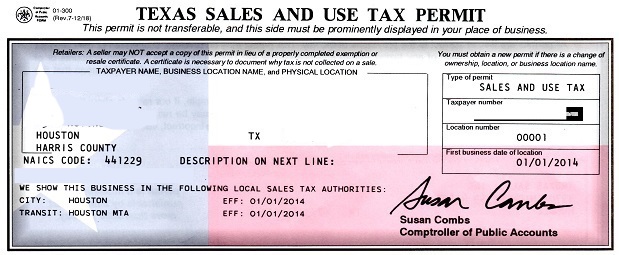

Texas Sales And Use Tax Return Short Form Texas Sales and Use Tax Forms If you do not file electronically please use the preprinted forms we mail to our taxpayers If your address has changed please update your account The forms listed below are PDF files They include graphics fillable form fields scripts and functionality that work best with the free Adobe Reader

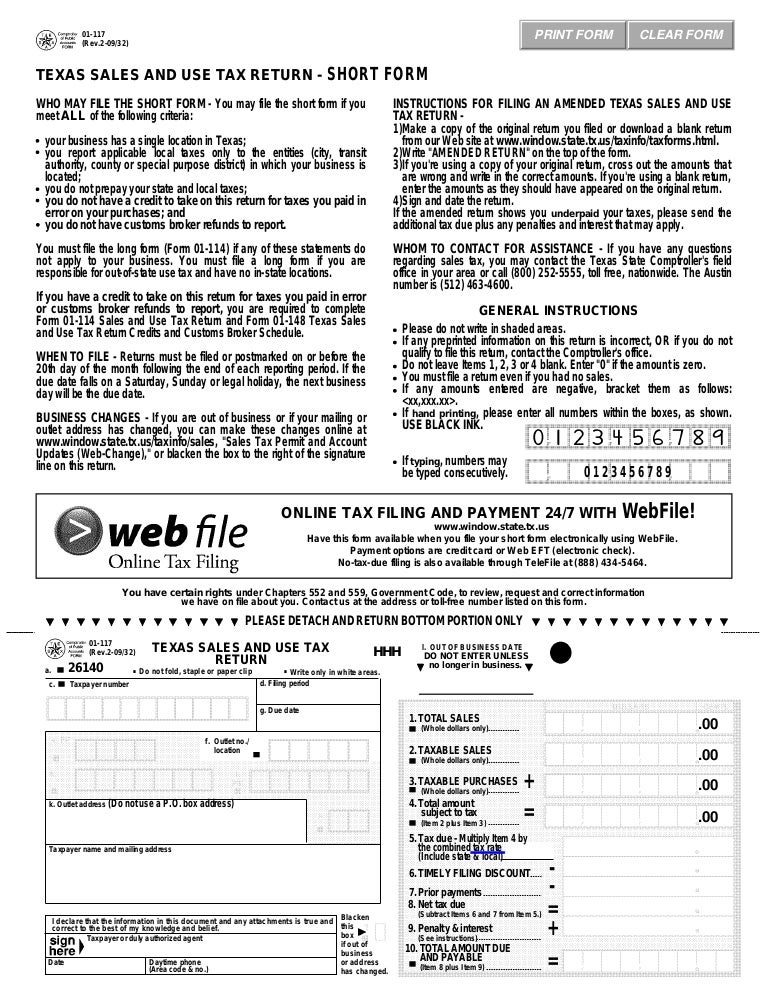

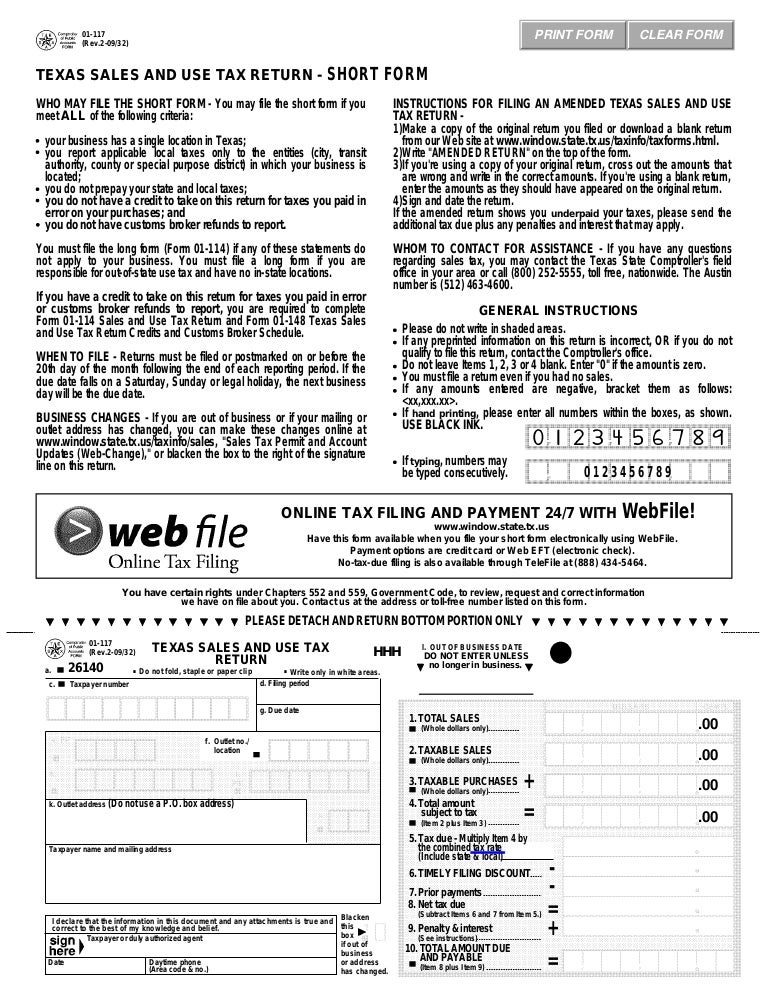

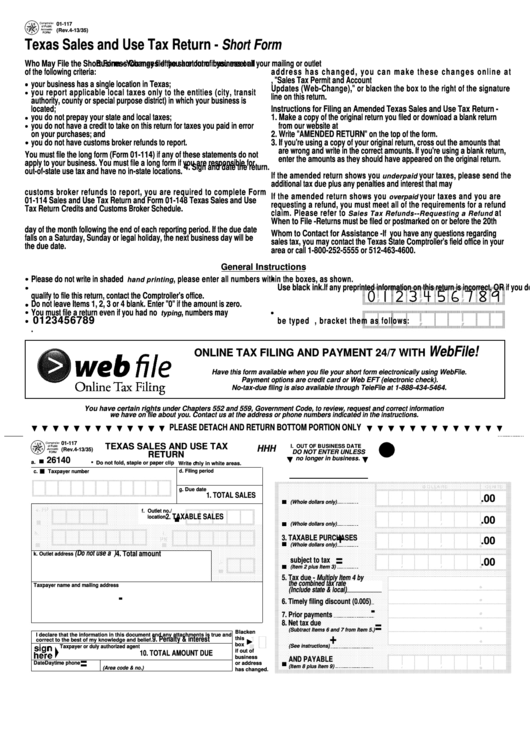

Texas Sales and Use Tax Return Short Form Who May File the Short Form You may file the short form if you meet all of the following criteria your business has a single location in Texas you report applicable local taxes only to the entities city transit authority county or special purpose district in which your business is located File Form 01 117 Texas Sales and Use Tax Return Short Form PDF if you have zero taxable sales and zero tax due You may use TeleFile even if total sales are greater than zero if no taxes are due

Texas Sales And Use Tax Return Short Form

Texas Sales And Use Tax Return Short Form

https://public-site.marketing.pandadoc-static.com/app/uploads/sites/3/BP_Sales-and-use-tax.png

Guide To Texas Sales Tax Reporting Paying Penalties More

https://images.taxcure.com/uploads/tmp/1661281068-759499255234219-0010-7268/Banner_1000x250__Texas_Sales_Tax_Requirements.png

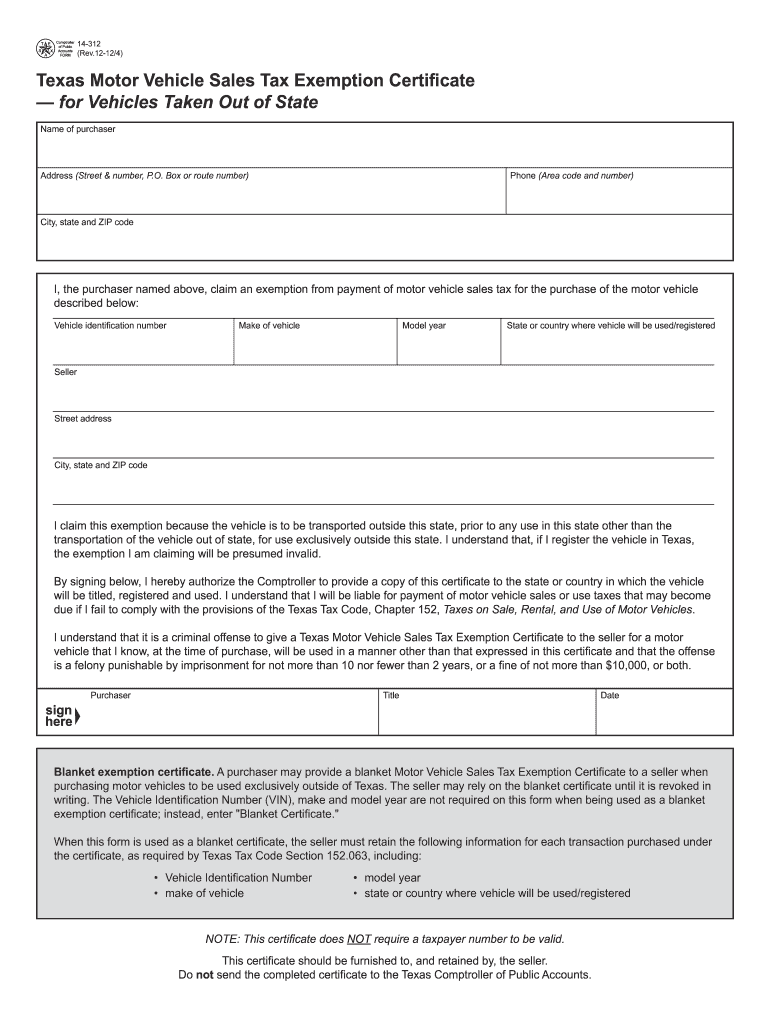

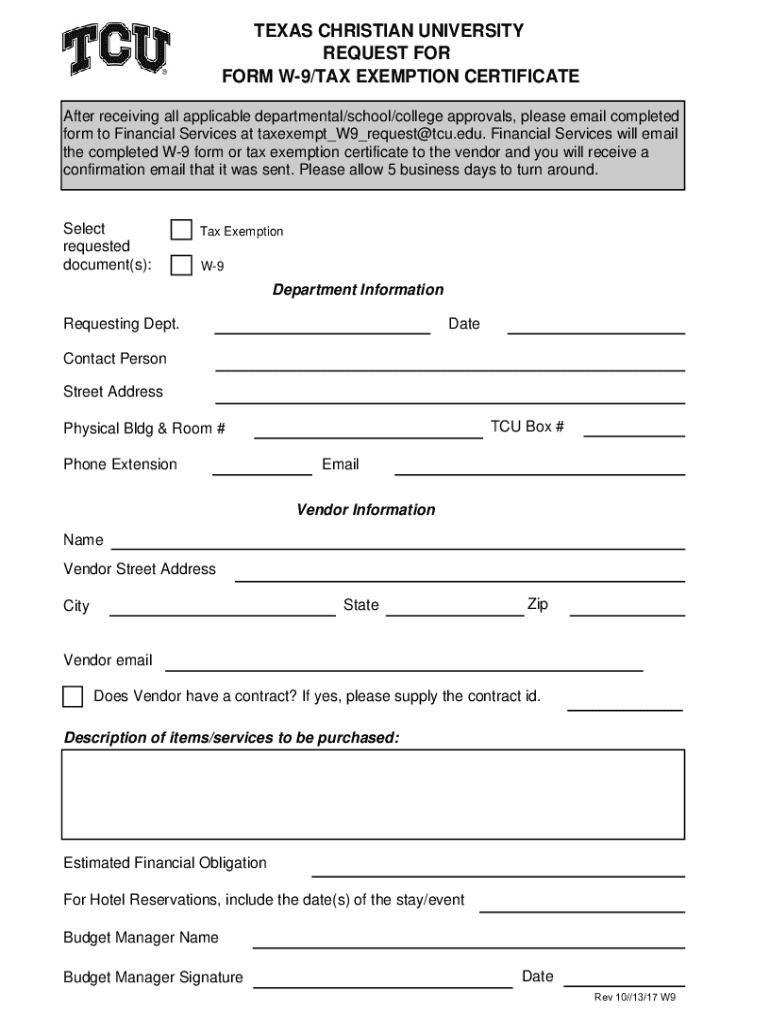

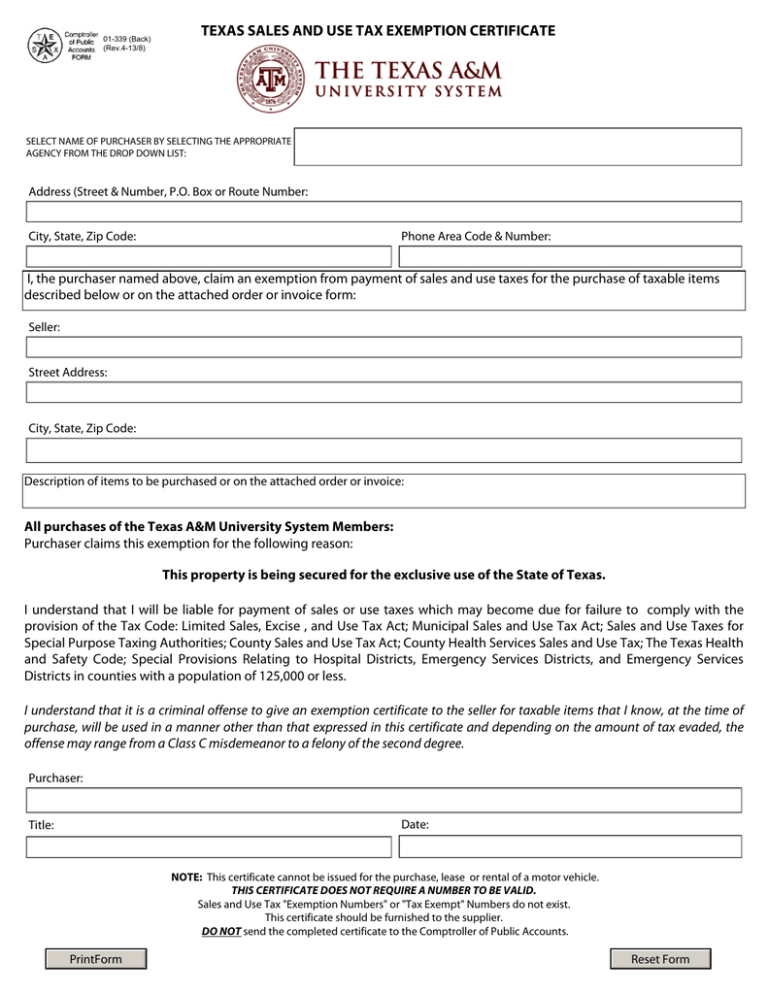

2023 Texas Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/tx-form-sales-tax-exemption-fill-online-printable-fillable-blank.png

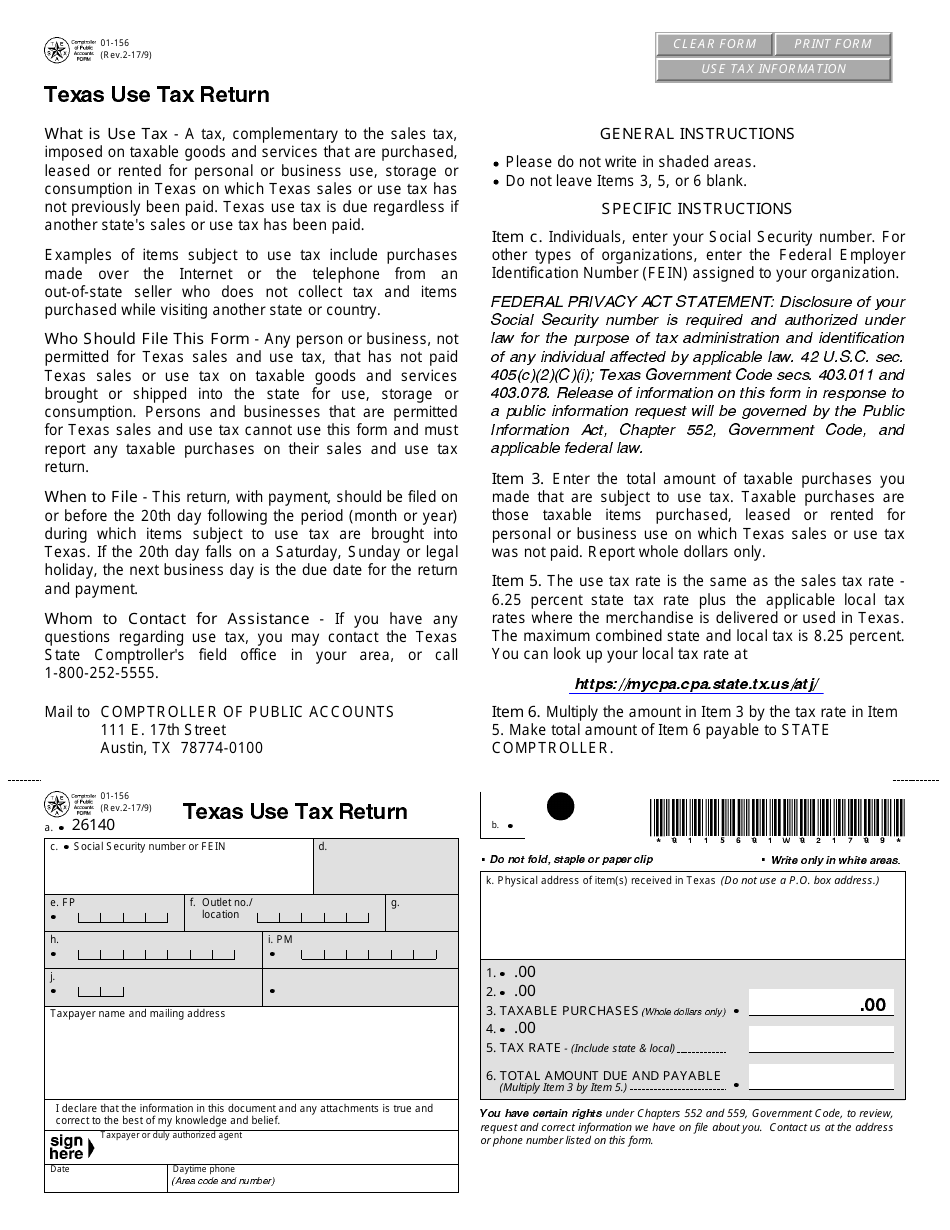

Leased or rented for personal or business use on which sales or use tax was not paid This includes purchases from Texas or out of state sellers or items taken out of inventory for use items given away and items purchased for an exempt use but actually used in a taxable manner Easily complete and download the Texas Sales and Use Tax Return Short Form Form 01 117 online in PDF format File your sales and use tax conveniently with Templateroller

Texas Sales and Use Tax Return Short Form Who May File the Short Form You may file the short form if you meet all of the following criteria your business has a single location in Texas you report applicable local taxes only to the entities city transit authority county or special purpose district in which your business is located Texas Sales and Use Tax Return Short Form conti ued Item c Enter the taxpayer number shown on your sales tax permit If you have not received your sales tax permit and you are a sole owner enter your Social Security number

Download Texas Sales And Use Tax Return Short Form

More picture related to Texas Sales And Use Tax Return Short Form

Fillable Online Texas Sales And Use Tax Return For List Filer Fax Email

https://www.pdffiller.com/preview/610/850/610850217/large.png

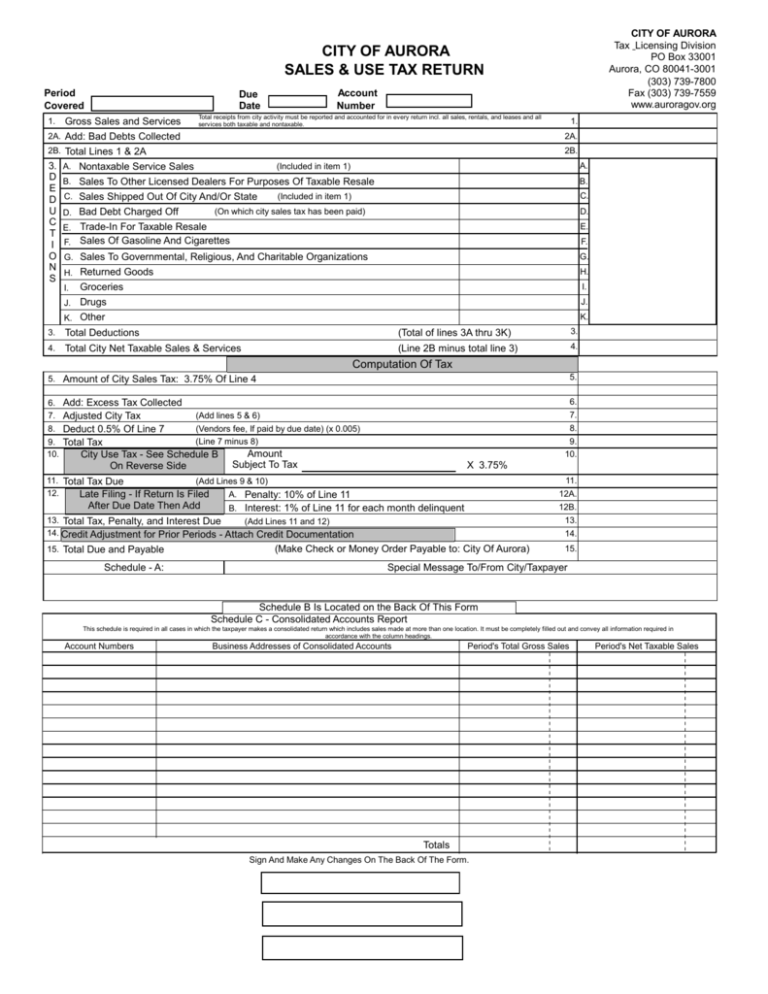

Sales And Use Tax Return Form

https://s3.studylib.net/store/data/008754085_1-c1b188d592909f51d444a3ad8df36f87-768x994.png

Fillable Online Texas Sales And Use Tax Exemption Certificate Form Fax

https://www.pdffiller.com/preview/615/215/615215806/large.png

Texas Sales and Use Tax Return Short Form Who May File the Short Form You may file the short form if you meet all of the following criteria your business has a single location in Texas you report applicable local taxes only to the entities city transit authority county or special purpose district in which your business is located Texas Sales and Use Tax Return Short Form Who May File the Short Form You may file the short form if you meet all of the following criteria your business has a single location in Texas you report applicable local taxes only to the entities city transit authority county or special purpose district in which your business is located

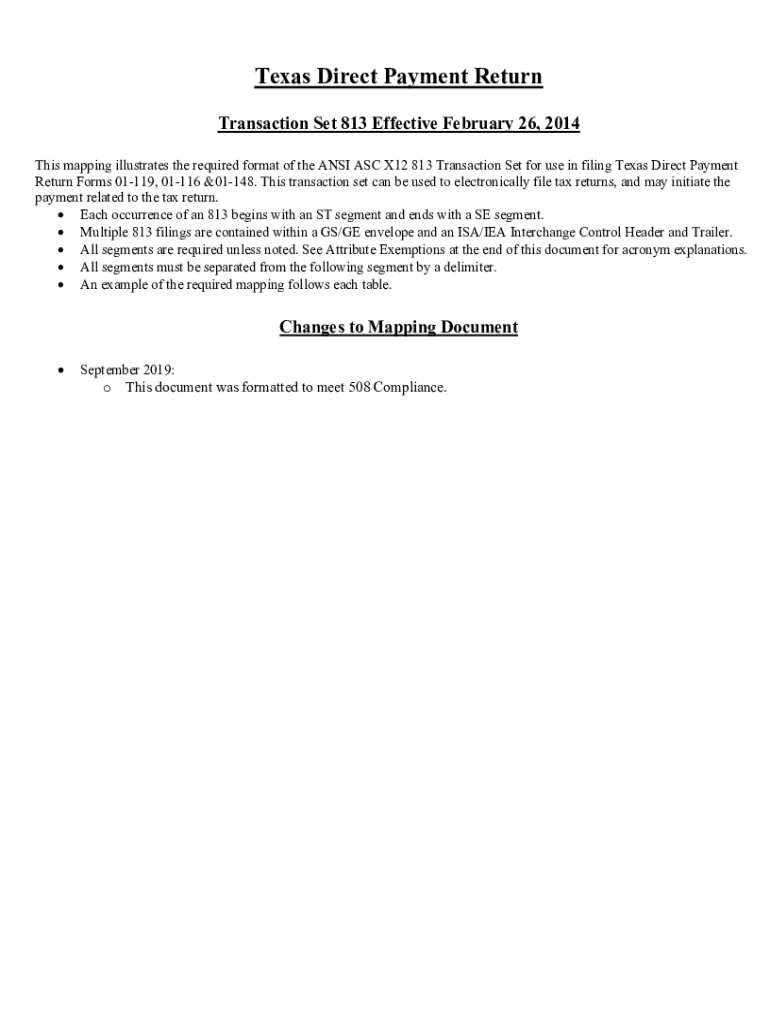

This worksheet is for taxpayers who report YEARLY qualify to file the short form and have experienced a local sales tax RATE CHANGE during the calendar year Make additional copies of this form as necessary If you have a credit to take on this return for taxes you paid in error or customs broker refunds to report you are required to complete Form 01 114 Sales and Use Tax Return and Form 01 148 Texas Sales and Use Tax Return Credits and Customs Broker Schedule Please do not write in shaded areas

Texas Fireworks Tax Forms 01 117 Texas Sales Use Tax Return Short

https://cdn.slidesharecdn.com/ss_thumbnails/1280465-thumbnail-4.jpg?cb=1239601967

Vsf Form Texas Printable

https://data.templateroller.com/pdf_docs_html/230/2309/230911/form-01-156-texas-use-tax-return-texas_print_big.png

https://comptroller.texas.gov › taxes › sales › forms

Texas Sales and Use Tax Forms If you do not file electronically please use the preprinted forms we mail to our taxpayers If your address has changed please update your account The forms listed below are PDF files They include graphics fillable form fields scripts and functionality that work best with the free Adobe Reader

https://d2l2jhoszs7d12.cloudfront.net › state › Texas...

Texas Sales and Use Tax Return Short Form Who May File the Short Form You may file the short form if you meet all of the following criteria your business has a single location in Texas you report applicable local taxes only to the entities city transit authority county or special purpose district in which your business is located

Texas Sales And Use Tax Prepayment Report Form ReportForm

Texas Fireworks Tax Forms 01 117 Texas Sales Use Tax Return Short

Bloomberg Tax Su LinkedIn Survey Of State Tax Departments Executive

Streamlined Sales And Use Tax Agreement Form Streamlined Sales And Use

Texas Sales Tax Exemption Certificate Form ExemptForm

N C Dept Of Revenue On Twitter We Invite You To Attend Our Sales And

N C Dept Of Revenue On Twitter We Invite You To Attend Our Sales And

Texas Sales And Use Tax Exemption Blank Form

Getting Started The Essentials

Tips For Tax Season Virginia Tax

Texas Sales And Use Tax Return Short Form - Leased or rented for personal or business use on which sales or use tax was not paid This includes purchases from Texas or out of state sellers or items taken out of inventory for use items given away and items purchased for an exempt use but actually used in a taxable manner