Tennessee 529 Tax Benefits Tennessee s TNStars college savings 529 program is a simple flexible way to save and invest for college Dream big Invest in their future With TNStars earnings grow tax free and money

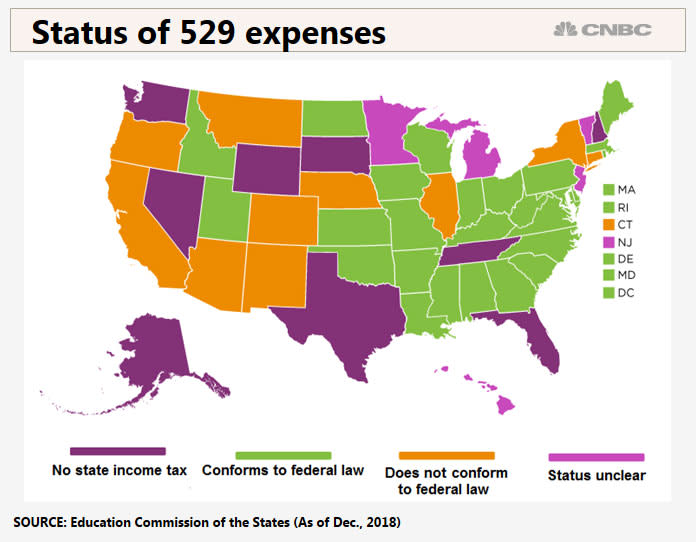

What are the benefits of a 529 plan Any earnings on contributions invested in a 529 plan grow tax deferred and may be withdrawn tax free when used forqualified higher education expenses Federal tax benefits 529 plan contributions grow federally tax free and earnings are not subject to federal income tax when you take withdrawals for qualified education expenses including up to 10 000 in K 12

Tennessee 529 Tax Benefits

Tennessee 529 Tax Benefits

https://i.ytimg.com/vi/m-rVajPpoF8/maxresdefault.jpg

529 Plan Tax Benefits NEST 529 College Savings 529 College Savings

https://i.pinimg.com/originals/29/79/61/297961f7119219dbae6b361b8a91e244.png

50 Unbeatable Benefits Of 529 Plan You Must Know 2023

https://www.collegewell.com/wp-content/uploads/2022/03/Comparison-Chart-b-01-1024x645.png

529 plan contributions grow tax free Withdrawals are tax free when used to pay for qualified higher education expenses A smart benefit for you and your employees TNStars gives you the opportunity to provide a valuable benefit that employees desire at little to no cost to your company Learn more

Tennessee offers tax benefits and deductions when savings are put into your child s 529 savings plan Unfortunately Tennessee does not offer any tax benefits for socking away funds in a 529 What are some Tennessee 529 plan benefits and tax advantages Funds you invest in a 529 plan grow tax deferred And funds that the student eventually withdraws from the plan towards qualified educational costs are

Download Tennessee 529 Tax Benefits

More picture related to Tennessee 529 Tax Benefits

529 Plan Investment Portfolio Options Invesco Invesco US

https://www.invesco.com/content/dam/invesco/education-savings/en/landing-page/LNDG-HRO-Tax-advantages.jpg

529 Tax Benefits By State Dumbfuckistan 2016 Transparent PNG

https://www.nicepng.com/png/detail/256-2561925_529-tax-benefits-by-state-dumbfuckistan-2016.png

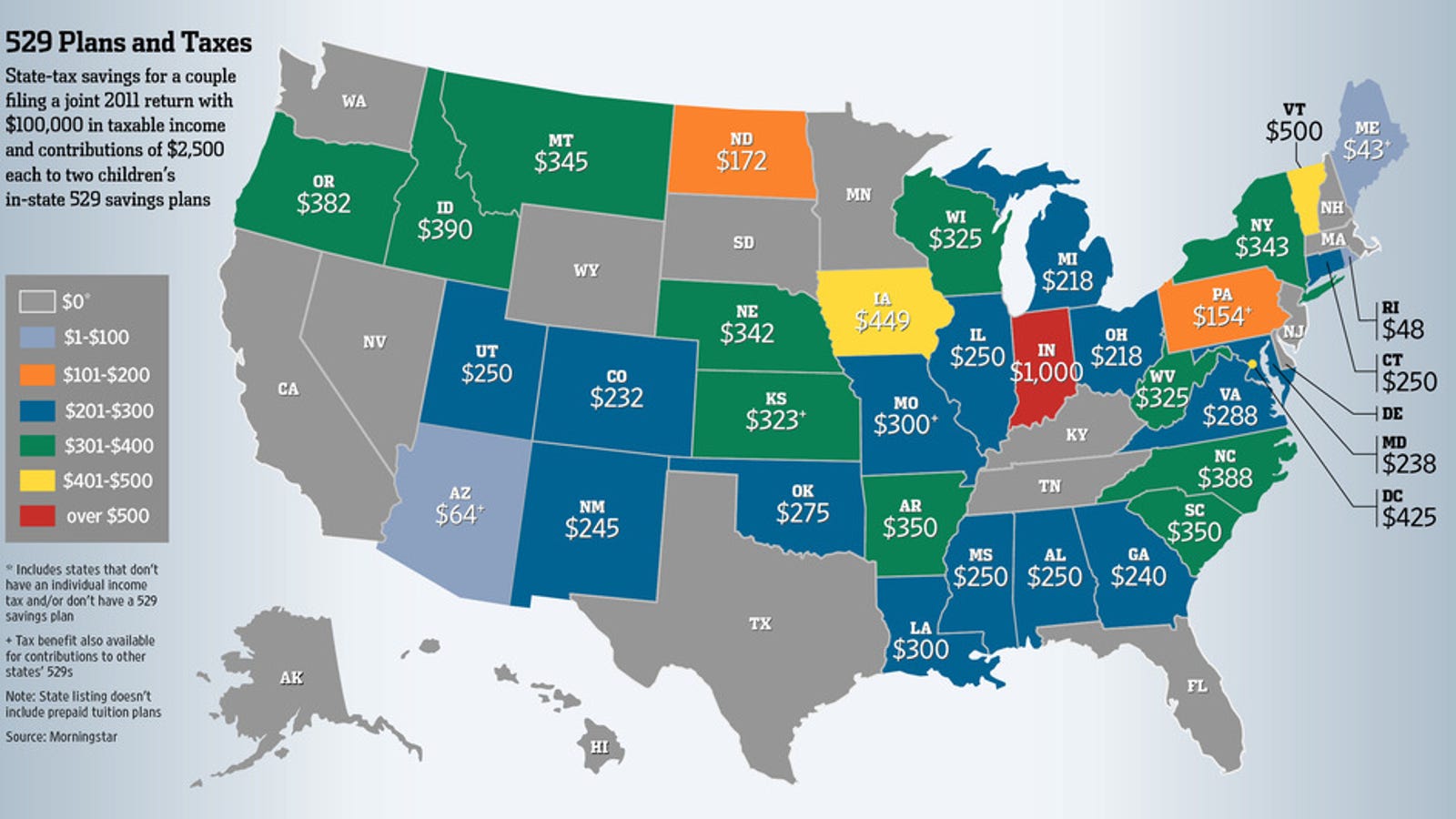

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

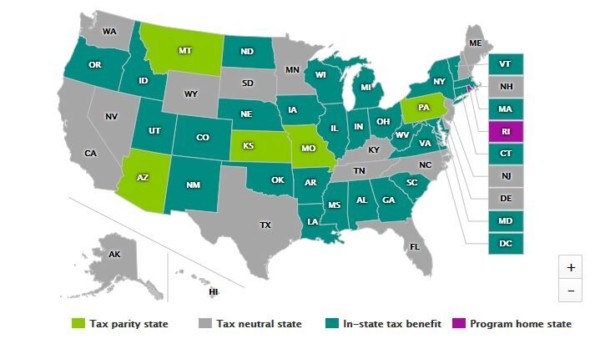

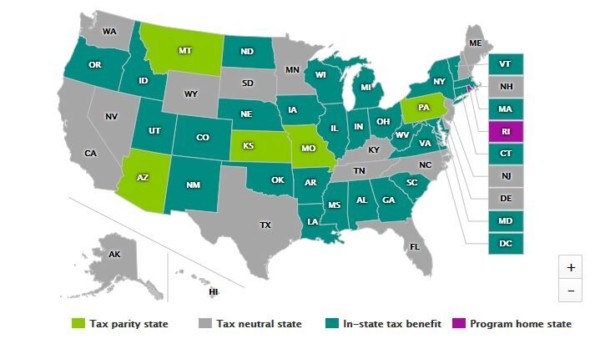

Tax Benefits There are no state income taxes in Tennesee however in and out of state participants get the federal tax benefits Other Benefits Tennessee residents who rollover This article outlines how 529 tax benefits work and gives education savers a checklist to consider when deciding whether to choose an in state 529 plan or shop around

Non Tennessee taxpayers and residents If you are not a Tennessee taxpayer you should determine whether your home state offers a 529 plan that provides state tax or other state This state does not offer any tax benefits for contributing to a 529 plan See below for options available in Tennessee or choose an out of state plan based on fees or

Give The Gift Of Education Through A 529 Plan

https://blog.mgallp.com/hubfs/tax benefits of a 529 plan.jpg

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

https://treasury.tn.gov/Services/For-All...

Tennessee s TNStars college savings 529 program is a simple flexible way to save and invest for college Dream big Invest in their future With TNStars earnings grow tax free and money

https://tnstars.treasury.tn.gov/Savings-T…

What are the benefits of a 529 plan Any earnings on contributions invested in a 529 plan grow tax deferred and may be withdrawn tax free when used forqualified higher education expenses

529 Tax Benefits By State Invesco US

Give The Gift Of Education Through A 529 Plan

529 College Savings Plans All 50 States Tax Benefit Comparison

Features Bloomwell 529

Enjoy Tax Benefits With Your 529 Account Sweet Romantic Quotes Good

Ohio State Tax Deduction Boost For 529 Savings Capstone Wealth Partners

Ohio State Tax Deduction Boost For 529 Savings Capstone Wealth Partners

An Overview Of 529 Plans Bank Of Tennessee

Connecticut Tax Deductions For 529 Savings Financial Advisor In

The New Tax Code Has Extra Perks For 529 Savers Your State May Not

Tennessee 529 Tax Benefits - Tennessee offers tax benefits and deductions when savings are put into your child s 529 savings plan Unfortunately Tennessee does not offer any tax benefits for socking away funds in a 529