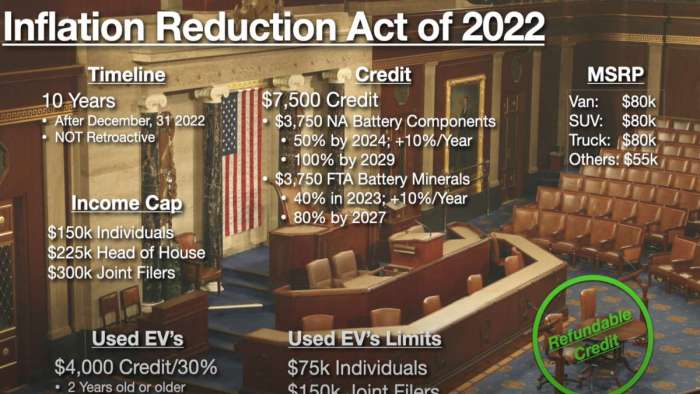

Tesla Tax Credit Refund Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

Consumer Vehicles Inflation Reduction Act On January 1 2023 the Inflation Reduction Act of 2022 qualified certain electric vehicles EVs for a tax credit of up to 7 500 for eligible buyers Qualifications include Customers must buy it for their own use not for resale Use the vehicle primarily in the U S The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid vehicles Nonrefundable tax

Tesla Tax Credit Refund

Tesla Tax Credit Refund

https://www.motorbiscuit.com/wp-content/uploads/2021/04/TeslaVsVW.jpg

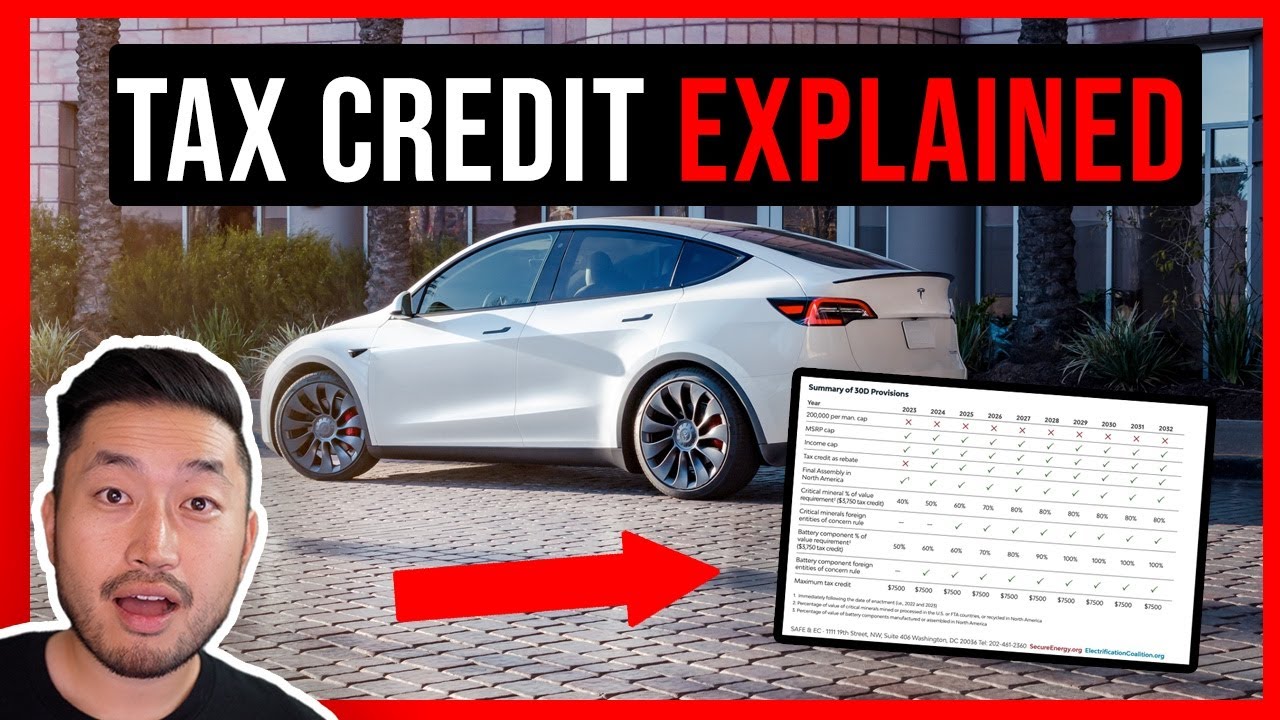

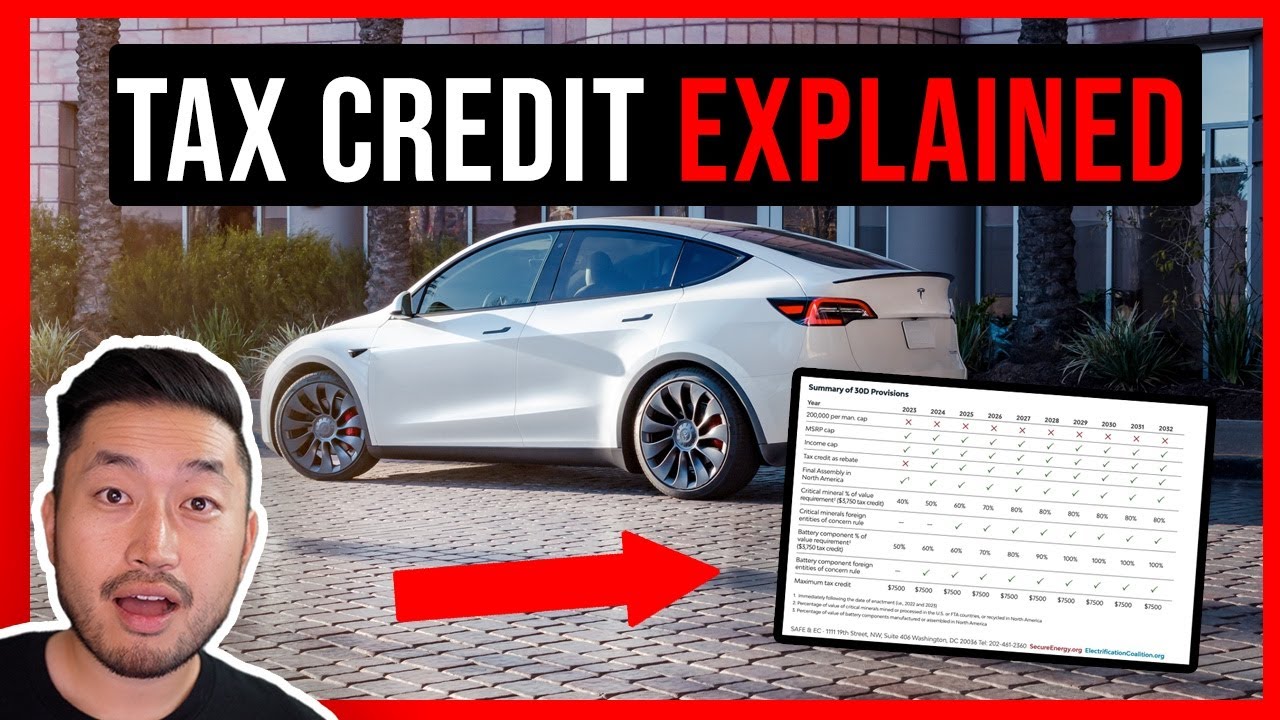

TESLA EV TAX CREDIT EXPLAINED YouTube

https://i.ytimg.com/vi/sZZn7-_iolU/maxresdefault.jpg

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

English Espa ol If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But

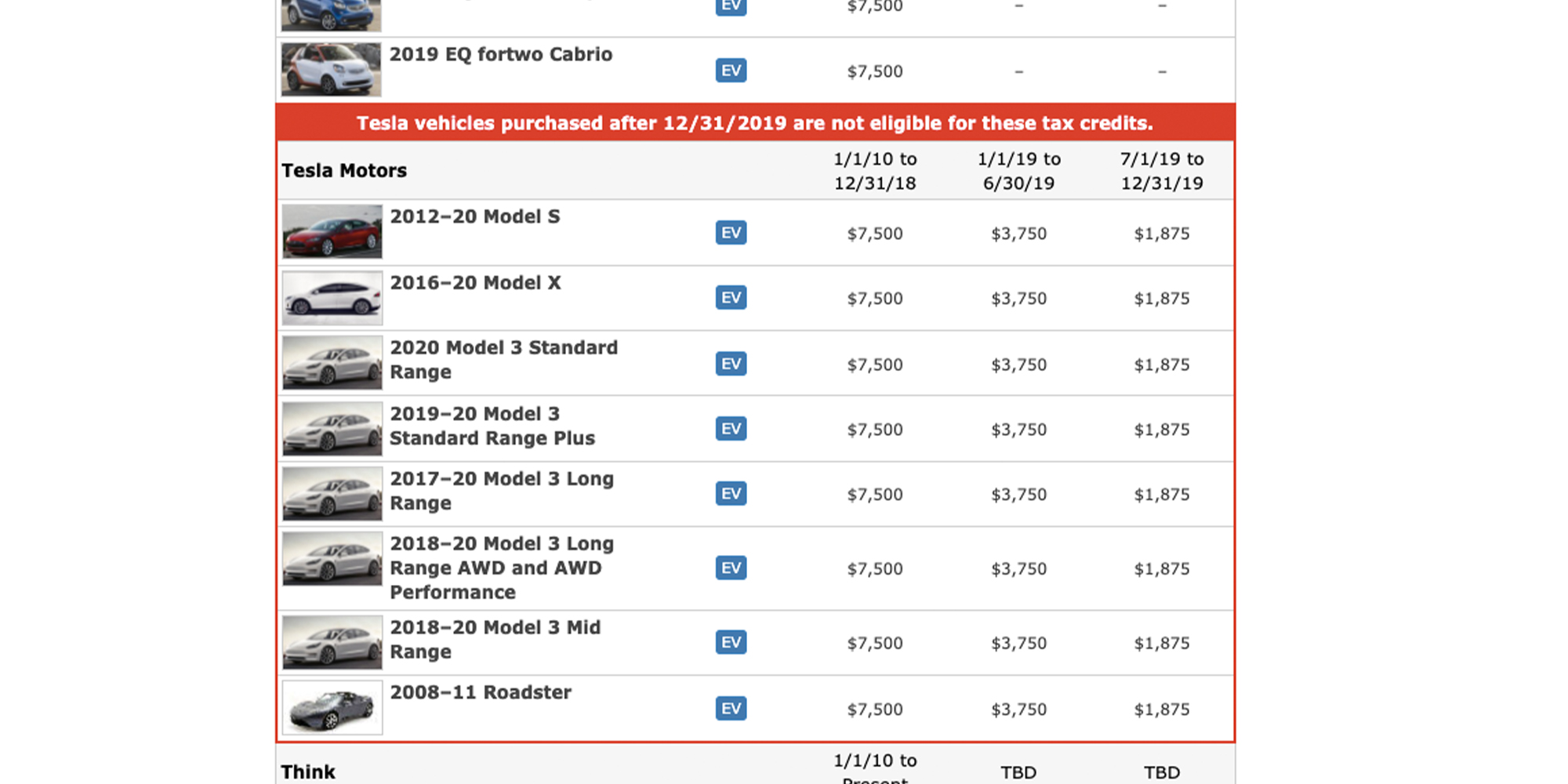

The Internal Revenue Service allows for a clean vehicle tax credit of up to 7 500 for 2023 Tesla has several qualifying models including Tesla Model 3 Standard Range Rear Wheel Drive Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7 500 federal tax credit This tax credit begins to phase out once a manufacturer has sold 200 000 qualifying vehicles in the U S

Download Tesla Tax Credit Refund

More picture related to Tesla Tax Credit Refund

Tesla s Genius Pricing Plan To Save You Thousands My Tech Methods

https://mytechmethods.com/wp-content/uploads/2021/09/tesla-tax-credit-2021-copy-2.jpg

Tesla Tax Credit 2021 Colorado Remona Gass

https://tflcar.com/wp-content/uploads/2021/01/tesla-model-s-scaled.jpeg

Tesla Says All New Model 3s Now Qualify For Full 7 500 Tax Credit

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1c4DLg.img

BREAKING Tesla is now officially offering the new 7 500 Fed EV point of sale POS rebate in the US enabling an estimated 250 million Americans up from 75M in 2023 To get a 7 500 discount Go to Tesla contactus then log into your account It ll then read Ask a question at the top of the page Click the drop down select Generate 2023 IRA Document You ll then enter select

The new 7 500 federal tax credit for electric vehicles in the US is coming into effect on January 1 2023 but there are still a lot of details we don t know about The biggest unknowns regard A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models

Elon Musk Promises To Repay Tax Credit If Tesla Misses Year End Delivery

https://www.thedrive.com/content/2018/12/20181227-Tesla-Tax-Credit.jpg?quality=85&width=1440&quality=70

IRS Investigates Huge 200 Million Fake Tesla Income Tax Refund Fraud

https://imageio.forbes.com/specials-images/imageserve/60be3977ce94cda03d38d7e0/0x0.jpg?format=jpg&width=1200

https://www. irs.gov /credits-deductions/credits-for...

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

https://www. tesla.com /support/incentives

Consumer Vehicles Inflation Reduction Act On January 1 2023 the Inflation Reduction Act of 2022 qualified certain electric vehicles EVs for a tax credit of up to 7 500 for eligible buyers Qualifications include Customers must buy it for their own use not for resale Use the vehicle primarily in the U S

Tesla s 7 500 Tax Credit Goes Poof But Buyers May Benefit WIRED

Elon Musk Promises To Repay Tax Credit If Tesla Misses Year End Delivery

Congress Passes 1 2 Trillion Infrastructure Bill 12 500 EV Tax

EV Tax Credits Are Coming Back How Tesla Benefits Torque News

Tesla Confirms Hitting Federal Tax Credit Threshold 7 500 Credit Cut

How To Qualify For Tesla Tax Credit In 2023 ZiiSaa

How To Qualify For Tesla Tax Credit In 2023 ZiiSaa

How Tesla Wins With No More Tax Credit Top 10 Advantages YouTube

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

Tax Credit Universal Credit Impact Of Announced Changes House Of

Tesla Tax Credit Refund - Now you still paid 20 000 throughout the year towards what you owed so now you ve paid 20 000 towards 8790 and will receive a refund of 11 210 7500 more than your original refund the full value of the EV tax credit