Transport Allowance Rebate In Income Tax 2021 22 97 rowsHigh Altitude Allowance is granted to armed forces

Deductions that will continue to allowed to Taxpayers in New Tax Regime under section 115BAC In case of Handicapped employee Transport Allowance of Rs 3200 p m Conveyance Tour You can claim tax exemption for Transport allowances in case of a specially abled person Conveyance allowance received to meet the conveyance expenditure incurred as part of the

Transport Allowance Rebate In Income Tax 2021 22

Transport Allowance Rebate In Income Tax 2021 22

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Income Tax 2021 22 Income From House Property Q 7 Hc Mehrotra

https://i.ytimg.com/vi/ATOefiZQ2sg/maxresdefault.jpg

The Government employee is then entitled to deduction from gross salary under section 16 ii on account of such entertainment allowance to the extent of minimum of the following 3 limits The tax exemption limit for conveyance allowance is 1 600 per month regardless of the employee s income tax bracket In case an employee receives a taxable special allowance they can replace 1 600 with it as a

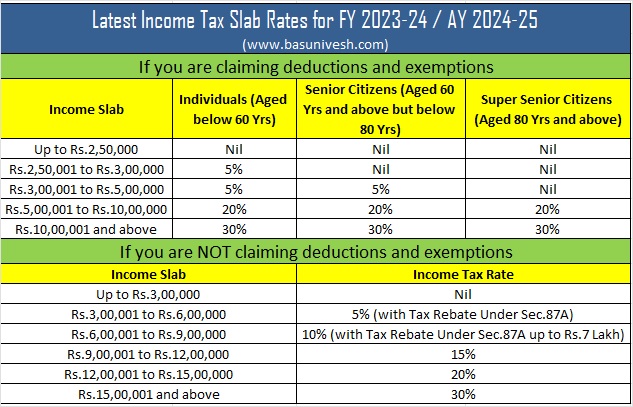

Tax credit for Alternative Minimum Tax paid in a prior year cannot be claimed in the new regime Section 115BAC the new tax regime system came into force from FY 2020 21 AY 2021 22 The new tax regime introduced concessional tax rates with reduced deductions

Download Transport Allowance Rebate In Income Tax 2021 22

More picture related to Transport Allowance Rebate In Income Tax 2021 22

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Income Tax Return

https://media.licdn.com/dms/image/D4D12AQH16mipCAWcKQ/article-cover_image-shrink_720_1280/0/1657633859840?e=2147483647&v=beta&t=6aoXUC-aT_rWIZcAVk2wa-5nIQBCt_E6Gw3dadRLWj4

How much can I claim tax exemption in Leave Travel Allowance Leave travel concession or LTA LTC If you are planning to opt for the new income tax regime which offers lower tax rates you can claim exemption on conveyance allowance received from your employer

To calculate your taxable income refer to your salary slip and determine your total income for the fiscal year including any variable income received quarterly or semi annually No if your employer provides transportation services then you won t receive any conveyance allowance regardless of whether you avail of the service or not

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

https://taxguru.in/income-tax/list-incom…

97 rowsHigh Altitude Allowance is granted to armed forces

https://icmai.in/TaxationPortal/upload/DT/Article/91.pdf

Deductions that will continue to allowed to Taxpayers in New Tax Regime under section 115BAC In case of Handicapped employee Transport Allowance of Rs 3200 p m Conveyance Tour

Irs Withholding Rates 2021 Federal Withholding Tables 2021 Free Nude

How To Calculate Standard Deduction In Income Tax Act Scripbox

Pa Rent Rebate 2021 Printable Rebate Form

Download Your Income Tax Form 2021 22 2021 22

Rebate Allowable Under Section 87A Of Income Tax Act

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

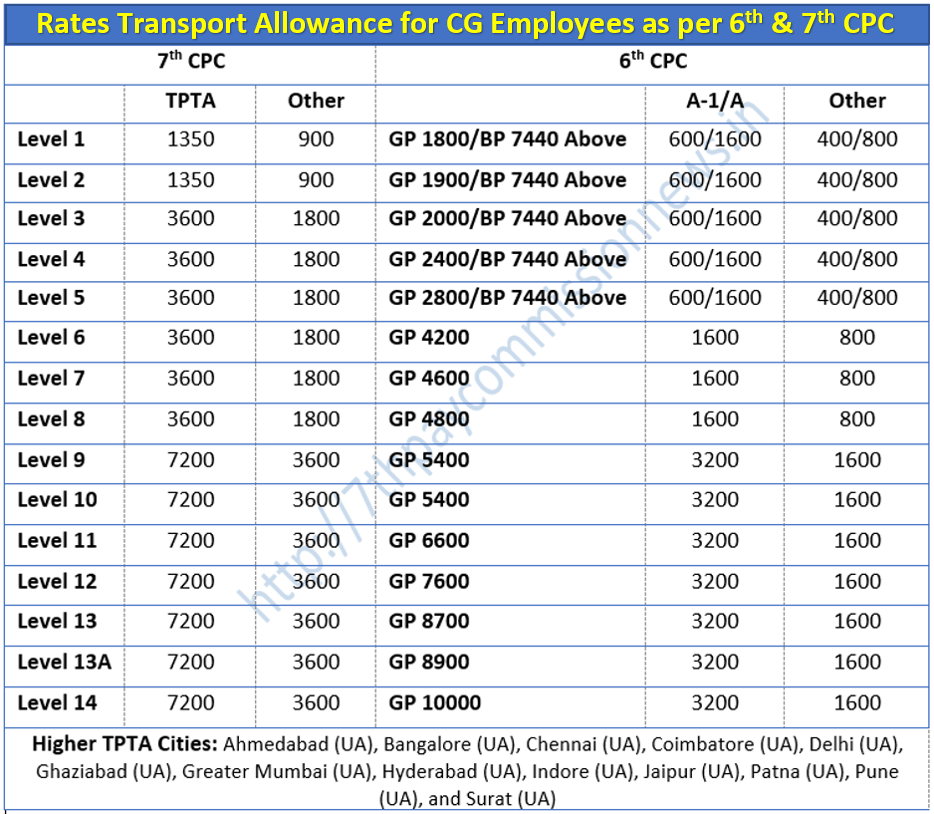

Th Pay Commission Rates Of Transport Allowance Central Government

Revised Latest Income Tax Slab Rates FY 2023 24

Transport Allowance Rebate In Income Tax 2021 22 - Tax credit for Alternative Minimum Tax paid in a prior year cannot be claimed in the new regime