Tax Return On College Fees Web All your study costs are included in your tax return Your estimated tax refund is calculated immediately free of charge and without risk When you are satisfied you can submit your tax documents to your tax

Web 15 Aug 2018 nbsp 0183 32 Hi All After 1 1 2 Year I have decided to claim my University tuition fees for my masters degree from Germany If it is possible I discussed with my German colleague whether I can claim the University Web 26 Apr 2021 nbsp 0183 32 Tax Tips Expenses from Your Profession Claim Costs for Further Education on Your Tax Return Tips on deductible costs amp plausibility check Receive an average

Tax Return On College Fees

Tax Return On College Fees

https://savingtoinvest.com/wp-content/uploads/2022/02/image-14.png

Tax Returns Preparation

http://www.adamkali.co.uk/wp-content/uploads/2019/08/tax-return-getty.jpg

LLC Vs S Corp Which Is Better Next Step Enterprises

https://nextstepenterprises.com/wp-content/uploads/2021/08/tax-planning-green.jpg

Web 15 Mai 2023 nbsp 0183 32 Overview You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees Web 29 Juni 2020 nbsp 0183 32 Studying Costs Pursuing a degree can lead to countless expenses but luckily for students a number of them can be claimed on their tax return As tax

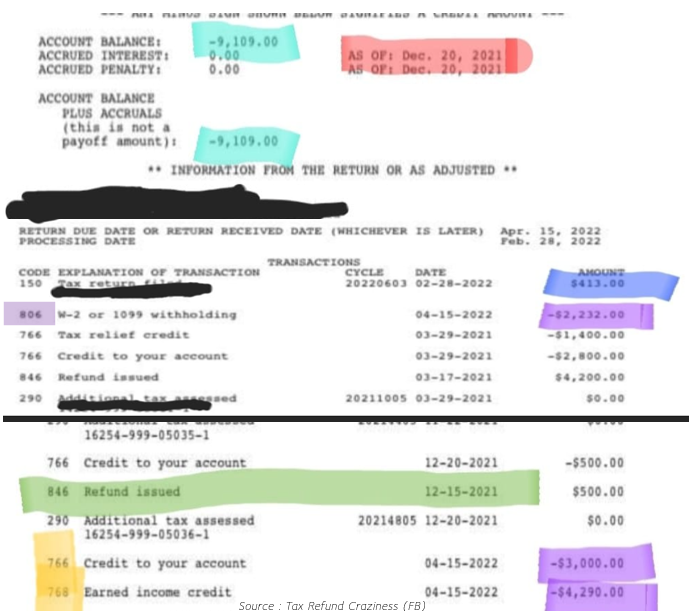

Web Some college tuition and fees are deductible on your 2022 tax return The American Opportunity and the Lifetime Learning tax credits provide deductions but you can only use one at a time Web 5 Okt 2023 nbsp 0183 32 See Publication 970 for information on what to do if you receive a refund of qualified education expenses during the tax year Return to Education Credits Page

Download Tax Return On College Fees

More picture related to Tax Return On College Fees

Don t Get Caught Up In A Tax Return Scam Acclaim Federal Credit Union

https://www.acclaimfcu.org/wp-content/uploads/2022/01/Dont-Get-Caught-up-in-a-Tax-Return-Scam-scaled-1-1536x1153.jpg

The Top Four Reasons To File Your Personal Tax Return On Time SCARROW

https://syccpa.com/wp-content/uploads/2017/04/shutterstock_330280214.jpg

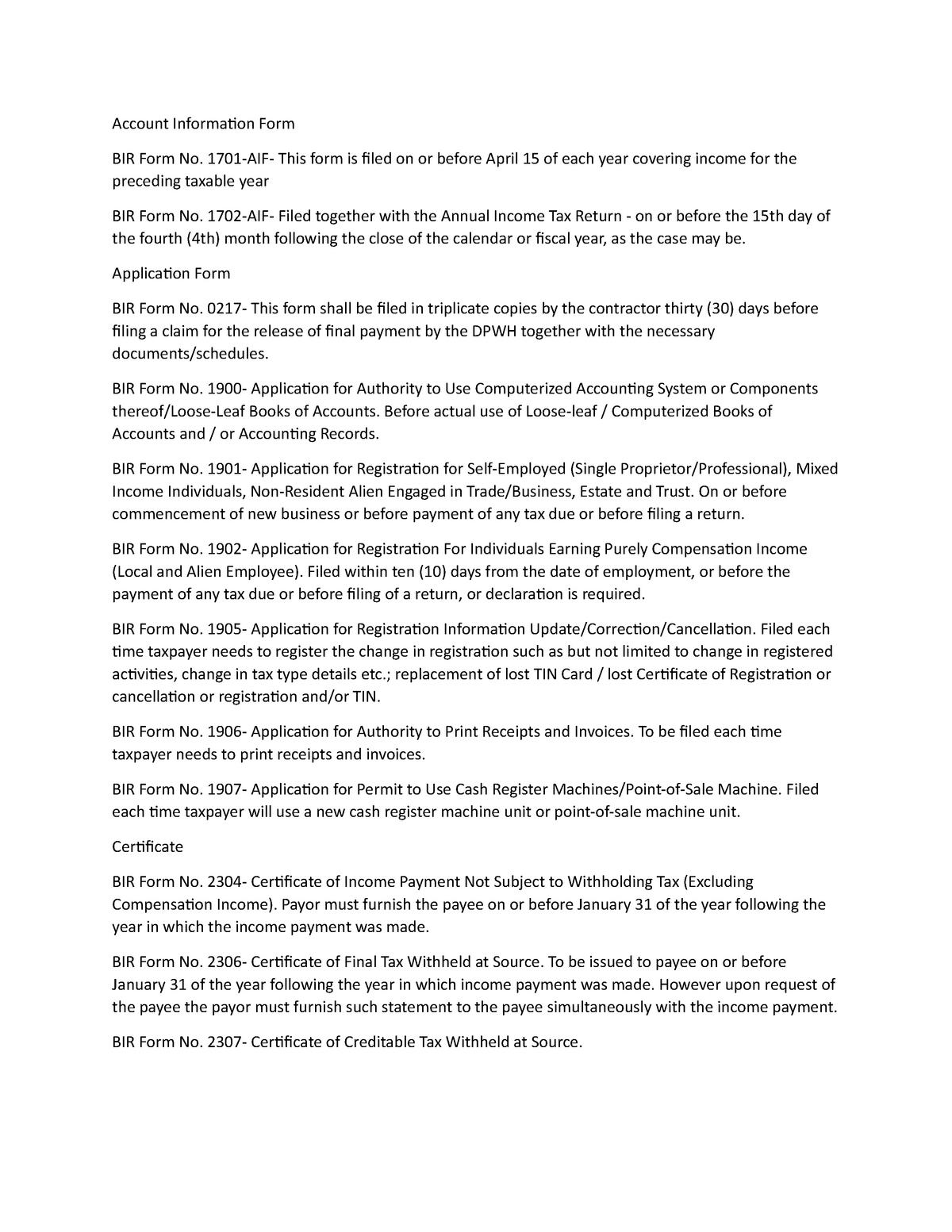

BIR Tax Forms Account Information Form BIR Form No 1701 AIF This

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1959413e5b49459ebb6388a0336dfd4c/thumb_1200_1553.png

Web 9 M 228 rz 2022 nbsp 0183 32 The deduction was 100 of qualified higher education expenses with a maximum of 4 000 2 000 or 0 depending on the amount of your modified AGI and filing status The phaseout for this Web 6 Jan 2023 nbsp 0183 32 Key Takeaways Proper records will help you accurately complete your tax forms when it s time to file so record all the money your student receives for school whether from savings scholarships or

Web Every year you make a tax return so that the tax office can note the 2 000 euros of study costs per year Now in 2022 you have started to work When the year is over you will Web 8 Juli 2023 nbsp 0183 32 Reduce your tax burden by declaring study related expenses and explore how tax returns work in Germany Maximize your refunds and offset future tax liabilities with

Extension Tax Taxgarden

https://blog.taxgarden.com/wp-content/uploads/2021/04/extension-online-1-1.png

File Your Income Tax Return Before 31st July Avoid Penalties And

https://media.licdn.com/dms/image/D4D22AQHYs2sW8njWog/feedshare-shrink_2048_1536/0/1688451839032?e=1696464000&v=beta&t=qyRgq8hyyaxEFvjW2gS5wVny9zxOWtObhTZBRO6YDpU

https://taxfix.de/en/student-tax-returns

Web All your study costs are included in your tax return Your estimated tax refund is calculated immediately free of charge and without risk When you are satisfied you can submit your tax documents to your tax

https://www.toytowngermany.com/forum/topic/…

Web 15 Aug 2018 nbsp 0183 32 Hi All After 1 1 2 Year I have decided to claim my University tuition fees for my masters degree from Germany If it is possible I discussed with my German colleague whether I can claim the University

How To Fill Out Your Tax Return Like A Pro The New York Times

Extension Tax Taxgarden

How To File Tax Return On FBR Teachers And Govt Servants YouTube

Five Tips For College Students Filing A Tax Return The Independent

What Is The Tax Year End Know The Important Dates Accounting Logic

WHY SHOULD I LODGE MY TAX RETURN ON TIME Langley McKimmie

WHY SHOULD I LODGE MY TAX RETURN ON TIME Langley McKimmie

Tax Returns Show Romney Rents Tax exempt Status Newsday

Spend Your Tax Return On These Stylish Basics That Will Actually Last

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

Tax Return On College Fees - Web 14 Dez 2023 nbsp 0183 32 Going to college seems to get more expensive every year Tuition fees room and board for an out of state student attending a four year public institution cost