Tax Return Review Process If your tax return has been flagged for review there s no need to panic just yet There are several reasons why the IRS agrees to take a closer look at

When the IRS officially places your return under review you ll receive a CP05 notice This will immediately put your refund processing on delay until the review is complete However if you owe money you re still expected to pay the IRS no The Best Way to Review a Tax Return Choose a process then trust it By Ed Mendlowitz How to Review Tax Returns The Field Tested Update I have mentioned seven types of tax return reviews and explained the first three Today it is time to look at the other four

Tax Return Review Process

Tax Return Review Process

https://lasouthbayaccounting.com/wp-content/uploads/2021/05/5-17-2120Tax20Personal20Email20-20Turbulent20Tax20Season-1.jpeg

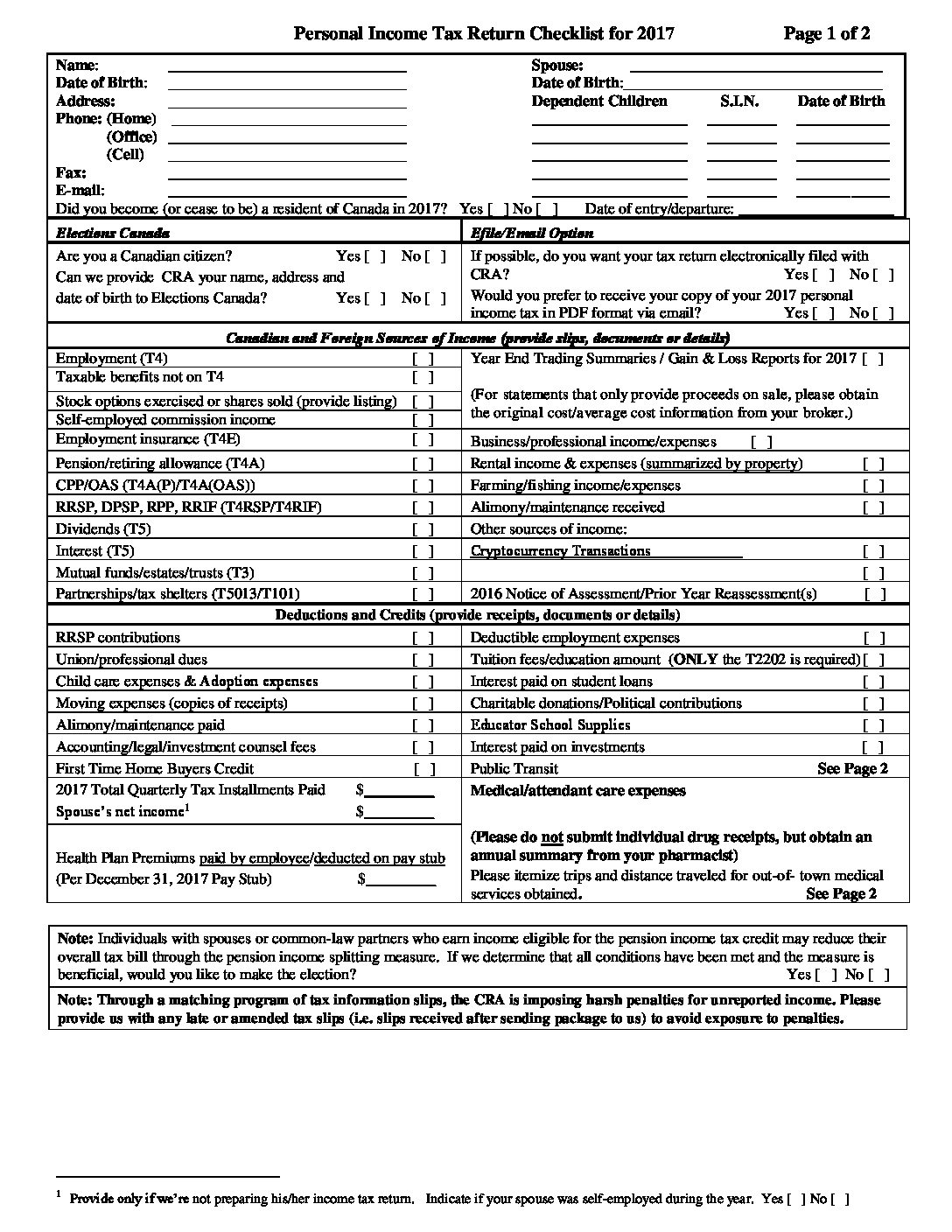

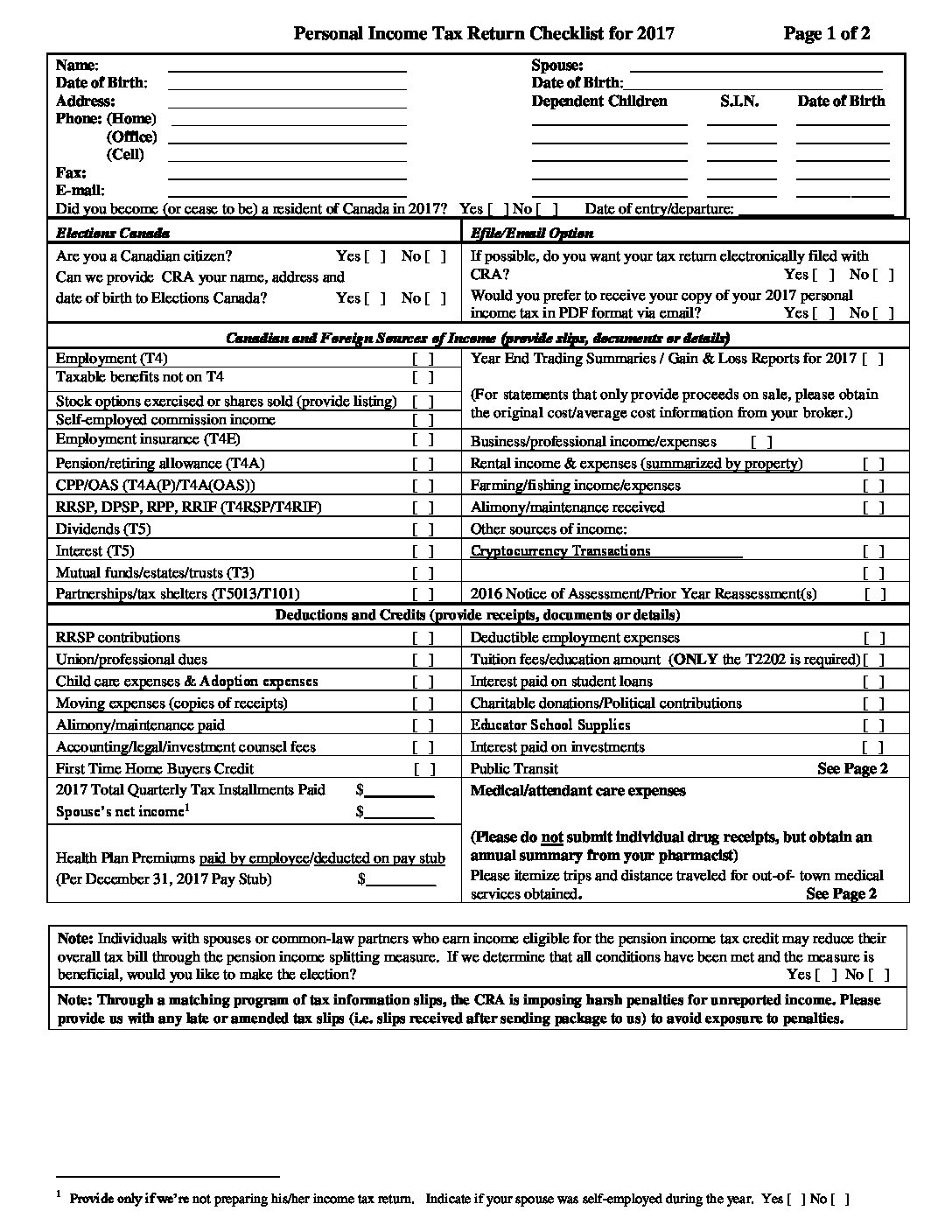

2017 Personal Tax Return Checklist Heary And Company

http://hearyandco.com/wp-content/uploads/2018/03/2017-Personal-Tax-Return-Checklist-pdf.jpg

4 Next Steps For Business Tax Return Review

https://dgriggscpa.com/wp-content/uploads/2021/05/5-17-2120Tax20Business20Email20-20What20Now_-768x536.jpg

When the return was completed and ready to go out I reviewed the tax comparison worksheet looking for differences and unexpected results I made sure the return was sent out with a bill Here are brief explanations of each of these three steps How to Review Tax Returns The Field Tested Update There are numerous ways to review tax returns Most reviewers have their own techniques and some alter these based on the type of or size of the return or who the preparer is or who the partner in charge of that client is MORE How to Turn Tax Returns into New Business

When you receive a CP05 notice it means that the IRS would like to verify the data you entered on your income tax return There issues for which your small business should provide further What is your tax return review process FIRM Software We use a simple spreadsheet that we created to quickly enter in basic information from client source documents to double check that nothing was missed or numbers weren t transposed on a tax return

Download Tax Return Review Process

More picture related to Tax Return Review Process

Trust The Process Part 3 Annual Tax Return Review Woodward

https://static.twentyoverten.com/5addfac9b3629d23041e1f91/BJDwWH-t7/Flow-Chart.png

Tax Return Review Flower Mound TX Chandler Knowles CPA

https://www.chandlerknowlescpa.com/wp-content/uploads/2020/04/tax-return-1024x1024.png

/cdn.vox-cdn.com/uploads/chorus_asset/file/22778395/Screen_Shot_2021_08_12_at_11.49.25_AM.png)

2017 Taxes Turbotax Online Vs Software Japna

https://cdn.vox-cdn.com/thumbor/sOh3KXYw5GzwZ9EQhNUvSfSuTMM=/1400x0/filters:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22778395/Screen_Shot_2021_08_12_at_11.49.25_AM.png

The IRS does check every tax return and may even correct errors but sometimes flags the tax return for audit The IRS tax return review process starts with a computer review for mathematical errors A human may review the return if a math issue is found or if the return is flagged for audit Learn how long it takes the IRS to review and process tax refunds including factors that influence the timeline and how to check the status

The Process Here are the final steps necessary for the filing of your tax returns Review your federal and state tax returns as necessary Ensure the information being presented looks and feels right and all material tax related matters are addressed What this notice is about We received your tax return and are holding your refund until we complete a more thorough review of the benefits you claimed under a treaty and or the deductions claimed on Schedule A Itemized Deductions

Browse Our Example Of Financial Due Diligence Report Template For Free

https://i.pinimg.com/originals/d2/5d/b0/d25db082ddfdc9a90bdb641ecb08bf84.jpg

LLC C Corp S Corp Double Tax Passes Through

https://i.ytimg.com/vi/IrKESBRD1Lw/maxresdefault.jpg

https://smartasset.com/taxes/what-happens-when...

If your tax return has been flagged for review there s no need to panic just yet There are several reasons why the IRS agrees to take a closer look at

https://www.lovetoknow.com/life/work-life/what...

When the IRS officially places your return under review you ll receive a CP05 notice This will immediately put your refund processing on delay until the review is complete However if you owe money you re still expected to pay the IRS no

Gilbert AZ CPA Ralph Willett CPA

Browse Our Example Of Financial Due Diligence Report Template For Free

The Advisor s Guide To Tax Return Reviews Holistiplan

Virginia Department Of Taxation Review Letter Sample 1

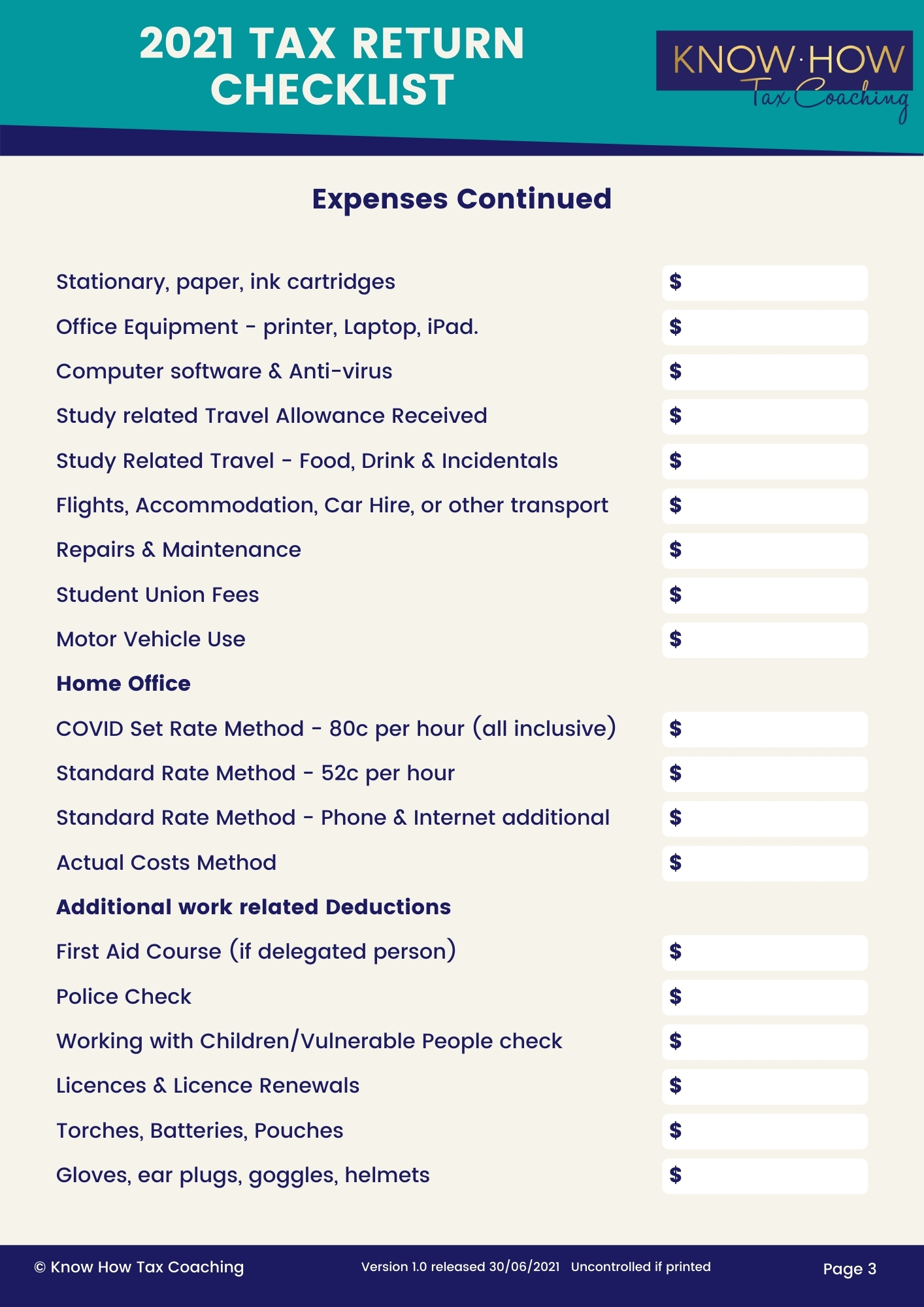

Tax Return Checklist Know How Tax Coaching

Past Business Tax Return Review Paragon

Past Business Tax Return Review Paragon

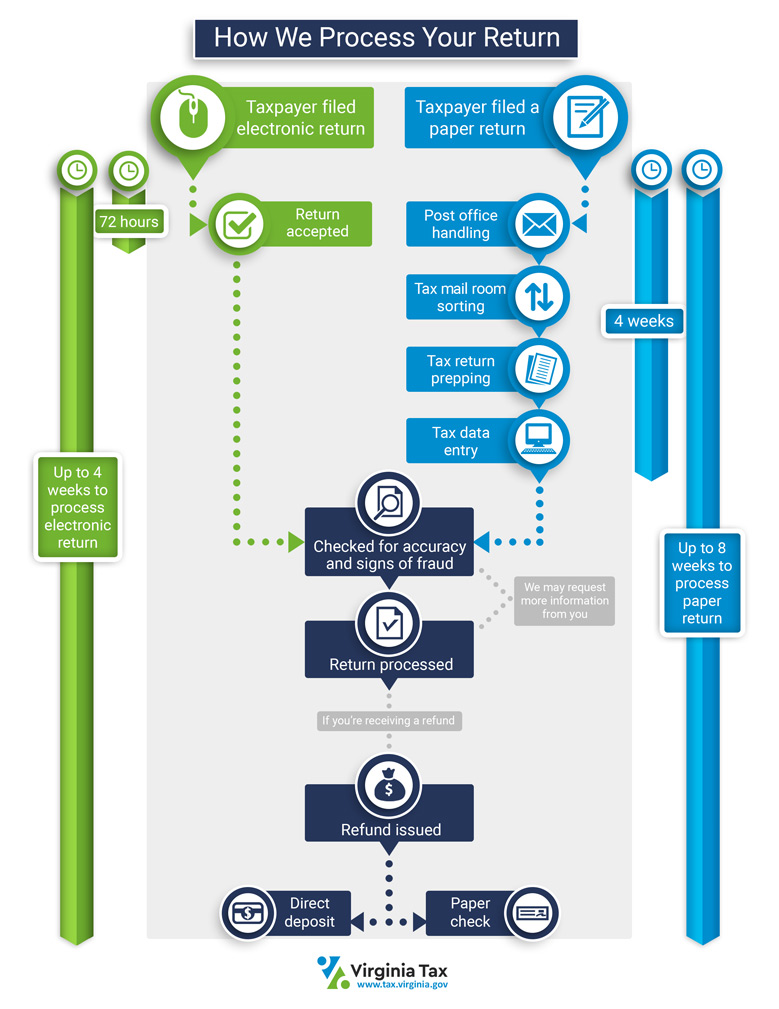

Where s My Refund Virginia Tax

Sales Receipt Template Fill Out Sign Online And Download PDF

IRS Updates Withholding Tables Paragon

Tax Return Review Process - Find our current processing status and what to expect for the tax form types listed below Individual returns Electronically filed Form 1040 returns are generally processed within 21 days