Vat Return Form Sample If your company has a VAT registration it must submit VAT returns for every tax period even if no activities were undertaken for which VAT must be paid Please submit your

General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C Find VAT forms and associated guides notes helpsheets and supplementary pages

Vat Return Form Sample

Vat Return Form Sample

http://freeagent-assets.s3.amazonaws.com/website-2014/images/pages/tour/vat-return-example.png

Value Added Tax VAT Return Form

http://docs.oracle.com/cd/E26228_01/doc.93/e38913/img/image063.gif

Product Update 402 VAT Return Introduced In Switzerland Swiss

http://productupdates.exact.com/docs/DocBinBlob.aspx?ID=a034108e-6d75-4d50-92d4-36cdc827f716

How do you complete a VAT 3 return The VAT 3 return records the Value Added Tax VAT payable or reclaimable by you in your taxable period You should Title Vat Return 2011 specimen 2 pdf Author 376 377 000m 000u 000s 000c 000m 0000 0000 0006 Created Date 20110702073320Z

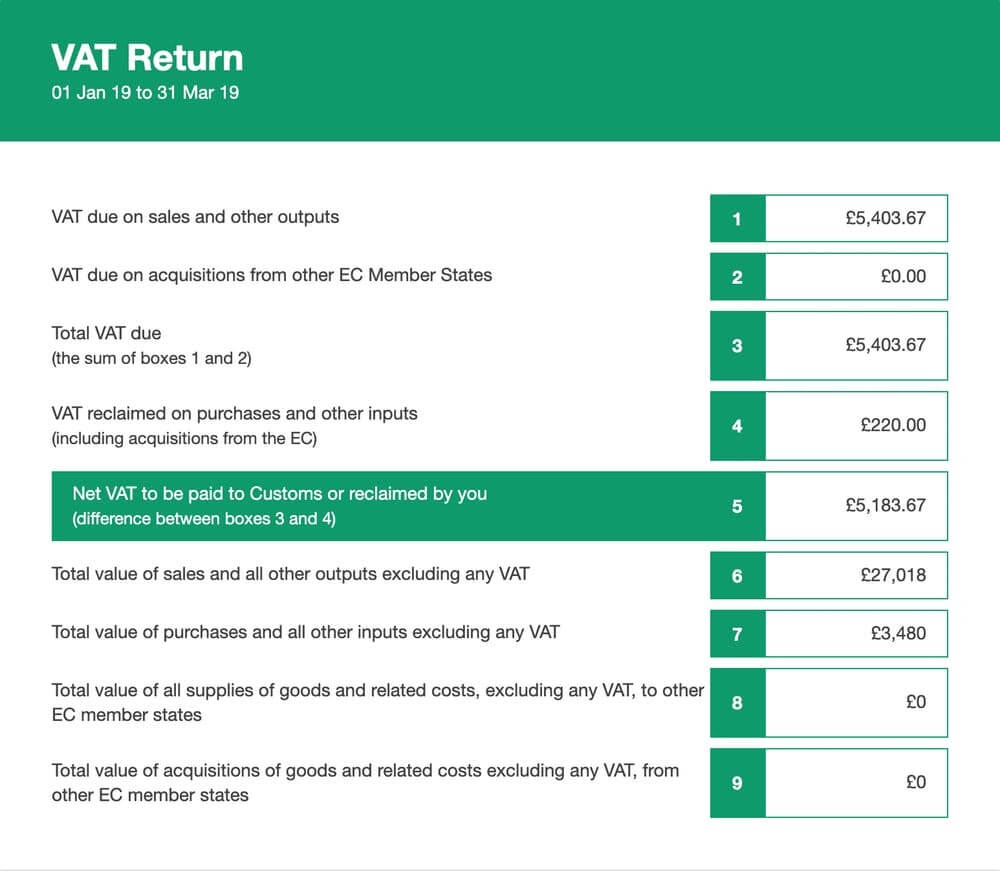

In a VAT return or declaration a taxable person business gives the tax authorities in the EU country where they are registered information about their taxable taxed exempt A VAT return is a digital form you send to HMRC showing how much VAT you owe It includes how much VAT you ve charged on sales minus the amount you can

Download Vat Return Form Sample

More picture related to Vat Return Form Sample

Procedure Of Filing Vat Return Accounting Education

https://1.bp.blogspot.com/-1wjkoNDsZF0/UQJdw8tus3I/AAAAAAAAKpA/UWOTfwBBN8k/s1600/VAT+return.PNG

VAT Return Software Thewealthworks

https://thewealthworks.com/wp-content/uploads/2019/12/VAT-Submit-return-1024x819.png

How To Avoid Common VAT Mistakes Tide Business

https://web.uploads.tide.co/2020/10/17144717/vat-return-form-sample.jpg

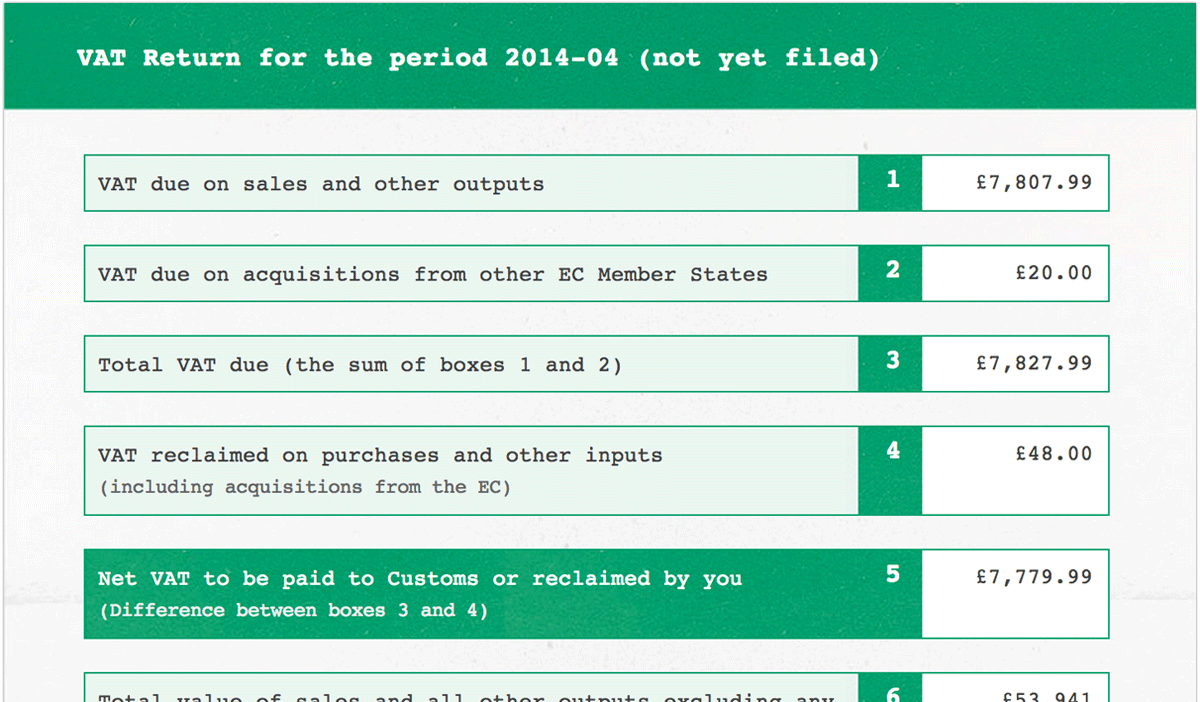

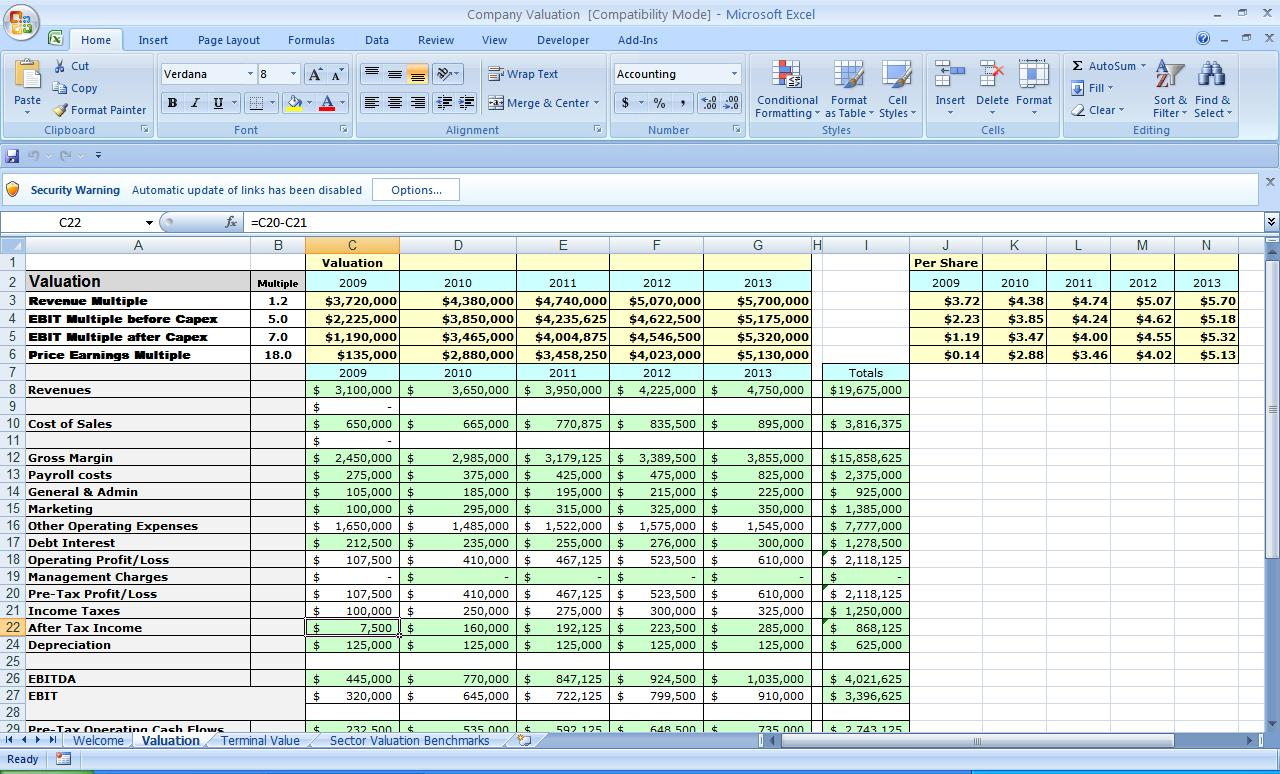

A VAT Return is a form you fill in to tell HM Revenue and Customs HMRC how much VAT you ve charged and how much you ve paid to other businesses You usually need to Produced by Tolley The following guidance note will provide details on what information needs to be included in each box on the UK VAT return For businesses using the flat

A VAT return is a form you must fill in to inform HMRC how much VAT you ve charged and how much you ve paid to other businesses All VAT registered 264 61 289 4000 itas mof gov na Domestic Taxes Department 10 John Meinert Molkte Street Windhoek

New Form 2550 M Monthly VAT Return P 1 2 1 Value Added Tax

https://imgv2-2-f.scribdassets.com/img/document/77527763/original/b5615a551e/1537323673?v=1

Company VAT RTD Return Boards ie

https://i.imgur.com/G073L.jpg

https://www.vero.fi/.../vat/when-to-file-and-pay

If your company has a VAT registration it must submit VAT returns for every tax period even if no activities were undertaken for which VAT must be paid Please submit your

https://www.youtube.com/watch?v=pJo_W9JNhDk

General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C

VAT Return Template

New Form 2550 M Monthly VAT Return P 1 2 1 Value Added Tax

What Is A VAT Return FreeAgent

VAT Return Get Hands On Help With Your VAT Return

Vat Return Spreadsheet Db excel

VAT Return Philippines

VAT Return Philippines

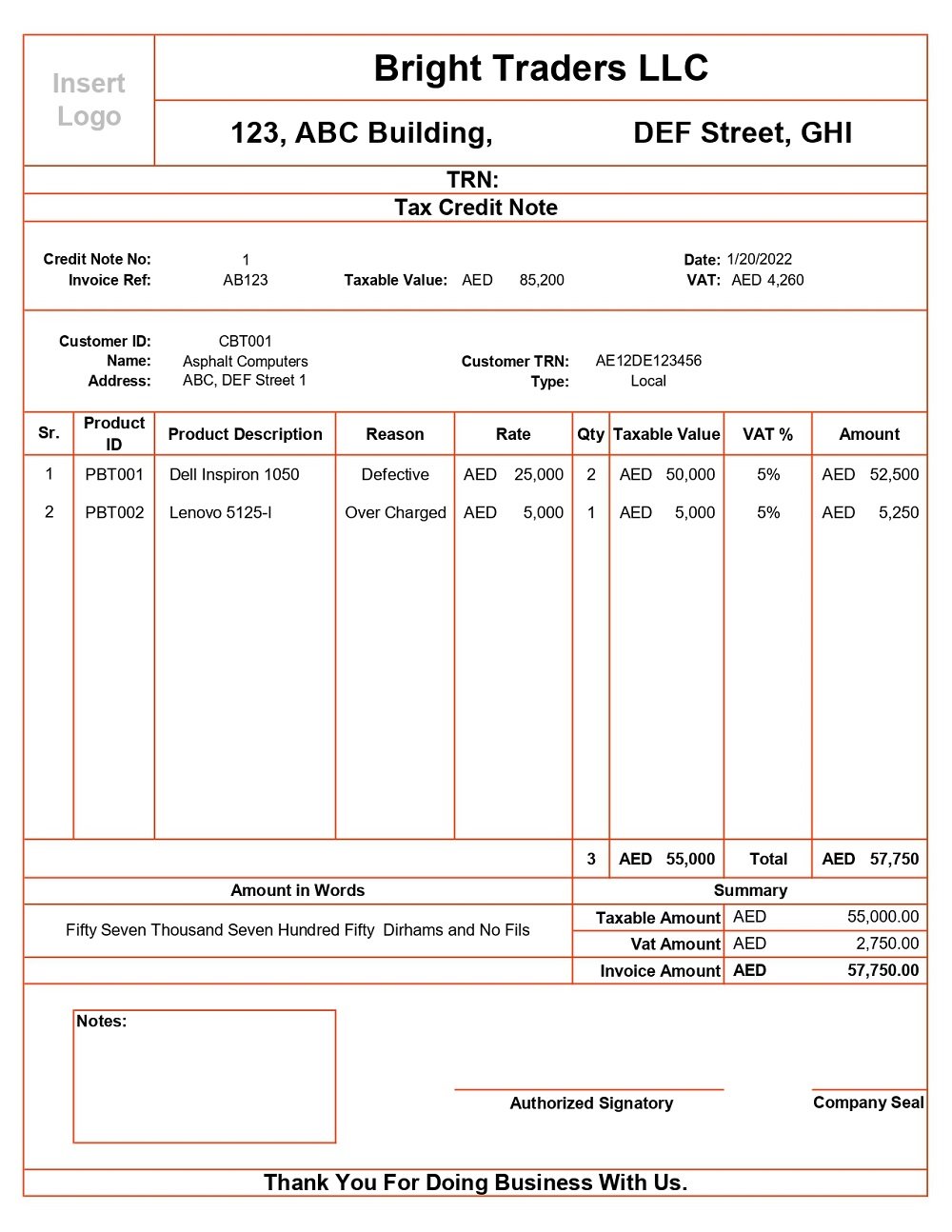

Ready To Use UAE VAT Credit Note Format MSOfficeGeek

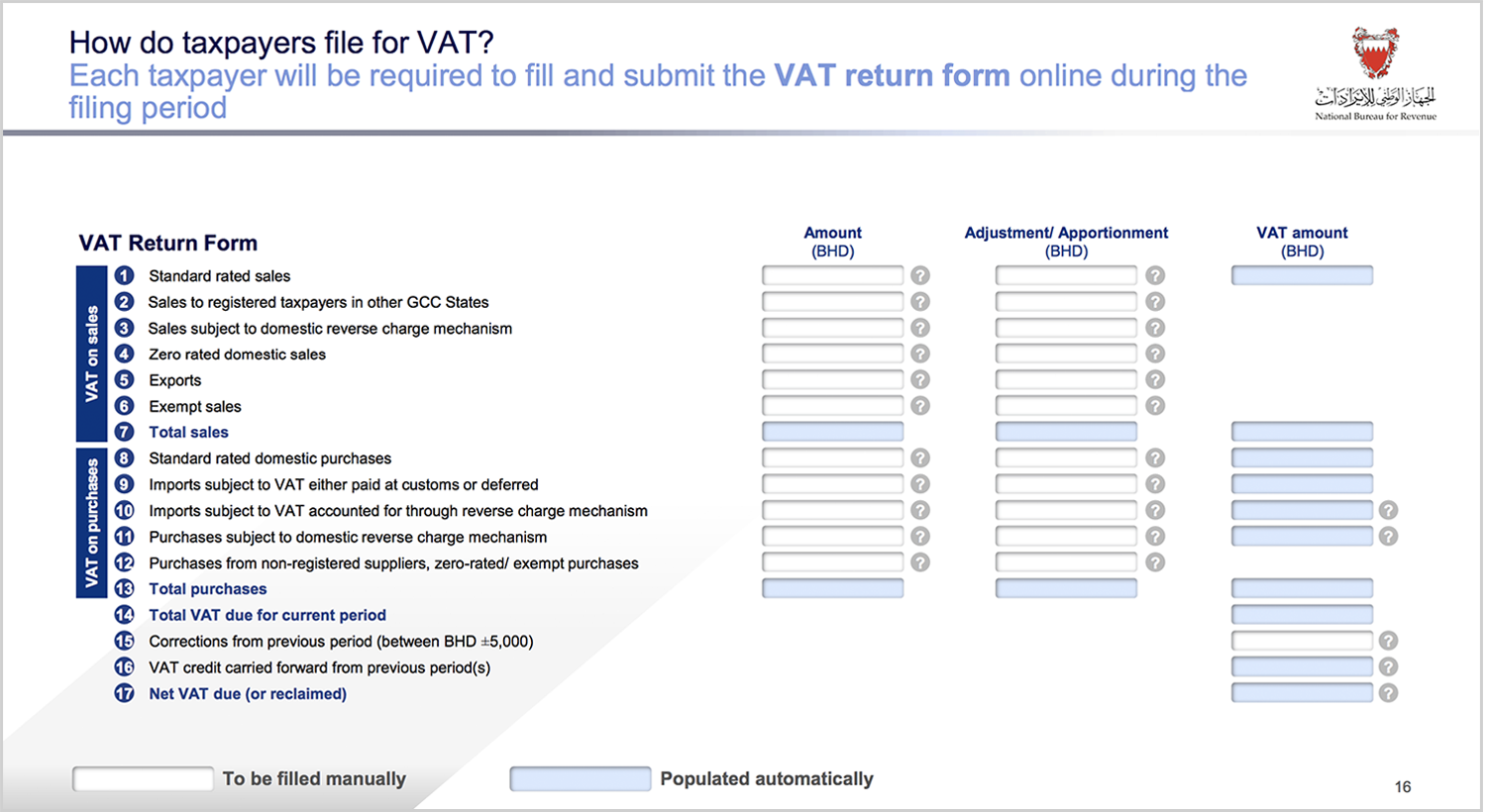

Returns Bahrain VAT Zoho Books

A Checklist For Completing A UK VAT Return Paul Beare

Vat Return Form Sample - Title Vat Return 2011 specimen 2 pdf Author 376 377 000m 000u 000s 000c 000m 0000 0000 0006 Created Date 20110702073320Z