Tax Treatment Of Electric Vehicle Charging Points Installation Costs CA20000 CA23156 Plant and Machinery Allowance PMA First Year Allowance FYA Expenditure on plant or machinery for an electric vehicle charging point CAA01 S45EA

9 rowsBefore 6 April 2018 Taxable benefit based on cost to the employer From 6 April This measure will extend the availability of the 100 first year allowance FYA for qualifying expenditure on plant and machinery equipment for electric vehicle

Tax Treatment Of Electric Vehicle Charging Points Installation Costs

Tax Treatment Of Electric Vehicle Charging Points Installation Costs

http://static1.squarespace.com/static/5fb6793008c78b1a0da3dde3/602562662b837c452a352f23/6123a261028f7a1943b2ce97/1649248664578/fundementals+giz+2.png?format=1500w

Optimal Planning Of Charging Station For Phased Electric Vehicle

https://www.scirp.org/html/paperimages/39780_1.jpg

Electric Vehicle Charging Points The Law On Installation

https://www.acenet.co.uk/media/4004/2a85f3e1-255d-4756-9caa-c2d6f37d59c7.jpg?anchor=center&mode=crop&quality=90&width=1200&rnd=132107868889870000

The guidance says that there is a tax and NIC liability where an employer reimburses their employee for the cost of charging a company owned wholly electric Consequently no tax charge arises if the employer meets the cost of electricity for the private use of an electric van Charging Points The company will be able to claim the

It states that the standard rate of VAT applies to supplies of electric vehicle charging through charging points in public places and explains when input tax can be recovered for charging electric There are also tax advantages if you provide your employee with charging facilities at your workplace and even for the installation of a vehicle charging point at the employee s

Download Tax Treatment Of Electric Vehicle Charging Points Installation Costs

More picture related to Tax Treatment Of Electric Vehicle Charging Points Installation Costs

Common Classifications Of Electric Vehicle Charging Piles

https://img01.71360.com/file/read/www/M00/78/7F/wKj0iWEKKEqAD4C-AACxYp0_rmw66.webp

Unlocking EV Charging Value Power Up Your Infrastructure

https://finmodelslab.com/cdn/shop/files/1x3fTmJuPsYeKrznFTm_ufwzNBjTJ3YaL.png?v=1690739053

Funding 4 Education Electric Vehicle Charging Points For Education

https://funding4education.co.uk/wp-content/uploads/2023/05/Blog-Header-1.png

Tax treatment of electric vehicle charging points installation costs Your business can potentially claim 100 of the installation costs of an electric vehicle charging point Capital allowances A first year capital allowance of 100 of the expenditure is available for expenditure on electric charge point equipment The allowance is

Electricity costs charging point at workplace Where the company permits an electric car to be recharged at the workplace the position is as follows If you use a company car 07 03 2024 As use of electric vehicles rapidly expands owners developers and occupiers are installing more Electrical Vehicle Charging Points EVCPs at their properties

PDF Optimal Planning Of Electric Vehicle Charging Stations

https://i1.rgstatic.net/publication/361906952_Optimal_Planning_of_Electric_Vehicle_Charging_Stations_Considering_User_Satisfaction_and_Charging_Convenience/links/62e324a57782323cf18241c3/largepreview.png

Electric Car Charging Point Installation In Worthing West Sussex J

https://www.jelectrical-services.co.uk/wp-content/uploads/2020/11/podpoint-wall-1200x1338.jpg

https://www.gov.uk/hmrc-internal-manuals/capital...

CA20000 CA23156 Plant and Machinery Allowance PMA First Year Allowance FYA Expenditure on plant or machinery for an electric vehicle charging point CAA01 S45EA

https://www.gov.uk/hmrc-internal-manuals/...

9 rowsBefore 6 April 2018 Taxable benefit based on cost to the employer From 6 April

All You Need To Know About EV Charging Levels

PDF Optimal Planning Of Electric Vehicle Charging Stations

Webinar Creating Value From EV Charging And Solar Carports OYA

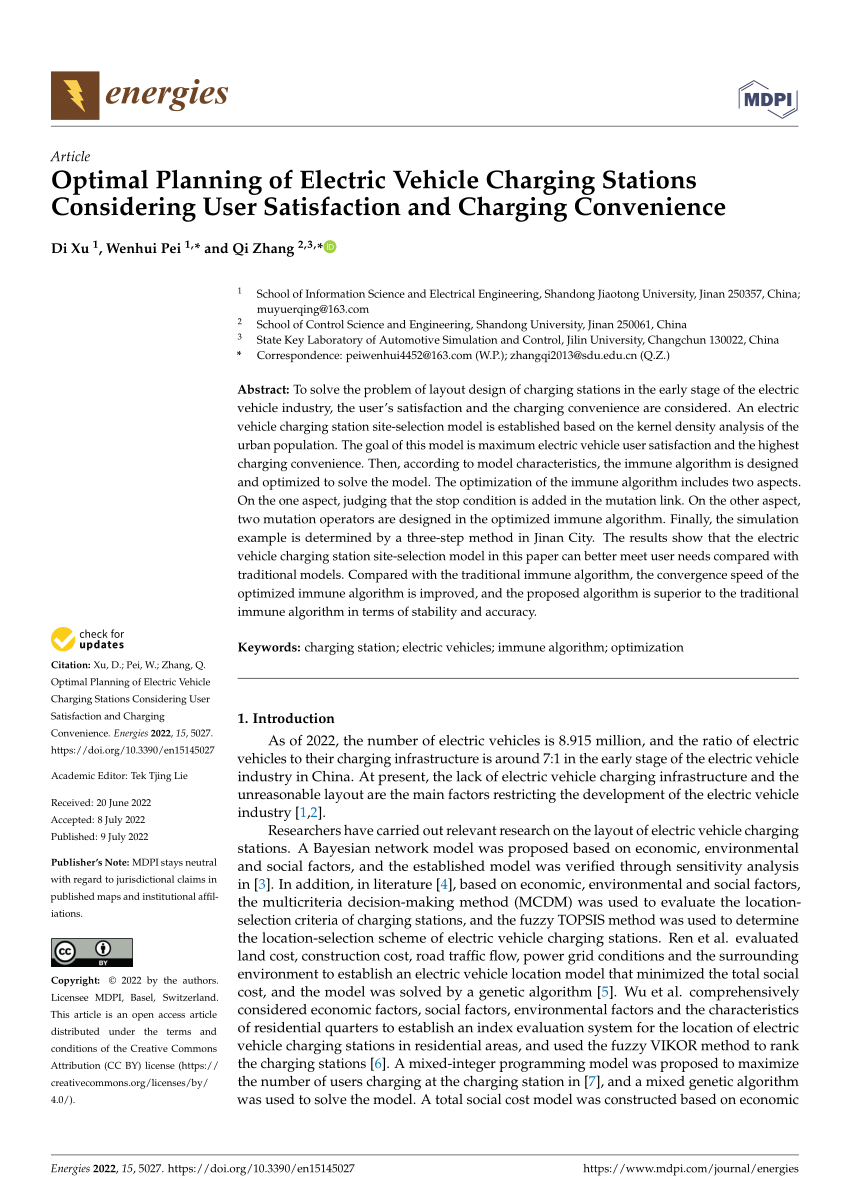

Processes Free Full Text Analysis And Design Of A Standalone

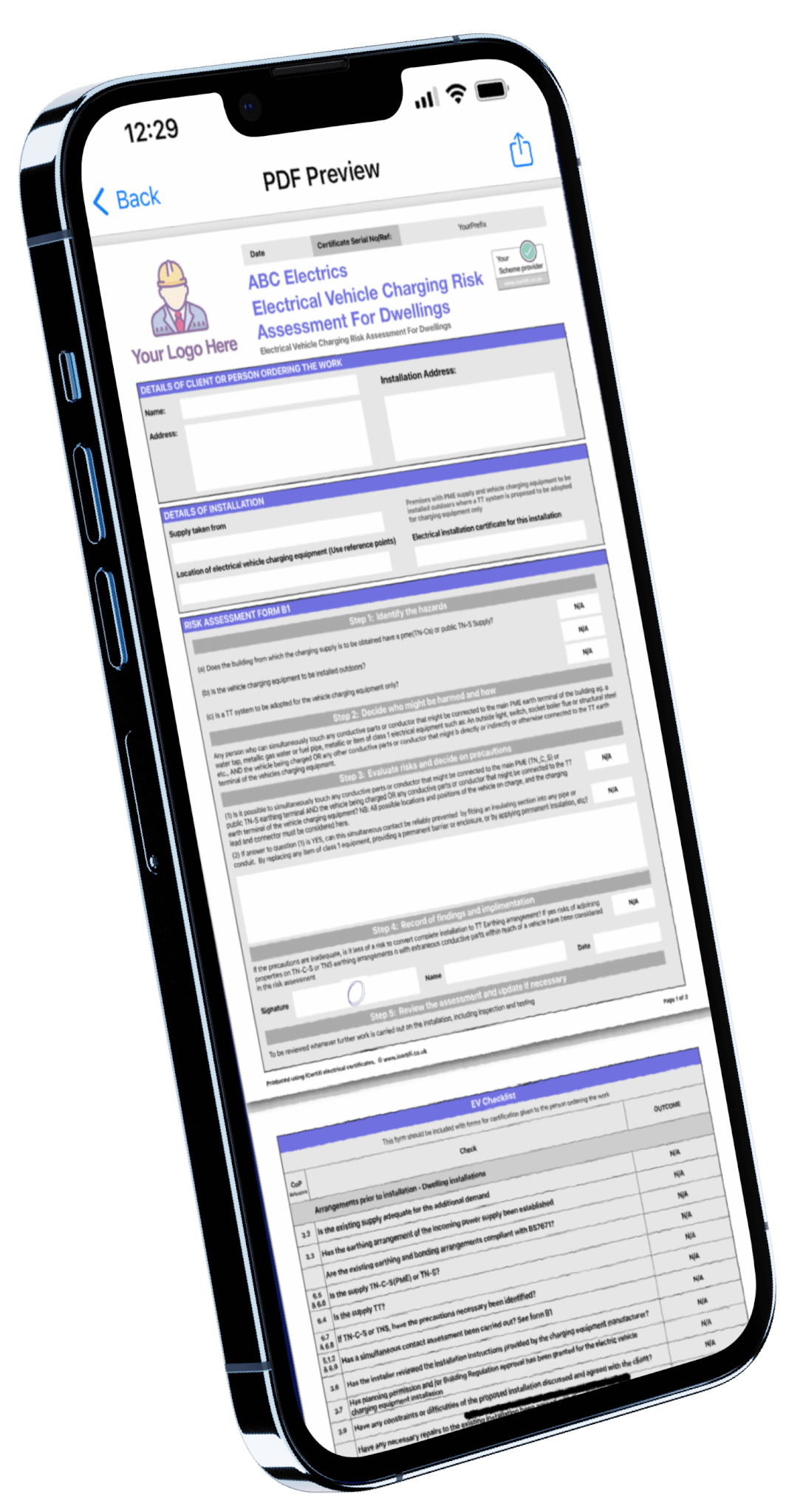

Electric Vehicle Charging Risk Assessment ICertifi

Optimal Siting And Sizing Of Electric Vehicle Charging Stations PDF

Optimal Siting And Sizing Of Electric Vehicle Charging Stations PDF

Electric Vehicle Charging Types Infrastructure And Accessibility

Car Charging Solutions EV Specialists Vehicle Charging Installs

Gbt CCS Chademo EV Fleets DC Fast Charging Station EV Charging Station

Tax Treatment Of Electric Vehicle Charging Points Installation Costs - Supplies of electric vehicle charging through charging points in public places are charged at the standard rate of VAT There is no exemption or relief that reduces the rate