Tax Return Policy Canada Basics of a tax return The 6 steps for all tax returns and how to file electronically Time to complete about 8 minutes Start this lesson This lesson includes 4 sections 1 question

Individual Taxes on personal income Last reviewed 15 December 2023 Individuals resident in Canada are subject to Canadian income tax on worldwide How you file your return can affect when you get your refund The CRA s goal is to send you a notice of assessment as well as any refund within the following timelines online 2

Tax Return Policy Canada

Tax Return Policy Canada

https://leestaxservicellc.com/files/IMG_1348.png

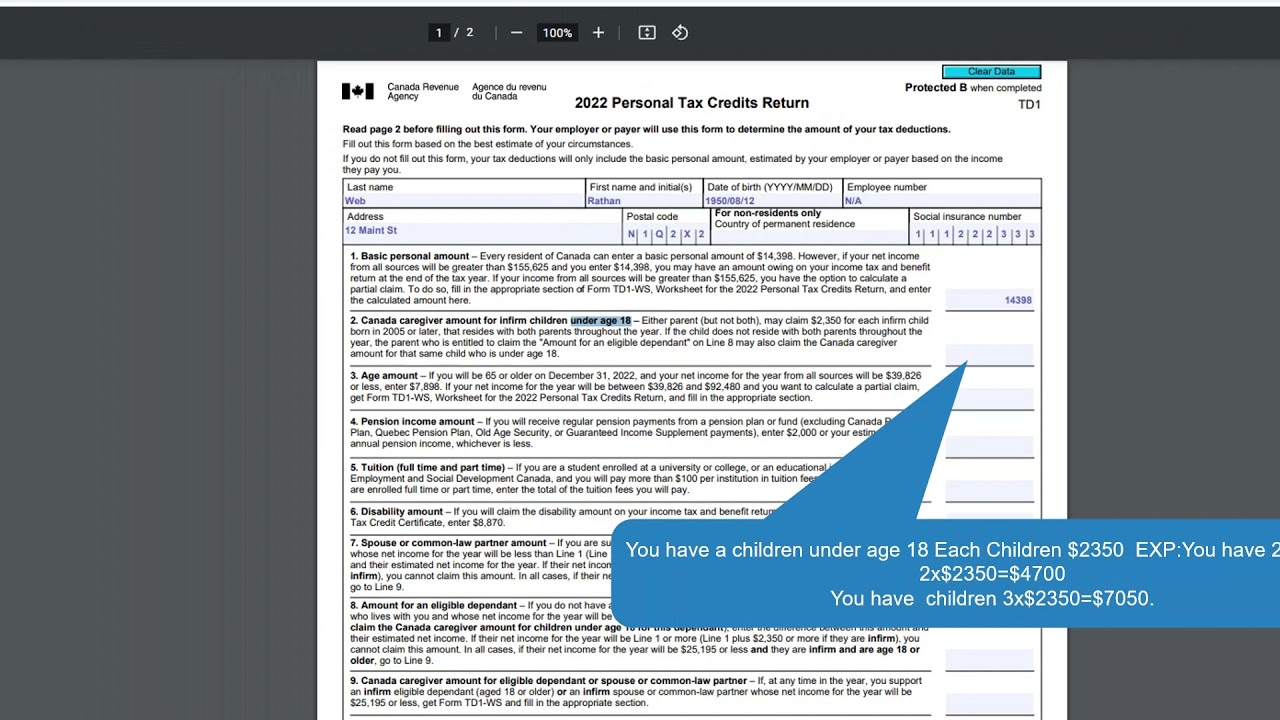

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

https://www.thebalance.com/thmb/n0qY5_o0VzoZ5tk64K_PBHbmHrs=/1333x1000/smart/filters:no_upscale()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif

Updated April 5 2024 Fact Checked This guide covers the basics of filing your tax return in Canada to ensure it s done correctly so you can get your refund quickly Each year the time comes to file taxes You can file your completed tax return with the Canada Revenue Agency CRA online or by mail If you are a non resident you can only send your tax return by mail Online

You re required to report your income to the CRA annually by filing paperwork known as a tax return In this return you must list all your income sources Access to Canada Revenue Agency CRA forms tax packages guides publications reports and technical notices

Download Tax Return Policy Canada

More picture related to Tax Return Policy Canada

Trump Tax Return Details Leaked

https://m.wsj.net/video/20170315/031517trumptax2/031517trumptax2_1280x720.jpg

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

How To Use Aadhaar Card For Electronic Tax Return Verification

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/09/How-to-use-Aadhaar-Card-for-Electronic-Tax-Return-Verification-1.png

A tax return is a uniform way for Canadians to file their taxes It involves reporting your previous calendar year s taxable income tax credits and other information Your CRA tax return filing must include all earned income for the tax year from January through December The standard Canada tax return deadline is April 30 of each year

You can request a change to your income tax and benefit return by amending the amount entered on specific lines of your return Wait until you receive your notice of assessment According to the Canada Revenue Agency CRA in the 2022 tax year 92 of Canadians chose to file their taxes online Alternatively you can fill out a paper

Tax Return Employment Self Employment Dividend Rental Property

https://i.pinimg.com/originals/d3/7f/83/d37f830fdf0e55518f62e71ed96aa8bd.png

File Your Income Tax Return By 31st July Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/ITR-31st-july.png

https://www. canada.ca /.../completing-basic-return.html

Basics of a tax return The 6 steps for all tax returns and how to file electronically Time to complete about 8 minutes Start this lesson This lesson includes 4 sections 1 question

https:// taxsummaries.pwc.com /canada/individual/...

Individual Taxes on personal income Last reviewed 15 December 2023 Individuals resident in Canada are subject to Canadian income tax on worldwide

Tax Return And Tax Investigators Stock Photo Alamy

Tax Return Employment Self Employment Dividend Rental Property

Withholding Tax Return

Extension Of Timelines For Filing Of Income tax Returns And Various

Tax Reduction Company Inc

CRA Read This Before You File Your Canadian Taxes In 2021

CRA Read This Before You File Your Canadian Taxes In 2021

Don t Want To Wait For Your Unemployment Refund Michigan Suggests

What We Think Are The 5 Best Uses For Your Tax Return New Dimensions

The Ultimate Guide Return Policy For Canadian Grocery Stores Grocery

Tax Return Policy Canada - The Canada Revenue Agency CRA processes income tax returns in Canada Most Canadians must file their tax returns and pay any taxes owed by April