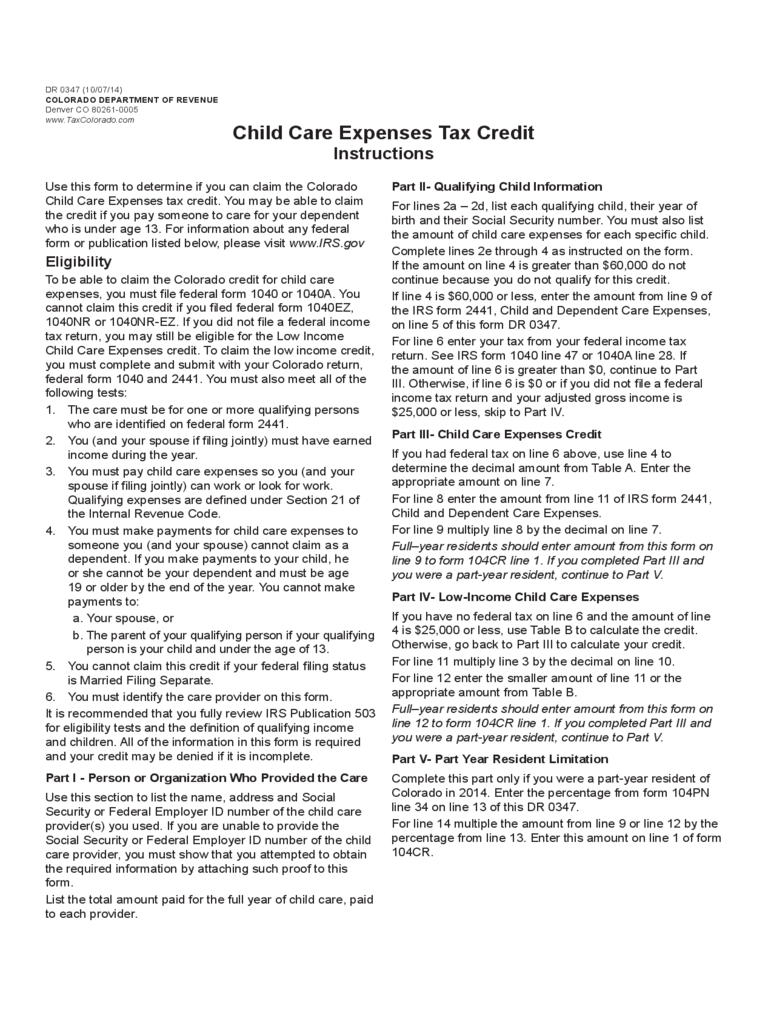

Government Rebate For Child Care Web 10 juil 2023 nbsp 0183 32 Assistance to help you with the cost of child care To get Child Care Subsidy CCS you must care for a child 13 or younger who s not attending secondary school

Web The Child Care Subsidy percentage you re entitled to depends on your family s income Your number of children in care can affect it You may get a higher Child Care Subsidy Web If you live in England and get 30 hours free childcare you can pay the childcare provider using Universal Credit tax credits childcare vouchers or Tax Free Childcare If you live in

Government Rebate For Child Care

Government Rebate For Child Care

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-rebate-application-form-d1.png

FREE 11 Child Care Application Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Child-Care-Rebate-Application-Form.jpg?width=390

Family Tax Child Care Rebate 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/2019-forms-for-family-and-children-fillable-printable-pdf-forms.png

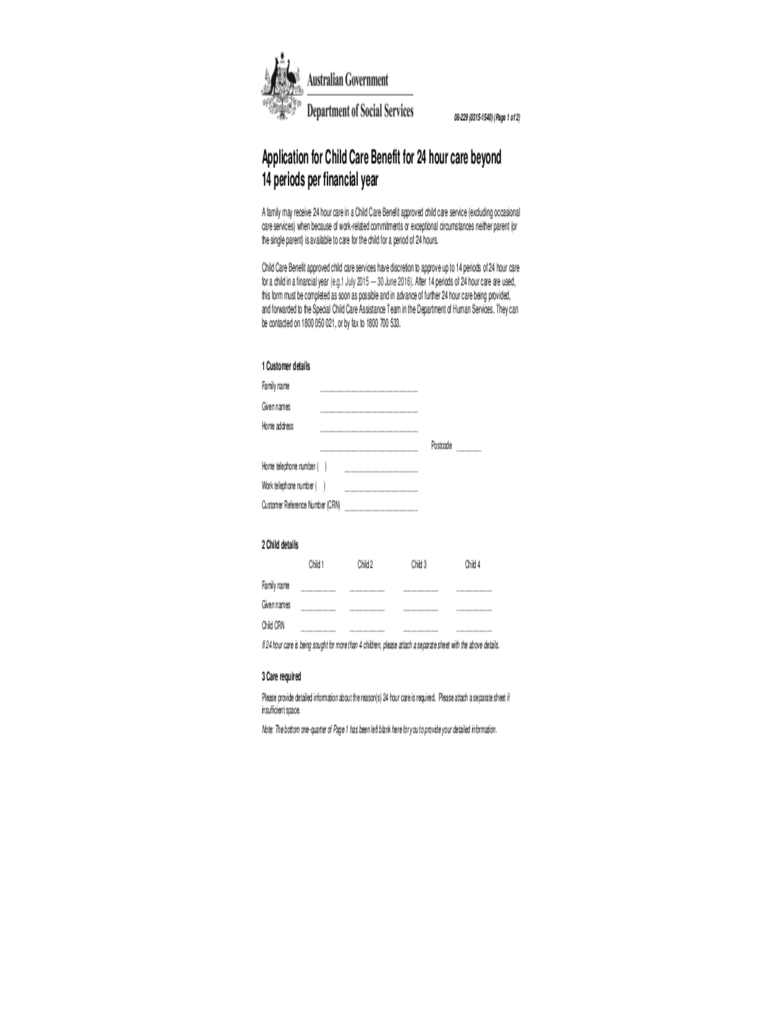

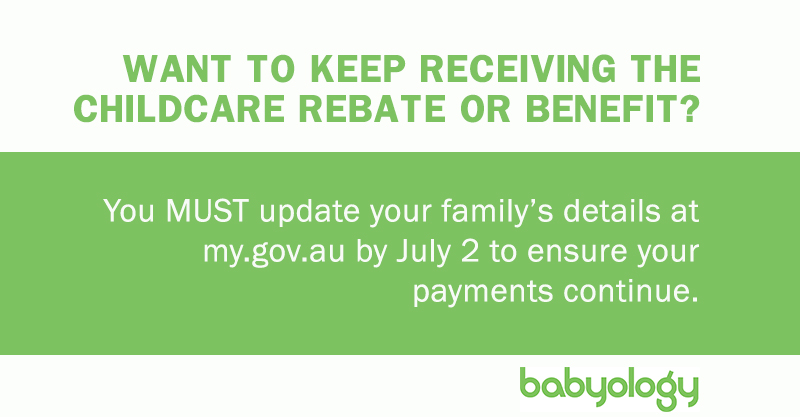

Web 20 juin 2022 nbsp 0183 32 Child Care Subsidy From 2 July 2018 one new Child Care Subsidy replaced the two previous child care payments benefit and rebate To learn more Web 30 juin 2021 nbsp 0183 32 Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not

Web These are services that have Australian Government approval to get Child Care Subsidy on your behalf to reduce your fees Approved child care includes Centre Based Day Web Child Care Subsidy CCS is an Australian Government childcare fee assistance package introduced in 2018 CCS provides financial support to families using Early Childhood

Download Government Rebate For Child Care

More picture related to Government Rebate For Child Care

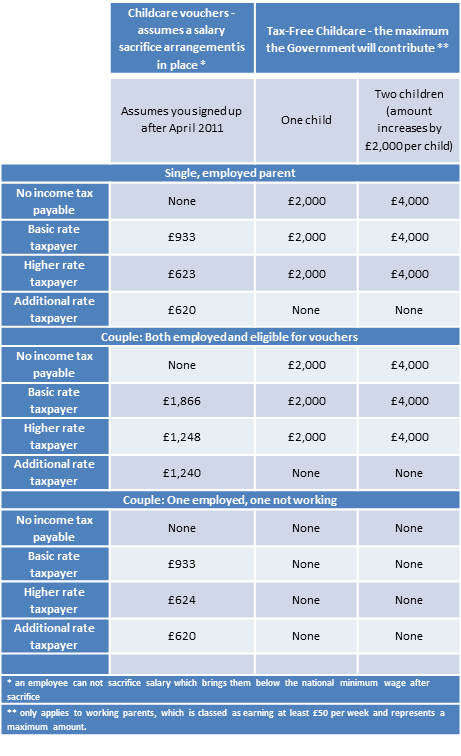

New Tax free Childcare Is It The End Of Salary Sacrifice For

https://blogs.mazars.com/letstalktax/files/2015/04/Childcare-table.png

Child Care Rebate Form 3 Free Templates In PDF Word Excel Download

https://www.formsbirds.com/formimg/child-care-rebate-form/3233/child-care-benefit-claim-form-notes-australia-d1.png

Ontario Inks Federal Child care Deal Retroactive Rebates To Begin In

https://canadainfo.net/eng/wp-content/uploads/2022/03/Doug-Ford_childcare-deal_20220328.jpg

Web 3 juil 2023 nbsp 0183 32 The government will cover a larger percentage of most families childcare fees and more families will also qualify for the subsidy Families earning less than 80 000 a year currently get up to 85 per cent Web Il y a 1 heure nbsp 0183 32 1 25 The UK government s plan to reduce the cost of child care fails to support the country s poorest parents new analysis shows Families on the lowest 30

Web 27 sept 2022 nbsp 0183 32 Under the legislation all families would have their childcare subsidy rate increased unless their total income is 530 000 or more That s a big deal given the subsidy currently stops once a family hits the Web 10 oct 2021 nbsp 0183 32 Annual cap Families earning more than 190 015 2021 22 terms have an annual subsidy cap of 10 655 per child each financial year From 10 December 2021

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-622x1024.jpg

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

https://www.servicesaustralia.gov.au/child-care-subsidy

Web 10 juil 2023 nbsp 0183 32 Assistance to help you with the cost of child care To get Child Care Subsidy CCS you must care for a child 13 or younger who s not attending secondary school

https://www.servicesaustralia.gov.au/how-much-child-care-subsidy-you...

Web The Child Care Subsidy percentage you re entitled to depends on your family s income Your number of children in care can affect it You may get a higher Child Care Subsidy

Child Care Rebate Application Form Free Download

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

Child Care Rebate To Be E

How To Keep Receiving Childcare Rebates Under The Government s New System

The Changes After The Child Care Rebate Ended In Australia By

Child Care Benefit Claim Form Notes Australia Free Download

Child Care Benefit Claim Form Notes Australia Free Download

What The Changes To Child Care Rebates Mean For YOUR Family Keep Calm

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

Doug Ford Child Care Rebate FordRebates

Government Rebate For Child Care - Web 30 juin 2021 nbsp 0183 32 Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not