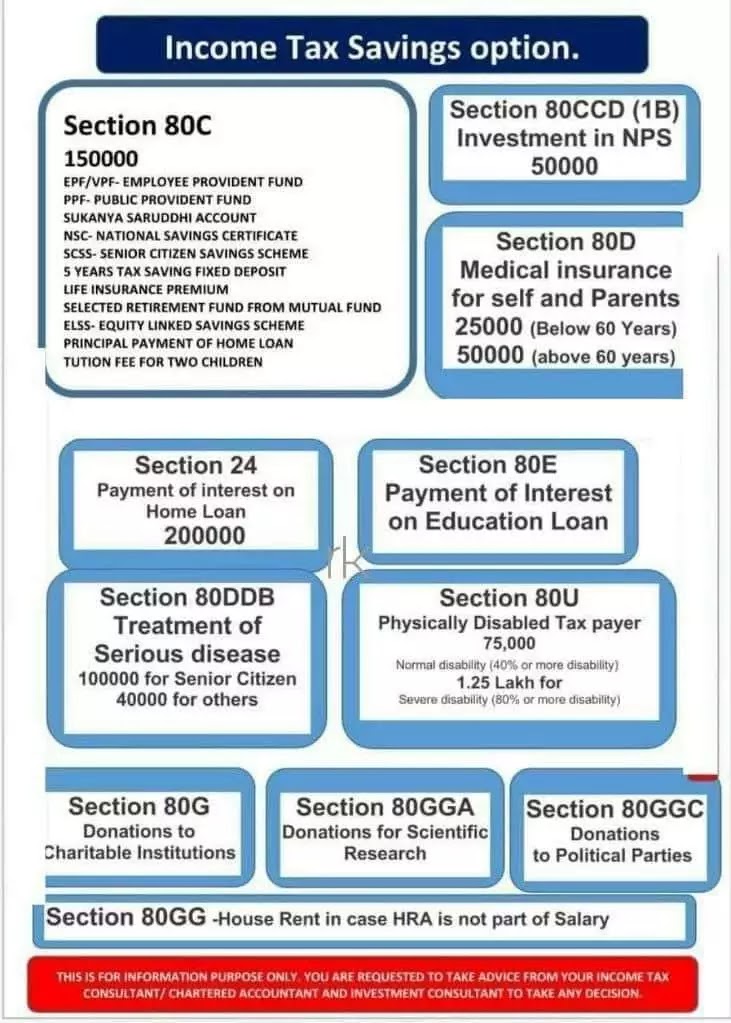

Tax Saving Options For Salaried Other Than 80c Other Tax Saving options beyond Section 80C Apart from the 80C deductions there are various deductions under Section 80 you

1 Additional tax saving for NPS investments under Section 80CCD 1B 2 Tax Saving on Health Insurance under Section 80D 3 Tax Savings on Disabled Here are some of the best tax saving options as per different sections other than section 80C Under Section 80D The following table elaborates on the

Tax Saving Options For Salaried Other Than 80c

Tax Saving Options For Salaried Other Than 80c

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2018/11/27/61587-taxes-pixabay.jpg?itok=hQvz8hno&c=24e3c3ca46a41e8219e76bb1527b7b4d

Income Tax Savings Options IT Savings Options For Salaried Employees

https://blogger.googleusercontent.com/img/a/AVvXsEgLDCnTZQuLnWBa8kiTwkdPhtVgzZiHH6BxGRp2eAYcysQ8S_DEuU7UQePjlrHlAZS4ajTVqfOZ3GbxKKR-63sbcNJATyghfwcQyN_7zwg2cdneuk46ffaLrRqHZe5vj5ZJJY-r8PDsrxyB6vOJoq-yCfY1agw1LwqrF1mAlhf71MR8MYMRP3uGWEVXRg=s16000

Salaried Employees How To Optimize Your Taxes ResolveIndia

https://www.resolveindia.com/blog/wp-content/uploads/2019/04/optimize-your-taxes-1024x514.png

Income tax saving instruments other than 80C can be listed under the following acts 1 Interest Income Generated from Savings Account Deposits Section 80TTA Limit Last minute tax saving options other than Section 80C investments Income Tax News The Financial Express Keep your financial borrowings records

1 House Rent Allowance HRA For those who live in a rented house apartment can claim HRA to lower tax outgo HRA is partially or completely exempt from taxes 2 Leave Travel Allowance LTA For Moreover an individual can also claim a tax deduction of Rs 5 000 for any payments made towards preventive health check ups But this amount Rs 5 000 shall

Download Tax Saving Options For Salaried Other Than 80c

More picture related to Tax Saving Options For Salaried Other Than 80c

Financial Planning For Salaried Employee And Strategies For Tax Savings

https://imgv2-1-f.scribdassets.com/img/document/446416877/original/69b04da5f0/1658504109?v=1

Top 5 Tax Saving Tips For Salaried Employees Vo marz

https://vo-marz.com/wp-content/uploads/2019/05/Tax-Saving-Tips.jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Here are 9 tax saving investment options for FY 2022 23 Getty Images An individual taxpayer planning to opt for the old tax regime for current FY 2022 23 must Here is a short list of tax saving options beyond Section 80C that you can consider to decrease your tax liability for the financial year Applicable Section Income Tax

Tax saving in Section 80 C a quick review An in depth understanding of section 80 C can help you to maximize your take home salary The maximum amount ELSS stands out from other tax saving options for salaried individuals because of its dual benefit comparatively higher returns which are partially taxable After Mar 31 2018

Best Tax Saving Mutual Funds Best ELSS Mutual Funds In 2022

https://i0.wp.com/www.niveshmarket.com/wp-content/uploads/2020/07/tax-saving-investment-options-section-80c.jpg

Tax Saving Options For Those In The 30 Tax Bracket Wealthzi

https://www.wealthzi.com/wp-content/uploads/2020/09/3-1.jpg

https://cleartax.in/s/income-tax-savings

Other Tax Saving options beyond Section 80C Apart from the 80C deductions there are various deductions under Section 80 you

https://www.etmoney.com/learn/income-tax/5-lesser...

1 Additional tax saving for NPS investments under Section 80CCD 1B 2 Tax Saving on Health Insurance under Section 80D 3 Tax Savings on Disabled

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Best Tax Saving Mutual Funds Best ELSS Mutual Funds In 2022

Tax Saving Options Other Than 80C Online Demat Trading And Mutual

All The Salaried Employees Out There Save More With These Simple Tax

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

Saving Tax Beyond 80C For Salaried Mployees In India

Saving Tax Beyond 80C For Salaried Mployees In India

Tax Saving Options For Salaried

Exemption In Lieu Of 80C Tax Benefits

FY 2022 23 Income Tax Calculation On Salaried Employee CTC

Tax Saving Options For Salaried Other Than 80c - Moreover an individual can also claim a tax deduction of Rs 5 000 for any payments made towards preventive health check ups But this amount Rs 5 000 shall