Tax Write Off Home Office Furniture Your home office may appear to be full of tax deductions at first glance equipment furniture and shelving all of which cost you a

As a result of the Tax Cuts And Jobs Act TCJA for the tax years 2018 through 2025 you cannot deduct home office expenses if you are an employee That s an important What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off

Tax Write Off Home Office Furniture

Tax Write Off Home Office Furniture

https://felix-homes-assets.s3.us-east-2.amazonaws.com/medium_How_To_Write_Off_Home_Office_Expenses_On_Your_Taxes_4ebd527148.jpg

What To Know About Tax Writeoffs Workshop Magazine

https://www.workshopmag.com/content/images/2021/11/Tax-Writeoff2.png

Home Office Deduction Explained How To Write Off Home Office Expenses

https://i.ytimg.com/vi/wDwGMLZ1enI/maxresdefault.jpg

If you do claim depreciation for your home office you may have a taxable gain when you sell your home Any gain or loss on the sale of the home may be both personal and Self employed people can generally deduct office expenses on Schedule C Form 1040 whether or not they work from home This write off covers office supplies

Furniture Desks chairs bookshelves filing cabinets and other furniture used in your home office may also be deductible Repairs or Maintenance Any Here s what you need to know about home office tax deductions and how to check your eligibility What is the home office tax deduction A home office tax

Download Tax Write Off Home Office Furniture

More picture related to Tax Write Off Home Office Furniture

CPA Answers Can You Write Off Home Office Expenses YouTube

https://i.ytimg.com/vi/a59aubizpvM/maxresdefault.jpg

Home Office Tax Strategies Write Off Home Office BIG Home Office Tax

https://i.ytimg.com/vi/0EqwAnP_CY4/maxresdefault.jpg

Home Business Tax Deduction For Two Businesses H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2019/05/Can-I-get-a-home-business-tax-deduction-if-i-have-two-businesses.jpg

If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission employees who sell While it might feel exciting to think you can deduct home office furniture expenses on your taxes you may or may not be able to In past years if you were an employee working for another company and

Looking to maximize your business deductions this tax season If you work full time or even occasionally from a dedicated home office you can take advantage of a few lesser known IRS tax write If your home office qualifies you can deduct your home office expenses from your business revenue People who work from home full time as well as those who have a

How To Write off Home Office Expense With An S corp Mark J Kohler

https://i.ytimg.com/vi/BnEOcbn_wZk/maxresdefault.jpg

Can A Pastor Write Off Home Office Expenses YouTube

https://i.ytimg.com/vi/JUx1A4w6-lo/maxresdefault.jpg

https://www.thebalancemoney.com/deductible...

Your home office may appear to be full of tax deductions at first glance equipment furniture and shelving all of which cost you a

https://www.forbes.com/sites/kellyphillipserb/2020/...

As a result of the Tax Cuts And Jobs Act TCJA for the tax years 2018 through 2025 you cannot deduct home office expenses if you are an employee That s an important

STEALTH TAX STRATEGY 1 HOW TO WRITE OFF HOME OFFICE EXPENSES WITHOUT

How To Write off Home Office Expense With An S corp Mark J Kohler

Home Salon Tax Deductions List

Landscaping And Home Improvements Tax Write Off

Home Office Tax Deduction How To Write Off Home Expenses YouTube

Can You Write Off Home Office Expenses On Your Taxes Firstcoastnews

Can You Write Off Home Office Expenses On Your Taxes Firstcoastnews

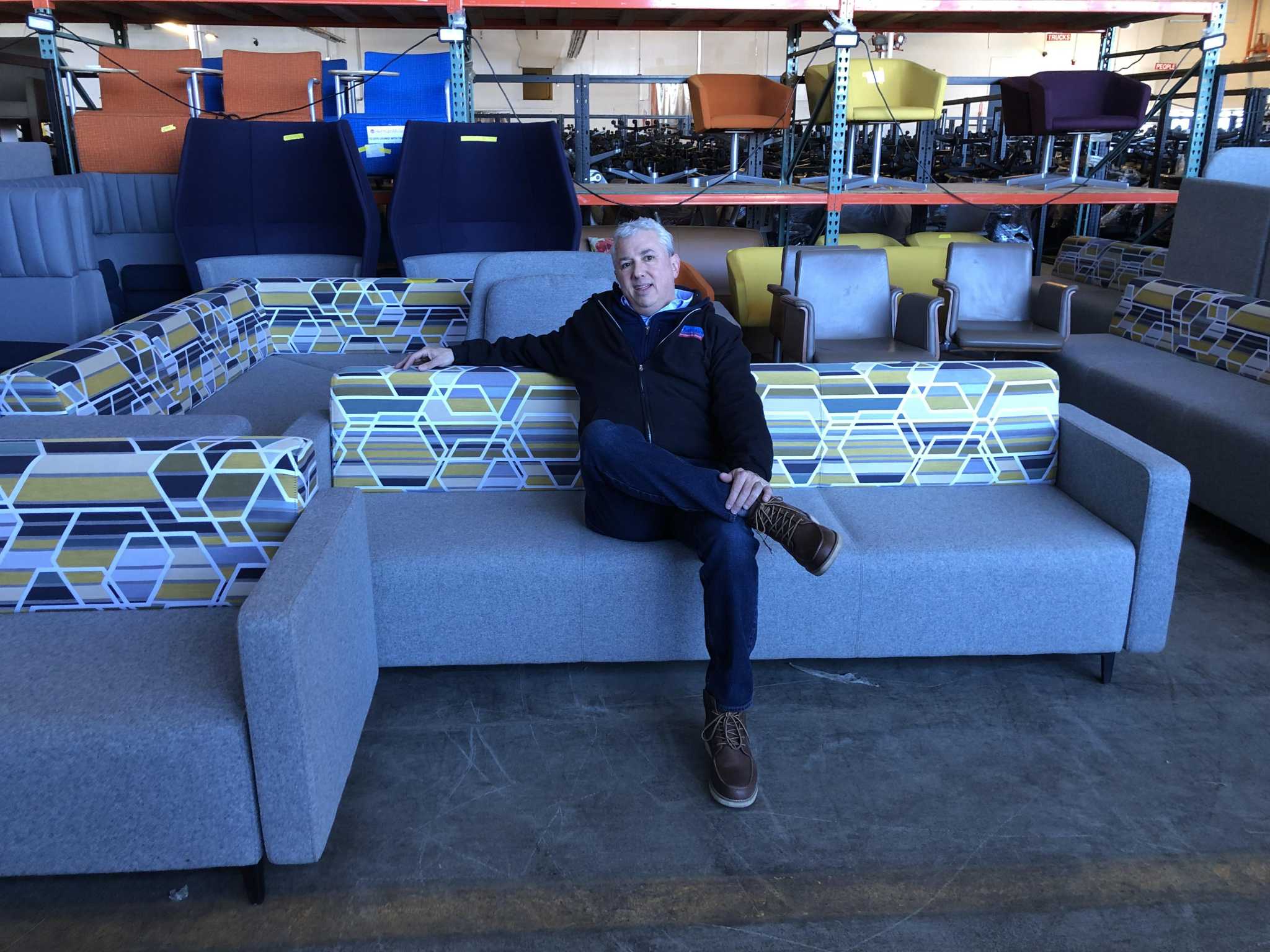

Office Furniture Resale Company Opens Danbury Store Capitalizes On

Simpli Home Harper Solid Hardwood Mid Century Modern 60 In Wide Desk

Simpli Home Erina Solid ACACIA Wood Industrial 60 In Wide Writing

Tax Write Off Home Office Furniture - Note Home Office Furniture costing over 500 is generally reported as a fixed asset for depreciation in the home office section of TurboTax However the IRS