U S Treasury Details Ev Tax Credit Rebate Rules WASHINGTON Reuters The U S Treasury Department on Friday issued new guidance on how a 7 500 electric vehicle tax credit can be used as a point of sale rebate starting in January

August 16 2022 Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released final rules on the clean vehicle provisions of the Inflation Reduction Act IRA that are lowering costs for consumers spurring a boom in U S manufacturing and strengthening energy security by building resilient supply chains with

U S Treasury Details Ev Tax Credit Rebate Rules

U S Treasury Details Ev Tax Credit Rebate Rules

https://static.wixstatic.com/media/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png/v1/fit/w_2500,h_1330,al_c/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png

U S Treasury s Yellen Says IRS Needs To Be completely Redone

https://s.yimg.com/ny/api/res/1.2/5.CUtPM.4PxhSGZIA5ergg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://s.yimg.com/os/creatr-uploaded-images/2023-01/e6f2fba0-9b31-11ed-b01d-4aacc7f8f44f

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

WASHINGTON Reuters The U S Treasury Department on Friday issued new guidance on how a 7 500 electric vehicle tax credit can be used as a point of sale rebate starting in January WASHINGTON Oct 6 Reuters The U S Treasury Department on Friday issued new guidance on how a 7 500 electric vehicle tax credit can be used as a point of sale rebate starting in January

WASHINGTON The US Treasury Department on Friday Oct 6 issued new guidance on how a US 7 500 electric vehicle tax credit can be used as a point of sale rebate starting in January Currently The U S government has loosened some rules governing electric vehicle tax credits a bit potentially making more EVs eligible for credits of up to 7 500 The Treasury Department announced final regulations for the credits under the 2022 Inflation Reduction Act on Friday May 3 giving automakers more time to comply with some

Download U S Treasury Details Ev Tax Credit Rebate Rules

More picture related to U S Treasury Details Ev Tax Credit Rebate Rules

U S Treasury Unveils New EV Tax Credit Rules

https://cdn.thefabricator.com/a/us-treasury-unveils-new-ev-tax-credit-rules-1680290381.JPG

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Direct Deposit Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Direct-Deposit-Invoice-Template.png

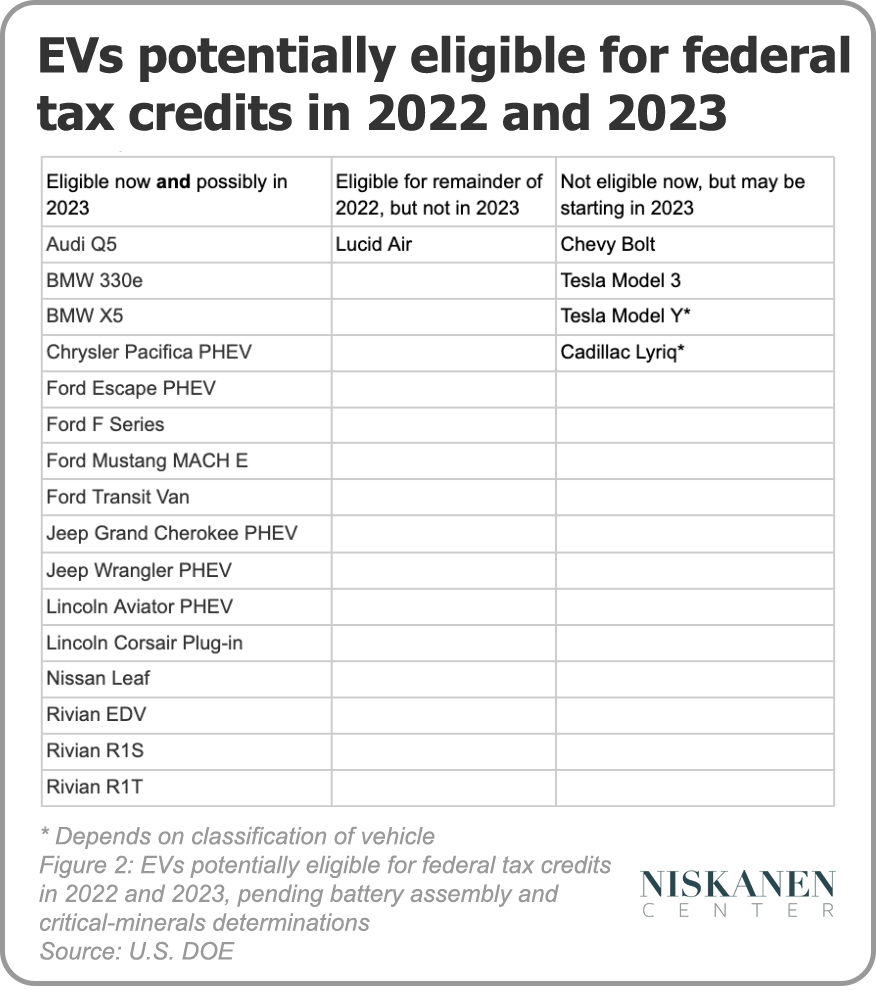

Currently only 22 out of the 104 electric vehicles for sale in the US are eligible to the tax credit More EVs are expected to become eligible as automakers start to adapt to the new rules Add Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and their previously owned clean vehicle credit of up to 4 000 to a car dealer starting January 1 2024

The U S Treasury Department and IRS released for publication in the Federal Register final regulations T D 9995 regarding clean vehicle tax credits under sections 25E and 30D introduced by the Inflation Reduction Act of 2022 IRA for the purchase of qualifying new and previously owned clean vehicles including new and previously WASHINGTON Reuters The U S Treasury Department on Friday issued new guidance on how a 7 500 electric vehicle tax credit can be used as a point of sale rebate starting in January Currently

U S Treasury nationwide Online Auction Ending 4 12 2022

http://s3-us-west-2.amazonaws.com/gotoauction.com.gallery/2705/1393868/2705_1393868_Gm45BIfOphhFOc2FihpXbmbTnfMUUg1F.jpg

2023 Federal Tax Credit Only Six BEV Manufacturers Qualify

https://cdn.motor1.com/images/custom/fact-sheet-ira-ev-tax-credits-electrification-coalition-and-safe.png

https://finance.yahoo.com/news/u-treasury-details...

WASHINGTON Reuters The U S Treasury Department on Friday issued new guidance on how a 7 500 electric vehicle tax credit can be used as a point of sale rebate starting in January

https://home.treasury.gov/news/press-releases/jy0923

August 16 2022 Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable

Treasury market Liquidity May Not Improve Under 2024 Buyback Plan

U S Treasury nationwide Online Auction Ending 4 12 2022

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Rule Bonds And Notes And Securities U S Treasury Legacy Treasury

Tether Resumed Lending Its USDT To Customer TokenInsight

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

U S Treasury Stalls EV Tax Credit Guidance The Truth About Cars

Federal EV Tax Credits Are About To Become Scarce Who Should Get Them

The U S Could Hit Its Debt Ceiling Within Days Here s What You Need

U S Treasury Details Ev Tax Credit Rebate Rules - The U S government has loosened some rules governing electric vehicle tax credits a bit potentially making more EVs eligible for credits of up to 7 500 The Treasury Department announced final regulations for the credits under the 2022 Inflation Reduction Act on Friday May 3 giving automakers more time to comply with some