Us Tax Filing Status Your filing status is used to determine your filing requirements standard deduction eligibility for certain credits and your correct tax If more than one filing status applies to you this interview will choose the one that will result in the lowest amount of tax Information you ll need

Taxpayers can start checking their refund status within 24 hours after an e filed return is received The tool also provides a personalized refund date after the return is processed and a refund is approved You can view the status of your refund for the past 3 tax years If you owe money or are receiving a refund you can check your return status by signing in to view your IRS online account information

Us Tax Filing Status

Us Tax Filing Status

https://i0.wp.com/www.the-sun.com/wp-content/uploads/sites/6/2022/01/NINTCHDBPICT000708039451.jpg?ssl=1

US Tax Filing Status For Those With A Foreign Spouse Escape Artist

https://www.escapeartist.com/wp-content/uploads/2017/02/E-2-Visa-for-Treaty-Investors-with-Tax-Holiday-pic.jpg

What s My Tax Filing Status YouTube

https://i.ytimg.com/vi/aF6kzEgt8XA/maxresdefault.jpg

Get Refund Status Please enter your Social Security Number Tax Year your Filing Status and the Refund Amount as shown on your tax return All fields marked with an asterisk are required Enter the SSN or ITIN shown on your tax return Check your federal tax refund status Before checking on your refund have the following ready Social Security number or Individual Taxpayer Identification Number ITIN Filing status The exact whole dollar amount of your refund Use the IRS Where s My Refund tool or the IRS2Go mobile app to check your refund online

To use the What Is My Filing Status tool you will need to know Marital status and spouse s year of death if applicable The percentage of the costs that your household members paid toward keeping up a home The tool is designed for taxpayers who are U S citizens or resident aliens for the entire tax year for which they re inquiring When you file your federal income tax return one of the first decisions you need to make is selecting your filing status

Download Us Tax Filing Status

More picture related to Us Tax Filing Status

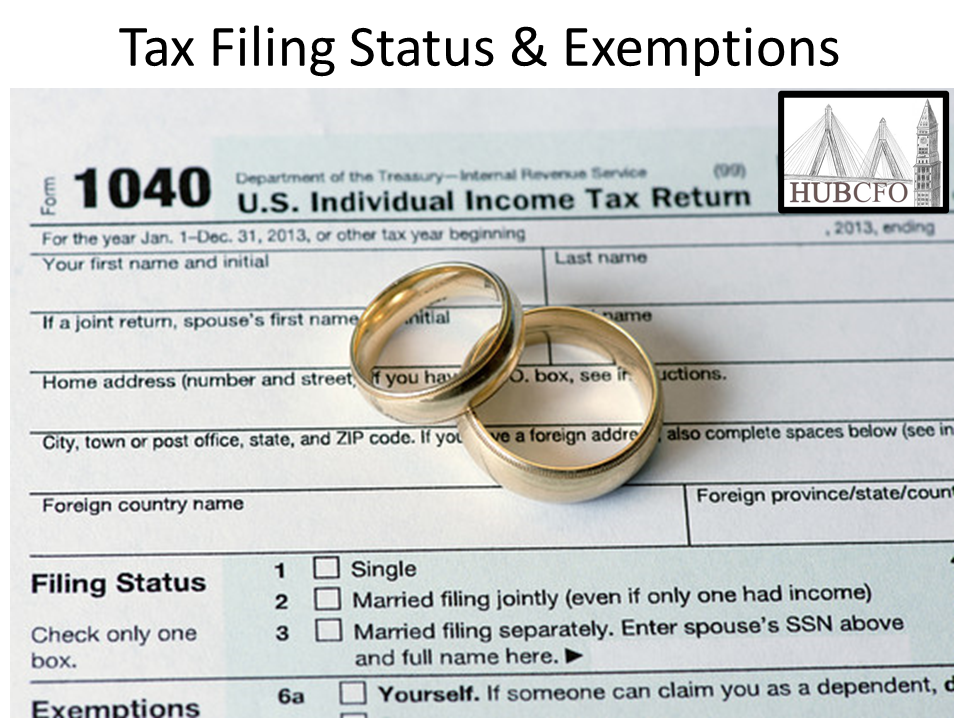

Tax Filing Status And Exemptions

http://blog.hubcfo.com/wp-content/uploads/2016/05/Tax-Filing-Status-Exemptions.png

What Is The Tax Filing Requirement In The USA Ebizfiling

https://ebizfiling.com/wp-content/uploads/2023/03/Tax-filing-requirement-in-the-USA.jpg

3 Ways To Determine Your Tax Filing Status WikiHow

https://www.wikihow.com/images/a/a5/Determine-Your-Tax-Filing-Status-Step-13-Version-2.jpg

An IRS online tool can help you decide whether your filing status and income require you to file a tax return How to file your federal income tax return Learn the steps to file your federal taxes and how to contact the IRS if you need help Find out if your federal or state tax return was received Filing status is a category that defines the type of tax return form a taxpayer must use when filing their taxes Filing status is closely tied to marital status Understanding Filing Status

[desc-10] [desc-11]

Filing US Taxes In Toronto SDG Accountant

https://accountingtoronto.ca/wp-content/uploads/2023/02/filing-us-taxes-in-toronto-sdg.jpg

Paper Calculations 20 Of Americans Are Making This Tax Filing Mistake

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/03/20/USATODAY/usatsports/tax-form-1040_gettyimages-624709906_large.jpg?width=3200&height=1680&fit=crop

https://www.irs.gov/help/ita/what-is-my-filing-status

Your filing status is used to determine your filing requirements standard deduction eligibility for certain credits and your correct tax If more than one filing status applies to you this interview will choose the one that will result in the lowest amount of tax Information you ll need

https://www.irs.gov/newsroom/heres-how-taxpayers-can-check-the...

Taxpayers can start checking their refund status within 24 hours after an e filed return is received The tool also provides a personalized refund date after the return is processed and a refund is approved

Choosing A Tax Filing Status Purposeful finance

Filing US Taxes In Toronto SDG Accountant

ITR Filing These Taxpayers Can Still File Income Tax Return Without

Understanding The Tax Filing Status Options Rodgers Associates

3 Ways To Determine Your Tax Filing Status WikiHow

Filing US Taxes For The First Time Here s What You Should Take Care Of

Filing US Taxes For The First Time Here s What You Should Take Care Of

Tax Filing Guide How To Determine Your Tax Filing Status

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Tax Season 2023 What s New Why Refunds May Be Smaller

Us Tax Filing Status - [desc-13]