Tax Return Tools Claim Maximum deduction for eligible tools is the lesser of a 1 000 b the amount if any determined by the formula A 1 368 where A the lesser of 1 the total cost of eligible tools that you bought in 2023 2 your income from employment as a

Thankfully buying tools equipment or a vehicle for your business can be claimed as a tax expense which reduces your taxable income and tax bill Which type of tax expense you claim depends upon what you re Claiming tax relief on expenses you have to pay for your work like uniforms tools travel and working from home costs Claim tax relief for your job expenses Buying other equipment

Tax Return Tools Claim

Tax Return Tools Claim

https://images.pexels.com/photos/6863517/pexels-photo-6863517.jpeg?auto=compress&cs=tinysrgb&dpr=3&h=750&w=1260

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

Tax Return Form 2011 A Tax Return Form From 2011 2012 I Am Flickr

https://live.staticflickr.com/7147/6757885809_728dd0dd5e_b.jpg

Did you know there are tax deductions for mechanics tools If you work as a mechanic some of your key business expenses may be tax deductible Learn how your business structure affects your taxes and where you may be able to save Maybe you re a mechanic who has to bring their tools to work or a chef with a set of specialist knives As such HMRC has kindly decided you can claim a portion of the cost of your tools by getting back some of the money you ve paid in

You can claim back tax relief for the tools light equipment you purchased in the last 4 tax years not 6 as used to be the case From the date of this article this means you can claim back tax for purchases from 6th April 2010 not before A tool tax rebate can be claimed by employees who buy their own tools to use for work It is often referred to as a mechanics tool rebate but it applies to other industries too As well as tools you can also claim tax for uniform laundering and repairs

Download Tax Return Tools Claim

More picture related to Tax Return Tools Claim

Tax Return Free Creative Commons Handwriting Image

http://www.picpedia.org/handwriting/images/tax-return.jpg

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

How to Claim Tools on Taxes By Steve Milano MSJ Updated Jan 28 2022 You can use business tools for personal use but you won t get as big of a deduction Image Credit Design Pics Design Pics Getty Images Can you deduct tools on your taxes The rules for deducting business items changed in 2018 with the passage of the Tax Cut You can normally claim tools tax relief worth 18 of your tool purchases A claim can be made for the previous four tax years If you ve still got receipts for tools bought before then these can be added to your claim You can use our tool tax back calculator to get an estimation of what you may be owed back Tool tax relief time limit

You can claim a deduction for tools or equipment if you use them for work purposes If you also use the tools or equipment for private purposes you can only claim the work related portion If you bought the tool or item of equipment part way through the financial year you can only claim a deduction for the portion of the year that you owned it You ll need to itemize deductions Schedule A to claim your job related expenses The cost of your tools won t be fully deductible as it will be subject to the 2 rule Note that if you are self employed you may deduct the cost of tools you use for work as a business expense To enter your job related tool expenses in TurboTax

5 Helpful Tax Tools For Filing Taxes Filing Taxes Tax App Income

https://i.pinimg.com/originals/fc/61/92/fc61924541c53544da802b4fc09040b4.jpg

Simplified Income Tax Return Online TaxNodes

https://www.taxnodes.com/gif/itr3.gif

https://www.canada.ca/en/revenue-agency/services...

Maximum deduction for eligible tools is the lesser of a 1 000 b the amount if any determined by the formula A 1 368 where A the lesser of 1 the total cost of eligible tools that you bought in 2023 2 your income from employment as a

https://www.gosimpletax.com/blog/how-to-claim-tax...

Thankfully buying tools equipment or a vehicle for your business can be claimed as a tax expense which reduces your taxable income and tax bill Which type of tax expense you claim depends upon what you re

Simplified Income Tax Return Online TaxNodes

5 Helpful Tax Tools For Filing Taxes Filing Taxes Tax App Income

H R BLOCK TAX RETURN PROGRAM FOR AT HOME On Mercari Tax Software Hr

Tax Return Employment Self Employment Dividend Rental Property

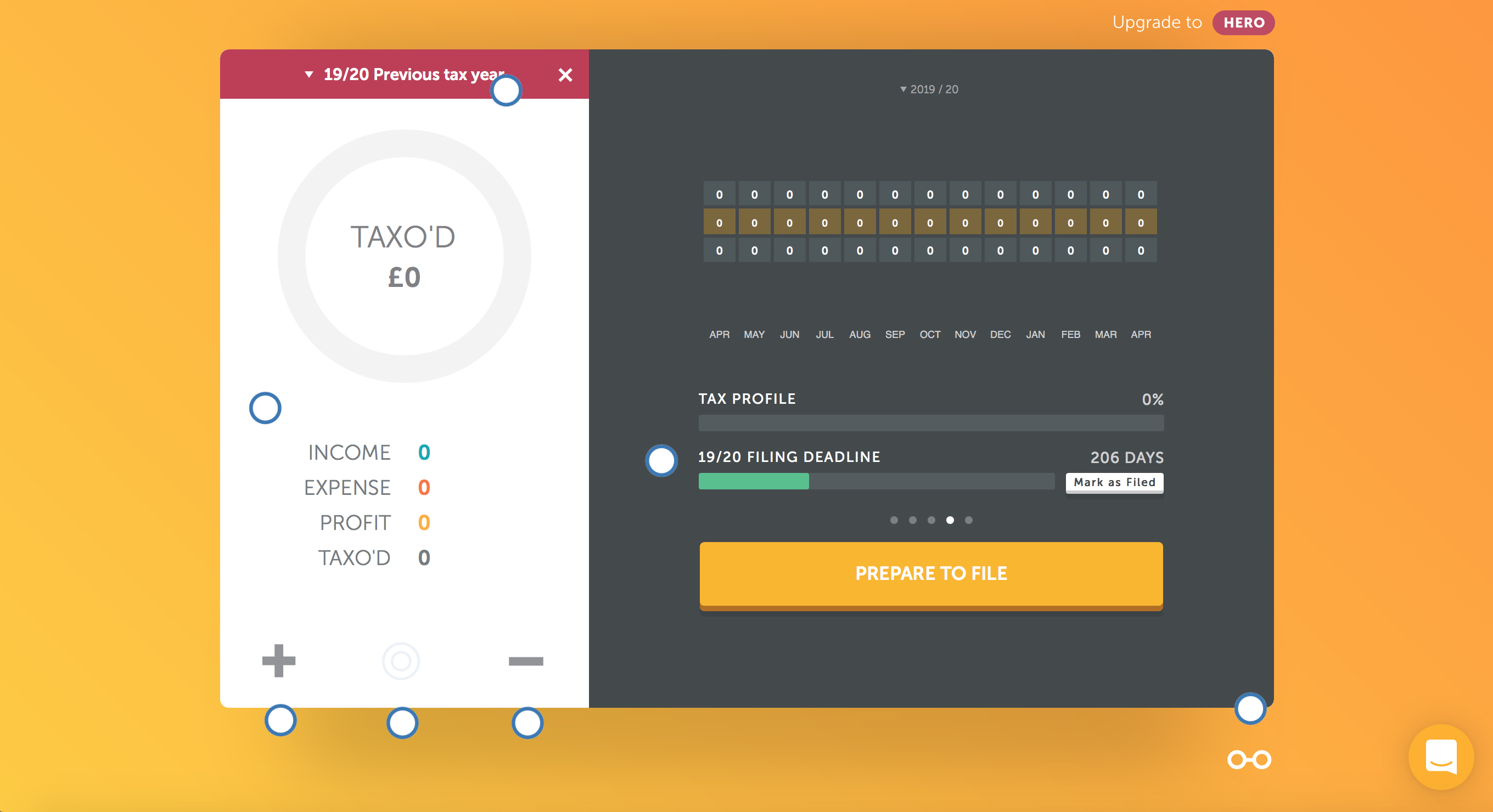

TAXO D TechRadar

How To Use Aadhaar Card For Electronic Tax Return Verification

How To Use Aadhaar Card For Electronic Tax Return Verification

Beyond Tax Return The 3 Tax Saving Tools You Want To Remember

How To Keep Your Tax Return From Getting Hung Up

Tax Return And Tax Investigators Stock Photo Alamy

Tax Return Tools Claim - You may be able to claim the following 15 common write offs which include both tax credits and deductions