Us Tax Filing Requirements For Non Residents If you are a U S citizen or resident living or traveling outside the United States you generally are required to file income tax returns estate tax returns and gift tax returns and pay estimated tax in the same way as those residing in the United States

Find tax filing and reporting information for U S citizens or resident aliens who reside and earn income overseas If you are living and working in the U S as a nonresident alien you may be required to file a federal tax return The Internal Revenue Service IRS considers you a nonresident alien if you are not a lawful permanent resident Green Card holder or do not pass their substantial presence test

Us Tax Filing Requirements For Non Residents

Us Tax Filing Requirements For Non Residents

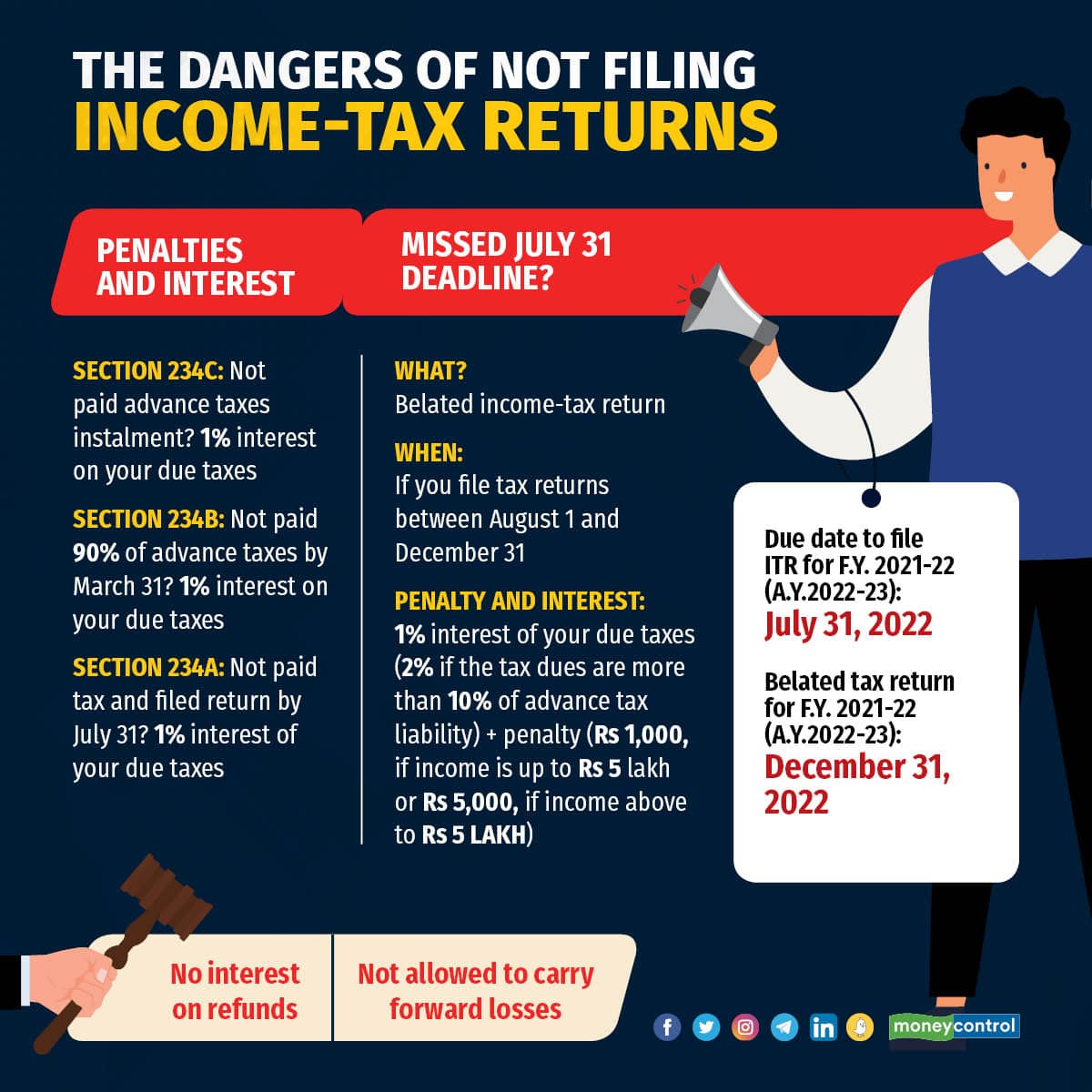

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

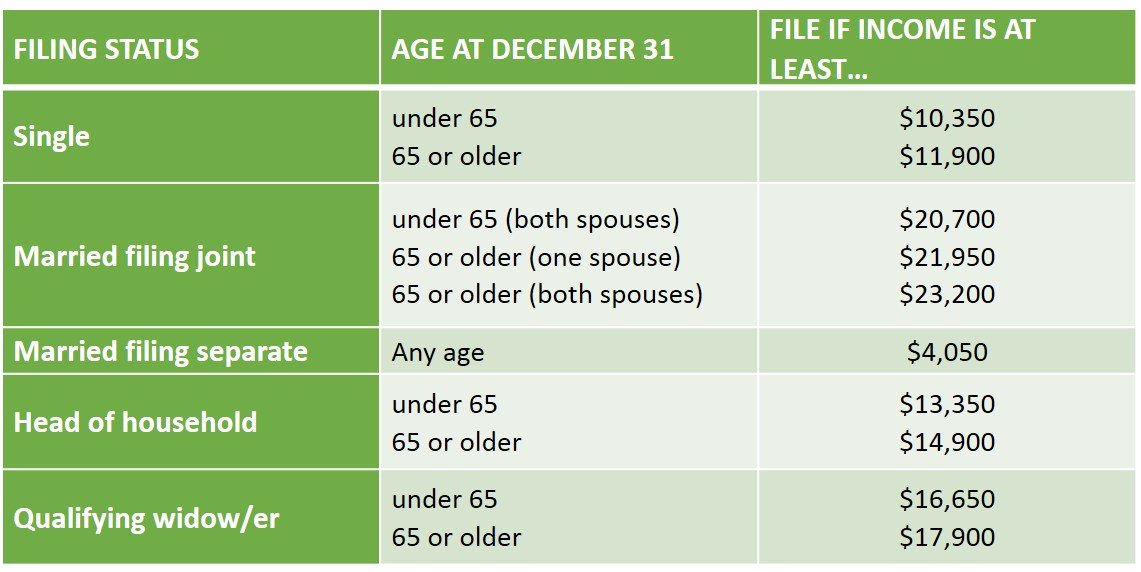

2023 Income Tax Filing Threshold Printable Forms Free Online

https://www.taxestalk.net/wp-content/uploads/a-reader-asks-im-dying-to-vote-in-the-u-s-prez-election-but-will.jpeg

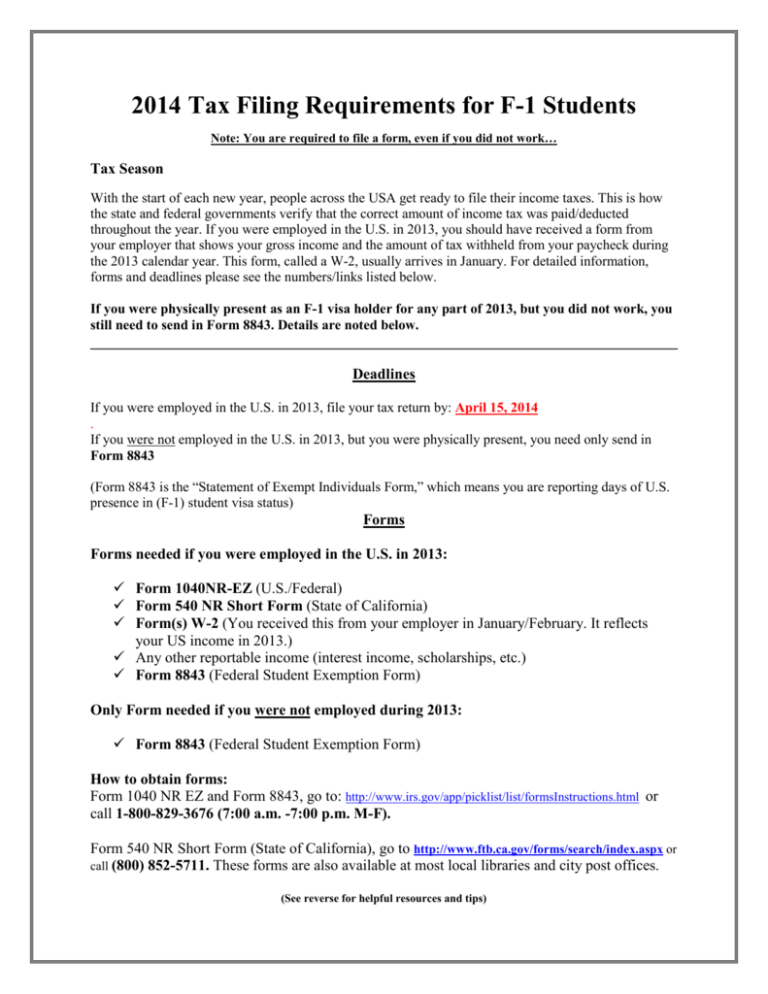

2014 Tax Filing Requirements For F 1 Students

https://s3.studylib.net/store/data/008724834_1-53aabf992961df56464262e2784770a3-768x994.png

If you live abroad and are a U S citizen or Green Card holder find out which tax forms to file what income to report and where to send your return Unlike resident aliens nonresident aliens must file taxes on any income generated within the United States Any foreign earned income doesn t qualify for taxation in the U S

This comprehensive guide simplifies US tax filing for non residents covering filing requirements deductions credits and unique considerations like having US citizen children Non resident filers should file a non resident return using Form 1040 NR and are only required to report U S earned income What are the benefits of filing a tax return if I m not a US resident While non residents cannot claim Social Security benefits there are still plenty of reasons why it can still be beneficial to file a tax return

Download Us Tax Filing Requirements For Non Residents

More picture related to Us Tax Filing Requirements For Non Residents

US Tax Filing Requirements For International Founders The Complete

https://docpro.com/news-preview/176/0e5a8078-8cc4-42f0-b1fe-e92e0f618153.png

Income Tax Return Filing Requirements Explained How To Know When To

https://i.ytimg.com/vi/f99735nYVm0/maxresdefault.jpg

U S Tax Filing Requirements

https://www.noordinaryhomestead.com/wp-content/uploads/2017/09/taxes-expats.jpg

As a legal U S resident you re subject to the same tax rules as U S citizens and must report all income you earn on annual tax returns regardless of which country in which you earn it The IRS uses two tests the green card test and the substantial presence test for assessing your alien status Form 1040NR US Nonresident Alien Income Tax Return is a critical document for certain individuals navigating the US tax system The requirement to file this form applies to non resident aliens engaged in trade or business in the US during the tax year

[desc-10] [desc-11]

Michigan Llc Tax Return Filing Requirements LLC Bible

https://llcbible.com/posts/michigan-llc-tax-return-filing-requirements.png

Income Tax Filing Requirements For Retirees In Good Health Central

https://www.cnyhealth.com/wp-content/uploads/2018/02/Income-tax-ThinkstockPhotos-908062776-715x400.png

https://www.irs.gov › individuals › international...

If you are a U S citizen or resident living or traveling outside the United States you generally are required to file income tax returns estate tax returns and gift tax returns and pay estimated tax in the same way as those residing in the United States

https://www.irs.gov › individuals › international...

Find tax filing and reporting information for U S citizens or resident aliens who reside and earn income overseas

Filing Requirements Table Colorado Value Tax Service

Michigan Llc Tax Return Filing Requirements LLC Bible

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Child Tax Credit

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Printable Tax Declaration Form Printable Form Templates And Letter

:max_bytes(150000):strip_icc()/TaxFilingChart-b3b0026b04464a8da66bcf7c9e479b65.jpg)

168 168

:max_bytes(150000):strip_icc()/TaxFilingChart-b3b0026b04464a8da66bcf7c9e479b65.jpg)

168 168

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

Federal Tax Filing Us Federal Tax Filing Status

Filing US Taxes For The First Time Here s What You Should Take Care Of

Us Tax Filing Requirements For Non Residents - Non resident filers should file a non resident return using Form 1040 NR and are only required to report U S earned income What are the benefits of filing a tax return if I m not a US resident While non residents cannot claim Social Security benefits there are still plenty of reasons why it can still be beneficial to file a tax return