Va State Tax Deductions Virginia law allows a subtraction for the amount of any state income tax refund or overpayment credit included in federal adjusted gross income The subtraction is the amount of refund or credit you reported on your federal return

Virginia state income tax rates are 2 3 5 and 5 75 Income tax brackets and rates depend on taxable income and residency status Virginia tax returns for the 2023 tax year were Virginia state offers tax deductions and credits to reduce your tax liability including a standard deduction itemized deduction dependent care credit deductions credits for taxes paid

Va State Tax Deductions

Va State Tax Deductions

https://i2.wp.com/m.foolcdn.com/media/the-blueprint/images/PayrollTaxes-01-IRSWithholdingTable.width-800.png

John A Field Jr W Va State Tax Commissioner West Virginia

https://wvhistoryonview.org/image/027823.jpg

1099 G 1099 INTs Now Available Virginia Tax

https://www.tax.virginia.gov/sites/default/files/inline-images/1099-g-2022.png

Find out how much you ll pay in Virginia state income taxes given your annual income Customize using your filing status deductions exemptions and more Menu burger SmartAsset s Virginia paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

Virginia has four tax brackets which start at a 2 percent tax rate and cap out at 5 75 percent for the highest earners You must file taxes if you have a Virginia adjusted gross Find Commonwealth of Virginia standard deductions tax brackets and rates by the current and previous tax years Also you can find links to other important Virginia income

Download Va State Tax Deductions

More picture related to Va State Tax Deductions

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

Pin On Business Template

https://i.pinimg.com/originals/d1/cc/34/d1cc3440c2d9554d9b23652b32649ea1.jpg

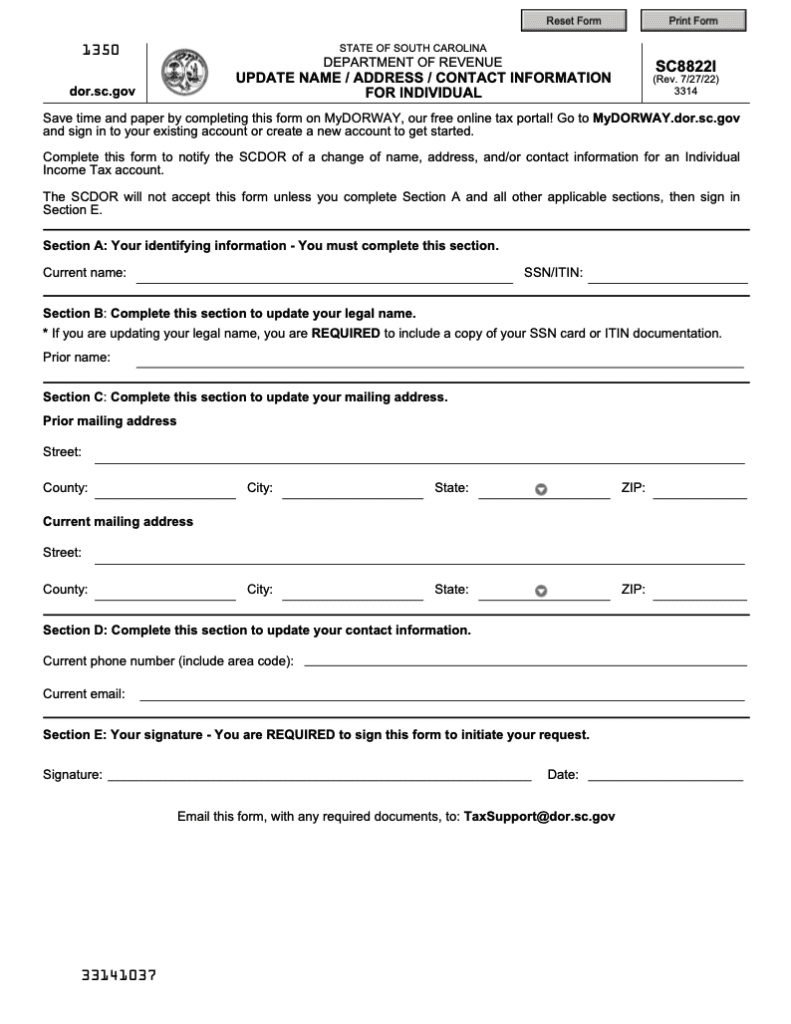

Va State Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-791x1024.png

Virginia residents are liable for state income taxes ranging from 2 to 5 75 in the 2024 tax year Updated on Jul 23 2024 Estimate your Virginia state tax burden with our Discover the Virginia tax tables for 2023 including tax rates and income thresholds Stay informed about tax regulations and calculations in Virginia in 2023

Virginia imposes state income taxes that range from 2 for lower incomes to 5 75 for higher earnings The 2024 tax rates and thresholds for both the Virginia State Tax Tables and Federal Tax Tables are comprehensively integrated into the Virginia Tax Calculator for 2024 This tool is

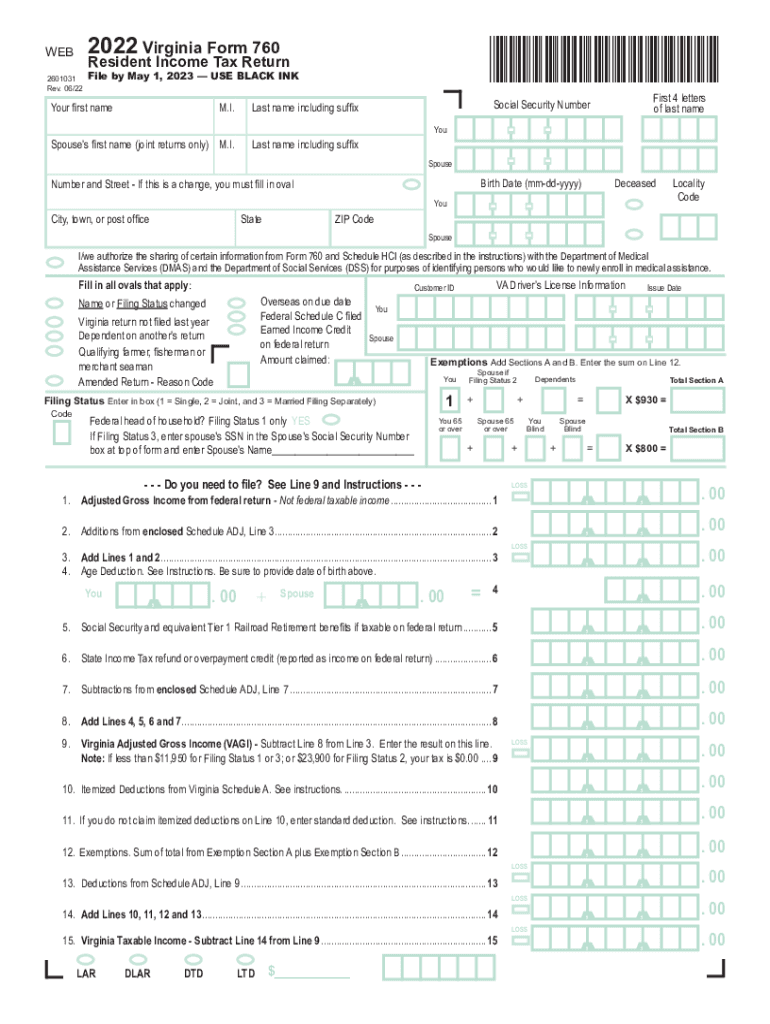

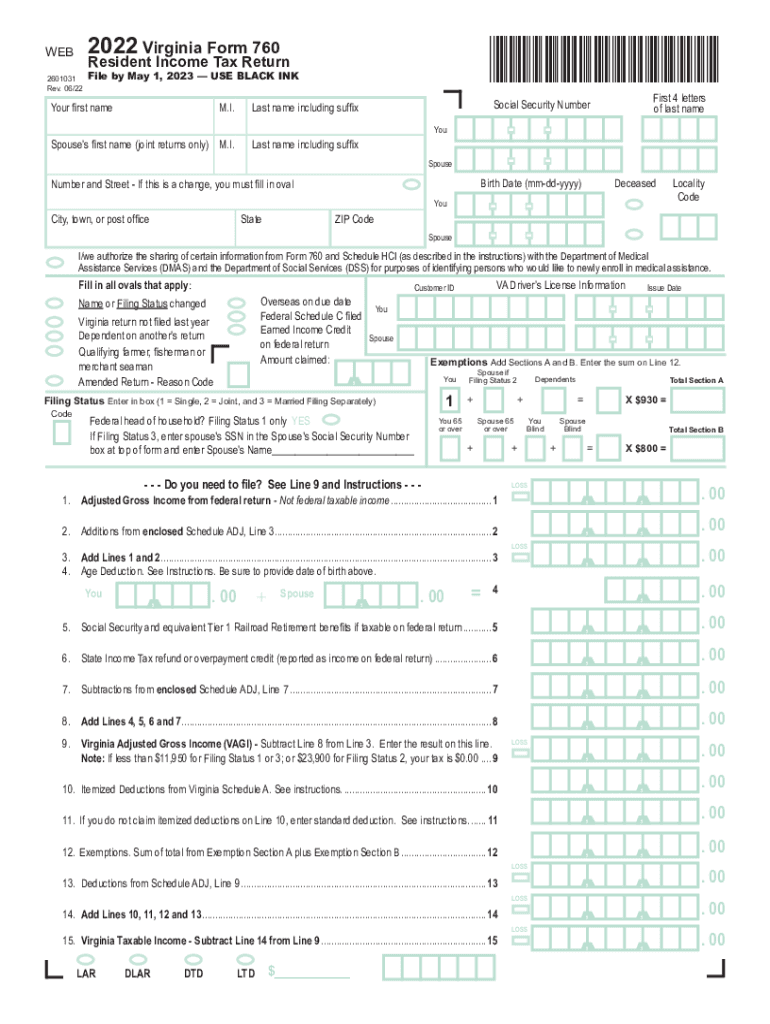

2022 Form VA DoT 760Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/622/49/622049008/large.png

Tax Credits Vs Tax Deductions Garden State Home Loans NJ

https://gardenstateloans.com/wp-content/uploads/2017/09/Tax-credits-vs-tax-deductions-1.jpg

https://www.tax.virginia.gov › subtract…

Virginia law allows a subtraction for the amount of any state income tax refund or overpayment credit included in federal adjusted gross income The subtraction is the amount of refund or credit you reported on your federal return

https://www.nerdwallet.com › ... › virgi…

Virginia state income tax rates are 2 3 5 and 5 75 Income tax brackets and rates depend on taxable income and residency status Virginia tax returns for the 2023 tax year were

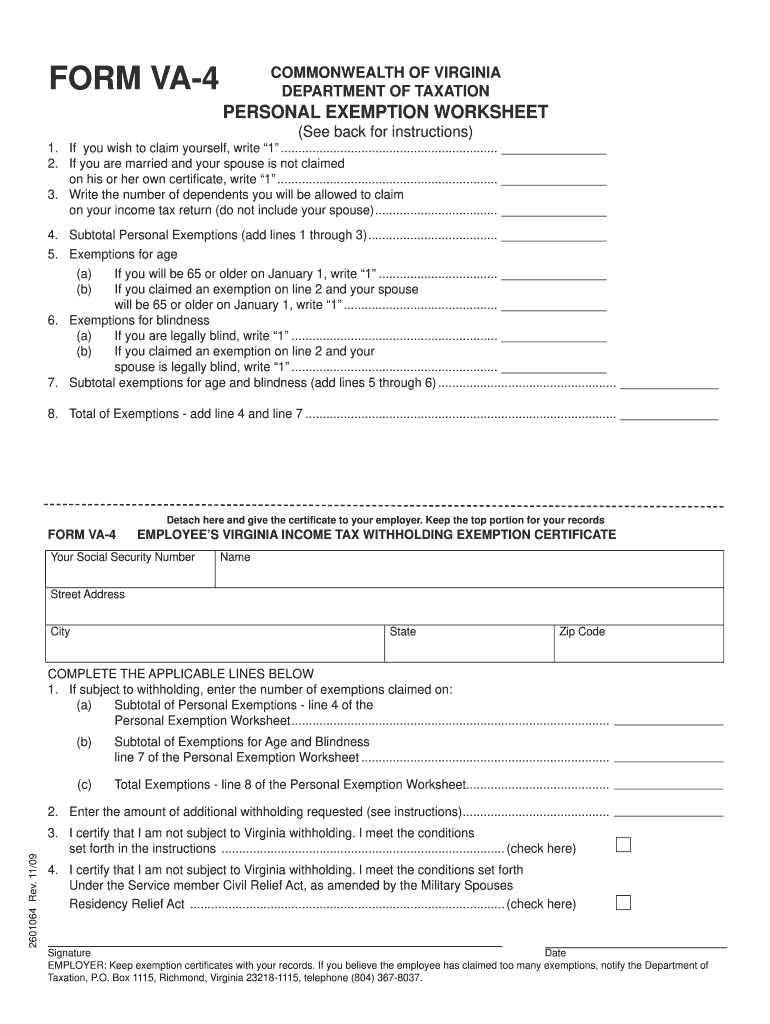

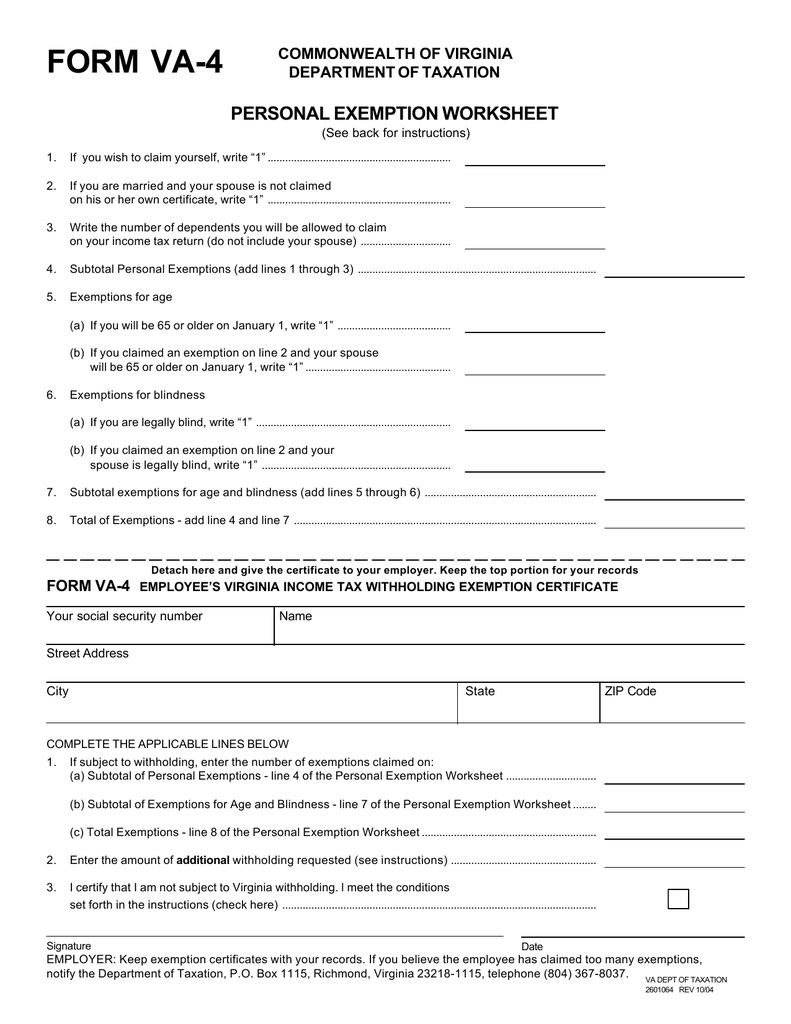

Va 4 State Tax Form Fillable Fill Out And Sign Printable PDF Template

2022 Form VA DoT 760Fill Online Printable Fillable Blank PdfFiller

Recreational Marijuana On The Ballot In These States This November R

Form VA 4 Employee s Virginia Income Tax Withholding

Wheres My Refund Va State Tax Change Comin

Massachusetts State Tax Deductions Pocket Sense

Massachusetts State Tax Deductions Pocket Sense

California s Workaround To The Federal Cap On State Tax Deductions MGO

Itemized Deductions Form 1040 Schedule A Free Download

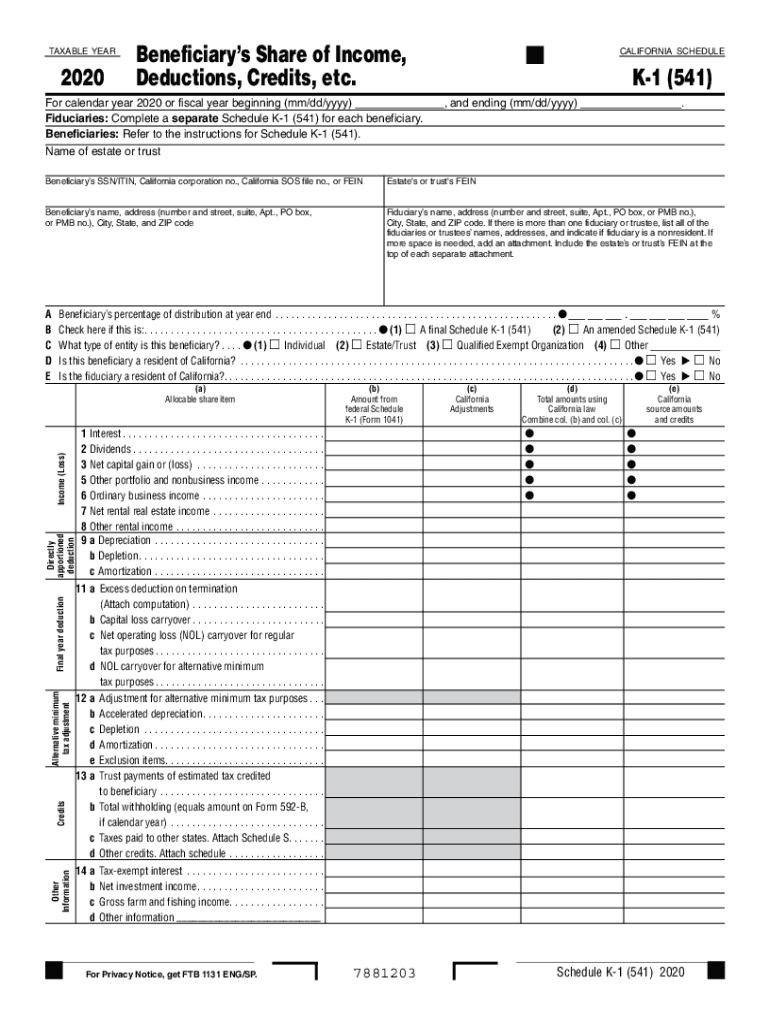

2018 Form K 1 Fill Out And Sign Printable PDF Template SignNow

Va State Tax Deductions - Exemptions Virginia allows an exemption of 930 for each of the following Yourself and Spouse Each filer is allowed one personal exemption For married couples each spouse is