Teacher Rebate Tax 2023 Tax Reductions Rebates and Credits Calculation of 40 tax reduction for a full time teacher or a full time researcher 15 Income from salary Rs 600 000 16 Gross income

For the first time since the Internal Revenue Service enacted the educator expense deduction in 2002 the agency raised it from 250 to 300 for the current tax This year an individual teacher is allowed to write off a total of 300 on their federal income taxes using the educator expense deduction This is the same figure that was allowed in

Teacher Rebate Tax 2023

Teacher Rebate Tax 2023

https://www.prestigeinvest.finance/assets/campaigns/rebate_campaign-6e71d07bdfe4e53ff9660d7974eee03eecb1c992f32c563c5b4dda098806ec52.jpg

Are You A Teacher Then You Might Be Due A Teacher s Tax Rebate Here s

https://i.pinimg.com/originals/c3/89/86/c38986f6326ef59e724e8d5459630c8f.png

Printable Rebate Forms Fillable Form 2023

http://fillableforms.net/wp-content/uploads/2022/09/printable-rebate-forms.jpg

According to the IRS eligible teachers can deduct up to 300 600 if married to another teacher and you are filing jointly of unreimbursed unrelated trade or For the current tax season i e the 2023 tax year the maximum educator expense deduction is 300 If you are an eligible educator more on that later you can

Last updated 3 Jun 2023 Both primary and secondary school teachers often end up spending their own money on things they need to do their job This can be for Teachers can claim the Educator Expense Deduction regardless of whether they take the Standard Deduction or itemize their tax deductions For the 2023 tax

Download Teacher Rebate Tax 2023

More picture related to Teacher Rebate Tax 2023

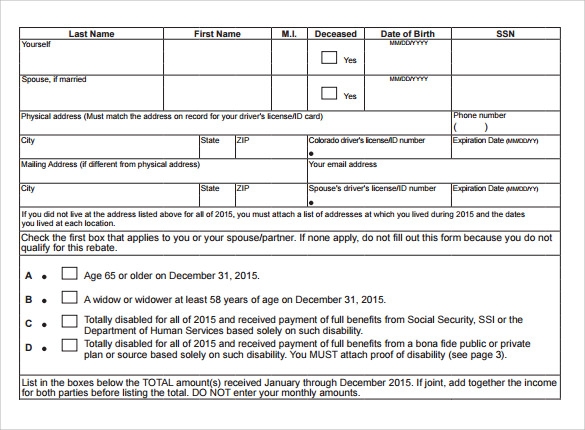

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

2023 Tax Relief Oh 2023 Tax Relief KLSE Malaysia

https://apicms.thestar.com.my/uploads/images/2023/12/02/2418512.jpg

Pa Estimated Tax Form Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/563/640/563640699/large.png

How to claim your teacher tax rebate To claim your teacher tax rebate you should get in touch with the tax office aka the tax office You can easily start the process online and Private expenses Examples of private expenses that you can t claim include the cost of flu shots and other vaccinations meeting students personal

Claiming the Credit The Eligible Educator School Supply Tax Credit is a refundable credit that Teachers and Early Childhood Educators may claim if they have You are considered an eligible educator if at any time during the 2023 tax year both of the following conditions are met You were employed in Canada as a teacher or an early

2022 Menards Rebate Forms RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/2022-menards-rebate-forms.jpg?fit=1024%2C963&ssl=1

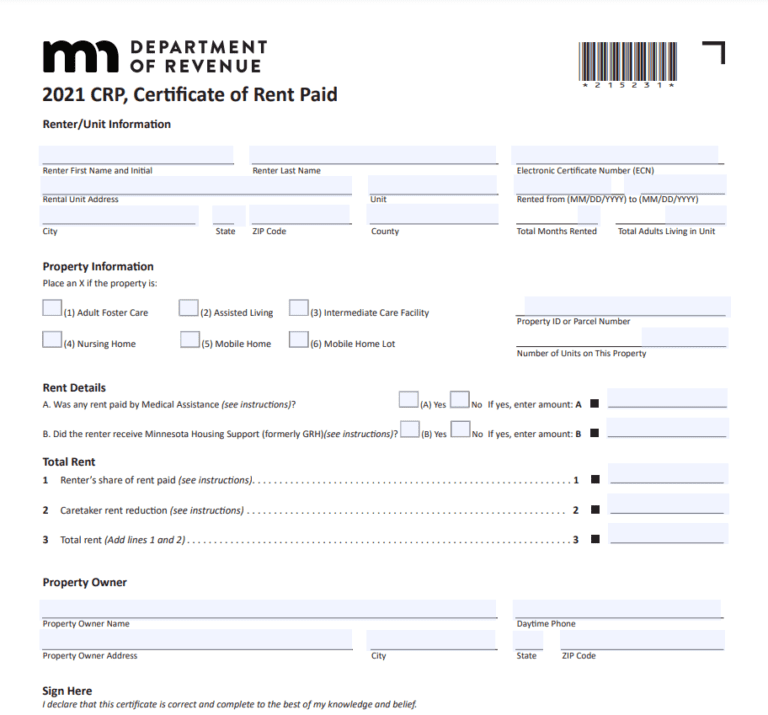

MN Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/12/MN-Renters-Rebate-Form-768x715.png

https://download1.fbr.gov.pk/Docs/201862914650229...

Tax Reductions Rebates and Credits Calculation of 40 tax reduction for a full time teacher or a full time researcher 15 Income from salary Rs 600 000 16 Gross income

https://www.edweek.org/.../2023/01

For the first time since the Internal Revenue Service enacted the educator expense deduction in 2002 the agency raised it from 250 to 300 for the current tax

Rent Rebate Form Missouri Printable Rebate Form

2022 Menards Rebate Forms RebateForMenards

Traderider Rebate Program Verify Trade ID

Is The Teacher Tax Rebate Genuine Accounting Firms

Pensioner Rebate Doubled To Provide Support Bundaberg Now

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits Save You More Than Deductions Here Are The Best Ones

2019 2024 Form VT LC 142 Fill Online Printable Fillable Blank

Government Solar Rebate QLD Everything You Need To Know

Deadline For Tax And Rent Relief Extended

Teacher Rebate Tax 2023 - Full Time Teacher You must be a full time teacher to qualify for tax deductions This means that you must be employed by an educational institution and