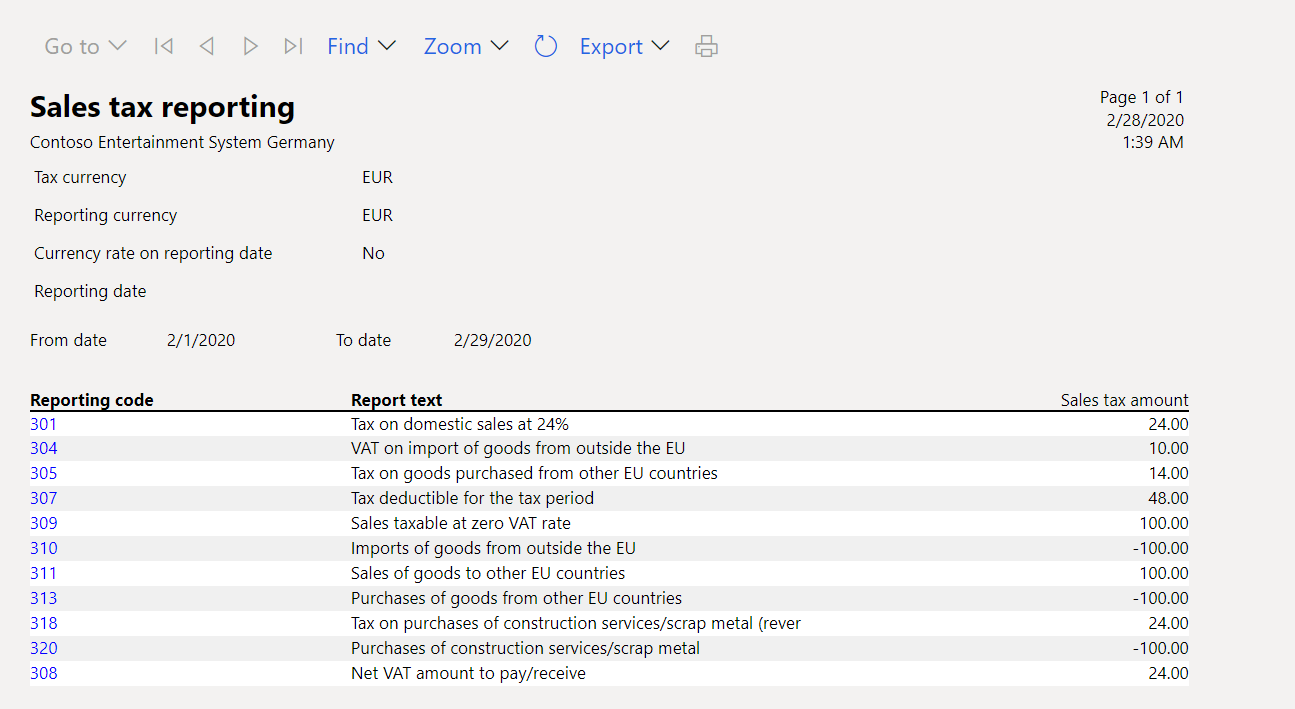

Us Sales Tax Reporting April 13 2023 If your business is in a sales tax state you ll need to collect report and pay sales taxes to your state on the products or services

01 Sync your sales data with what you already use including Shopify Amazon Etsy Walmart Marketplace and over 1 000 other signed partner integrations STEP 02 Add registration details for all the locations where The 50 US states are broadly free to charge sales tax on businesses with a local permanent establishment or nexus in their territory This is typically employees and or premises

Us Sales Tax Reporting

Us Sales Tax Reporting

https://leestaxservicellc.com/files/IMG_1348.png

Washington Ranks Highest In Nation For Reliance On Sales Tax 790 KGMI

https://kgmi.com/wp-content/blogs.dir/70/files/2019/05/Tax-Foundation-Sales-Tax-Reliance-by-State.png

Sales Tax Finevolution

https://finevolution.com.ua/wp-content/uploads/2021/11/sales_tax_finevolution_article-2.jpg

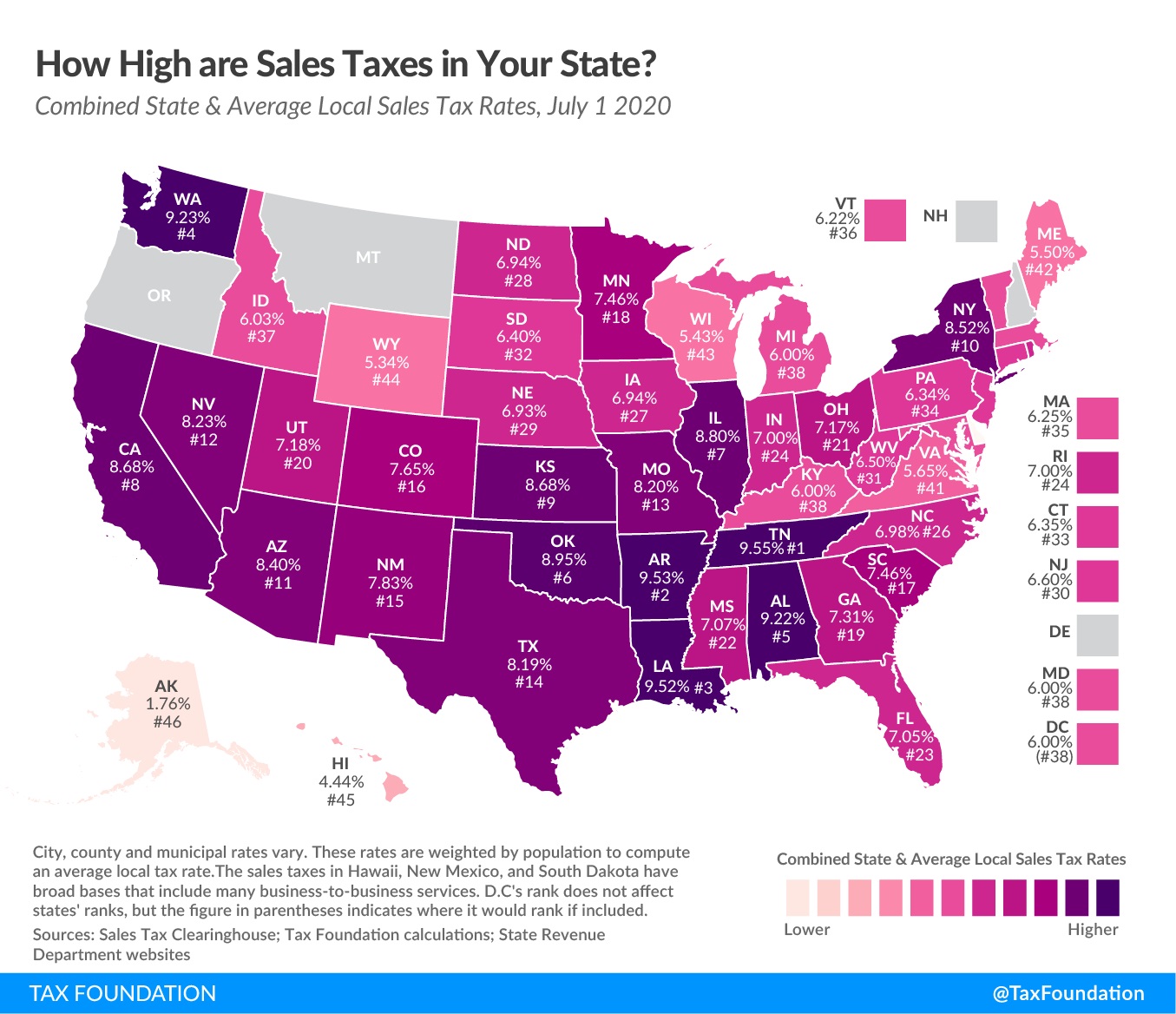

When an out of state retailer makes sales to customers in a state where the seller has no actual place of business but otherwise has sufficient connection nexus with that state the retailer is generally required to 0 3 6 9 12 State Local Sales Taxes 2021 Median household income and taxes State local sales taxes average Sales taxes in the United States are taxes placed on the sale or lease of goods and

One of the most important parts of collecting and remitting sales tax is filing your sales tax return with the relevant state If you re registered for sales tax with a state then you re US Sales Tax is a consumption tax on the sale of goods and services to the end consumer Unlike VAT or GST it is only levied on the final transaction with the customer and there

Download Us Sales Tax Reporting

More picture related to Us Sales Tax Reporting

Top 3 Which States Do Not Collect Sales Tax In 2022 G u y

https://www.taxjar.com/wp-content/uploads/TAX_States-Without-Sales-Tax_Blog_L1R1-copy.jpg

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Sales Tax pdf Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/6e659190-6e21-499f-b500-e7f0a3517f93_1.png

45 states impose sales and use tax at the state level The 5 that do not are the NOMAD states New Hampshire Oregon Montana Alaska and Delaware Many Here are the main steps in the process of preparing to collect report and pay sales taxes Begin by determining whether you must collect sales taxes in a

View your sales and tax data by state county and local jurisdictions making it easier to accurately file your sales tax returns Rate updates are worry free Stop wading through When you first start using Business Central you can run an assisted setup guide to quickly and easily set up sales tax information for your company customers

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Best Used

https://files.taxfoundation.org/legacy/docs/State-and-Local-Rates-LOST-(Large).png

The State With The Greediest Politicians Part II Dan Mitchell

https://freedomandprosperity.org/wp-content/uploads/2020/07/Jul-14-20-Sales-Tax-Map.jpg

https://www.freshbooks.com/.../report-sales-tax

April 13 2023 If your business is in a sales tax state you ll need to collect report and pay sales taxes to your state on the products or services

https://www.avalara.com/us/en/products/sale…

01 Sync your sales data with what you already use including Shopify Amazon Etsy Walmart Marketplace and over 1 000 other signed partner integrations STEP 02 Add registration details for all the locations where

Where Could Interest And Tax Rates Be Headed Mercer Advisors

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Best Used

To What Extent Does Your State Rely On Sales Taxes Upstate Tax

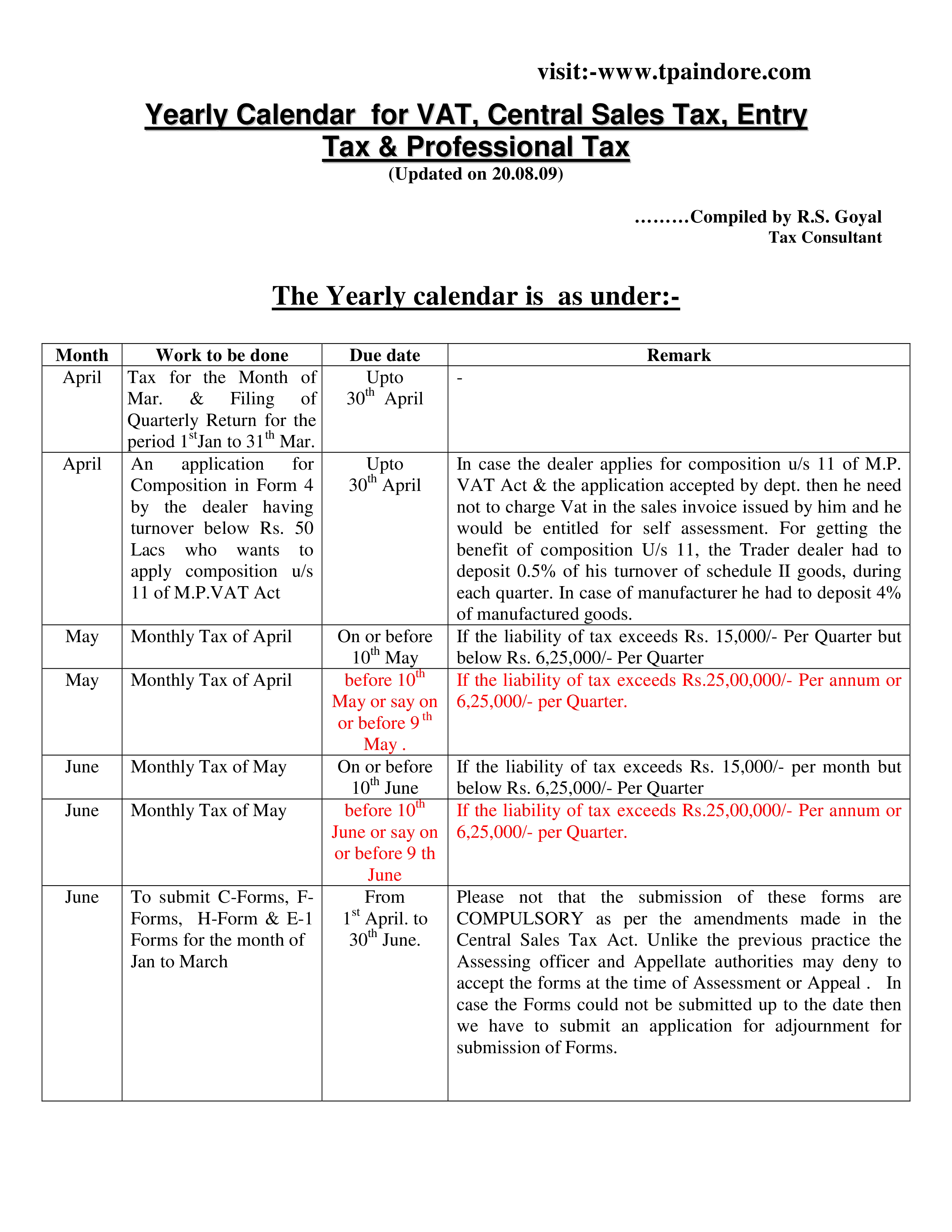

Sales Tax Report For Finland Finance Dynamics 365 Microsoft Learn

Sales Tax In The US How Does It Work Latin Post Latin News

What Is ERS Employment Related Securities Reportable Events

What Is ERS Employment Related Securities Reportable Events

Which State Has The Lowest Sales Tax WorldAtlas

Simplified Tax Reporting For Self employed And Small Businesses

Vector Illustration Of Filing And Payment Of Income Tax With Online

Us Sales Tax Reporting - What is the United States Sales Tax Report You now have near instant access to all the details you need to prepare for filing sales tax This new report