Taxable Rebate In Income Tax Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds because governments can enact them at

Web The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization and Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Taxable Rebate In Income Tax

Taxable Rebate In Income Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Web 11 avr 2023 nbsp 0183 32 The 80C tax rebate is a provision in the Indian Income Tax Act that allows individuals to claim a deduction of up to Rs 1 5 lakh from their taxable income This Web 2 mai 2023 nbsp 0183 32 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified A resident individual with taxable income up to Rs 7 00 000 will receive a

Web A tax credit is much more valuable than a deduction because it reduces tax not taxable income For example if the 300 credit were instead a 300 deduction it would reduce Web 9 sept 2023 nbsp 0183 32 taxes taxable income Will Your State Rebate Check Be Taxed for 2023 Here s what the IRS says about taxing state stimulus checks and other special state

Download Taxable Rebate In Income Tax

More picture related to Taxable Rebate In Income Tax

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Are Investment Expenses Tax Deductible In 2019 Antique Wooden World

https://i.pinimg.com/564x/b6/70/c4/b670c47f275a63df1ef5550404fec2b1.jpg

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less Web 3 f 233 vr 2023 nbsp 0183 32 If your net taxable income does not exceed Rs 5 lakh you are eligible for the tax rebate under Section 87A This tax rebate will be automatically taken into account at

Web 22 f 233 vr 2023 nbsp 0183 32 On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down 2024 tax year 1 March 2023 29 February 2024 22 Web Your rebate income is the total amount of your taxable income excluding any assessable First home super saver released amount plus the following amounts if they apply to you

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

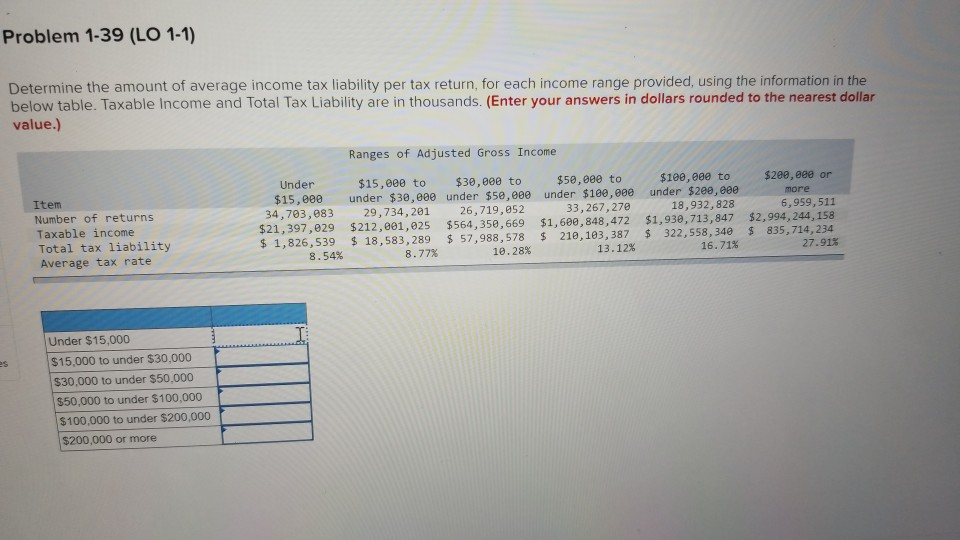

Solved Problem 1 39 LO 1 1 Determine The Amount Of Average Chegg

https://media.cheggcdn.com/media/9ec/9ec51619-cf20-4157-94f9-e208f37c3ee5/image.png

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds because governments can enact them at

https://www.journalofaccountancy.com/issues/2008/oct/tax_treatment_of...

Web The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization and

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Deferred Tax And Temporary Differences The Footnotes Analyst

Travelling Expenses Tax Deductible Malaysia Paul Springer

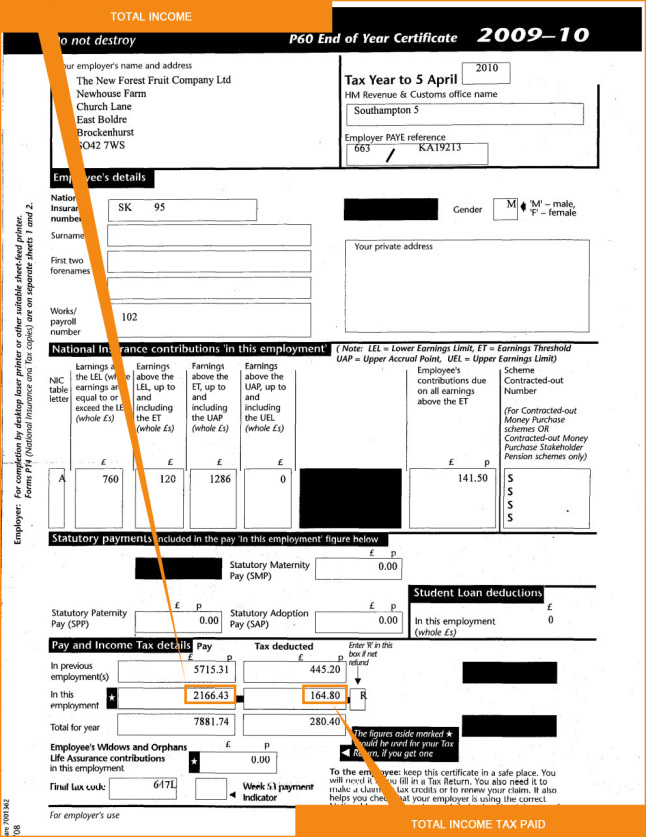

How To Check Your P60 Form Or Payslips For Tax Rebate Payslips

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Tax Rebate For Individual Deductions For Individuals reliefs

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Taxable Rebate In Income Tax - Web 9 sept 2023 nbsp 0183 32 taxes taxable income Will Your State Rebate Check Be Taxed for 2023 Here s what the IRS says about taxing state stimulus checks and other special state