Tax Return Home Office Deduction Individuals Tax card and tax return Deductions Remote working and deductions Working remotely may cause you expenses that are deductible in taxation These include your expenses caused by using a remote workspace expenses paid for tools and for a data connection

What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area

Tax Return Home Office Deduction

Tax Return Home Office Deduction

https://i.etsystatic.com/7329950/r/il/0a4d8c/1935516758/il_fullxfull.1935516758_mwfz.jpg

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy UK

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

![]()

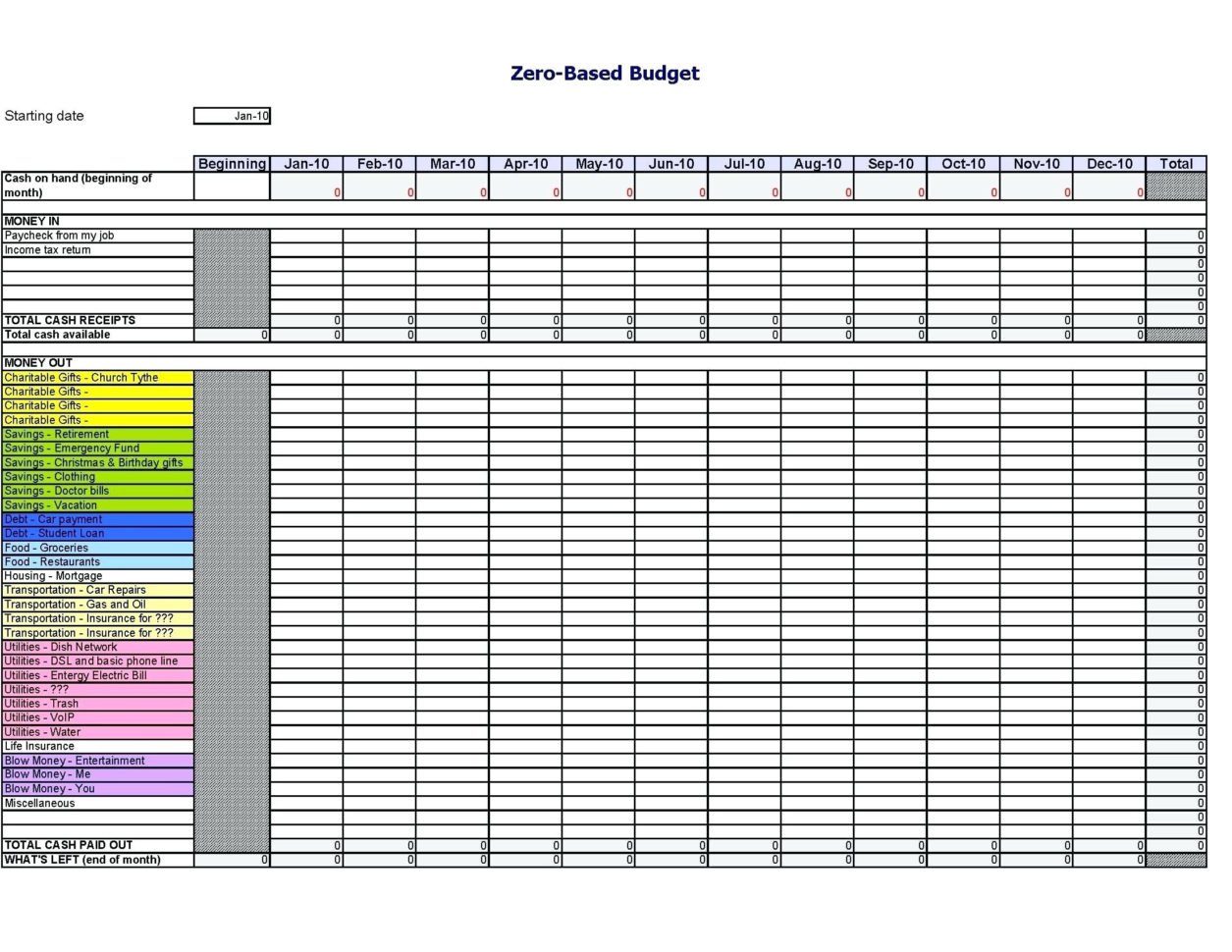

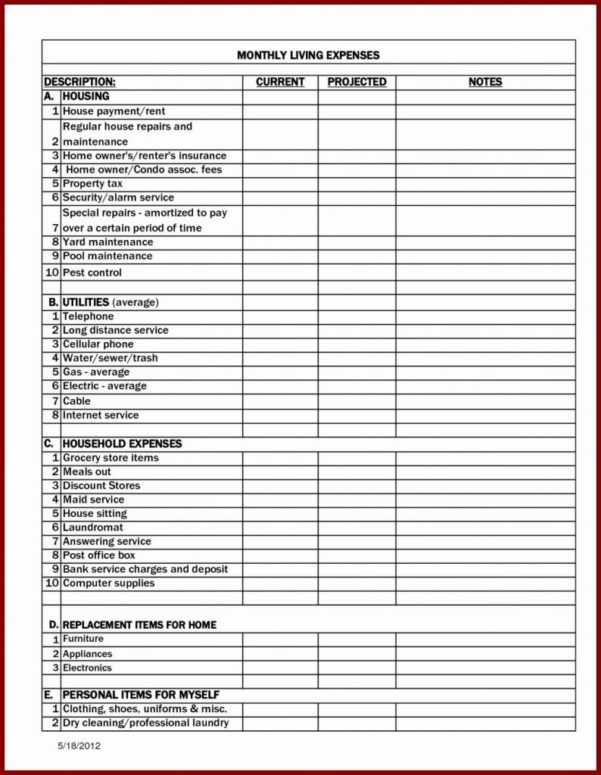

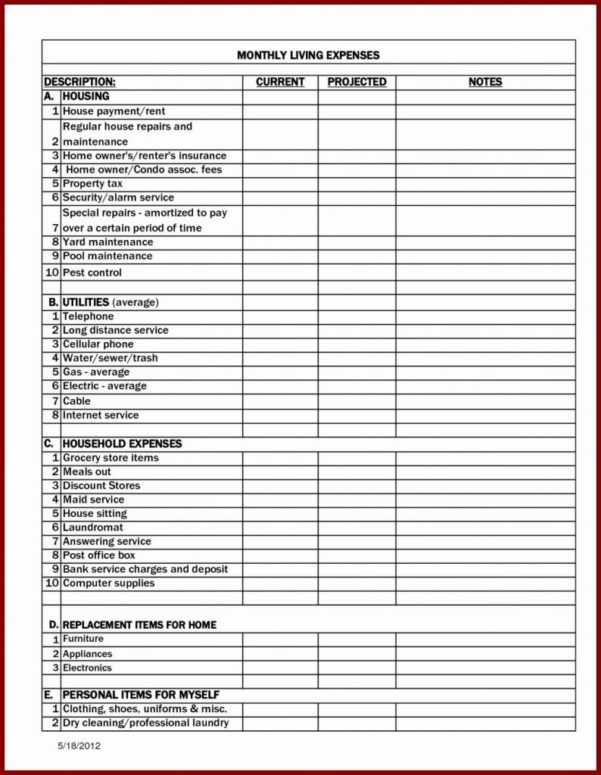

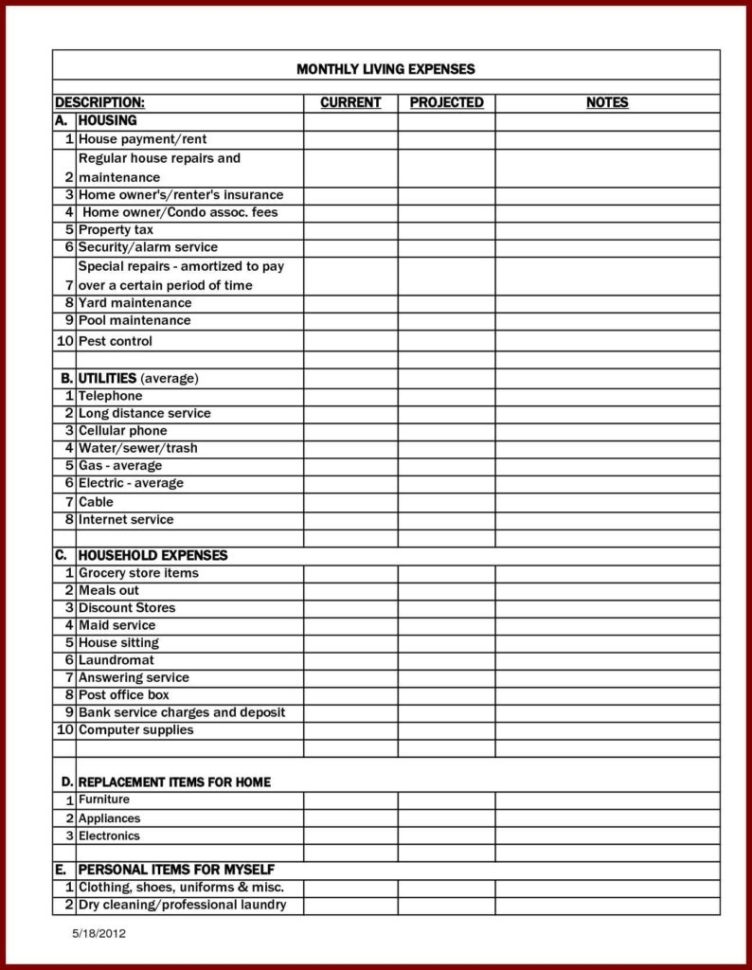

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

https://db-excel.com/wp-content/uploads/2019/01/real-estate-expense-tracking-spreadsheet-with-regard-to-realtor-expense-tracking-spreadsheet-fresh-tax-deduction-cheat-sheet.png

OVERVIEW An unprecedented number of workers and businesses have transitioned to a work from home model If you work from home you should know these important tax implications of setting up a home office TABLE OF CONTENTS Do I qualify for the home office tax deduction The home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business Your home can be a house apartment condo or

Tax Tip 2022 10 January 19 2022 The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes To claim the home office deduction on their 2021 tax return taxpayers generally must exclusively and regularly use part of their home or a separate structure on their property as their primary place Here s what you should know about the home office tax deduction before you file your 2023 tax return Home office tax deduction Who qualifies

Download Tax Return Home Office Deduction

More picture related to Tax Return Home Office Deduction

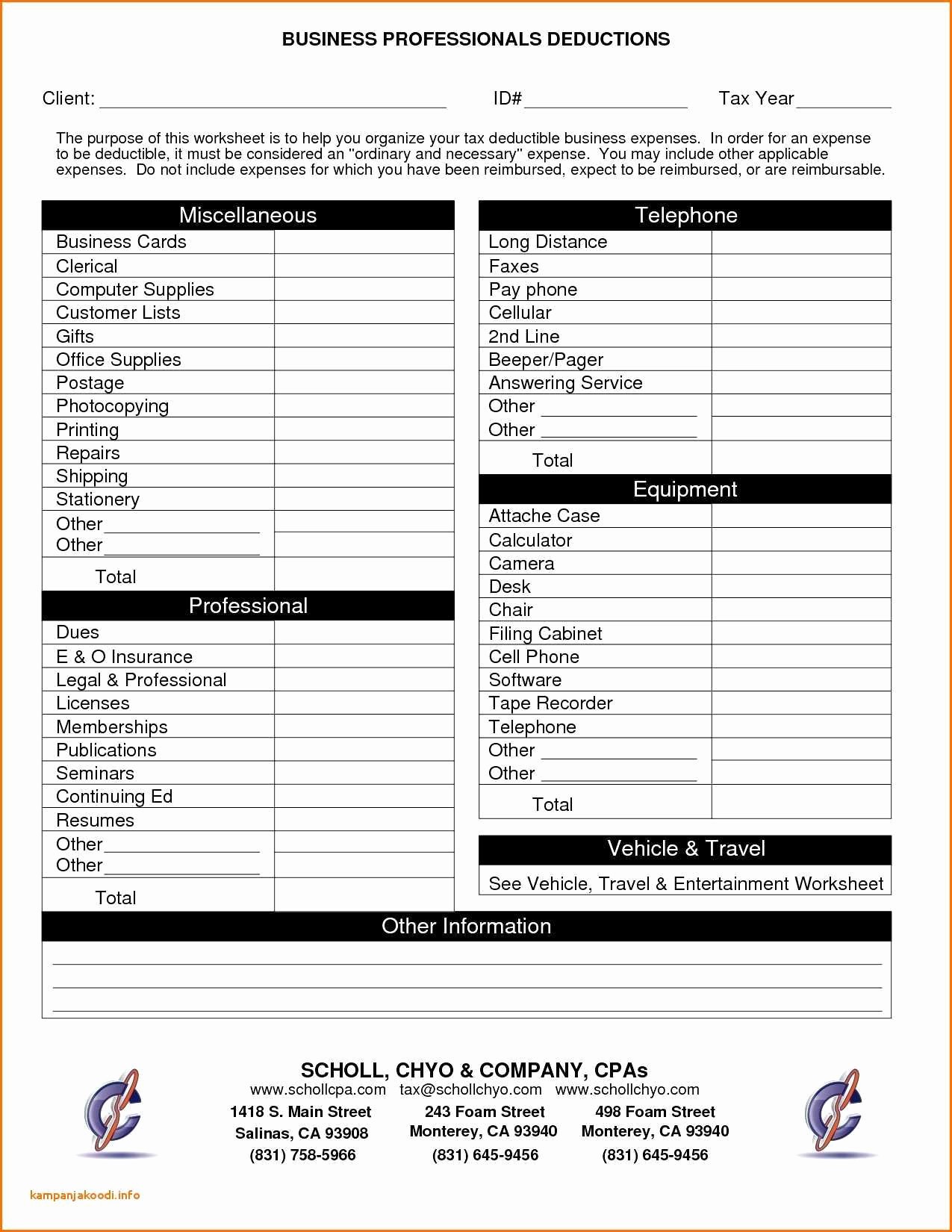

8 Tax Preparation Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2015/05/small-business-tax-deduction-worksheet_449268.png

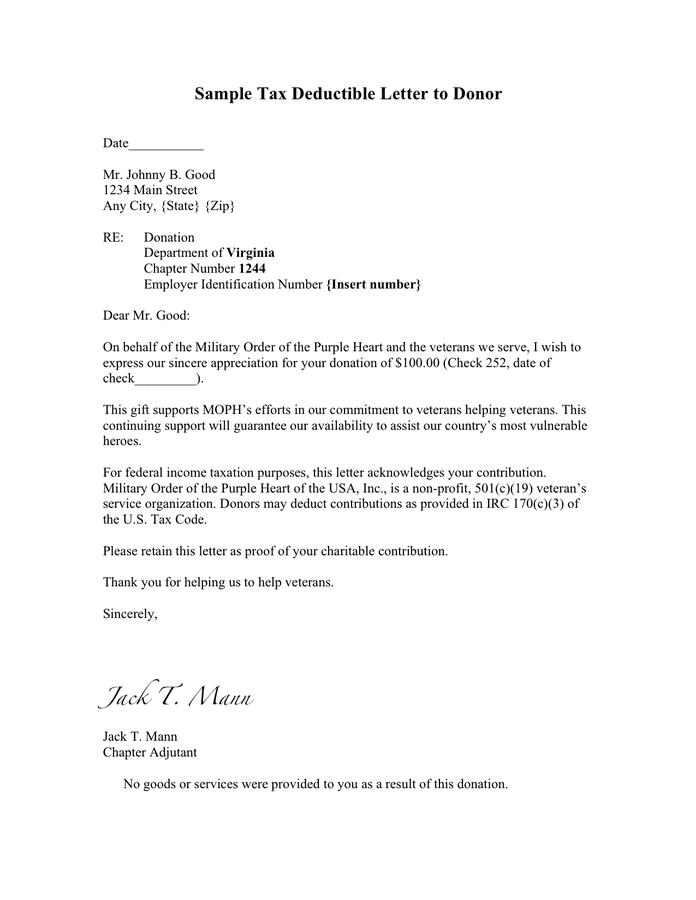

Sample Tax Deductible Letter To Donor In Word And Pdf Formats

http://static.dexform.com/media/docs/7116/sample-tax-deductible-letter-to-donor_1.png

Request Letter For No Deduction From Salary

https://www.bizzlibrary.com/Storage/Media/86ce71ae-c3f0-443d-84cc-7978d21a4d07_1.png

What Is the Home Office Deduction How To Calculate the Home Office Deduction Tips for Taking the Home Office Deduction Frequently Asked Questions FAQs Photo Alistair Berg Getty Images Sources Home business owners can take a deduction for their home business space expenses Feb 26 2024 at 11 28 a m Getty Images You may be eligible for the home office deduction if you had any income from self employment in 2023 but the rules are strict Key Takeaways Under

Step 2 Find out the square footage of your home For our example let s say your home has a total area of 1 600 square feet Step 3 Now divide the area of your office by the area of your house Deductions for expenses you incur to work from home such as stationery energy and office equipment Last updated 25 April 2023 Print or Download On this page Eligibility to claim Additional running expenses Choosing a method to calculate your claim Prior year work from home methods Expenses you can t claim Eligibility to claim

Uniform Inventory Spreadsheet Within Tax Deduction Spreadsheet Excel On

https://db-excel.com/wp-content/uploads/2019/01/uniform-inventory-spreadsheet-within-tax-deduction-spreadsheet-excel-on-inventory-template-austinroofing-601x775.jpg

Tax Deduction Excel Template

https://db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-excel-for-tax-deduction-spreadsheet-excel-lovely-awesome-template-examples-1255x970.jpg

https://www.vero.fi/en/individuals/tax-cards-and...

Individuals Tax card and tax return Deductions Remote working and deductions Working remotely may cause you expenses that are deductible in taxation These include your expenses caused by using a remote workspace expenses paid for tools and for a data connection

https://www.nerdwallet.com/article/taxes/home-office-tax-deduction

What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off

List Itemized Tax Deductions Worksheet

Uniform Inventory Spreadsheet Within Tax Deduction Spreadsheet Excel On

Small Business Tax Worksheet Excel

What Can You Write Off For The Home Office Deduction Small Business

Tax Deduction Worksheet Realtors Form Fill Out And Sign Printable Pdf

Rental House Expenses Spreadsheet Intended For Property Expenses

Rental House Expenses Spreadsheet Intended For Property Expenses

Cleaning Business Expenses Spreadsheet Db excel

10 Business Tax Deductions Worksheet Worksheeto

30 Home Office Deduction Worksheet Worksheets Decoomo

Tax Return Home Office Deduction - Tax Tip 2022 10 January 19 2022 The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes To claim the home office deduction on their 2021 tax return taxpayers generally must exclusively and regularly use part of their home or a separate structure on their property as their primary place