Tax Write Off Philippines Taxes Corporate taxpayers can claim a deduction for all taxes paid or accrued within the taxable year in connection with their trade or business except for the following

Under Revenue Regulations RR No 25 2002 for taxpayers to validly claim bad debts or receivables written off 1 there must be an existing valid and legally demandable Writing off an accounts receivable is a crucial decision for companies not only in terms of the financial aspect but also on its impact on tax compliance Companies need to comply with the

Tax Write Off Philippines

Tax Write Off Philippines

https://assets.cdn.filesafe.space/CcRpTmeNbNvnfQufa8ey/media/644888913b5f5e41624c86f6.png

Make The Most Of Tax Write offs Money

https://img.money.com/2012/01/508707411.jpg?quality=85

National Tax Preparation Company Dearborn MI

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100069332370607

Some of the usual differences are as follows Bad debts written off Claims that remain outstanding after quite some time are usually written off by companies and charged as expense on the year when the management has concluded As the title of this article suggests we will talk about how to treat your business related expenses identify if they are deductible for income tax purposes and prevent making

Learn how to lower your income tax with the advice of tax and accounting services in Pasig Metro Manila regarding acceptable tax deductible expenses In computing for the income tax in the Philippines certain deductible expenses are subtracted from gross income They are technically termed as allowable deductions from gross income

Download Tax Write Off Philippines

More picture related to Tax Write Off Philippines

.png)

How Do Tax Write offs actually Work when You re Self employed

https://assets.website-files.com/60ea39bf3d69eb332f567a61/62d0069f2b16b66933892bd0_creatorbread covers (43).png

Tax Write Offs For Your Vehicle Infographic Real Estate Education

https://i.pinimg.com/originals/53/34/7c/53347cf685d90ab73bb841fef2e5763d.jpg

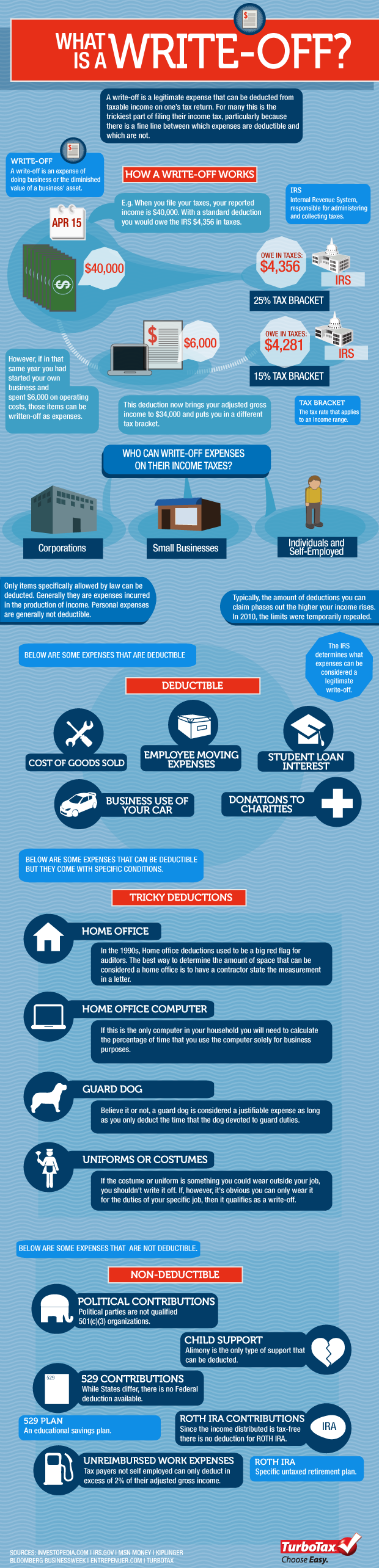

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

http://blog.turbotax.intuit.com/wp-content/uploads/2010/12/writeoff.png

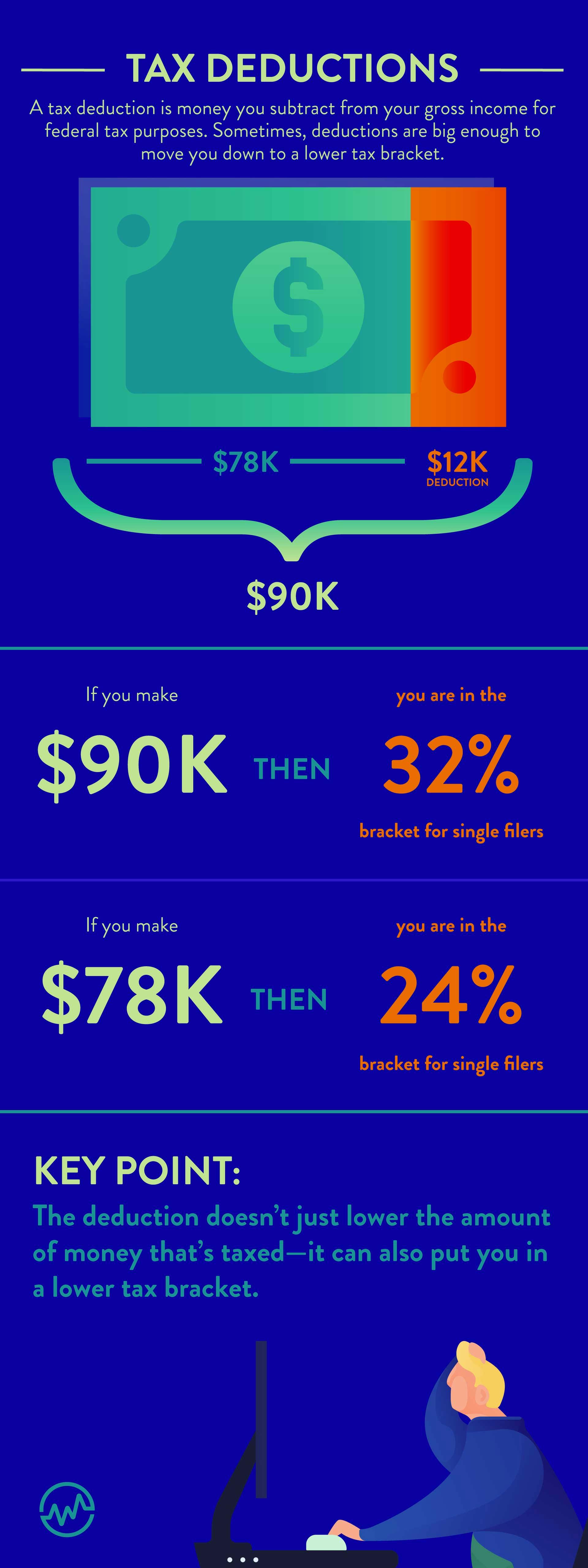

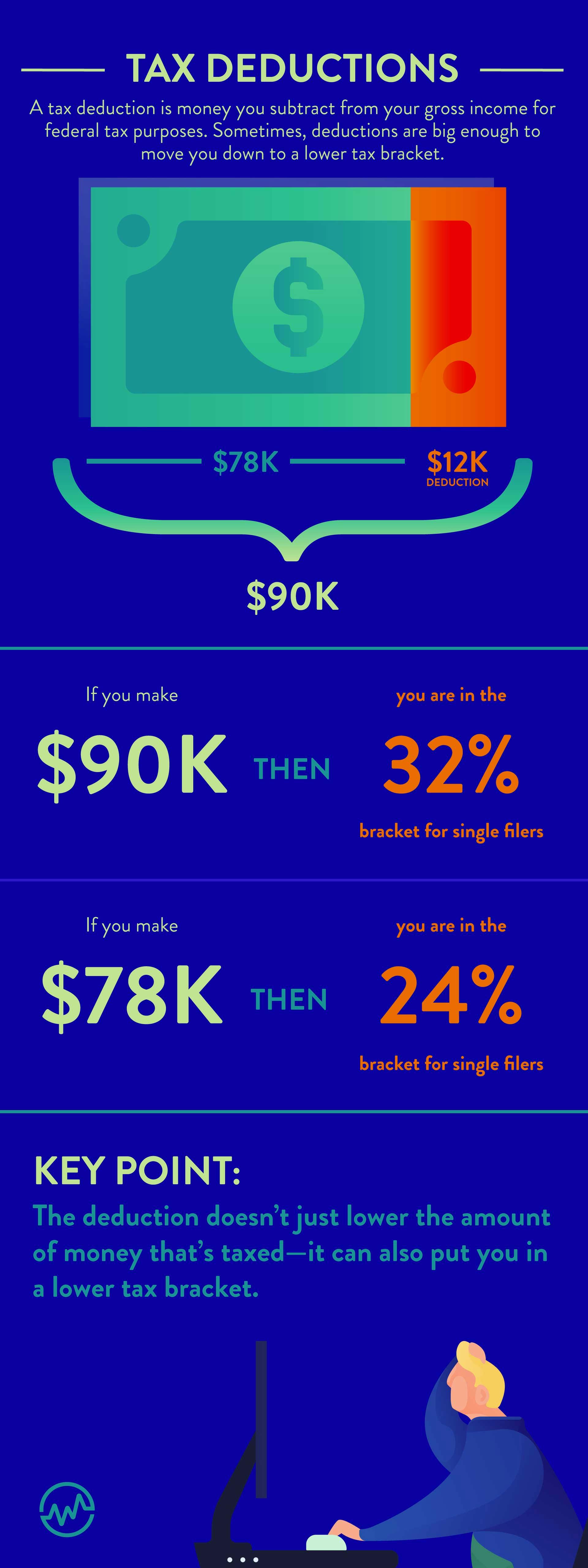

A tax deduction is a business expense that can lower the amount of tax you have to pay It s deducted from your gross income to arrive at your taxable income It is sometimes called a tax Foreign expenses incurred by a Philippine business can be tax deductible provided they are ordinary necessary and supported by proper documentation It is also vital to comply

What are the deductions and exemptions you can claim against your taxable income in computing income tax and preparing your annual tax return The following reduce Businesses organized as sole proprietorships partnerships C corporations S corporations and limited liability companies LLCs can utilize deductions also known as tax

Pin On All The Latest Science Tech

https://i.pinimg.com/originals/95/01/c4/9501c40ccdc75cffce7388d25690a9f9.jpg

What Is A Tax Write Off

https://www.deskera.com/blog/content/images/size/w2000/2023/01/2-4.png

https://taxsummaries.pwc.com › philippines › corporate › deductions

Taxes Corporate taxpayers can claim a deduction for all taxes paid or accrued within the taxable year in connection with their trade or business except for the following

https://www.grantthornton.com.ph › insights › lets-talk-tax › ...

Under Revenue Regulations RR No 25 2002 for taxpayers to validly claim bad debts or receivables written off 1 there must be an existing valid and legally demandable

TAX

Pin On All The Latest Science Tech

150 000 Instant Asset Write off For Eligible Businesses Sure Solar

Essential Tax Write Offs Deducting Business Expense From Your Taxes

5 Deducciones De Impuestos Para Tu Boda 5 Tax Write offs For Your

How Do Tax Write Offs Work WealthFit

How Do Tax Write Offs Work WealthFit

Freelance Accounting Personal Tax Services

Amazon Tax Deduction Check List Track Your Annual Tax Write Off s

Income Tax Diary Kolkata

Tax Write Off Philippines - In computing for the income tax in the Philippines certain deductible expenses are subtracted from gross income They are technically termed as allowable deductions from gross income