Trade Union Tax Rebate Web You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or

Web Trade unions have therefore a clear interest in tax reforms implementing a higher taxation of top incomes and wealth taxes To reduce the income gap between workers and high Web These options are first a carbon tax adjusted at the border second the inclusion of importers under the EU emission trading scheme and third import tariffs on products

Trade Union Tax Rebate

Trade Union Tax Rebate

https://www.creditunion.ie/ILCU/media/Images/Public site/News/Blog/tax_rebate_ireland.jpg?ext=.jpg

Retaliation Independent Trade Union Leaders Found Guilty Of Tax Evasion

https://belsat.eu/wp-content/uploads/2018/07/20180730_sud_rep_sait2.jpg

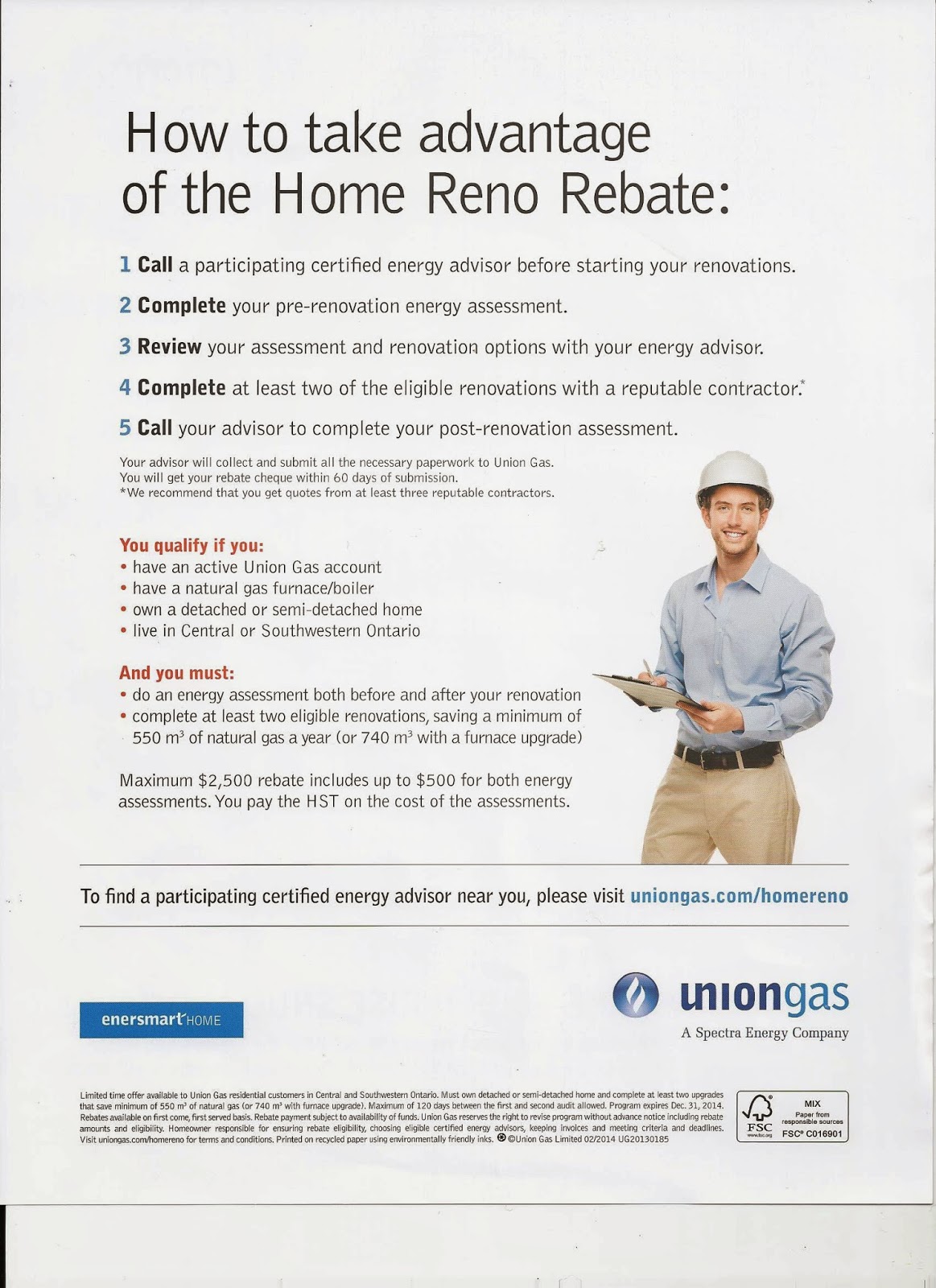

Winter Wonderland Home Renovations Rebate From Union Gas

https://2.bp.blogspot.com/-az7p2C_c76g/VQ3dQzNMO-I/AAAAAAAALgg/DGKCCu65zVQ/s1600/Scan0001.jpg

Web 25 sept 2013 nbsp 0183 32 If you belong to a union for the industry in which you work and you pay membership subscriptions fees or dues you may not only be able to receive a union Web 27 avr 2023 nbsp 0183 32 To claim a tax refund or tax relief in the country where you live you will probably have to show some documents proving that you paid tax on the income you

Web 6 janv 2020 nbsp 0183 32 The Canada Revenue Agency refunds GST at a rate of 5 105 and HST at a rate of 12 112 13 113 14 114 or 15 115 depending on the rate applied to your dues Web 1 oct 2020 nbsp 0183 32 This paper exploits China s frequent adjustments of VAT rebates and large scale data on export transactions to understand this question Theoretically Feldstein

Download Trade Union Tax Rebate

More picture related to Trade Union Tax Rebate

Marape Government s Move To Cut Tax A Joke Of The Century PNG Trade

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgxkvlPato3akh_dk3kUqG3GFHEMyD6xAs0oTFRuJMbpnZVa_VXW6079TbZ-ZkH4xG_tCZxNjnFVoom429uky4XqkfqkD5PpCnLjlTOF11ou4DmNN7FzZUZvNRw8Hpc8qD0CPxya8-Ex7ElVv0OJXbUcPhwmVw5Vn-0_uwoffUJsDwrbINYwfq2pqX4nw/s16000/Trade union.PNG

UNION Rebate Kit To Suit Union 26773 2077 2026 Locks Satin Chrome

https://res.cloudinary.com/manutantraders/image/upload/w_500,c_scale,f_auto,q_auto/ironmongery/products/803553.jpg

Union Budget 2019 India Interim Budget News Expectations Tax

https://1.bp.blogspot.com/-ua9ivrzSr5Q/XIfIjVTGftI/AAAAAAAAAOg/tcUIIxBdNdUNqrW3d0_ro26i3ASn1xUCwCLcBGAs/s1600/tax2.jpg

Web The three types of exempt supply Exemptions without the right to deduct EN e g public interest supplies Exemptions with the right to deduct EN e g exports and Web Tax deduction of 170 per month from taxable value income tax for BEVs from 1 January 2021 until 31 December 2025 Charging of electric vehicles at workplace is exempted

Web 1 oct 2022 nbsp 0183 32 Many studies in the available literature have concluded that economic policies or institutions may misguide the allocation of resources across firms having Web 12 nov 2014 nbsp 0183 32 What tax relief can UNITE members claim for Unfortunately there is no general agreement between Unite and the Tax Office which would mean that you could

Union Budget 2023 New Tax Regime Explained Tax Rebate Hiked To 7

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA16YrN6.img?w=1280&h=720&m=4&q=93

Union Budget 2023 Know The Difference Between Tax Exemption Deduction

https://www.eastcoastdaily.in/wp-content/uploads/2023/01/tax-2-768x431.jpg

https://www.gov.uk/tax-relief-for-employees/professional-fees-and...

Web You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or

https://www.ituc-csi.org/.../tax_-_why_is_it_relevant_for_trad…

Web Trade unions have therefore a clear interest in tax reforms implementing a higher taxation of top incomes and wealth taxes To reduce the income gap between workers and high

Get More With A Mortgage From Affinity Federal Credit Union

Union Budget 2023 New Tax Regime Explained Tax Rebate Hiked To 7

Union 2650 Rebated Tubular Latch DJM Direct

Winter Wonderland Home Renovations Rebate From Union Gas

Union Budget 2023 Updates Incom Tax Slab Revised No Income Tax Up To

Tax Rebate For Individual China Individual Income Tax IIT Reform

Tax Rebate For Individual China Individual Income Tax IIT Reform

Hatch Union Exemption From Obamacare Tax Is Payback Senators

Exemptions Still Available In New Tax Regime with English Subtitles

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Trade Union Tax Rebate - Web 11 mai 2021 nbsp 0183 32 According to the Announcement about Raising Export Tax Rebate Rates for Some Products State Taxation Administration Announcement 2020 No 15 starting from