Tax Treatment Of Discount Bonds Capital appreciation from bond funds and discounted bonds may be subject to state or local taxes Capital gains are not exempt from federal income tax Fixed income securities are subject to increased

The tax treatment will vary depending on whether you bought the bond at par that is at its face value at a premium for more than the face value or a discount for less than face value With all Investor buys a bond at a discount when the dollar price paid is below the stated face value of 100 00 per bond1 also known as par Tax exempt bonds can trade at a

Tax Treatment Of Discount Bonds

Tax Treatment Of Discount Bonds

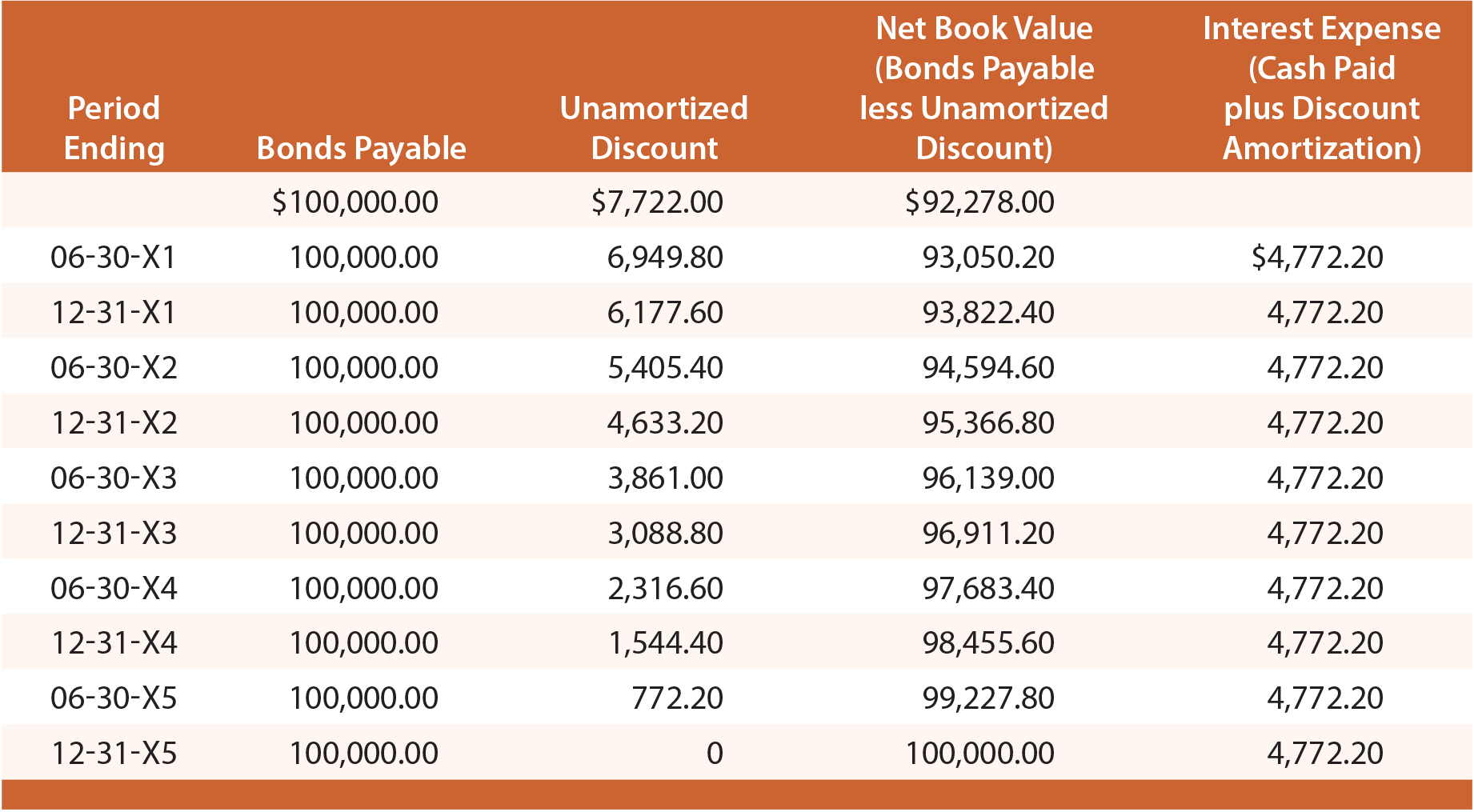

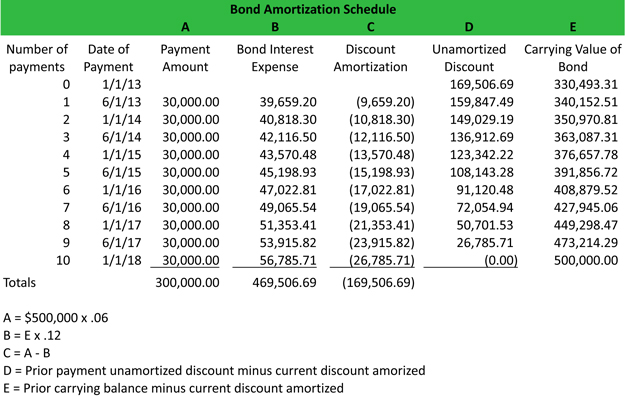

https://www.principlesofaccounting.com/wp-content/gallery/chapter-13/discountex.png

Discount Bond Definition Examples Top 2 Types Of Discount Bonds

https://www.wallstreetmojo.com/wp-content/uploads/2019/11/Discount-Bonds.png?x75132

How To Calculate Discount On Bonds Payable Haiper

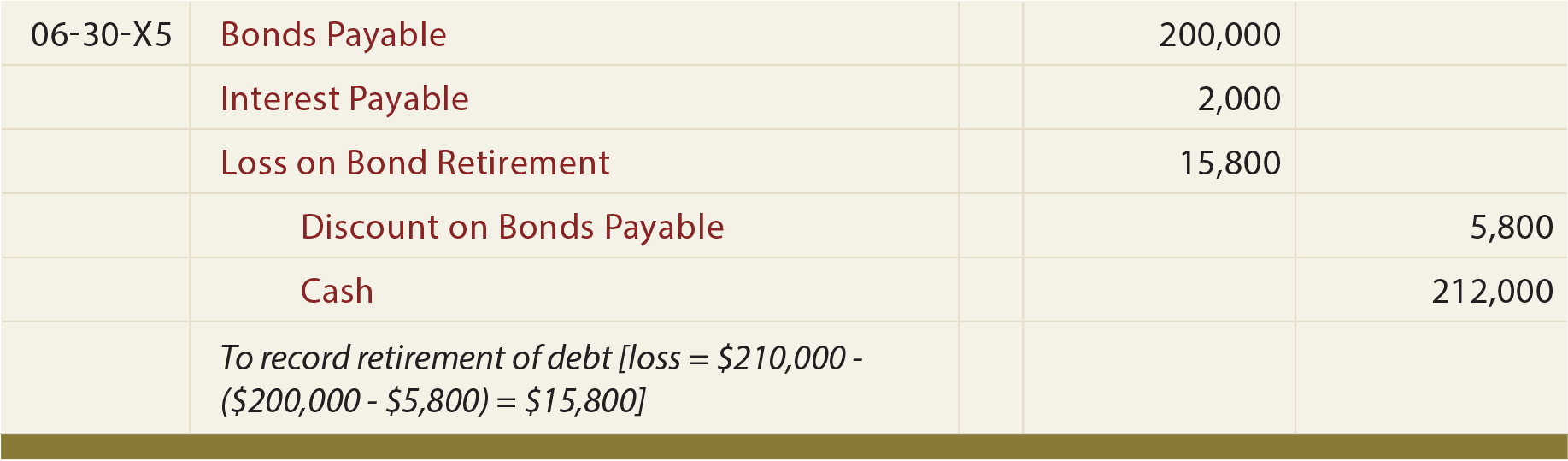

https://www.principlesofaccounting.com/wp-content/gallery/chapter-13/retirementje2.png

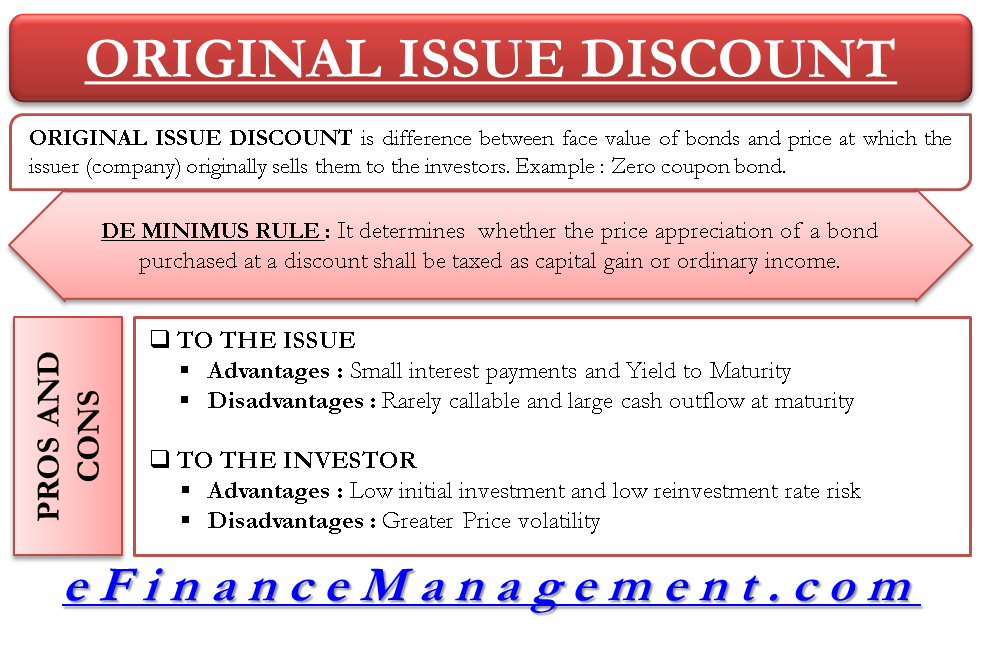

Tax rules for bond investors vary for government municipal or corporate bonds Munies are completely tax free if you live in the state or municipality of the issuer Original issue discount OID on tax exempt state or local government bonds is treated as tax exempt interest For information on the treatment of OID when you dispose of a tax

However the key risk with OID bonds is the tax treatment Investors must pay tax on the imputed interest each year even though they receive the actual cash once the bond matures This requires careful tax If a taxpayer is considering purchasing a debt instrument that is subject to the market discount bond rules the potential tax implications need to be included when

Download Tax Treatment Of Discount Bonds

More picture related to Tax Treatment Of Discount Bonds

HowtoInvestOnline How To Calculate Interest And Capital Gains For Tax

https://4.bp.blogspot.com/-Do0_NLvVuIE/TX3sYuQKWrI/AAAAAAAABGk/098aFMgtUTc/s1600/Bond-discount-tax.png

Original Issue Discount Bonds Meaning Accounting Benefits And Drawba

https://efinancemanagement.com/wp-content/uploads/2019/03/Original-Issue-Discount.png

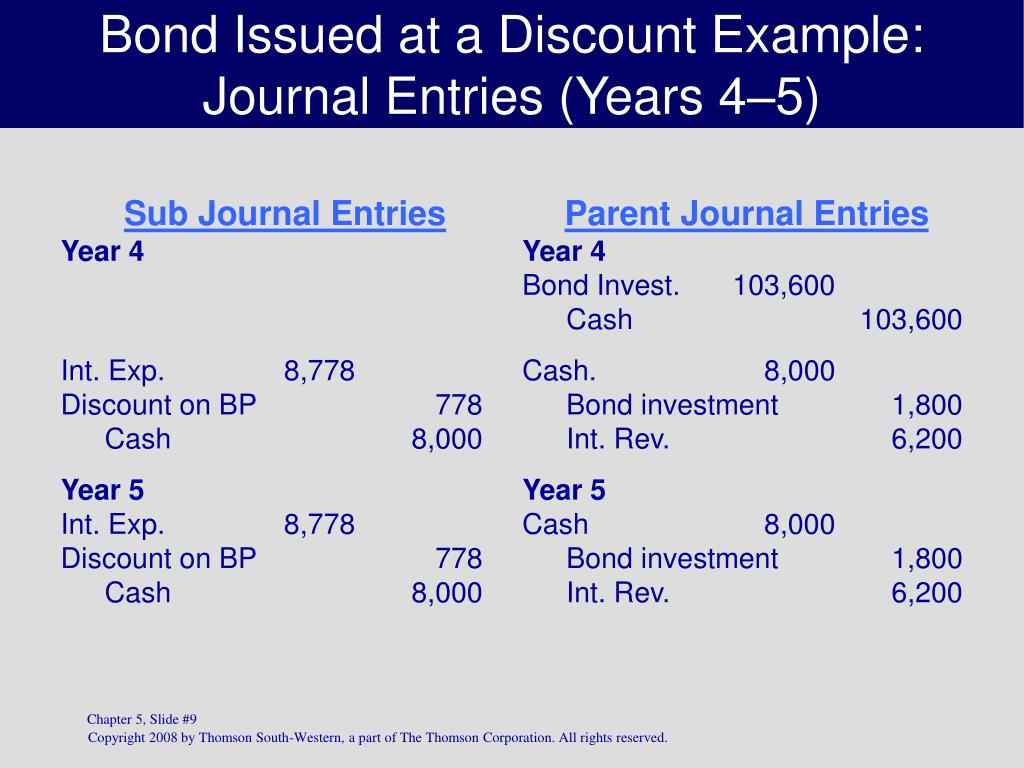

PPT CHAPTER PowerPoint Presentation ID 259047

http://image.slideserve.com/259047/bond-issued-at-a-discount-example-journal-entries-years-4-5-l.jpg

The following article provides an overview of bonds that pay regular interest Determining the Adjusted Cost Base ACB defining what premiums and discounts are and Market discount bonds generally do not include any bonds acquired at their original issue Also they do not include 1 short term obligations that mature within

Tax Treatment of Amortization on Market Discount Bonds The purchase of equity and debt securities can play a significant role in a company s overall investment strategy but may have tax Tax treatments for discounted bonds are complex and depend on their terms and whether they were original issue discounts OID or market discounts

How Much Tax Do You Pay On Bond Investment Mint

https://images.livemint.com/img/2021/03/16/original/G2GB1HE1_1615919333139.png

Premium Vs Discount Bonds What s The Difference Investment U

https://investmentu.com/wp-content/uploads/2021/06/premium-vs-discount-bonds.jpg

https://www.schwab.com/learn/story/whe…

Capital appreciation from bond funds and discounted bonds may be subject to state or local taxes Capital gains are not exempt from federal income tax Fixed income securities are subject to increased

https://www.schwab.com/.../your-guide-to …

The tax treatment will vary depending on whether you bought the bond at par that is at its face value at a premium for more than the face value or a discount for less than face value With all

You May Want To Read This The Discount On Bonds Payable Account Is

How Much Tax Do You Pay On Bond Investment Mint

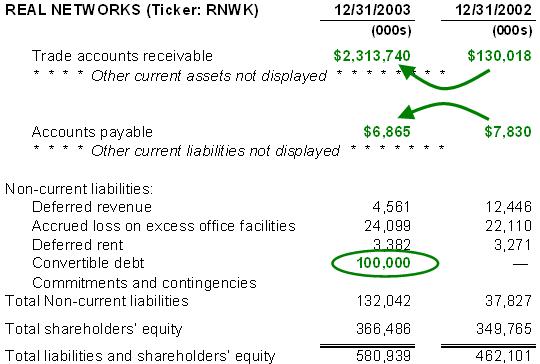

Accounting For Bonds Payable Principlesofaccounting

Carrying Value Of A Bond Definition Meaning Example

Tax Treatment Of Foreign Exchange Gains Or Losses Tax Mind

Tax Treatment Taxability Of Various Financial Investments

Tax Treatment Taxability Of Various Financial Investments

Tax Treatment Of Non Profit Entities In Nigeria Grey Matter Banwo

The Tax Benefits Of Municipal Bonds YouTube

Bond With 10 Percent Return Choosing Your Gold IRA

Tax Treatment Of Discount Bonds - Tax rules for bond investors vary for government municipal or corporate bonds Munies are completely tax free if you live in the state or municipality of the issuer