Tax Return Moving Expenses Canada You are eligible to claim a deduction for moving expenses Complete Form T1 M Moving Expenses Deduction to calculate the moving expenses deduction that you are eligible to claim

If you move to be closer to work or school you can deduct most of your moving and relocation expenses on your personal income tax return Moving expenses can be deducted if the taxpayer does not already have a job at the new location but subsequently finds one there See Tax Court of Canada case Abrahamsen v The Queen 2007 TCC 95 What is an Eligible Relocation

Tax Return Moving Expenses Canada

Tax Return Moving Expenses Canada

https://moving.tips/wp-content/uploads/2016/02/moving-tax-deductions.jpg

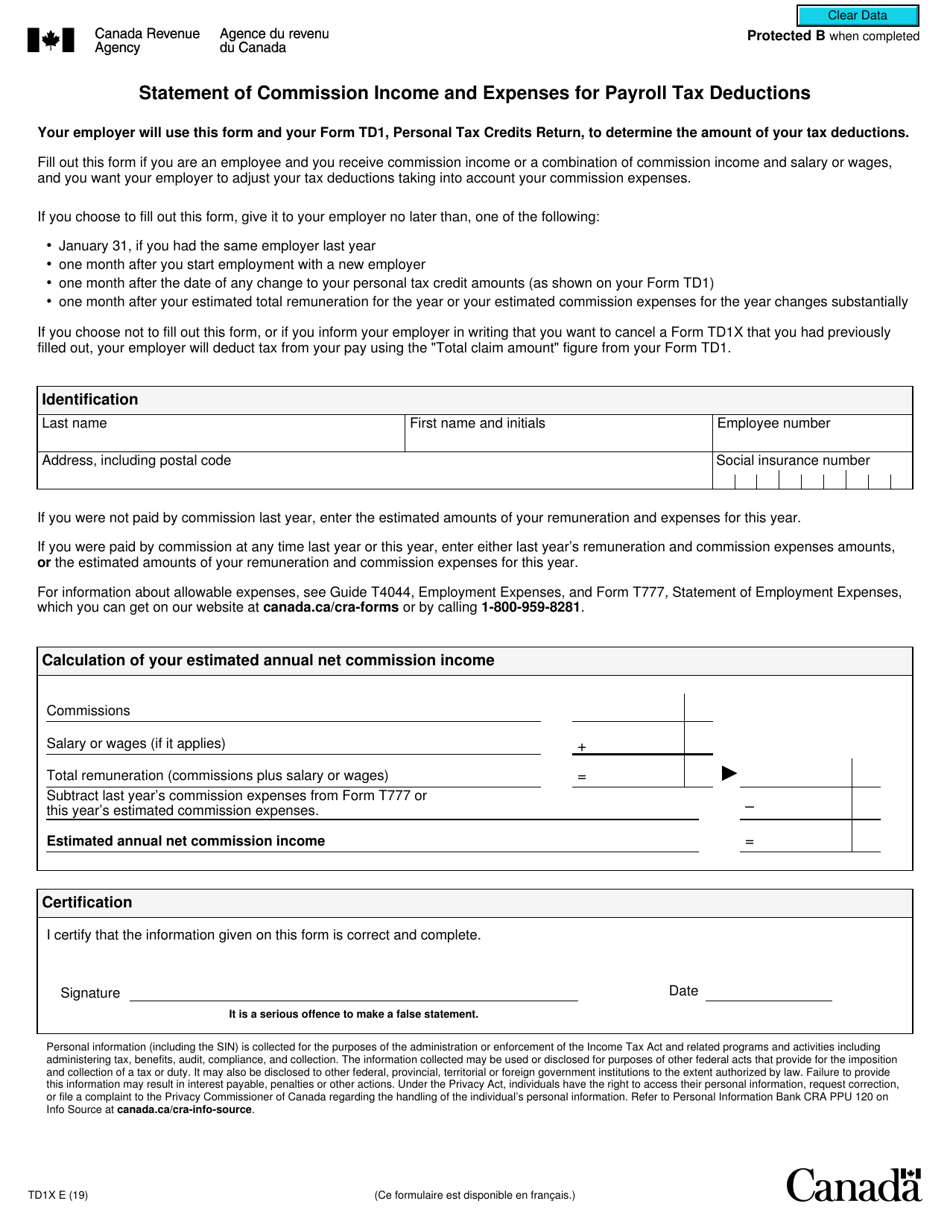

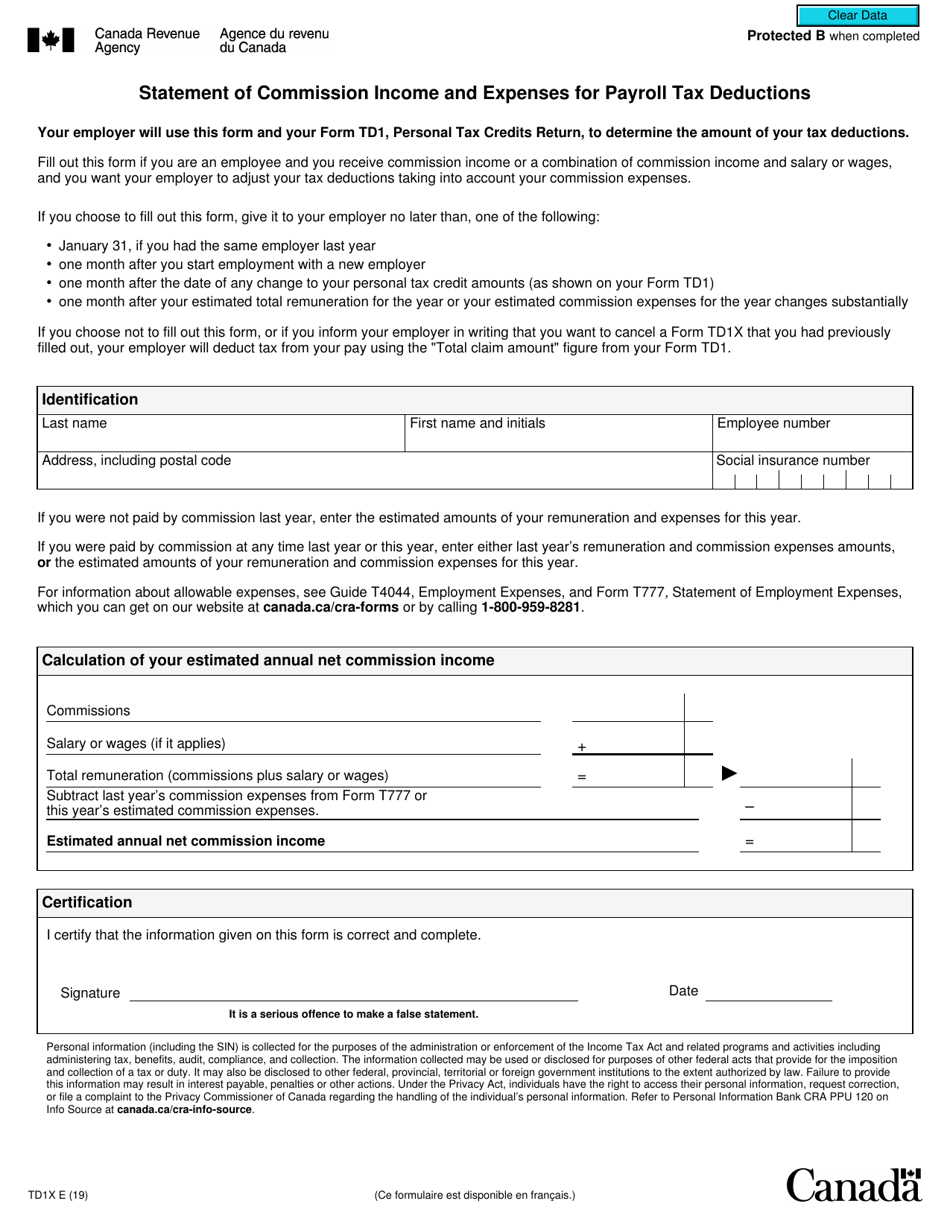

Form TD1X Download Fillable PDF Or Fill Online Statement Of Commission

https://data.templateroller.com/pdf_docs_html/2030/20309/2030992/form-td1x-statement-of-commission-income-and-expenses-for-payroll-tax-deductions-canada_print_big.png

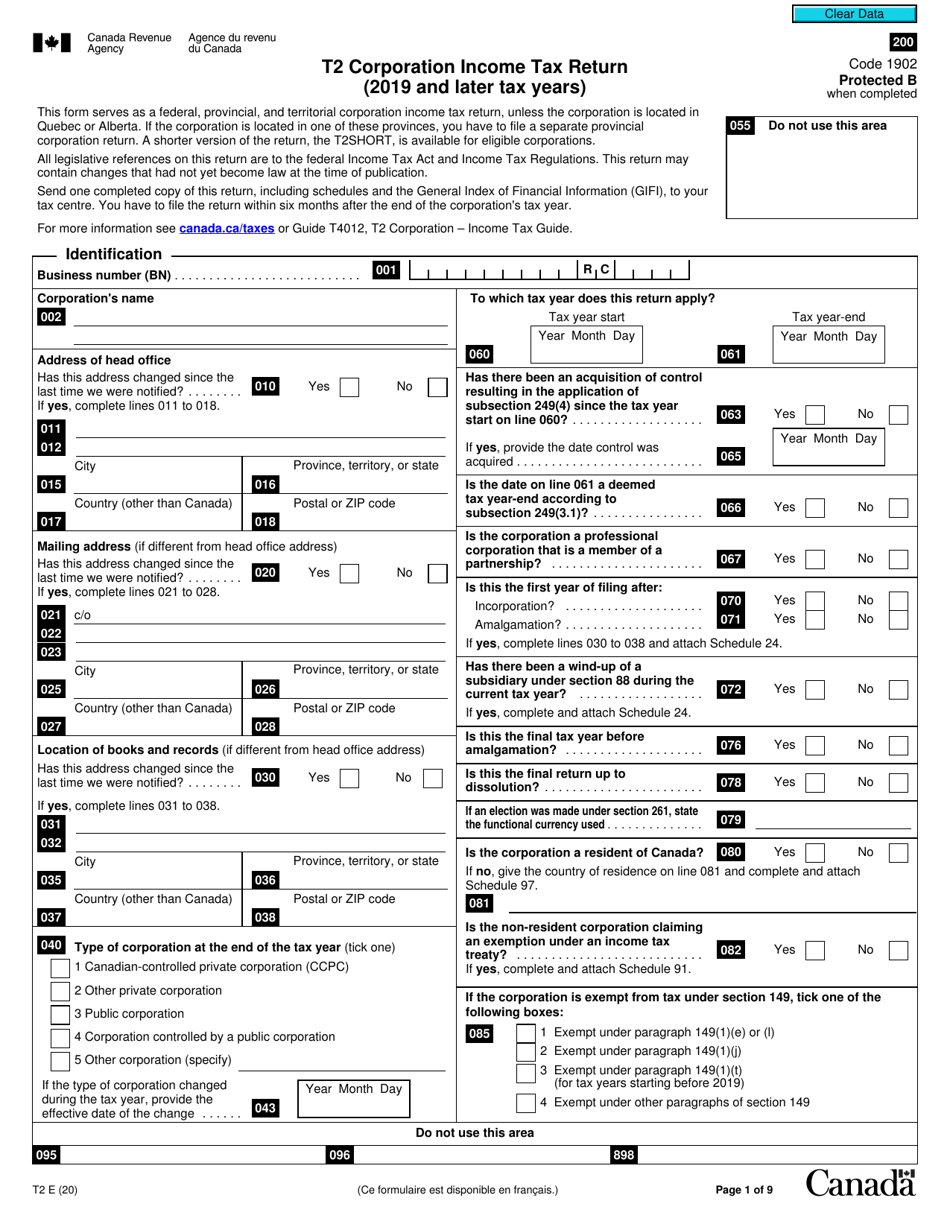

Form T2 Fill Out Sign Online And Download Fillable PDF Canada

https://data.templateroller.com/pdf_docs_html/2080/20804/2080492/form-t2-corporation-income-tax-return-canada_print_big.png

Discover how to claim moving expenses on your Canadian tax return eligibility deductions and common errors to avoid The Canada Revenue Agency allowed some of the taxpayer s moving costs including the cost of her mover 1 702 travel 131 hook up of utilities 268 notary public fees 1 845 and land transfer taxes 2 000

Moving within Canada Your moving expenses may be tax deductible Find out about moving tax deductions credits forms more from TurboTax Moving expenses are a deduction from income not a tax credit so they save taxes at your marginal tax rate Moving expenses can be claimed for the move to the educational institution at the beginning of each academic period and for

Download Tax Return Moving Expenses Canada

More picture related to Tax Return Moving Expenses Canada

Are Moving Expenses Tax Deductible Next Moving

https://nextmoving.com/wp-content/uploads/2021/05/Qualifications-For-Moving-Tax-Deductions-For-Eligible-Civilians-1x1-640x640-1.png

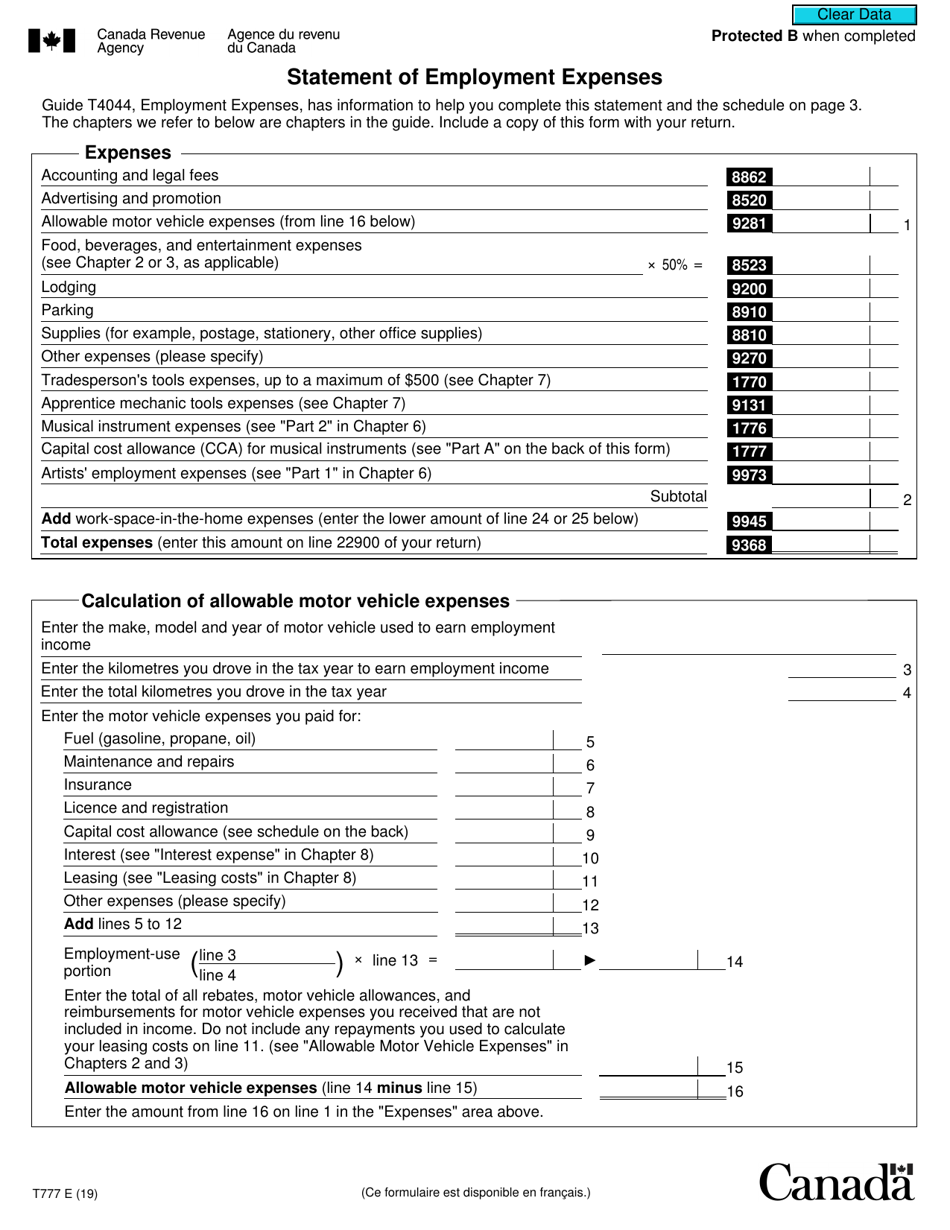

Form T777 Fill Out Sign Online And Download Fillable PDF Canada

https://data.templateroller.com/pdf_docs_html/2066/20664/2066446/form-t777-statement-of-employment-expenses-canada_print_big.png

How To Declare Your Income And Expenses As A Blogger Canada Save

https://www.savespendsplurge.com/wp-content/uploads/CRA-Tax-form-T2125-Business-Expenses.png

In this post liv rent will walk you through which moving expenses you can claim a deduction for how the process works in Canada as well as some tips and resources to help you get the most out of your tax return Moving expenses are tax deductible in cases where you re moving for employment or education When this happens you can claim the amount spent on moving against your taxable income reducing how much tax you

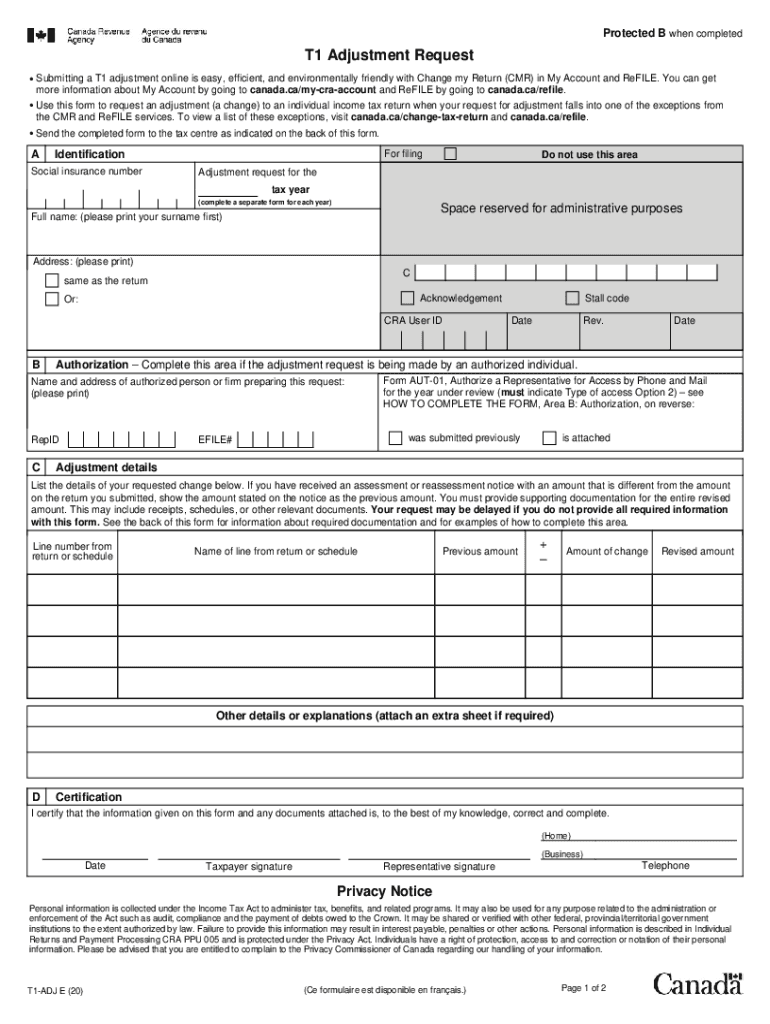

Tax deductible moving expenses include Reasonable travel costs for you and your household members including airfare train bus tickets vehicle rentals and personal To claim moving expenses on your tax return you need to complete Form T1 M Moving Expenses Deduction claim on line 21900 and attach it to your income tax return

What Are The Different Types Of Tax Deductible Moving Expenses

https://images.wisegeek.com/tax-return-form-with-pencil.jpg

Are Moving Expenses Tax Deductible Under The New Tax Bill

https://www.imperialmovers.com/wp-content/uploads/2018/01/moving-expense-tax-deduction-2018.jpg

https://www.canada.ca › ...

You are eligible to claim a deduction for moving expenses Complete Form T1 M Moving Expenses Deduction to calculate the moving expenses deduction that you are eligible to claim

https://turbotax.intuit.ca › tips

If you move to be closer to work or school you can deduct most of your moving and relocation expenses on your personal income tax return

How To Know If You Can Deduct Moving Expenses taxes CPA Moving

What Are The Different Types Of Tax Deductible Moving Expenses

2020 2023 Form Canada T1 ADJ E Fill Online Printable Fillable Blank

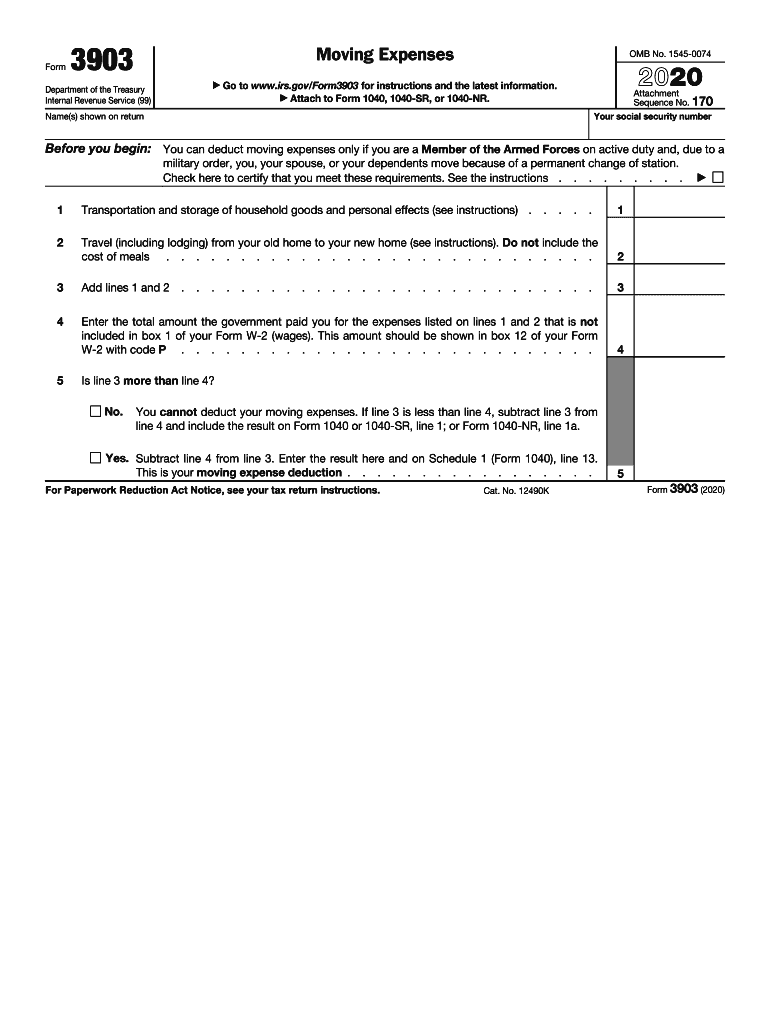

Form 3903 Moving Expenses 2015 Free Download

Claiming Childcare Expenses In Canada Blueprint Accounting

Tax Deductible Moving Expenses

Tax Deductible Moving Expenses

3903 Tax Form Fill Out And Sign Printable PDF Template SignNow

Are Moving Expenses Tax Deductible HowStuffWorks

What Are The Different Types Of Tax Deductible Moving Expenses

Tax Return Moving Expenses Canada - Moving expenses are a deduction from income not a tax credit so they save taxes at your marginal tax rate Moving expenses can be claimed for the move to the educational institution at the beginning of each academic period and for