Tax Return Working From Home 2022 To claim working from home expenses you must be working from home to fulfil your employment duties not just carrying out minimal tasks such as occasionally checking emails or taking calls incur additional running expenses as a result of working from home have records that show you incur these expenses

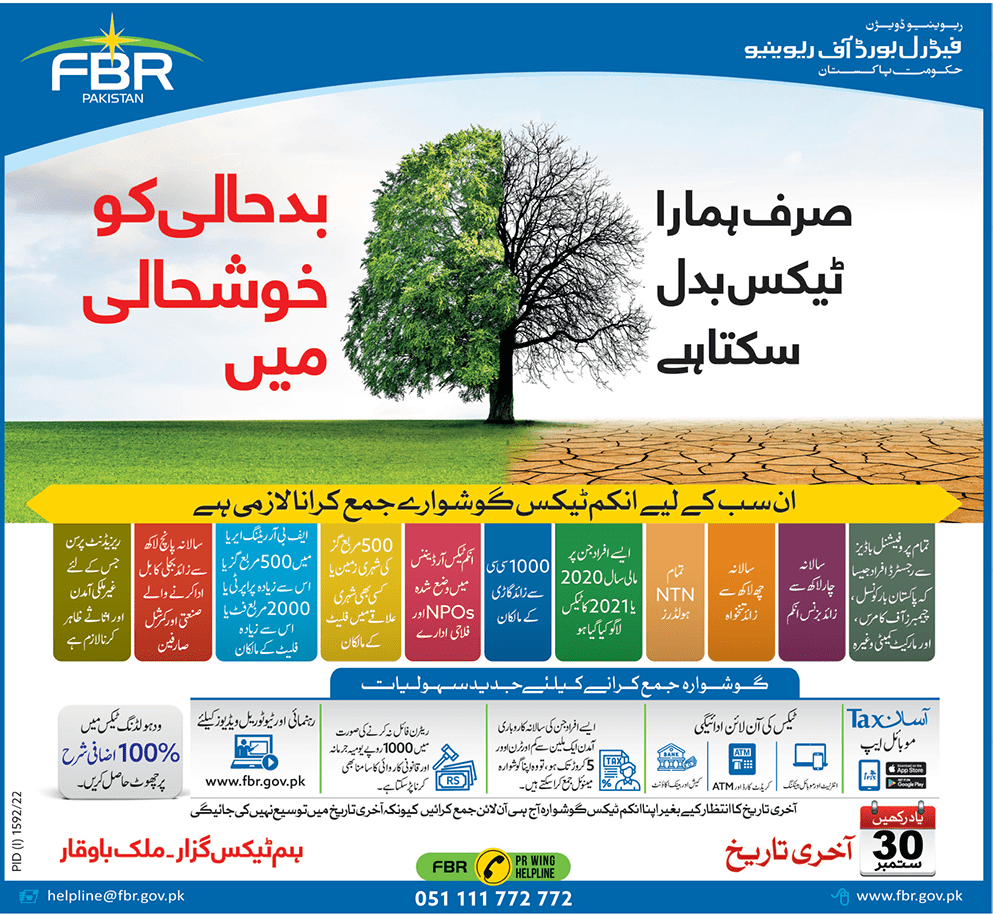

The Australian Taxation Office ATO has refreshed the way that taxpayers claim deductions for costs incurred when working from home The changes better reflect contemporary working from home arrangements From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self assessment SA returns online or on a paper P87 form

Tax Return Working From Home 2022

Tax Return Working From Home 2022

https://cdn.mos.cms.futurecdn.net/285sr7iY5FcNx8K3S2JeUd.jpg

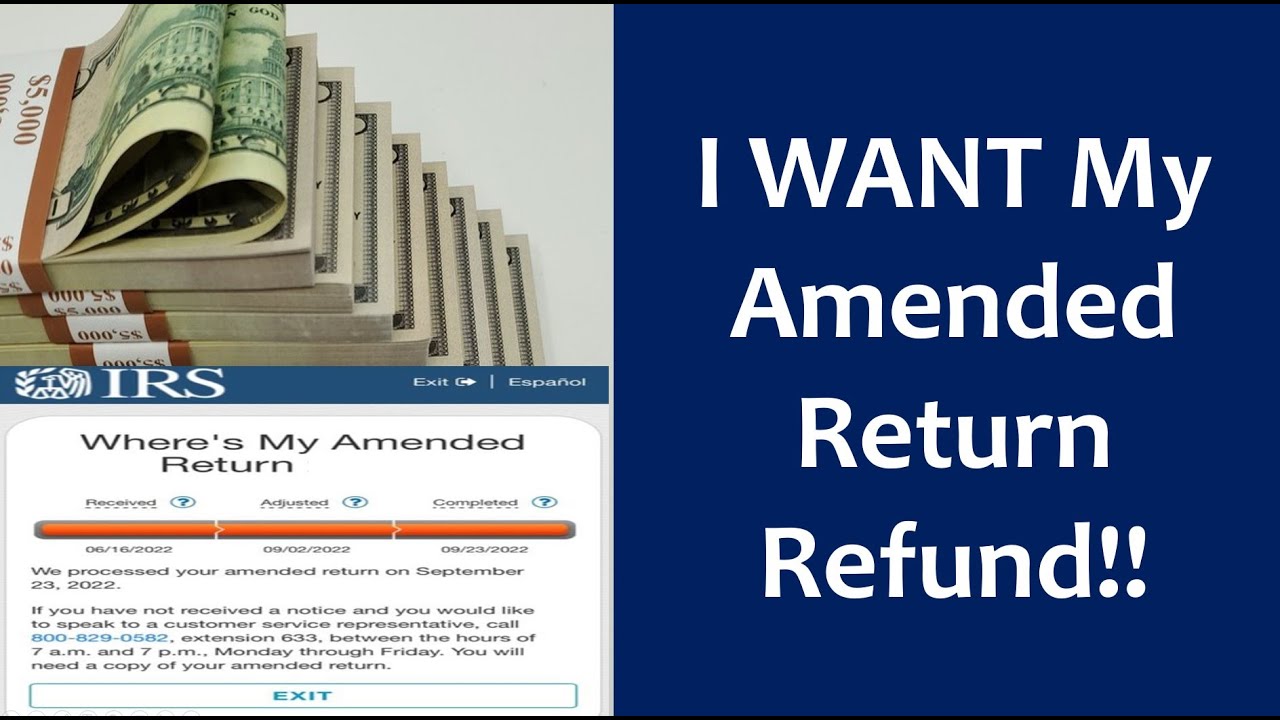

Help Where Is My Amended Return Refund How To Check Your IRS Tax

https://i.ytimg.com/vi/rFVZRBVko04/maxresdefault.jpg

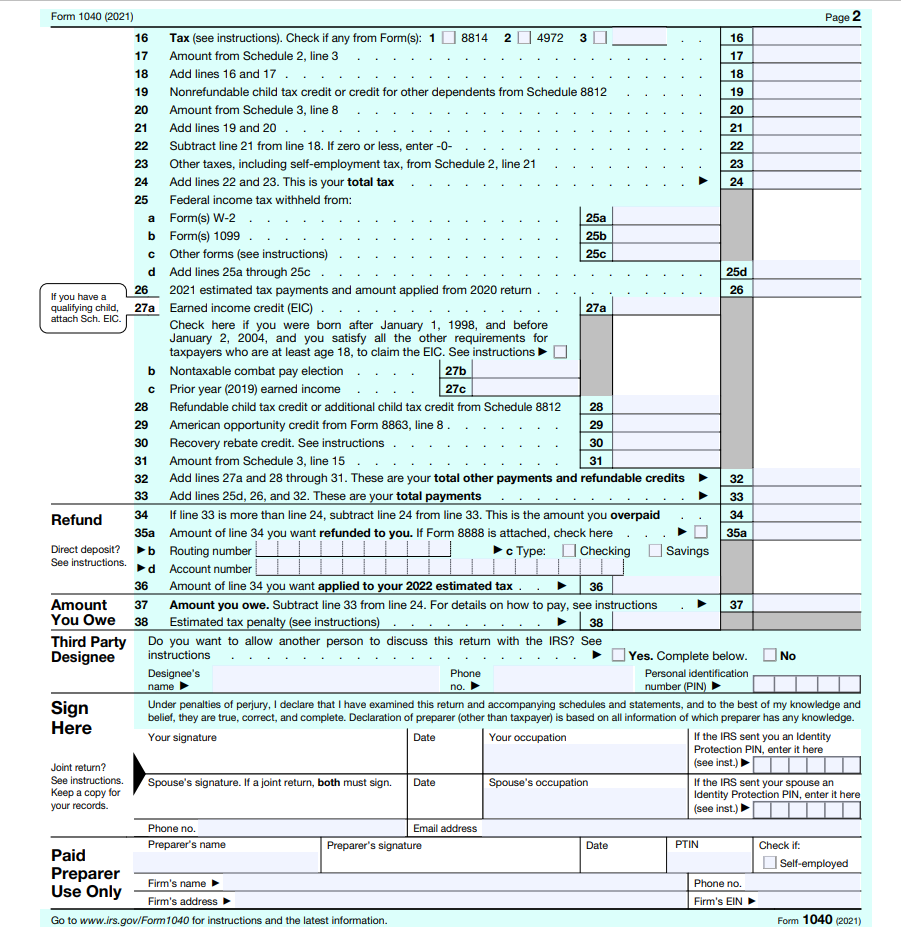

What To Know When Filing Your 2022 Tax Return From JustAnswer Tax Experts

https://www.justanswer.com/blog/sites/blog/files/marketing_blog/images/Tax blog post.jpg

The fixed rate method for calculating your deduction for working from home expenses is available from 1 July 2022 If you don t use the fixed rate method you need to use the actual costs method to claim a deduction for the additional expenses you incur as a result of working from home Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return Prior to the 2018 tax reform employees could claim these expenses as an itemized deduction

Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home The Australian Taxation Office s shortcut method for calculating work from home expenses introduced in 2020 during the pandemic is ending on June 30 2022

Download Tax Return Working From Home 2022

More picture related to Tax Return Working From Home 2022

2023 Tax Return Working From Home Deductions Changes Tax Digital

https://images.prismic.io/tax-digital/3f876afb-93d6-419c-87d6-ddf2eaab8df2_Working+From+Home+1.png?auto=compress,format

You Will File 2021 Federal Income Tax Return treat Chegg

https://media.cheggcdn.com/media/b0a/b0a28a99-d2e3-4e46-804f-c713b1914a6d/phpfaXmx0

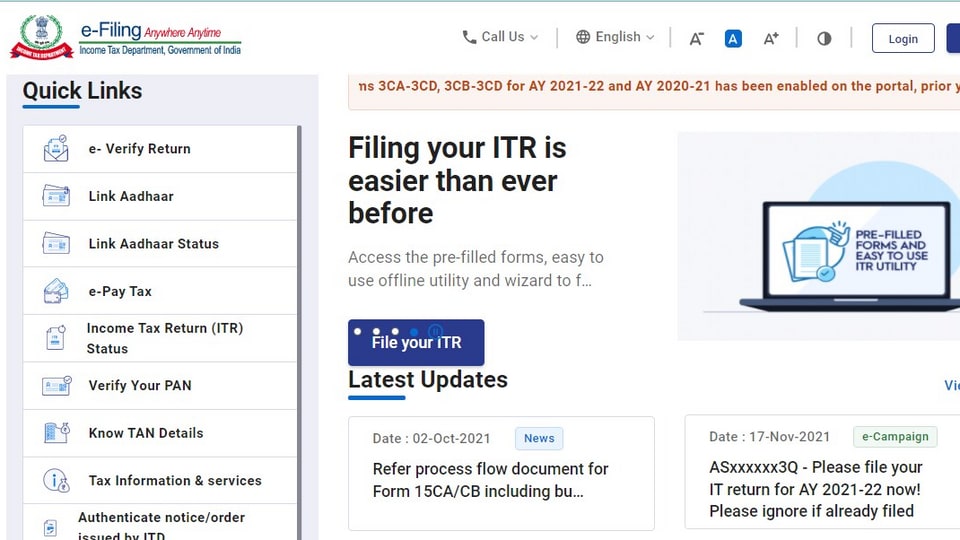

File Income Tax Return For FY 2021 22 Now Online To Avoid Rs 5000

https://images.hindustantimes.com/tech/img/2022/07/15/960x540/itr_1638249050262_1657879361820_1657879361820.PNG

From July 2022 onward the Australian Tax Office revised the rules for home office expenses giving Australians an avenue for claiming some work from home costs even if they don t have a dedicated home office We cover these changes below in the section on the revised fixed rate method If you ve been working from home during the 2022 2023 financial year you may be eligible to claim deductions for your work related expenses However it s important to be aware of the recent changes announced by the Australian Taxation Office ATO in March 2023

HMRC sets out different ways you can claim for working from home if you re self employed In this guide you ll find out your options to claim for your home office the work from home allowances for 2022 2023 as well as how to claim it on your self assessment tax return To claim for the working from home tax relief Head to the government s microservice portal and answer the eligibility questions During this process you also be asked about other work related expenses that you could claim for too

)

Income Tax Return Filing Latest Updates On ITR Forms For Current

https://cdn.zeebiz.com/sites/default/files/2023/06/26/248454-article-65-zee-biz.jpg?im=FitAndFill=(1200,900)

ITR 2022 10 Documents You Must Have Before Filing Income Tax Return

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202207/itr-gfx_0.jpg?itok=BK9C0lwT

https://www.ato.gov.au/.../working-from-home-expenses

To claim working from home expenses you must be working from home to fulfil your employment duties not just carrying out minimal tasks such as occasionally checking emails or taking calls incur additional running expenses as a result of working from home have records that show you incur these expenses

https://www.ato.gov.au/media-centre/ato-announces...

The Australian Taxation Office ATO has refreshed the way that taxpayers claim deductions for costs incurred when working from home The changes better reflect contemporary working from home arrangements

How To Get Ready For Tax Season Wealthfront

)

Income Tax Return Filing Latest Updates On ITR Forms For Current

Last Date To Submit Income Tax Returns 2022 Govt Jobs Employees

2022 Tax Return Organizer Binder Individual AND Small Business Tax PDF

Your Income Tax As A Sole Trader Chan Naylor

Working Holiday Visa Tax Return Accountants In Adelaide

Working Holiday Visa Tax Return Accountants In Adelaide

)

Income Tax Return Filing Invested In Foreign Assets And Stocks Follow

Income Tax Form 2022

Tax Return 2022 5 Ways Your Tax Return Can Generate Passive Income

Tax Return Working From Home 2022 - Were you among the employees forced to work from home in 2021 TurboTax expert breaks down what is and isn t deductible for remote workers who are filing taxes in 2022