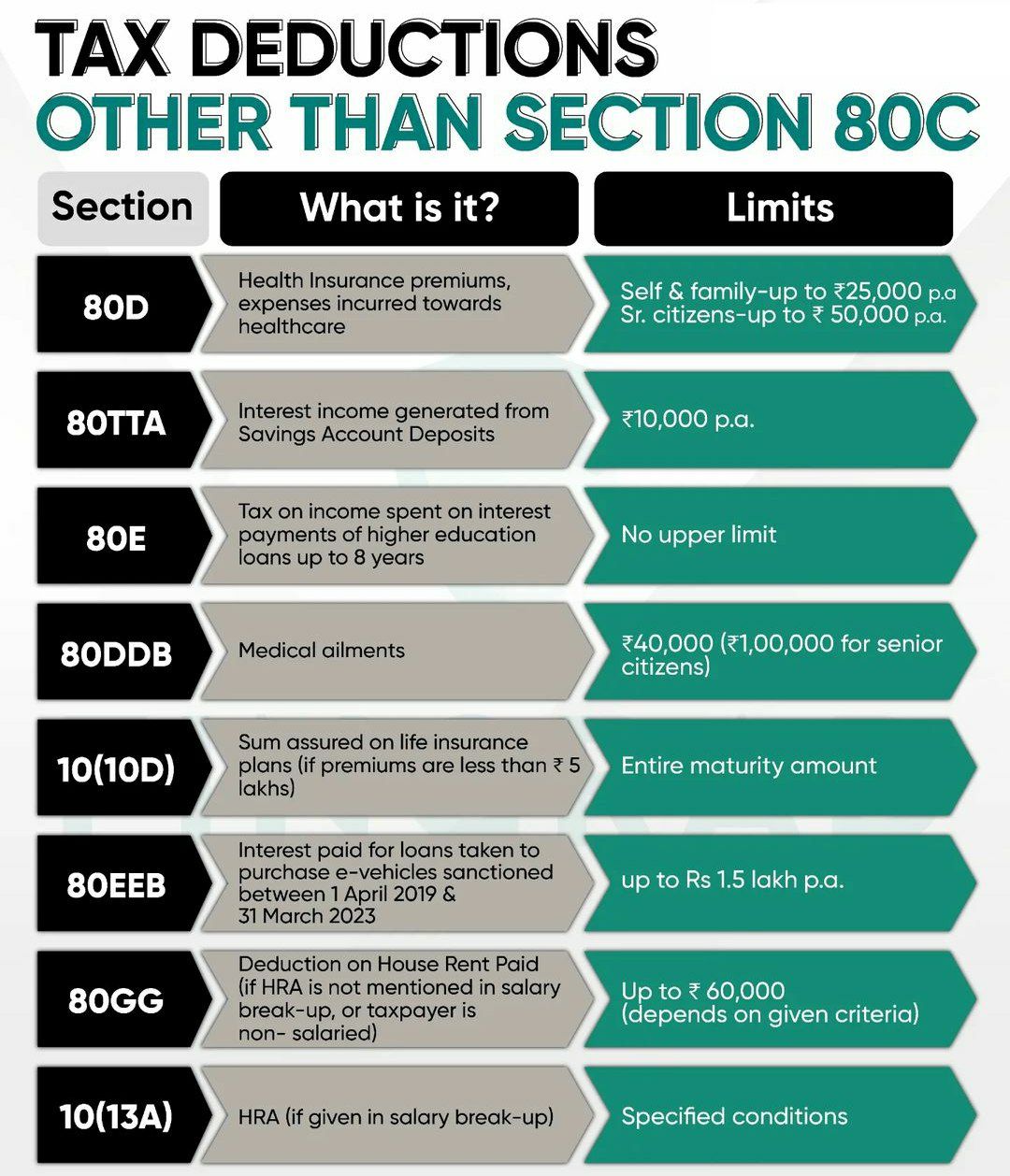

U S 80g Deduction Is Allowed For Web 11 Dez 2023 nbsp 0183 32 80GG deduction will be allowed as lowest of below mentioned Rs 5 000 per month 25 of the adjusted total income Actual rent minus 10 of adjusted total income

Web 12 Apr 2023 nbsp 0183 32 Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions ranging from 50 to Web 9 Feb 2023 nbsp 0183 32 Last updated on February 9th 2023 Section 80G of income tax act allows tax deductions on donations made to certain organizations and relief funds This deduction encourages taxpayers to donate and avail the satisfaction of giving back to the community along with a reduction in their tax liability

U S 80g Deduction Is Allowed For

U S 80g Deduction Is Allowed For

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/SECTION-80G-Deduction-for-Donations-to-certain-Charitable-Institutions.png

What Is Section 80G Tax Deductions On Your Donations Deduction U s

https://i.ytimg.com/vi/qbX0I6TKH9g/maxresdefault.jpg

Calculation Of Deduction U s 80G YouTube

https://i.ytimg.com/vi/cPm3JIxRiM0/maxresdefault.jpg

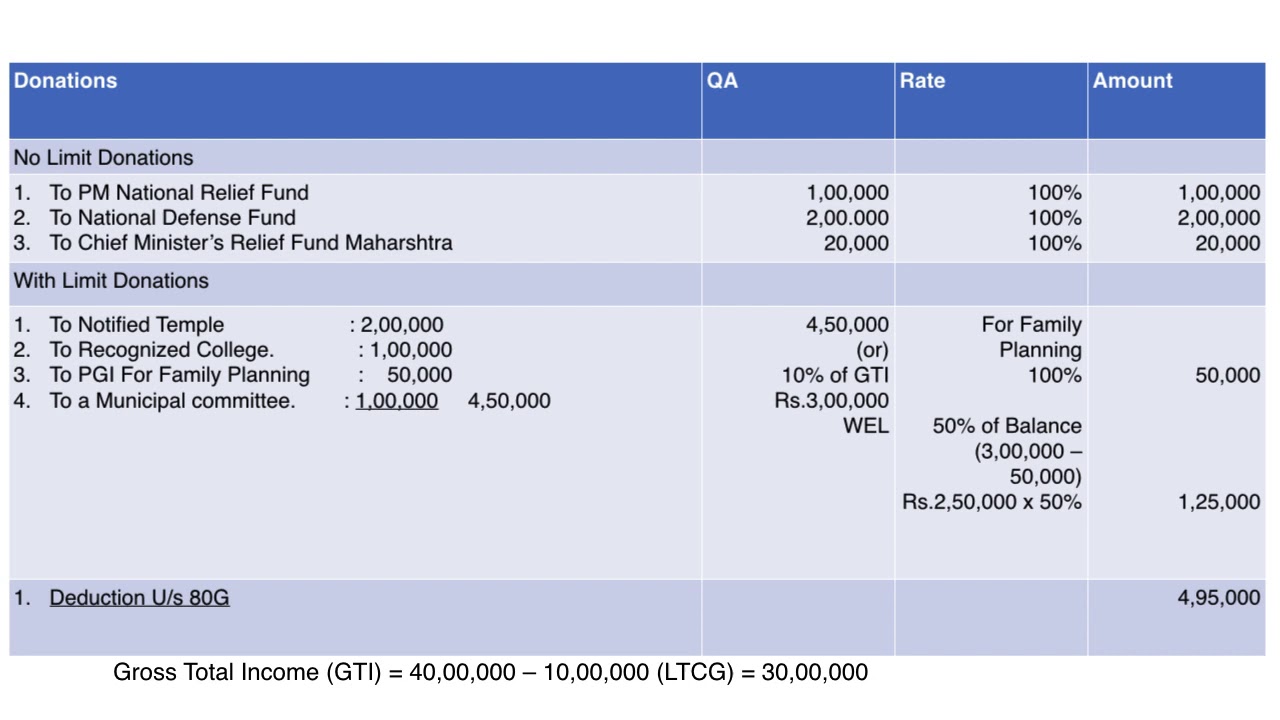

Web Deductions which are allowed without any maximum limit The following donations are allowed to be claimed as a deduction under section 80G However in some cases the full deduction is allowed of the amount donated whereas in some cases only 50 of the amount donated can be claimed as a deduction Web 30 Dez 2023 nbsp 0183 32 Some points to be kept in mind while claiming deduction u s 80G are as follows If you make any donation to a foreign trust then no deduction u s 80G will be allowed Any donation made to political parties like souvenirs pamphlets etc will not be eligible for deduction under this All

Web 24 Okt 2023 nbsp 0183 32 Donations Eligible for 100 Deduction u s 80G Without Qualifying Limit Following are donations eligible for 100 deduction u s 80G without qualifying limit National Defence Fund set up by the Central Government Prime Minister s National Relief Fund National Foundation for Communal Harmony Web Deduction u s 80G is available on account of any donation made by the assessee to specified funds or institutions In some cases deduction is available after applying a qualifying limit while in others it is allowed without applying any qualifying limit

Download U S 80g Deduction Is Allowed For

More picture related to U S 80g Deduction Is Allowed For

Section 80g Deduction 80g Section 80g Of Income Tax Act 2020 21

https://i.ytimg.com/vi/gJwepgBOgKE/maxresdefault.jpg

Information On Section 80G Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2021/12/Section-80G-Deduction-1024x536.png

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191025/a893d00e6a764d2f9dbbb7838baa295d.jpg

Web 18 Juni 2021 nbsp 0183 32 While filing their income tax returns Donor A could easily avail 80G deduction for the donation given XYZ Foundation had no other obligations to fulfill to ensure that Donor A was eligible to claim the benefit of Web Deduction u s 80G is available on account of any donation made by the assessee to specified funds or institutions In some cases deduction is available after applying a qualifying limit while in others it is allowed without applying any qualifying limit

Web 8 Feb 2023 nbsp 0183 32 CSR expenditure is not voluntary but mandatory in Nature whereas 80G deduction should be allowed in a case of voluntary payment The intention of the legislature was never to allow deduction for CSR expenditure else it would result in subsidising the CSR expenditure by one third amount Web To be able to claim deductions under Section 80G donations of more than Rs 2 000 have to made to be made in any mode other than cash The donations will either be eligible for a deduction of 50 or 100 with or without restriction as

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Explanation Of Section 80G Tax ExemptionLimit Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/07/Section-80G.png

https://cleartax.in/s/donation-under-section-80g-and-80gga

Web 11 Dez 2023 nbsp 0183 32 80GG deduction will be allowed as lowest of below mentioned Rs 5 000 per month 25 of the adjusted total income Actual rent minus 10 of adjusted total income

https://economictimes.indiatimes.com/wealth/tax/what-is-section-80g...

Web 12 Apr 2023 nbsp 0183 32 Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions ranging from 50 to

What Is Section 80G Tax Deductions On Your Donations Deduction U s

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Changes In Norms Exemptions Under Section 80G Section 12A 12AA

Chapter VI A 80G Deduction For Donation To Charitable Institution

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Section 80G Deduction Is Allowed By ITAT If Assessee Provides

Section 80G Deduction Is Allowed By ITAT If Assessee Provides

Deduction Under Section 80G Part 2 YouTube

Section 80C Deductions List To Save Income Tax FinCalC Blog

Deductions U S 80C Under Schedule VI Of Income Tax India Financial

U S 80g Deduction Is Allowed For - Web Deduction u s 80G is available on account of any donation made by the assessee to specified funds or institutions In some cases deduction is available after applying a qualifying limit while in others it is allowed without applying any qualifying limit