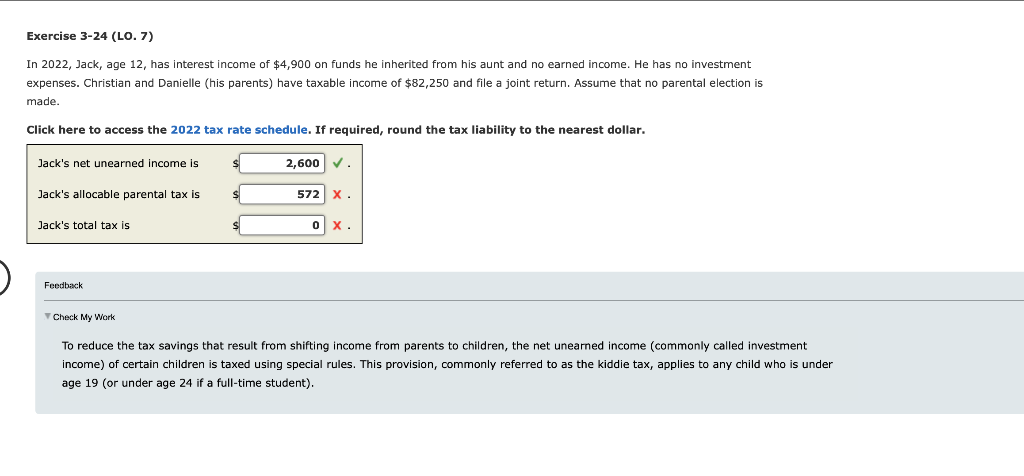

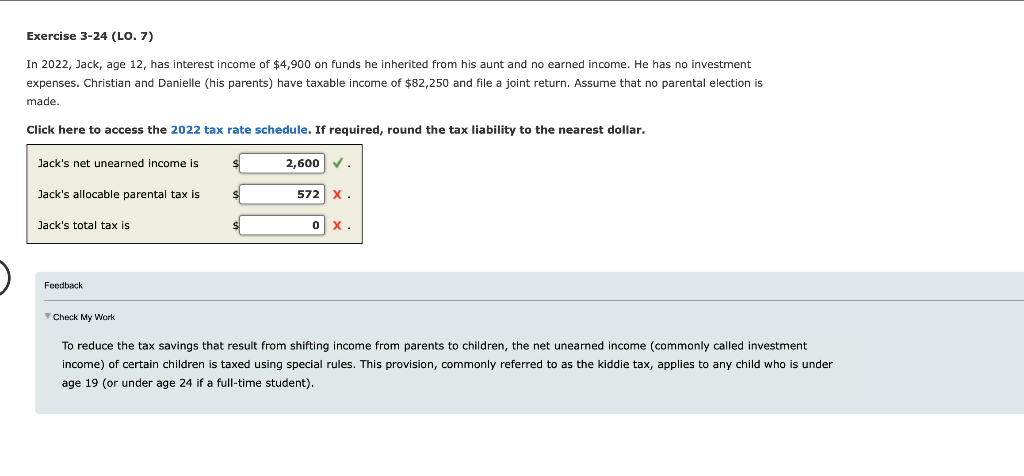

Tax Return Interest Earned Verkko 9 jouluk 2022 nbsp 0183 32 When you earn interest income on your investments or other financial endeavors then you ll likely need to pay taxes on all or part of that income Earned interest is considered the same as any other ordinary income and must be included as part of your federal and state tax returns

Verkko 21 jouluk 2023 nbsp 0183 32 Interest from a savings account is taxed at your earned income tax rate for the year As of the 2022 tax year those rates ranged from 10 to 37 If your net investment income NII or Verkko 1 jouluk 2023 nbsp 0183 32 Regular taxable interest is taxed as ordinary income like an individual retirement account IRA or retirement plan distribution Interest income is added to the taxpayer s other ordinary

Tax Return Interest Earned

Tax Return Interest Earned

https://media.cheggcdn.com/media/399/3990067e-0401-4de1-961e-6da4b8d5ce53/phpAtGIv8

Freelance Accounting Personal Tax Services

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100057362743633

Withholding Tax Return

https://zatca.gov.sa/ar/eServices/PublishingImages/incom tax submission.png

Verkko 23 tuntia sitten nbsp 0183 32 The rate of late payment interest is now 7 75 the highest level for 15 years and there s a 5 penalty charged on tax outstanding on 1 March 2024 with further penalties if the tax is more Verkko 6 syysk 2023 nbsp 0183 32 Most of the time you ll report interest income on your federal tax return and that money will be taxed as ordinary income That means your interest income will be added on top of your other sources of ordinary income to help determine what income tax bracket you re in and then it will be taxed according to your income tax rate

Verkko If you complete a Self Assessment tax return report any interest earned on savings there You need to register for Self Assessment if your income from savings and investments is over Verkko Most interest income is taxable as ordinary income on your federal tax return and is therefore subject to ordinary income tax rates There are a few exceptions however Generally speaking most interest is considered taxable at the time you receive it or can withdraw it Interest taxed as ordinary income

Download Tax Return Interest Earned

More picture related to Tax Return Interest Earned

Tax Return Deadline Extension

https://i0.wp.com/www.bachesamuels.com/wp-content/uploads/2022/01/Tax-return-red-1.png?fit=6912%2C3456&ssl=1

WHAT HAPPENS IF YOU DON T FILE AN INCOME TAX RETURN The Global Hues

https://theglobalhues.com/wp-content/uploads/2022/03/Imcome-Tax-Return.jpg

Irs Tax Return 2023 Form Printable Forms Free Online

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2023/03/17/16790692102965.jpg

Verkko 21 syysk 2023 nbsp 0183 32 Even if your bank doesn t send you a Form 1099 INT because you earned less than 10 in interest you still need to report any interest income on your tax return How the tax rate affects your savings account interest Your tax rate will depend on two things your income for the year and how much interest you earned on your Verkko 12 syysk 2022 nbsp 0183 32 Interest on U S savings bonds and is generally taxable on your federal tax return at your regular tax rate However interest on U S Treasury bonds is usually exempt from taxes at the state and local levels Interest earned in mutual funds is taxable But if the mutual fund is in a tax deferred account such as a you won t have

Verkko Topic No 403 Interest Received Most interest that you receive or that is credited to an account that you can withdraw from without penalty is taxable income in the year it becomes available to you However some interest you receive may be tax exempt Verkko 31 toukok 2019 nbsp 0183 32 quot You must include all taxable interest in your income on your federal income tax return even if you don t receive a Form 1099 INT or 1099 OID quot May 31 2019 4 52 PM 13 69 364 Reply or if you received interest under 10 for the tax year you are still required to report any interest earned and credited to your account

File FREE Income Tax Return ClearTax ITR E filing Para Android Download

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/7db9b7c2-9ff1-41ac-bbee-27dcf1be0514/1391937416/file-free-income-tax-return-cleartax-itr-e-filing-screenshot.png

What Happens If You Don t Report Foreign Income Leia Aqui What Is The

https://www.greenbacktaxservices.com/wp-content/uploads/2023/03/Screen-Shot-2023-03-23-at-10.49.50-AM-1024x696.png

https://smartasset.com/taxes/how-much-interest-from-interest-is-ta…

Verkko 9 jouluk 2022 nbsp 0183 32 When you earn interest income on your investments or other financial endeavors then you ll likely need to pay taxes on all or part of that income Earned interest is considered the same as any other ordinary income and must be included as part of your federal and state tax returns

https://www.investopedia.com/.../052515/how-savings-account-tax…

Verkko 21 jouluk 2023 nbsp 0183 32 Interest from a savings account is taxed at your earned income tax rate for the year As of the 2022 tax year those rates ranged from 10 to 37 If your net investment income NII or

Tax Return Employment Self Employment Dividend Rental Property

File FREE Income Tax Return ClearTax ITR E filing Para Android Download

New Sugar Tax Over 200 000 Jobs Under Threat May Cost FG N409b Tax

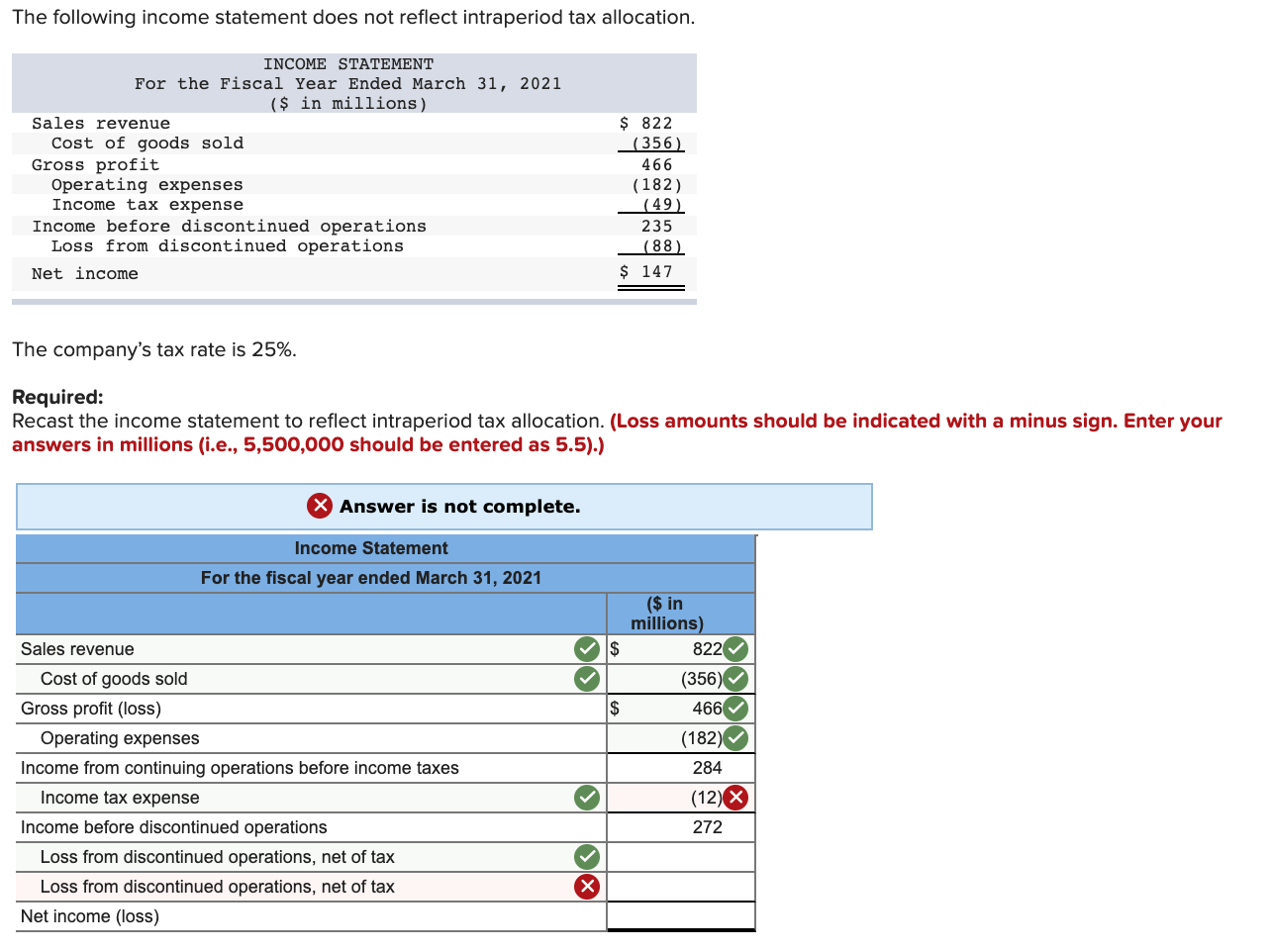

Solved The Following Income Statement Does Not Reflect Chegg

When Should I File My UK Self Assessment Tax Return For 2022 23 Gold

How To Read And Understand A Tax Return C2P Central

How To Read And Understand A Tax Return C2P Central

Democratic Plan Would Close Tax Break On Exchange traded Funds

4 Smart Investments Using Your Tax Return

How Much Foreign Income Is Tax Free In USA Leia Aqui How Much

Tax Return Interest Earned - Verkko 6 syysk 2023 nbsp 0183 32 Most of the time you ll report interest income on your federal tax return and that money will be taxed as ordinary income That means your interest income will be added on top of your other sources of ordinary income to help determine what income tax bracket you re in and then it will be taxed according to your income tax rate