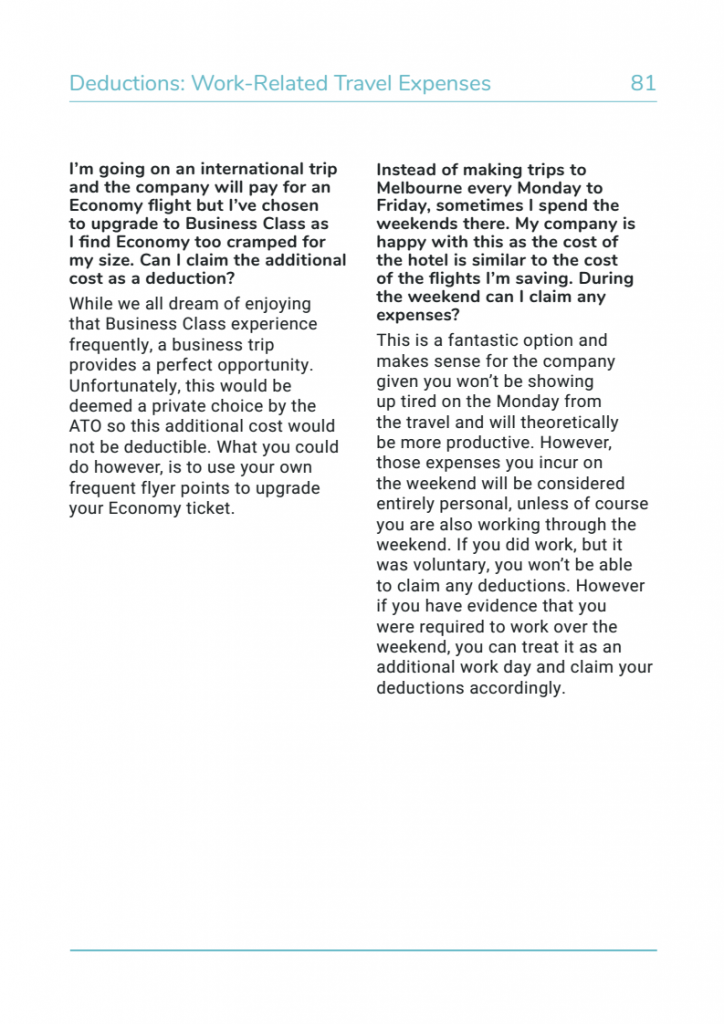

Travel Tax Deduction Australia Web 13 Dez 2023 nbsp 0183 32 You can claim a deduction for travel expenses accommodation meals and incidental expenses if you travel and stay away from your home overnight in the

Web 25 Apr 2023 nbsp 0183 32 You can claim a tax deduction for the cost of transport on trips to perform your work duties for example if you travel from your regular place of work to Web 18 Aug 2019 nbsp 0183 32 Your business can claim a deduction for travel expenses related to your business whether the travel is taken within a day overnight or for many nights

Travel Tax Deduction Australia

Travel Tax Deduction Australia

https://www.smarttaxdeductions.com.au/wp-content/uploads/2020/07/travel-faq-724x1024.png

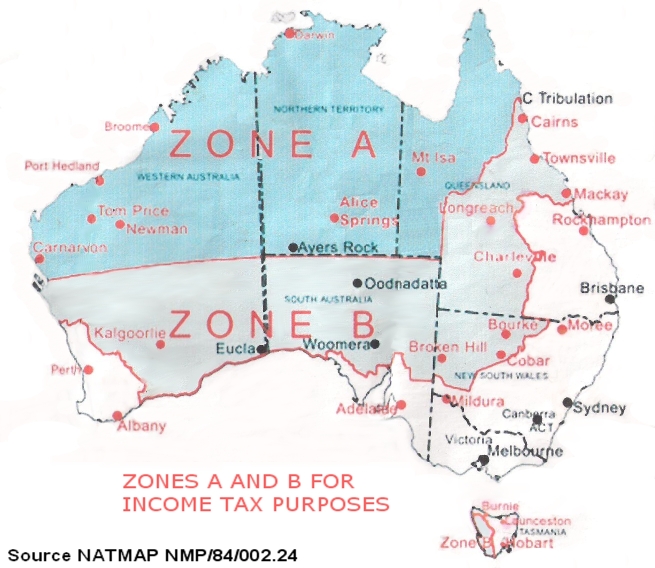

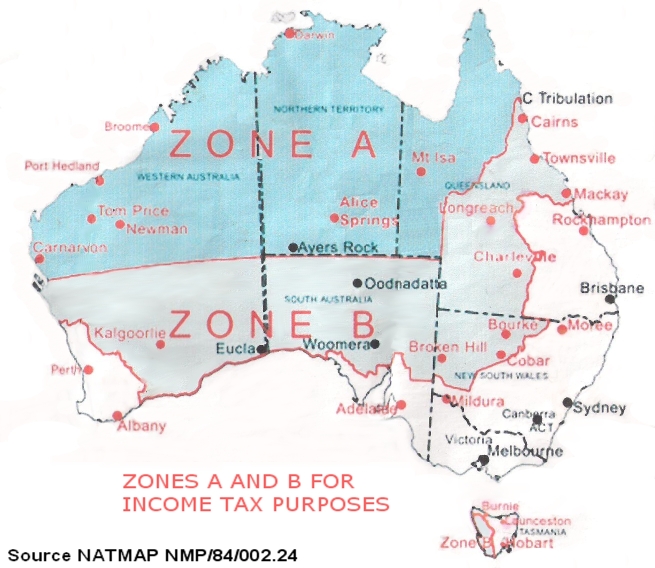

Travelling Workers BAN TACS

http://www.bantacs.com.au/wp-content/uploads/2016/03/taxzones.jpg

Everything You Need To Know About The Business Travel Tax Deduction

https://tmdaccounting.com/wp-content/uploads/2022/11/Everything-You-Need-to-Know-About-the-Business-Travel-Tax-Deduction.png

Web 31 Mai 2022 nbsp 0183 32 If the expense was for both work and private purposes you can only claim a deduction for the work related portion If your total claim for work related expenses is Web 1 Nov 2023 nbsp 0183 32 Work related travel expenses are usually tax deductible However the Australian Taxation Office gets thousands of incorrect claims every year for work

Web Deductions for car transport and travel expenses you incur in the course of your work Tools computers and items you use for work Deductions for tools computers internet Web TR 2021 D1 travelling vs living expenses Where an employer provides an allowance or pays or reimburses an employee for travel expenses including accommodation food

Download Travel Tax Deduction Australia

More picture related to Travel Tax Deduction Australia

Business Travel Tax Deduction All You Need To Know TFX US Expat

https://tfxstorageimg.s3.amazonaws.com/hw6p4xyvqzl4i7bunsi5pb6ddkhi

Which Business Travel Expenses Are Tax Deductible Blogger s Beat

https://i.pinimg.com/originals/e2/ab/24/e2ab2447da171af429fb514f23fbc9eb.png

Online Travel Tax Payment The Gozum Show

https://jdcgzm.files.wordpress.com/2017/05/travel-tax-8.jpg

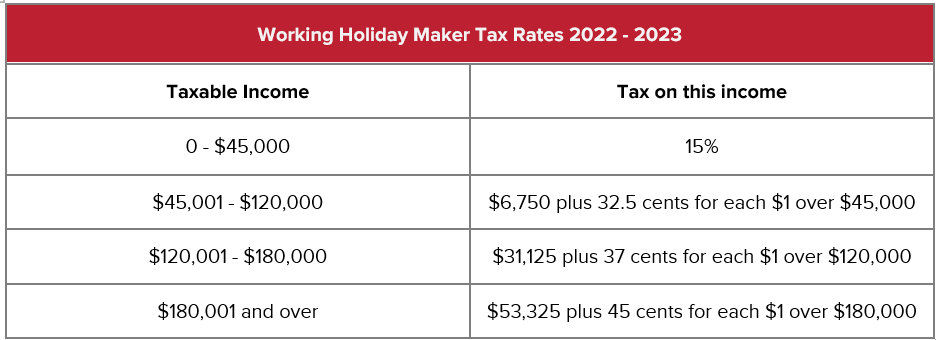

Web On 17 February 2021 the Australian Taxation Office ATO released the following new guidance in relation to whether an employee is travelling on work or otherwise and the Web If you do this you will not pay any income tax on your travel allowance However if you spent more than your travel allowance on deductible travel allowance expenses you

Web 24 Aug 2021 nbsp 0183 32 Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away Web The following travel related expenses are tax deductible if you are eligible to claim them check eligibility rules further down this page Accommodation Incidental expenses

You Can Now Pay Travel Tax Online Here s How Philstar

https://media.philstar.com/photos/2022/07/30/travel_2022-07-30_21-52-17.jpg

Calculating GST On Uber Income DriveTax Australia

https://www.drivetax.com.au/wp-content/uploads/2020/02/Calculating-GST-on-Uber-Income.jpg

https://www.ato.gov.au/individuals-and-families/income-deductions...

Web 13 Dez 2023 nbsp 0183 32 You can claim a deduction for travel expenses accommodation meals and incidental expenses if you travel and stay away from your home overnight in the

https://www.ato.gov.au/individuals-and-families/income-deductions...

Web 25 Apr 2023 nbsp 0183 32 You can claim a tax deduction for the cost of transport on trips to perform your work duties for example if you travel from your regular place of work to

Ato Tax Calculator Australia 2021 Ato Weekly Tax Calculator STJBOON

You Can Now Pay Travel Tax Online Here s How Philstar

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

10 Easy Home Based Small Business Tax Deductions LearnAboutUs

Maximise Tax Deduction Australian Tax YouTube

Travel Tax Petition Taxpayers Union

Travel Tax Petition Taxpayers Union

Weekly Tax Table Australian Taxation Office

The Latest In Payroll News Australia 2022 2023 Polyglot Group

Company Eligible For Deduction Of Foreign Travel Expenses Of Employee

Travel Tax Deduction Australia - Web 20 Sept 2023 nbsp 0183 32 Some expenses the Australian Taxation Office ATO allows as travel tax deductions include accommodation meals and transportation For accommodation