Tax Withholding Calculator Massachusetts Use ADP s Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

Massachusetts has a flat income tax rate of 5 but charges a 4 surtax on income over 1 million The state also has a flat statewide sales tax rate of 6 25 The state s income tax rate is only one of a handful of states that levy a flat rate Enter your financial details to calculate your taxes Household Income If you re an employer you need to withhold Massachusetts income tax from your employees wages This guide explains your responsibilities as an employer including collecting your employee s tax reporting information calculating withholding and filing and paying withholding taxes

Tax Withholding Calculator Massachusetts

Tax Withholding Calculator Massachusetts

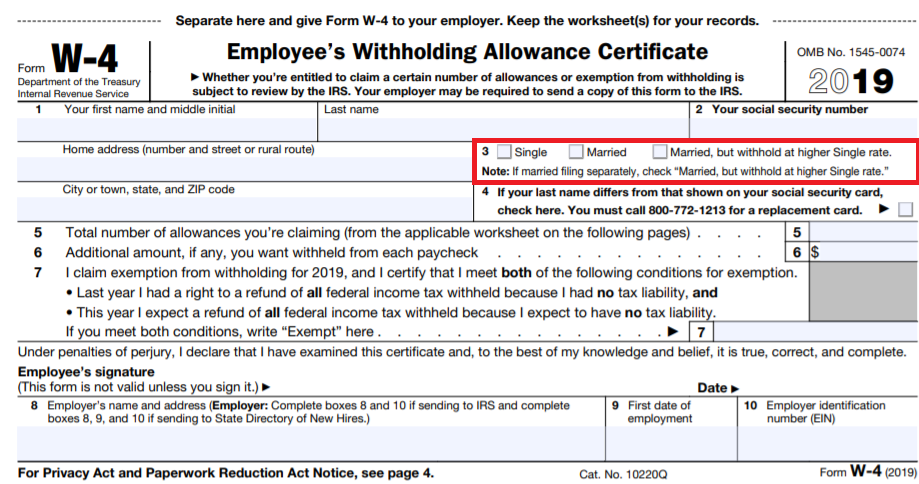

https://www.withholdingform.com/wp-content/uploads/2022/08/w-4-employee-s-withholding-certificate-and-federal-income-tax-21.png

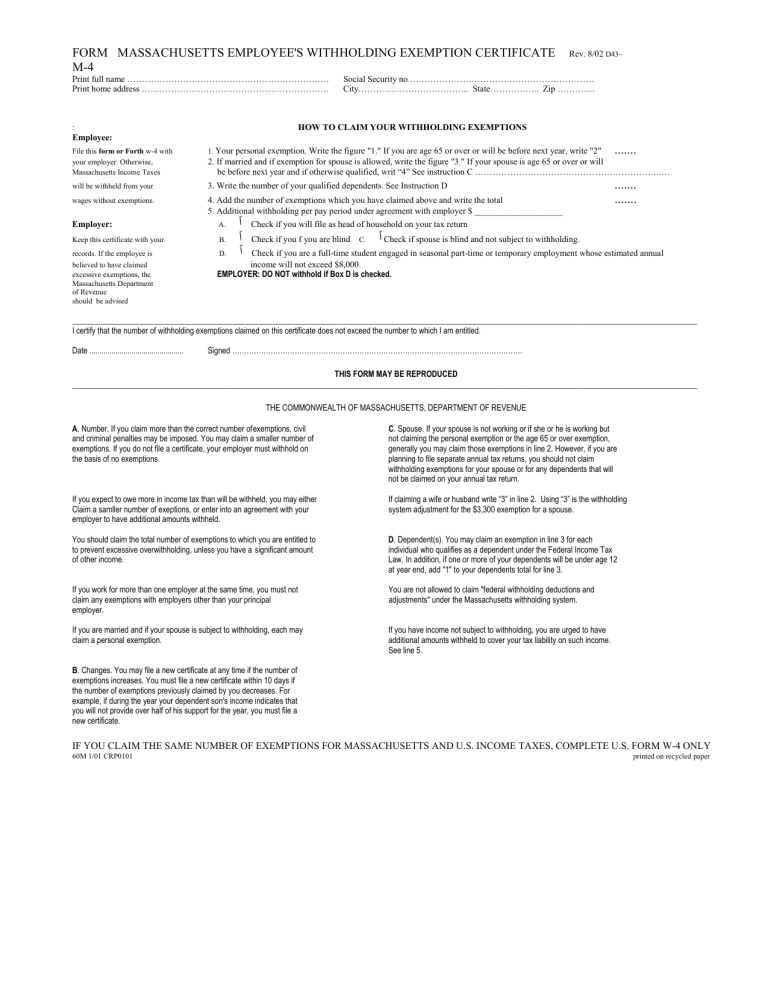

FORM MASSACHUSETTS EMPLOYEE S WITHHOLDING

https://s3.studylib.net/store/data/008675957_1-6ce579dc4a9adebc55523596110501e3-768x994.png

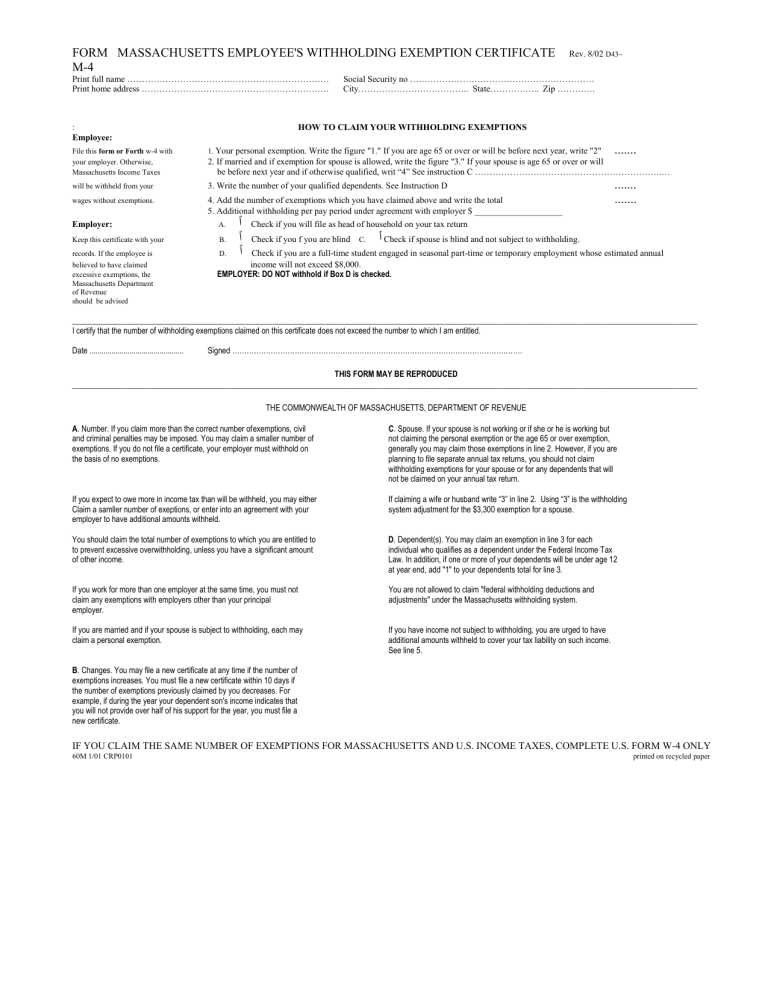

Calculate Federal Withholding Per Paycheck GraceMorven

https://lh6.googleusercontent.com/dALpbUePNJvWgGL2BDXTi8SfotJpSC4NF-OW9BvQPb02CXn-2JBkR6xTDM-2wkBPDzAtChWeIw1mlv4aDQgkBHxJS9UWF76t2mS-5DYaQ3tQiyg1bEWXXmq6wd5A9cdvCTh7CSWd

Use our income tax calculator to find out what your take home pay will be in Massachusetts for the tax year Enter your details to estimate your salary after tax Work out your total federal income tax Calculate your total Massachusetts state income tax Gross income minus taxes deductions and withholdings Divide your net pay by your pay frequency

Massachusetts Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator If you re Calculate your Massachusetts net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator

Download Tax Withholding Calculator Massachusetts

More picture related to Tax Withholding Calculator Massachusetts

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/06/sars-monthly-tax-tables-2021-mansa-digital-1.jpg

Massachusetts DOR Income Tax Calculator Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/11/Massachusetts-dor-tax-calculator.png

2024 Federal Tax Brackets Kyla Tillie

https://federalwithholdingtables.net/wp-content/uploads/2021/06/2020-income-tax-brackets-pasivinco.png

Use this Massachusetts State Tax Calculator to determine your federal tax amounts state tax amounts along with your Medicare and Social Security tax allowances Use Gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in Massachusetts We ll do the math for you all you need to do is enter the applicable information on salary federal and state W 4s deductions and benefits

Use Gusto s hourly paycheck calculator to determine withholdings and calculate take home pay for your hourly employees in Massachusetts Simply enter their federal and state W 4 information as well as their pay rate deductions and benefits and we ll crunch the numbers for you The Massachusetts Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in Massachusetts the calculator allows you to calculate income tax and payroll taxes and deductions in Massachusetts

2022 Ga Tax Withholding Form WithholdingForm

https://i0.wp.com/www.withholdingform.com/wp-content/uploads/2022/08/tax-calculator-atotaxrates-info.jpg

Massachusetts Income Tax Calculator 2023 2024

https://www.taxuni.com/wp-content/uploads/2022/10/Massachusetts-Income-Tax-Calculator-TaxUni-Cover-1-1536x864.jpg

https://www.adp.com/resources/tools/calculators/...

Use ADP s Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

https://smartasset.com/taxes/massachusetts-tax-calculator

Massachusetts has a flat income tax rate of 5 but charges a 4 surtax on income over 1 million The state also has a flat statewide sales tax rate of 6 25 The state s income tax rate is only one of a handful of states that levy a flat rate Enter your financial details to calculate your taxes Household Income

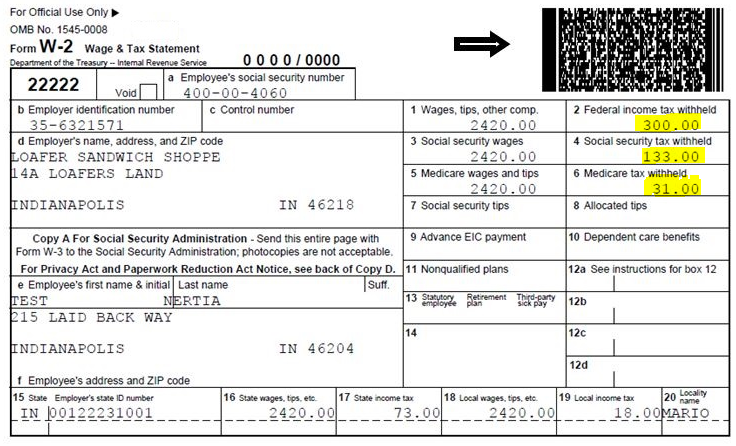

Form Used To Calculate Employee s Income Tax 2024 Employeeform

2022 Ga Tax Withholding Form WithholdingForm

Tax Withholding Calculator Debuts On IRS Website SavingAdvice Blog

Fast US Federal Tax Calculator 2022 2023 Internal Revenue Code

What Is Form M 4 2022 Massachusetts Employee S Withho Vrogue co

Massachusetts W4 Form 2018

Massachusetts W4 Form 2018

Massachusetts Income Tax Withholding Tables 2018 Brokeasshome

2022 Irs Tax Brackets Head Of Household Latest News Update

Arkansas Withholding Tax Formula 2023 Printable Forms Free Online

Tax Withholding Calculator Massachusetts - Investomatica s Massachusetts paycheck calculator shows your take home pay after federal state and local income tax Just enter your salary or hourly income