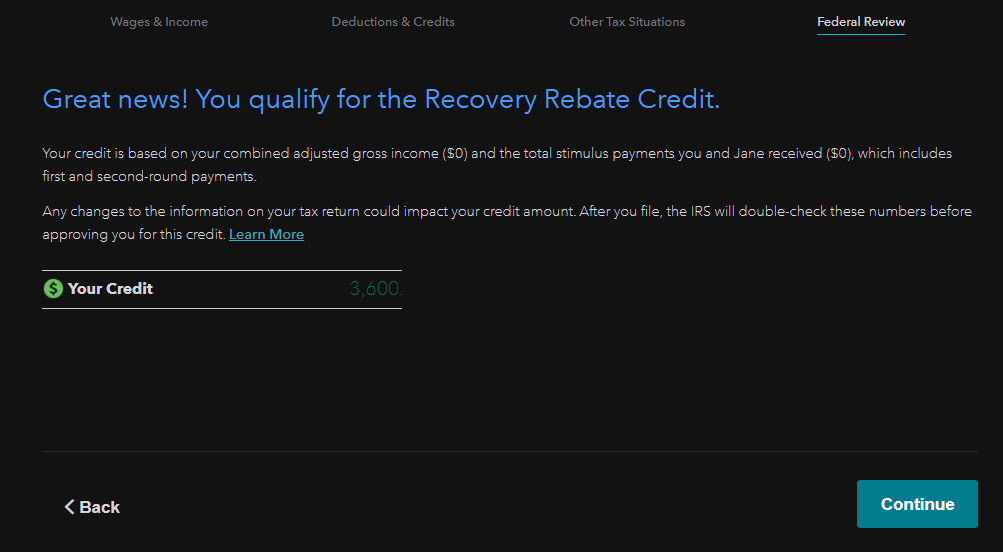

Turbotax Recovery Rebate Credit 2024 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax return and continue processing it

People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020 and early 2021 Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return

Turbotax Recovery Rebate Credit 2024

Turbotax Recovery Rebate Credit 2024

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/where-to-enter-recovery-rebate-credit-in-turbotax-recovery-rebate-15.jpg

Recovery Rebate Credit Form Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/2022-tax-form-1040es.jpg

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-stimulus-check-2021-turbotax-it-s-not-too-late-claim-a.jpg?resize=1536%2C1025&ssl=1

TurboTax requires a minimum tax refund of 500 and can loan as much as 4000 at 0 APR Taxes must be e filed with TurboTax and you cannot file as a resident of Connecticut Illinois or North The Recovery Rebate Credit is a credit that was authorized by the Coronavirus Aid Relief and Economic Security CARES Act

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit IRS Free File participants These tax providers are participating in IRS Free File in 2024 Tax Tip 2024 03 Jan 22 2024 IRS Free File is now available for the 2024 filing season With this program eligible taxpayers can prepare and file their federal tax returns using free tax software from trusted IRS Free File partners

Download Turbotax Recovery Rebate Credit 2024

More picture related to Turbotax Recovery Rebate Credit 2024

Recovery Rebate Credit On The 2022 Tax Return Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/turbotax-recovery-rebate-credit-form-printable-rebate-form-14.jpg

What Section Is The Recovery Rebate Credit On Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-30.png?fit=924%2C568&ssl=1

Recovery Rebate 2023 Turbotax Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-6.jpg

You might remember that back in early 2022 the FTC took action against Intuit the company that owns TurboTax The FTC said that TurboTax s file FREE claims misled people because most people didn t qualify for 0 to file Except they only found that out well after they spent a lot of time putting all their info into the system The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000 198 000 for married couples you got no

If you have an adjusted gross income AGI of up to 75 000 112 500 Head of Household 150 000 married filing jointly you could be eligible for the full amount of the recovery rebate 600 for eligible individuals 1 200 for joint taxpayers and an additional 600 for each dependent child under 17 Even if you don t file taxes you can still file for the recovery rebate credit with the 1040 form but at this point the filing lines for the IRS aren t even open yet

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-turbotax-studying-worksheets.jpg?resize=1536%2C864&ssl=1

How To Claim Stimulus Recovery Rebate Credit On TurboTax

https://www.irsofficesearch.org/wp-content/uploads/2021/02/recovery-rebate-credit.png

https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-credits-deductions/refund-adjusted-claiming-recovery-rebate-credit/L6nvkjniG_US_en_US

The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax return and continue processing it

https://www.irs.gov/newsroom/recovery-rebate-credit

People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020 and early 2021

What Is The 2020 Recovery Rebate Credit And Am I Eligible TurboTax Tax Tips Videos

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

Stimulus Checks Tax Return Irs Turbotax QATAX Recovery Rebate

Stimulus Check Irs Turbotax STIMUQ Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

What Is A Recovery Rebate Tax Credit The TurboTax Blog

What Is A Recovery Rebate Tax Credit The TurboTax Blog

How To Claim The Recovery Rebate Credit Stimulus Checks On TurboTax YouTube

What Is A Recovery Rebate Tax Credit The TurboTax Blog

What Is A Recovery Rebate Tax Credit The TurboTax Blog

Turbotax Recovery Rebate Credit 2024 - TurboTax requires a minimum tax refund of 500 and can loan as much as 4000 at 0 APR Taxes must be e filed with TurboTax and you cannot file as a resident of Connecticut Illinois or North