Under Construction Property Tax Benefit India Web 20 Okt 2023 nbsp 0183 32 The answer is no but not without certain caveats One reason why you can t enjoy a home loan interest tax benefit under Section 80EEA for an under construction property is that you need a possession certificate to claim it The certificate is only issued once construction is complete and handover is done

Web Check Out If An Individual Can Avail Tax Benefits On Under Construction Property Know More On Income Tax Benefit On Home Loan s Interest In The Pre Construction Period In This Blog From Tata Capital Web 29 M 228 rz 2023 nbsp 0183 32 Home Loan Tax Benefits on Under Construction Properties Under Section 80EEA As mentioned before under Section 24 of the Income Tax Act borrowers can claim tax exemption on interest paid during the construction phase after the completion of construction

Under Construction Property Tax Benefit India

Under Construction Property Tax Benefit India

https://www.lawampm.com/wp-content/uploads/2022/11/know-about-the-property-tax-benefit.jpg

Registration In Delhi

https://registrationindelhi.com/pic/const.jpg

Tax Benefits On Under Construction Properties Home Loan Tax Benefits

https://img.staticmb.com/mbcontent/images/uploads/2023/1/under-construction-property-tax-benefit.jpg

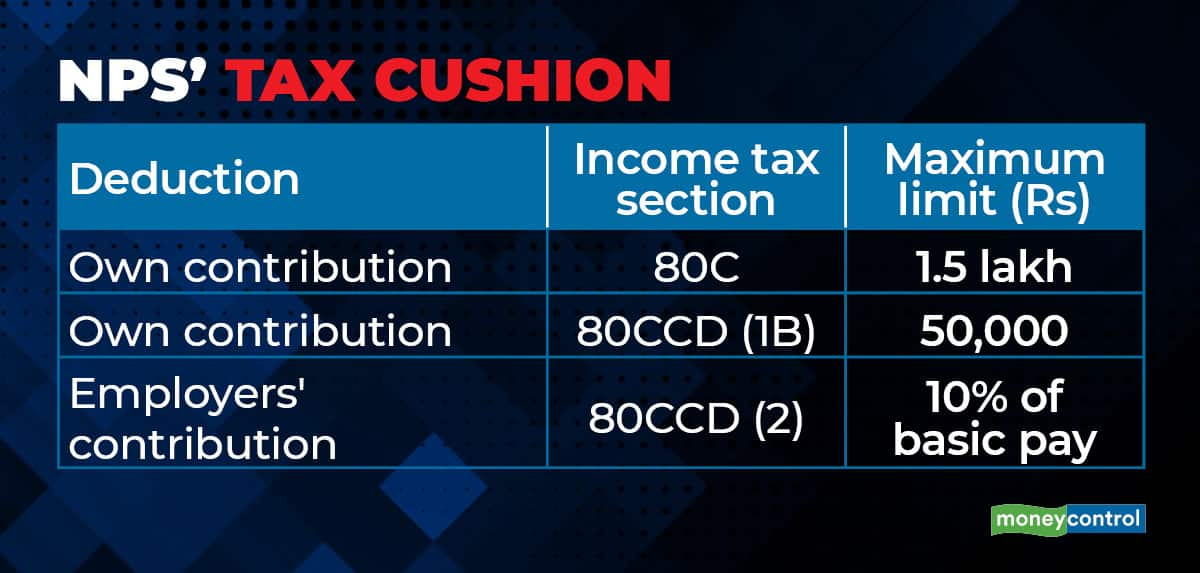

Web 20 Sept 2023 nbsp 0183 32 Under Construction Property Tax Benefit Section 80C Once the pre construction period ends homeowners can claim the tax benefit on under construction property under Section 80C of up to Rs 1 5 lakh per financial year This deduction is available for the paid home loan principal amount Web 9 Nov 2023 nbsp 0183 32 Section 80EEA of the Income Tax Act introduces an additional tax benefit for individuals investing in under construction properties This benefit allows for a deduction of up to 1 50 000 per financial year on the interest paid on home loans provided that the limit of 1 5 lakh under Section 80C has already been exhausted

Web 26 Okt 2022 nbsp 0183 32 When the under construction house qualifies as a long term capital asset the benefit of indexation shall be available Selling a property requires a lot of research and survey about the market rates stamp duty value brokerage tax implications and so on Web The amount claimed under Section 80C will be added back to his income in the year of sale and he will be taxed accordingly if the property is sold within five years from the date of completion of construction obtaining possession Now let s look at interest paid when the house was under construction

Download Under Construction Property Tax Benefit India

More picture related to Under Construction Property Tax Benefit India

Property Tax Breaks California Property Tax NewsCalifornia Property

https://propertytaxnews.org/wp-content/uploads/2022/01/Property-Taxes-In-California-scaled.jpg

Make The Right Choice Between Resale And Under Construction Property

https://www.bajajfinservmarkets.in/content/dam/discover/Make the right choice between resale and under construction property.jpg

What Are The Tax Benefits That NPS Offers

https://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

Web 12 Nov 2021 nbsp 0183 32 Section 24 of the Income Tax Act makes it plain that no tax benefits can be obtained if the construction is not complete Here s how you can calculate the deduction for an under construction property What is the meaning of the previous period Web 9 M 228 rz 2021 nbsp 0183 32 Income tax laws allow you to claim the total interest paid during the pre delivery period as a deduction in five equal instalments starting from the financial year in which the construction was completed or you acquired your apartment generally denoting the date of possession

Web 1 Dez 2023 nbsp 0183 32 Under Section 80C of the Income Tax Act a borrower can claim tax exemption on the payments made towards stamp duty registration charges and repayment of principle amount of housing loan However once again one can claim these deductions only after the construction of the property is complete Web 5 Feb 2023 nbsp 0183 32 Say you bought an under construction property and have not moved in yet But you are paying the EMIs In this case your eligibility to claim interest on the home loan as a deduction begins only upon completion of construction or immediately if you buy a fully constructed property

Is It Good To Buy Under Construction Property In Delhi

https://www.onemidtowndelhi.com/img/blogs/94649d8edf_Increase-the-Value-of-Your-Real-Estate-Properties-681x511.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

https://www.iiflhomeloans.com/blogs/section-80eea-under-construction...

Web 20 Okt 2023 nbsp 0183 32 The answer is no but not without certain caveats One reason why you can t enjoy a home loan interest tax benefit under Section 80EEA for an under construction property is that you need a possession certificate to claim it The certificate is only issued once construction is complete and handover is done

https://www.tatacapital.com/blog/loan-for-home/home-loan-tax-benefits...

Web Check Out If An Individual Can Avail Tax Benefits On Under Construction Property Know More On Income Tax Benefit On Home Loan s Interest In The Pre Construction Period In This Blog From Tata Capital

Compare Home Loan Offers Get Best Deal Lowest Rate Makaanloan

Is It Good To Buy Under Construction Property In Delhi

Property Tax Rates By State Millionacres

What Are The Tax Benefits Of Investing In Real Estate A Guide For

The Best Tax Benefits Of Real Estate Investing FortuneBuilders

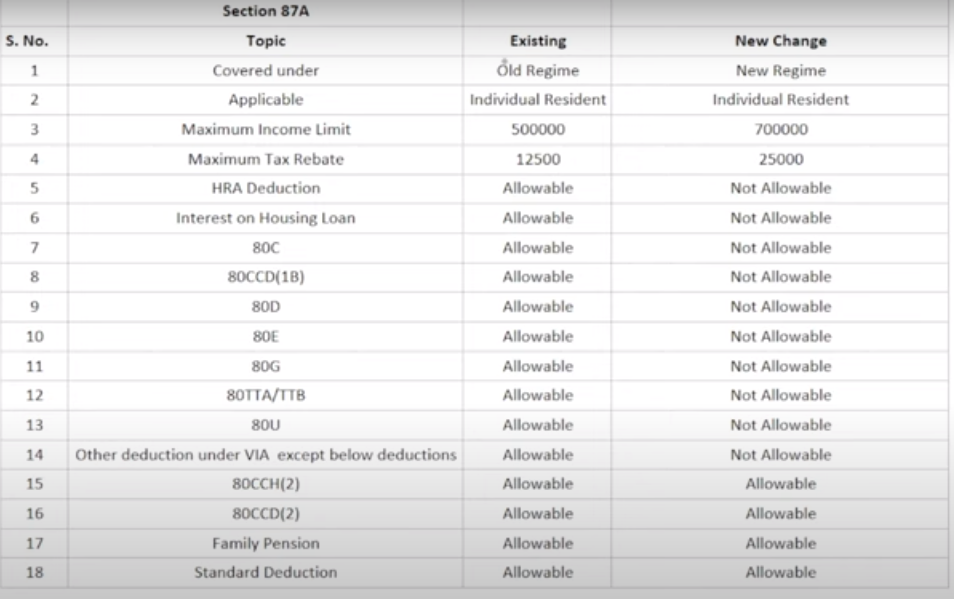

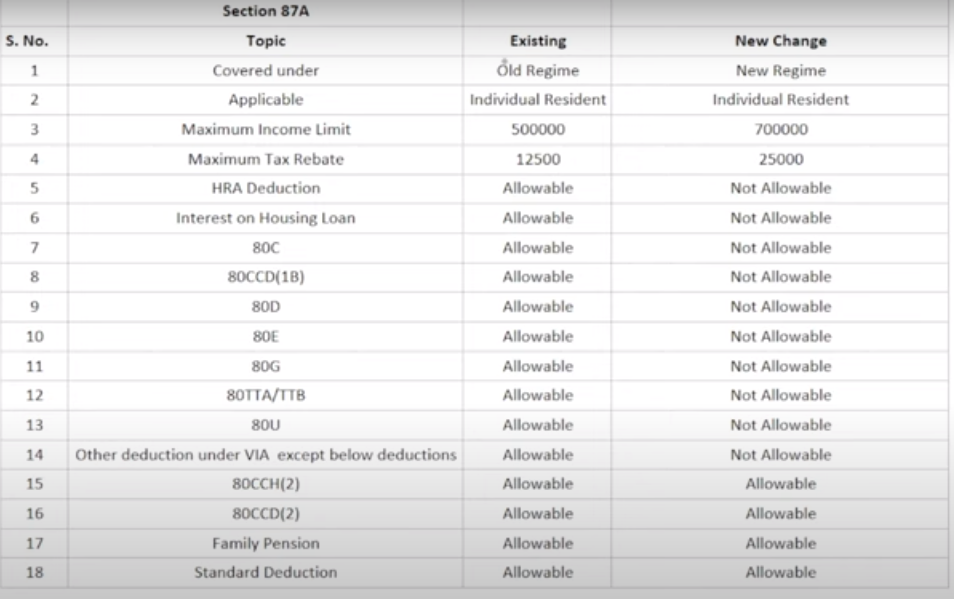

New Income Tax Slab Rate For FY 2023 2024 AY 2024 2025 Stocks

New Income Tax Slab Rate For FY 2023 2024 AY 2024 2025 Stocks

)

Under construction Or Ready to move in House How To Make A Choice

How To Appeal Your Property Taxes In 3 Quick Steps Property Buying

Benefits Of Buying Under construction Property Apartments In Manapakkam

Under Construction Property Tax Benefit India - Web 26 Okt 2022 nbsp 0183 32 When the under construction house qualifies as a long term capital asset the benefit of indexation shall be available Selling a property requires a lot of research and survey about the market rates stamp duty value brokerage tax implications and so on