Tax Return Health Insurance Premiums Verkko 10 maalisk 2023 nbsp 0183 32 You might be able to deduct your health insurance premiums and other health care costs from your taxable income

Verkko Tax on insurance premiums is regarded as a consumption tax complementary to the value added tax VAT Over the years the tax rate on insurance premiums has Verkko 6 helmik 2017 nbsp 0183 32 In the case of fire insurance the tax on insurance premiums would amount to 2 472 euros 10 000 3 x 10 000 x 24 If the policyholder is liable to

Tax Return Health Insurance Premiums

Tax Return Health Insurance Premiums

https://www.knowyourinsurance.net/wp-content/uploads/how-does-health-insurance-affect-my-tax-return-health.png

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

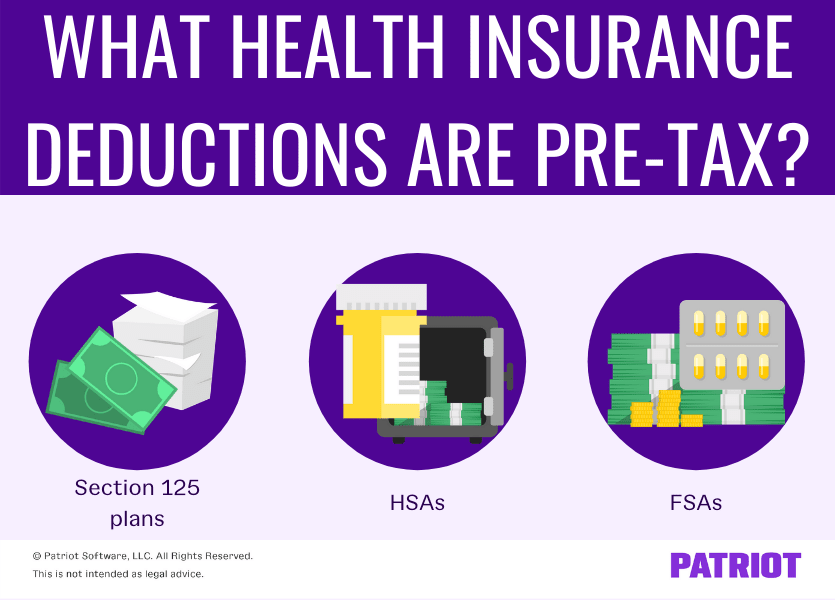

Are Payroll Deductions For Health Insurance Pre Tax Details More

https://www.patriotsoftware.com/wp-content/uploads/2021/06/health-insurance-pre-tax-1.png

Verkko 12 hein 228 k 2023 nbsp 0183 32 You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who Verkko Health insurance premiums are deductible if you itemize your tax return Whether you can deduct health insurance premiums from your tax return also depends on when

Verkko 19 lokak 2023 nbsp 0183 32 If you qualify the deduction for self employed health insurance premiums is a valuable tax break With the rising cost of health insurance a tax Verkko 13 jouluk 2021 nbsp 0183 32 In 2021 the average cost for health insurance premiums ranged from 2 664 to 7 152 per person You may be eligible to claim your health insurance premiums on your tax forms

Download Tax Return Health Insurance Premiums

More picture related to Tax Return Health Insurance Premiums

/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg)

Are Health Insurance Premiums Tax Deductible

https://www.investopedia.com/thmb/MlLHZTpP13VHUZz-t-fGGQ9EC7c=/2122x1415/filters:fill(auto,1)/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg

What Is Health Insurance Marketplace What You Need To Know Health

https://www.healthplansinoregon.com/wp-content/uploads/2017/06/Photo-minimal-new-product-neutral-social-media-4-2.png

Insurance Premium Tax Increase Connect Insurance

https://www.connect-insurance.uk/wp-content/uploads/2018/10/insurance_premium_tax_2015.png

Verkko 7 helmik 2022 nbsp 0183 32 In some states you may be able to deduct eligible health insurance expenses on your state income tax return even if you don t itemize your federal return says Armstrong HSA Withdrawals May Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 How to Deduct Medical Insurance Premiums on Your Tax Return To deduct health insurance premiums on your tax return you must first determine if

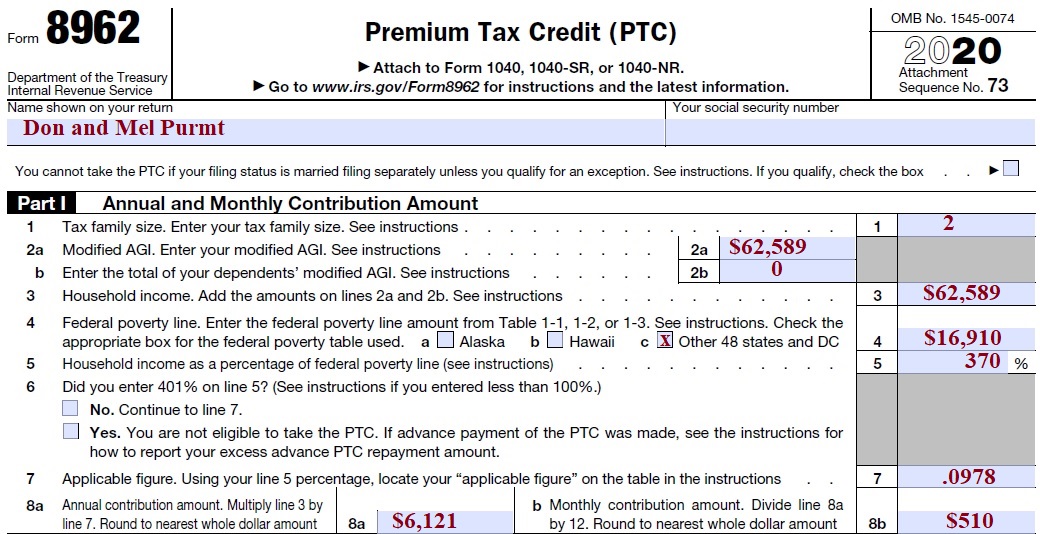

Verkko 9 tammik 2023 nbsp 0183 32 How do you claim deductions for health insurance premiums on your tax return Medical expense deductions including any deductions for insurance Verkko The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased

2018 Tax Reform Changes To Health Insurance Tax Penalty YouTube

https://i.ytimg.com/vi/nsGHOriu3fM/maxresdefault.jpg

Health Insurance Premiums To Rise Early 2021 What We Know How Much

https://www.4kq.com.au/wp-content/uploads/sites/12/2020/10/oz-dollars-1.jpg?crop=0px,84px,1620px,911px&resize=2400,1350&quality=75

https://www.forbes.com/.../is-health-insuranc…

Verkko 10 maalisk 2023 nbsp 0183 32 You might be able to deduct your health insurance premiums and other health care costs from your taxable income

https://vm.fi/en/tax-on-insurance-premiums

Verkko Tax on insurance premiums is regarded as a consumption tax complementary to the value added tax VAT Over the years the tax rate on insurance premiums has

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

2018 Tax Reform Changes To Health Insurance Tax Penalty YouTube

Watch Out Decisions You Make On Your 2021 Tax Return Can Affect Your

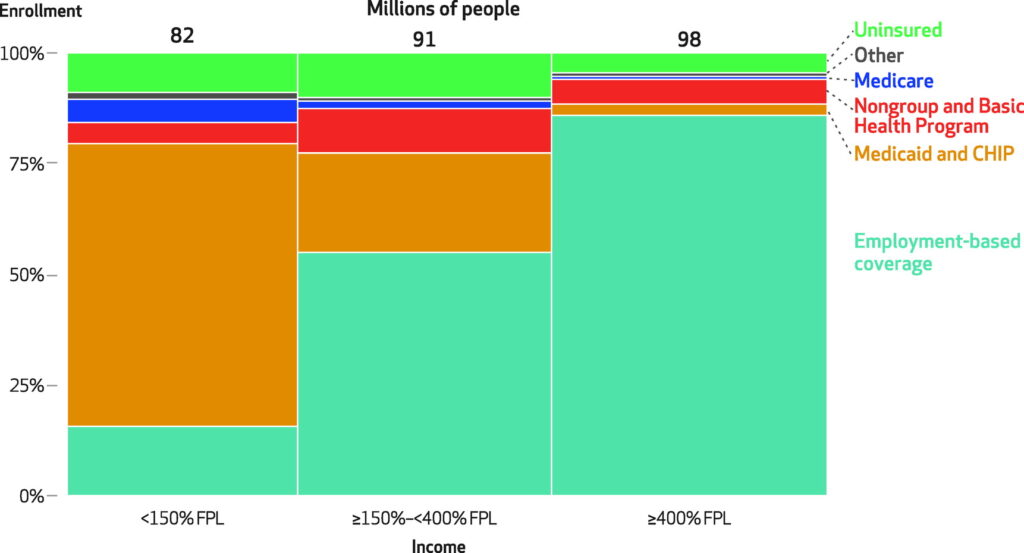

CBO Projections Of US Health Insurance Coverage 2023 2033 Healthcare

Qualified Business Income Deduction And The Self Employed The CPA Journal

Tax Subsidies For Private Health Insurance III Special Tax Deduction

Tax Subsidies For Private Health Insurance III Special Tax Deduction

How The Health Insurance Premium Tax Credit Affects Your 2014 Return

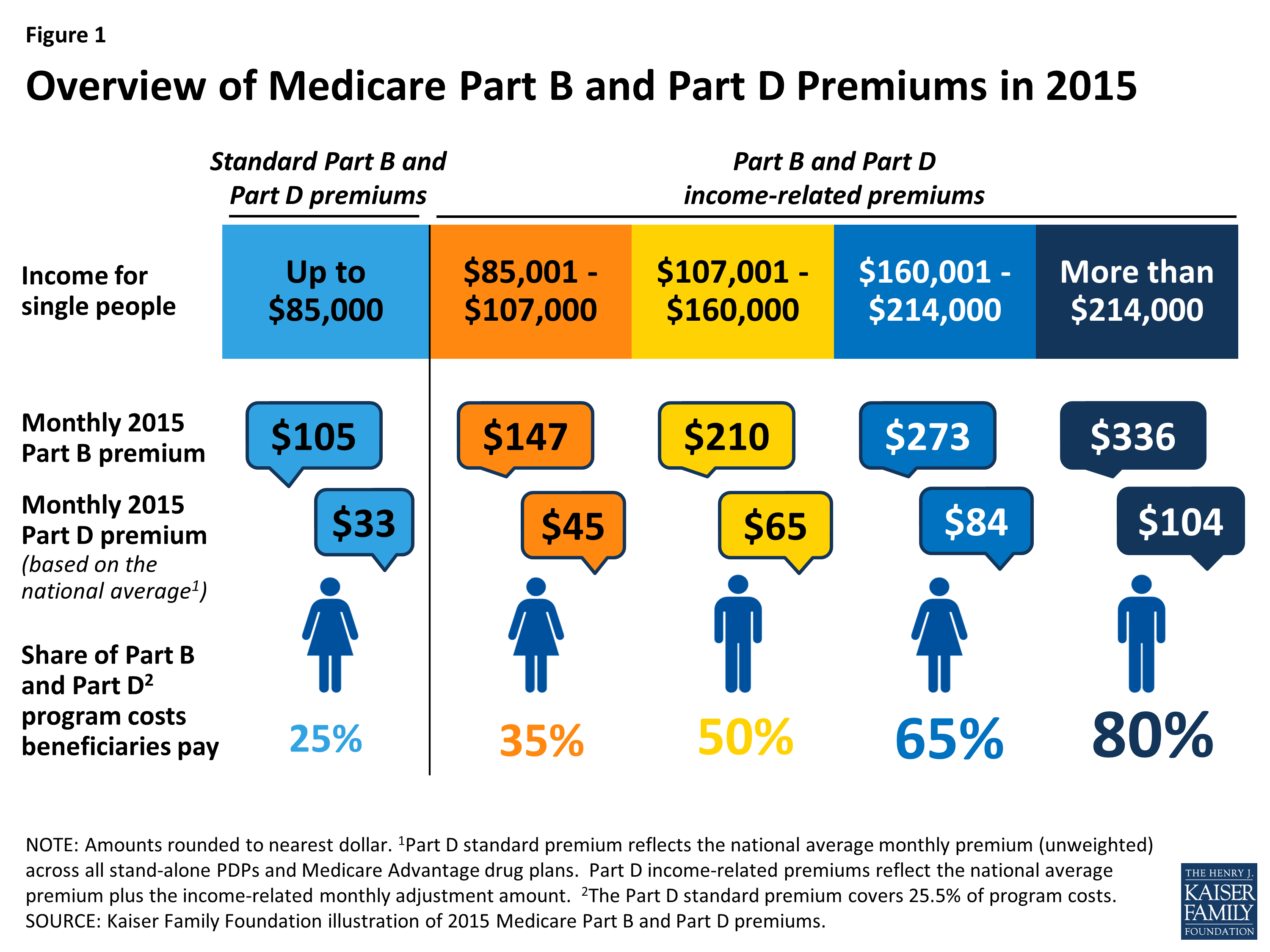

Medicare s Income Related Premiums A Data Note KFF

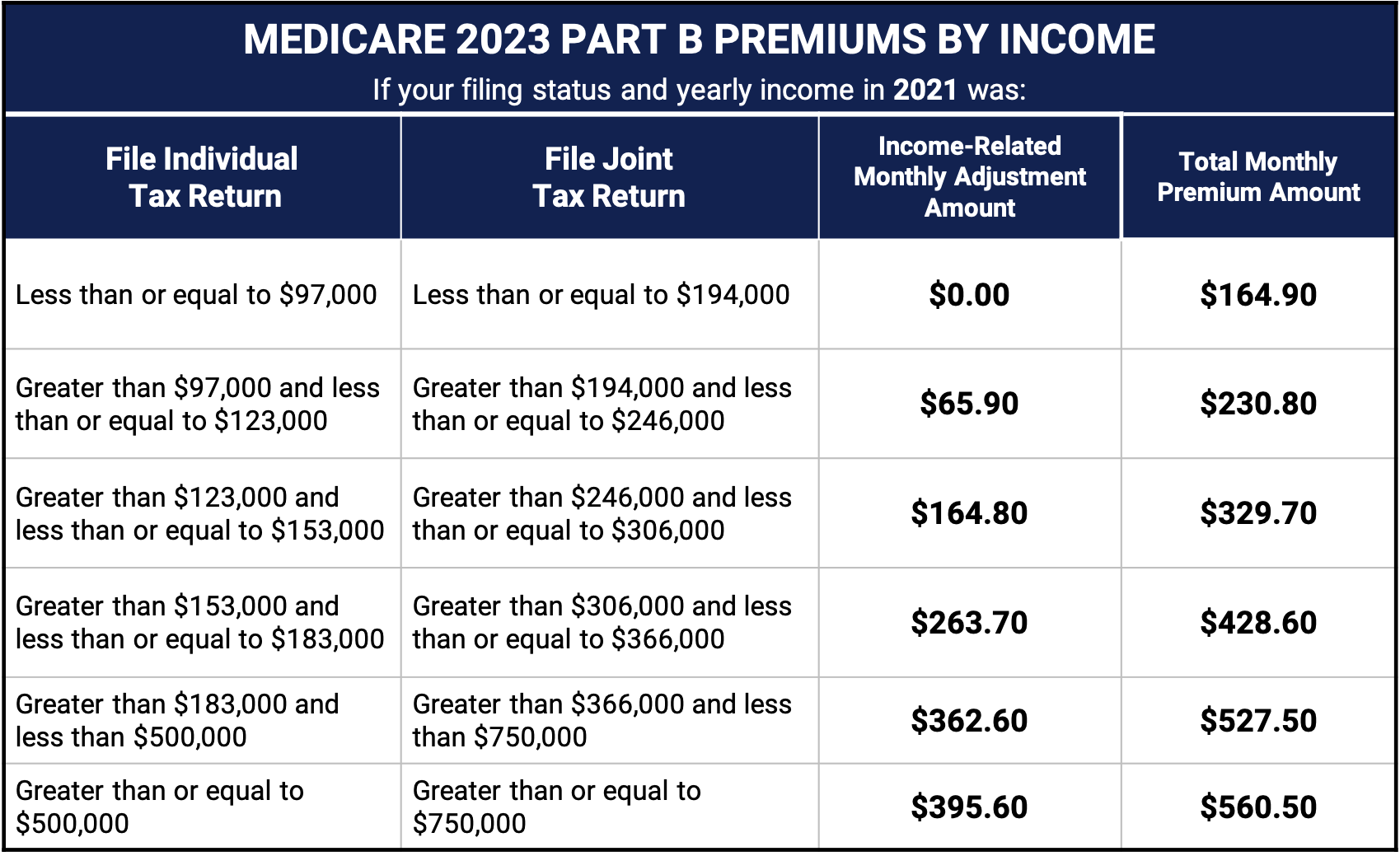

Medicare Part B Premium 2024 Chart

Tax Return Health Insurance Premiums - Verkko updated Nov 29 2023 You can claim health insurance premiums you pay yourself on your federal taxes based on your financial situation and how you obtain health