Transition To Retirement Pension Tax Treatment You can do this by choosing to start a transition to retirement income stream TRIS The TRIS payment tops up your part time income with a regular income stream from

There are two types of taxes you need to be aware of with transition to retirement pensions i investment earnings tax and ii pension payments tax When you start a transition to retirement pension your pension balance is invested How transition to retirement works If you ve reached your preservation age between 55 and 60 and still working you can use a TTR strategy to supplement your income if you reduce your work hours or boost your super and save on

Transition To Retirement Pension Tax Treatment

Transition To Retirement Pension Tax Treatment

https://themilitarywallet.com/wp-content/uploads/2008/01/GettyImages-1160636403-scaled.jpg

Account Based Pension Vs Transition To Retirement Super Guy

https://superguy.com.au/wp-content/uploads/2018/10/Account-Based-Pension-vs-Transition-To-Retirement.jpg

Transition To Retirement Tax Your Guide To Tax On TTR Pensions

https://superguy.com.au/wp-content/uploads/2022/03/Transition-To-Retirement-Tax.jpg

Pension tax legislation sets out the tax treatment of transfers to and payments made from QROPS Legislation sets out that when a lump sum is paid from a QROPS it is A transition to retirement TTR pension allows you to supplement your income by allowing you to access some of your super once you ve reached age 60 What are the benefits Cut back

Earnings do not enjoy the tax free status of pension phase but instead are taxed at 15 and your pension income withdrawn must be between 4 and 10 of the account balance each year A TTR pension automatically converts to a retirement phase pension when you meet a superannuation condition of release such as retiring or reaching age 65 unless you choose to transfer it back into the accumulation phase and stop

Download Transition To Retirement Pension Tax Treatment

More picture related to Transition To Retirement Pension Tax Treatment

Transition To Retirement Pension What Is It How Does It Work YouTube

https://i.ytimg.com/vi/5KngiXX4TWY/maxresdefault.jpg

Who You Are In The Contributory Pension Scheme Vanguard News

https://cdn.vanguardngr.com/wp-content/uploads/2021/05/pension1.jpg

3 Reasons To Start A Transition To Retirement Pension SuperGuy

https://superguy.com.au/wp-content/uploads/2023/03/Start-A-Transition-To-Retirement-Pension.jpg

By setting up a TTR pension you could choose to work less or continue working the same hours while salary sacrificing or making personal contributions into super some which may be tax deductible In both cases Issues an SMSF trustee needs to consider when commencing running or stopping a transition to retirement income stream This information applies to taxed complying super

Capital gains from transition to retirement pension investments are taxed at a minimum of 15 However this decreases to 10 if the asset was held for a minimum of 12 months due to a 33 tax offset Transition to retirement income streams TRIS are available to assist members to gradually move to retirement by accessing a limited amount of super Find out about the impacts for

Workers Pension Fund Not For Borrowing NLC Warn Governors

https://lawcarenigeria.com/wp-content/uploads/2020/12/pension-e1562619027391.jpg

Retirement Has The Potential To Be Relax

https://assets.cdn.filesafe.space/Fp0n8CDmmcy2Nz7RsdE3/media/6492d6d14e07381939a3fc93.png

https://www.ato.gov.au › ... › transition-to-retirement

You can do this by choosing to start a transition to retirement income stream TRIS The TRIS payment tops up your part time income with a regular income stream from

https://superguy.com.au › transition-to-…

There are two types of taxes you need to be aware of with transition to retirement pensions i investment earnings tax and ii pension payments tax When you start a transition to retirement pension your pension balance is invested

Save It For Another Day Pension Tax Relief And Options For Reform

Workers Pension Fund Not For Borrowing NLC Warn Governors

How To Model A Transition To Retirement Pension Income

How The Pension Loan Scheme Could Help Your Parents Boost Their

How To Retire Desire To Retire

State Pension MbarakDaeney

State Pension MbarakDaeney

PDF Adjustment To Retirement

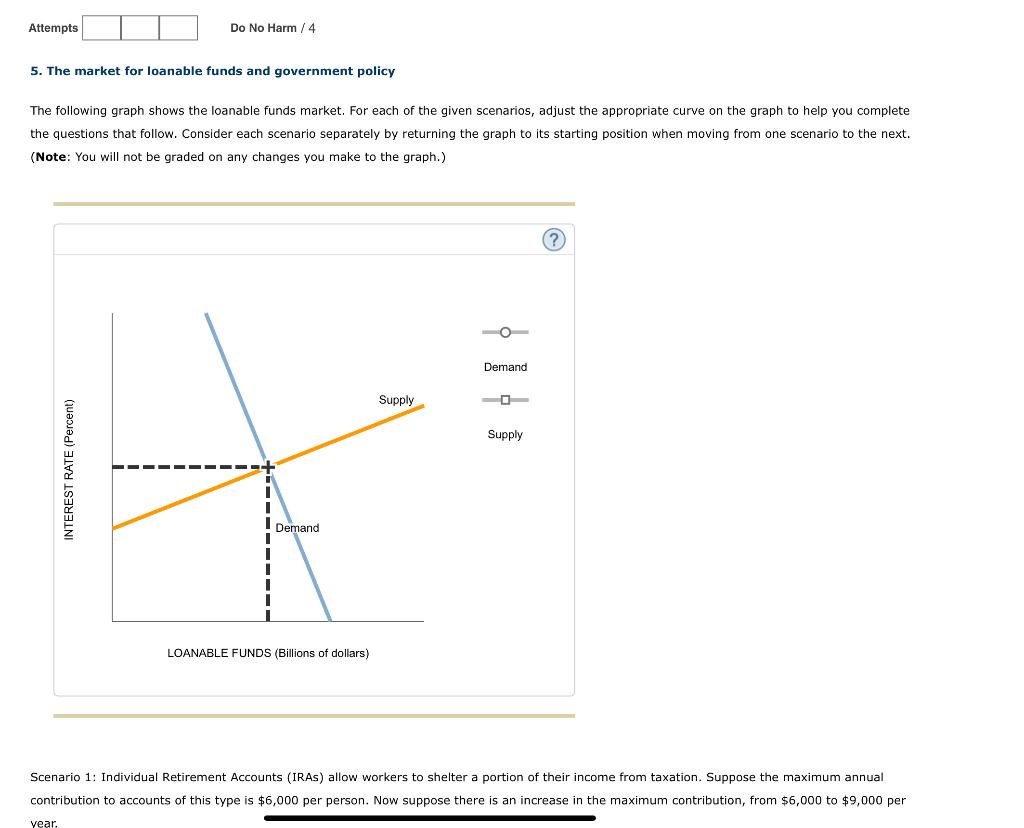

Solved Scenario 1 Individual Retirement Accounts IRAs Chegg

Meaning And Purpose In Retirement Career Life Transitions

Transition To Retirement Pension Tax Treatment - A TTR pension automatically converts to a retirement phase pension when you meet a superannuation condition of release such as retiring or reaching age 65 unless you choose to transfer it back into the accumulation phase and stop