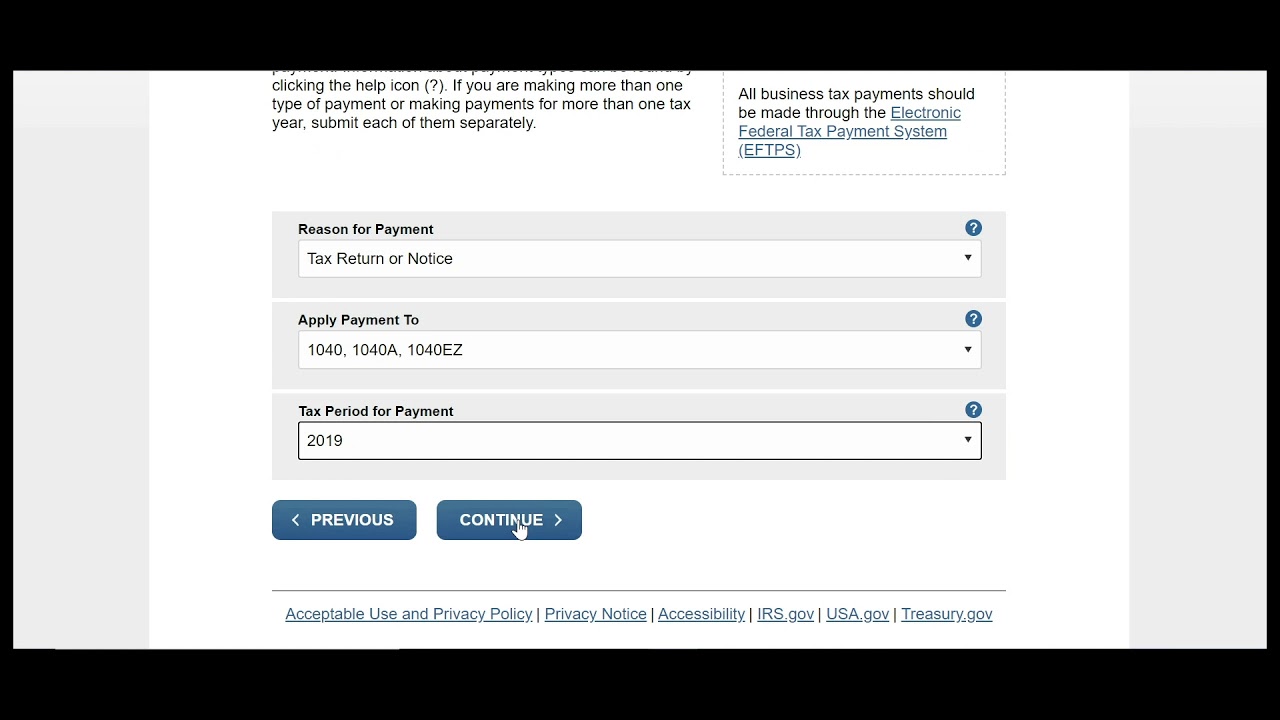

How To Pay Federal Tax On Your Tax Return Online Via IRS Website YouTube

https://i.ytimg.com/vi/tFZayorDGOM/maxresdefault.jpg

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software It s safe easy and no cost to you

https://www.irs.gov/wheres-my-refund

Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year

4 Smart Investments Using Your Tax Return

How To Pay Federal Tax On Your Tax Return Online Via IRS Website YouTube

Tax Return Highway Sign Image

How To Use Aadhaar Card For Electronic Tax Return Verification

Tax Return Employment Self Employment Dividend Rental Property

Tax Return Employment Self Employment Dividend Rental Property

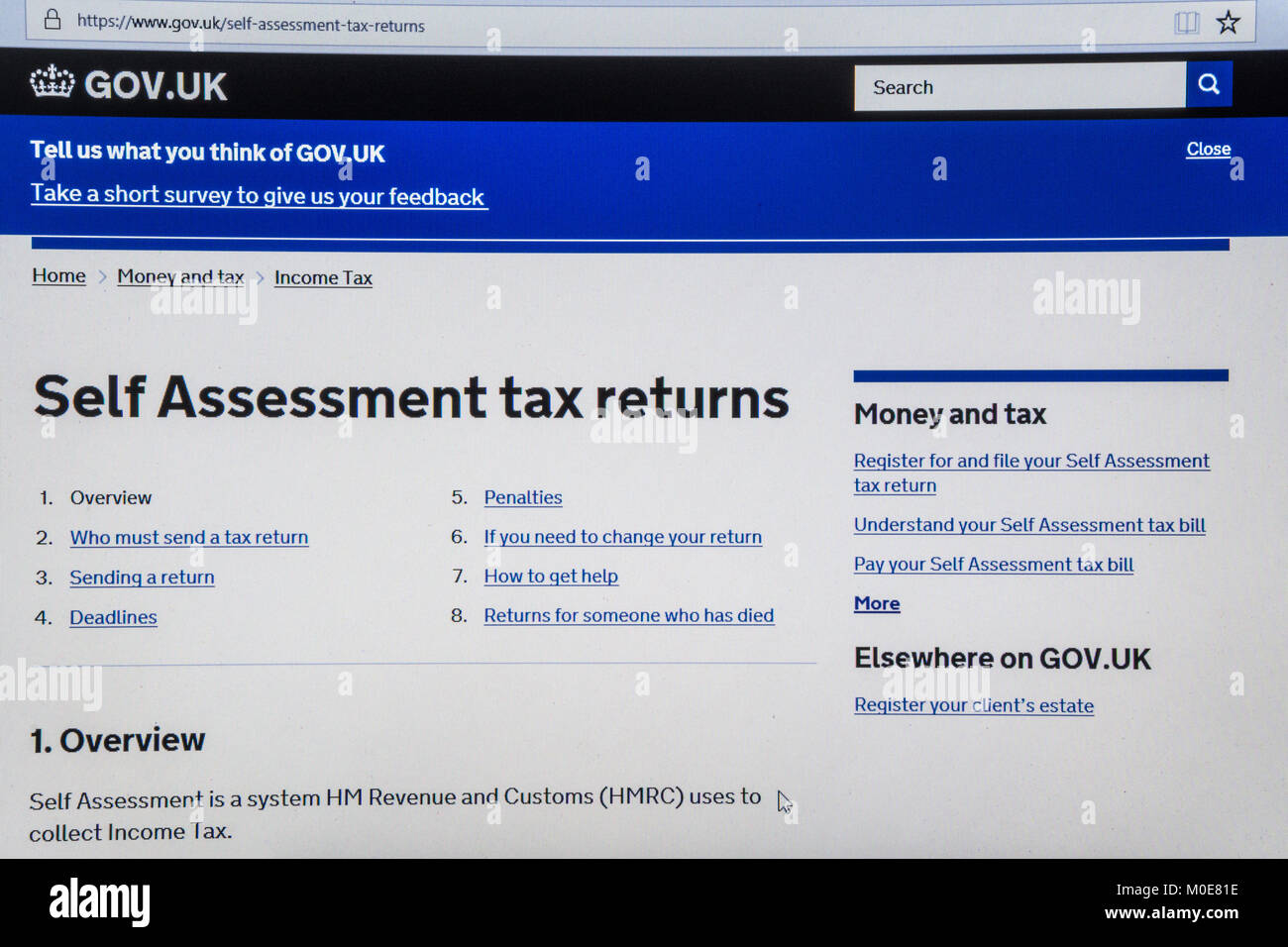

Computer Screenshot With Gov uk Website Showing Self assessment Tax

Quarterly VAT Return And Payment Deadline Approaching Munir Tatar

Income Tax Return ITR Filing Website Won t Be Available For 6 Days

Tax Return Gov Website - Tax credits and benefits for individuals Payment dates Canada child benefit GST HST credit Disability tax credit Canada workers benefit and other benefits and credits